Economic Illusions: Superficial Prosperity Masking Deeper Problems

Updated July 2023

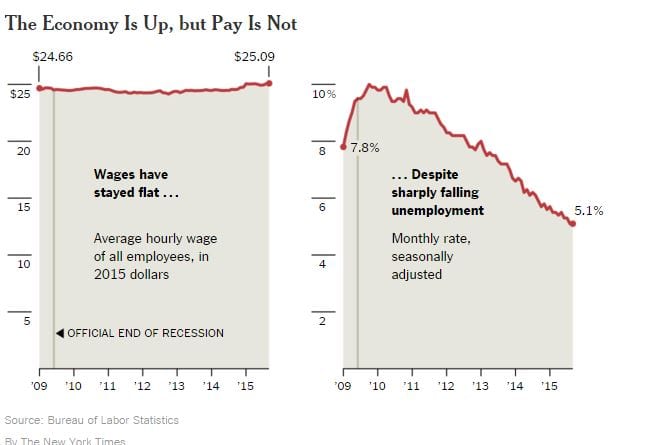

The BLS (Bureau of Labor Statistics) and the Obama administration keep pushing figures that illustrate the economy is improving, unemployment is dropping, and things are improving. Getting better based on whose perspective; are these people on drugs?

- More men and women are working than ever before, yet families can barely make enough to cover their monthly expenses.

- The cost of education is rising faster than wages

- Rents are rising faster than wages

- The cost of medical care is growing faster than wages

- Food costs have grown faster than wages over the past seven years.

We could go on, but we will stop there as we listed the most critical factors, and based on these factors, the only common trend we see is that people are working more for less money. In other words, they work like dogs and can barely pay the bills.

Economic Illusions: Unveiling the Impact of Corporate Practices on Wages

Many factors are at play here, contributing to lower wages, but the prime driver appears to be corporate gluttony. Corporations use billions of dollars to repurchase shares instead of investing the money in their companies. This technique artificially boosts the earnings per share metric (EPS) and is done without hard work. As rates are meager right now, corporations can borrow money for next to nothing and use these funds to buy back their shares and, in the process, magically boost earnings. This is done without spending money on new equipment or hiring new workers. It is fast, simple and fraudulent, but the government is not prosecuting anyone so this trend will continue. We covered this recently in an article titled “Share Buybacks Just Another Wall Street Scam.”

Then we have other trends, as noted by Peter Cappelli, a Wharton School of Business professor. He states that many retailers base manager’s bonuses on whether they can keep labour costs below a certain level. If these managers blow the budget ceiling, they blow their bonuses away, too.

Corporate Practices and Workers’ Earnings: A Disturbing Trend

As a result of these actions, the percentage of corporate income going to workers has dropped like a rock and is now at the lowest level since 1951. The Economic Policy Institute has stated that the labour’s share of corporate income has cost workers $535 billion annually; put in another way, it has cost $3,770 per worker.

There is only one way to win this filthy game, and that is for you to take control of your finances. Do not trust Wall Street or your government to take care of you. There is a saying: God helps those who help themselves and the devil, all those who fall in between. Learn how to use Mass Psychology to be on the right side of the markets and how to make sure you do rot in your Golden years. Subscribe to our Free Newsletter and learn how to be on the right side of the market instead of always following the herd that always does the wrong thing at precisely the right time.

Conclusion

Despite record-breaking employment levels, families struggle to make ends meet, contending with the relentless rise in the cost of education, soaring rents, and the ever-increasing burden of medical expenses. Food prices have surged, leaving many working individuals with barely enough to cover their monthly bills. The common thread in all these economic illusions is that people find themselves toiling harder, working longer hours, yet seeing diminishing returns.

This disheartening trend finds its roots in corporate practices driven by greed and short-term gains. Corporations prioritize share buybacks over investments in their workforce and infrastructure, artificially inflating earnings per share without substantive contributions. In parallel, some retailers tie managers’ bonuses to keeping labour costs at a minimum, further squeezing workers’ income.

Consequently, the share of corporate income allocated to workers has plummeted to levels not witnessed since 1951, resulting in significant losses for the workforce, estimated at $535 billion annually, or $3,770 per worker.

The takeaway from this grim reality is clear: relying on external entities, whether Wall Street or government, to secure your financial well-being is a risky proposition. The path to financial security lies in taking control of your finances and making informed decisions. Utilizing Mass Psychology to navigate the markets wisely can safeguard your future, ensuring you don’t fall victim to the herd mentality that often leads to the wrong choices at the wrong time. It’s time to empower yourself and secure your golden years on your terms. Subscribe to our Free Newsletter to gain the insights needed to thrive in these challenging economic times.

Originally published on Jan 26, 2016, and updated on July 2023.