The Accurate Alternative to Dow Theory Forecasts

Updated March 2024

Introduction

History remains an invaluable teacher, and as the saying goes, those who fail to learn from it are destined to repeat its mistakes. Therefore, we will present real historical examples, culminating with our latest perspectives.

Welcome to an exploration of the alternative to Dow Theory forecasts. In this article, we will delve into the limitations of the traditional Dow Theory and introduce the Tactical Investor’s Alternative Dow Theory. By incorporating an analysis of Dow utilities and leveraging modern computing and data science, this alternative approach aims to provide a more accurate and nuanced prediction of market performance. We will also discuss the importance of incorporating elements of mass psychology and contrarian investing to further enhance this alternative approach’s effectiveness.

Dow Theory Forecasts: The Alternative Version

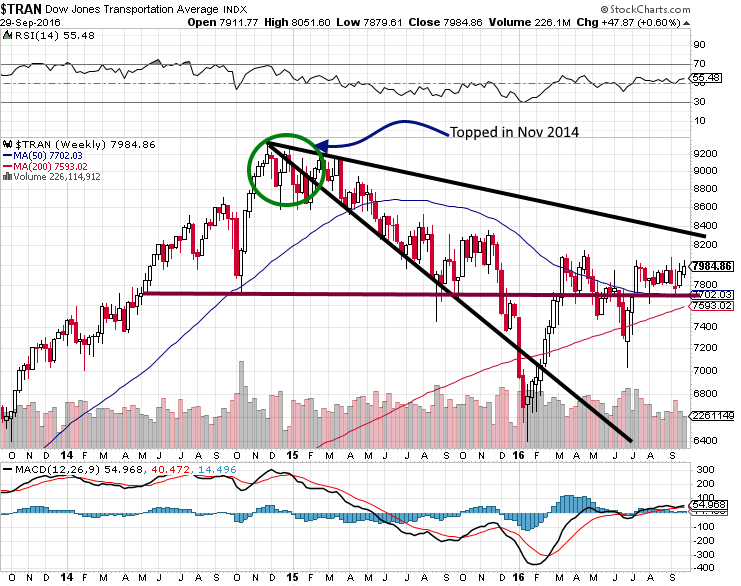

The transport topped out in November of 2014, and according to the Dow theory, this is a big negative; the Dow industrials should have followed suit. Instead, the Dow soared higher, paying no heed to this theory, proving to a large degree that this argument had lost its value. After all, it is a theory, and the definition of a theory is “a supposition or a system of ideas intended to explain something, especially one based on general principles independent of the thing to be explained.”

Dow Theory Forecasts: Might an Alternative be Better?

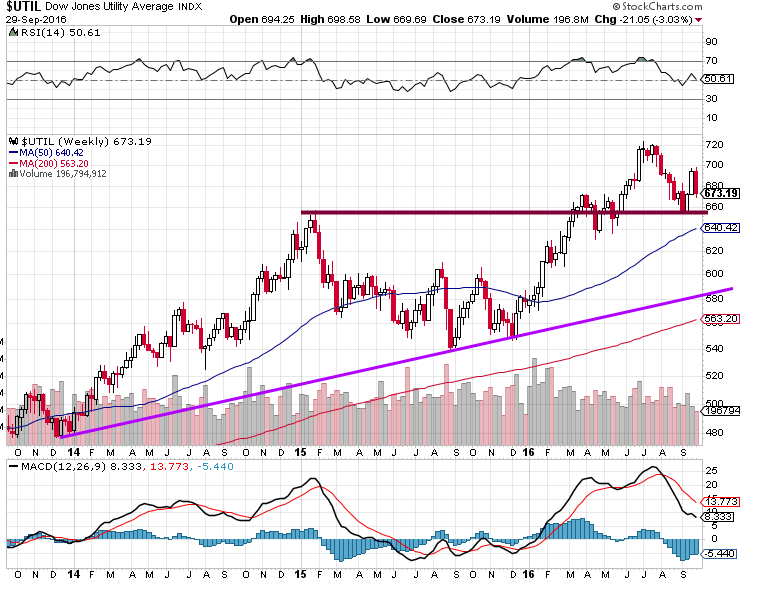

That is why 2006 we offered an alternative that proved far more accurate and reliable than Dow’s theory. Just to let this sink in, the transport topped out almost two years ago, and instead of trending lower, the markets have surged to new highs. If you look at the above chart, the Transports appear to be finally gathering momentum and breaking out. In the Dow theory alternative, we stated that the Utilities led the way instead of the Dow transports; well, let’s see if that holds.

The Dow Theory Signal is Malfunctioning?

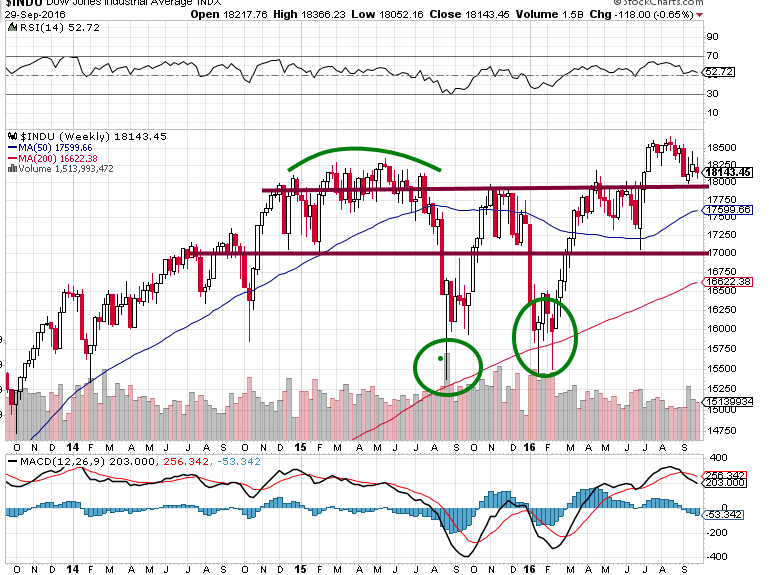

The Dow rallied until Aug of 2016, proving that the utilities are a better indicator of market direction than the Dow transports. At this point, the utilities are building momentum to take off again. If the pattern holds, then the Dow should follow its path.

It is also interesting to note that after almost two years of doing nothing, the Dow transports also attempted to break out.

Paying attention to what the utilities are doing in the future could be rewarding. Once the Dow utilities start to trend upward, it should serve as a strong signal that the Dow will follow in its path.

Using Original Dow Theory In Technical Analysis Leads to Bad Results

The Dow utilities and the Dow industrials traded to new highs; this means that rather than leading the way up, the Dow transports propel individuals to draw the wrong conclusion. The Dow Theory ceased to work correctly a long time ago, and in the era of hot money, it has a hard time trying to be relevant.

Using the alternate Dow Theory in technical analysis, where the focus is on the Dow utilities, yields better results. Maybe it is time to put this 100-year-old theory to rest and try something new; we will let you be the judge.

Dow Theory Limitations: Why It Often Fails to Predict the Market

The Dow theory is an investment strategy based on the Dow Jones Industrial Average movement. While it has been effective at times, there are several reasons why it does not always work:

1. The market is complex: The Dow theory assumes the market moves in predictable cycles, but in reality, it is influenced by countless complex factors that the theory does not account for.

2. Emotions impact the market: Investor psychology and emotions significantly affect market movements, which the Dow theory does not consider. During market extremes, the theory often fails.

3. The indicators are lagging: The Dow theory uses indicators like price and volume, which tend to lag actual market movements. When the indicators signal a move, the move may already be underway.

4. It relies on the past: The Dow theory assumes past market patterns will repeat, but the market is constantly evolving, and past patterns are not guaranteed to repeat.

5. It ignores external events: The theory largely ignores external events that impact the market, like geopolitical tensions, economic data releases, and company-specific news.

Some examples of when the Dow theory failed include the 1987 stock market crash, the 2000 dot-com bubble burst, and the 2008-2009 financial crisis. In these extreme market events, the Dow theory signals failed or lag significantly in market moves.

The Tactical Investor’s Alternative Dow Theory: March 2024 update

The Dow Theory has been a cornerstone of market analysis for over a century, providing investors with valuable insights into market trends and potential investment opportunities. However, like any analytical tool, it has its limitations. Recognizing these limitations, the Tactical Investor has developed an alternative approach offering a more nuanced and precise market performance analysis.

The Tactical Investor’s Alternative Dow Theory diverges from the traditional Dow Theory by incorporating an analysis of Dow utilities. By monitoring these utilities and identifying when they enter an oversold range and begin to form a bottom, this alternative approach can provide a more accurate prediction of market performance.

This innovative approach leverages the power of modern computing and data science, enabling the analysis of larger and more complex data sets. This, in turn, allows for a more detailed and precise analysis of market trends, providing investors with a more reliable tool for making investment decisions.

In conclusion, while the Dow Theory has served investors well for over a century, the Tactical Investor’s Alternative Dow Theory offers a promising alternative that could provide a more accurate and nuanced market performance analysis. However, as with any investment strategy, it’s essential to use this tool judiciously and in conjunction with other strategies to mitigate risk and maximize returns.

Incorporating Mass Psychology and Contrarian Investing

The Tactical Investor’s Alternative Dow Theory offers a promising approach to market analysis. However, to further enhance its effectiveness, it’s recommended that elements of mass psychology and contrarian investing be incorporated.

Mass psychology refers to the behaviour of the masses in the market, which can significantly impact market trends. Understanding groupthink dynamics and societal trends can provide valuable insights into investor decision-making and market movements. This understanding can help identify market inefficiencies created by overreactions to news and events.

Contrarian investing, conversely, involves taking positions that counter the overall market sentiment. Contrarian investors believe that when most investors are overly optimistic or pessimistic, it can lead to mispricings and opportunities for profit. This approach can be convenient during market overreaction and underreaction periods, where investors react too hastily or too slowly when learning new information, leading to short-term price movements that deviate from their intrinsic worth.

Moreover, contrarian investing can help mitigate the impact of cognitive biases that often lead to irrational decision-making, such as overconfidence, confirmation bias, loss aversion, and anchoring. By taking a contrarian approach, investors can avoid falling prey to these common pitfalls and make more rational and profitable investment decisions.

By combining the Tactical Investor’s Alternative Dow Theory with an understanding Groupthink psychology and a contrarian investing approach, investors can enhance their market analysis and make more informed and profitable investment decisions.

Impiety. Your irreverence toward my deity.

Ambrose Bierce

Enrich Your Knowledge: Articles Worth Checking Out

The Prudent Investor: Prioritizing Trends Over Speculation

Optimal Strategies for The Best Stocks To Invest Long Term

Market Correction Definition: Myths and Realities

Seizing Dominance: The Relentless Rise of Mental Warfare

Stock Market Predictions Today: Americans Fear The Market

Investor Sentiment Survey Defies Stock Market Crash Outlook

What is Inflation? Unveiling Effects and Strategies for Mastery

The Cycle of Manipulation in Investments

Market Opportunity: Buy The Fear & Sell The Noise

Investor Sentiment Data Manipulation: Unveiling Intriguing Insights

Stock Buybacks: Exploring Their Detrimental Effects

US Dollar Rally: Is it Ready to Rumble?

Stock Books For Beginners: Investing Beyond the Pages

Psychological Manipulation Techniques: Directed Perception

False Information and Its Consequences

Warren Buffett Investment Strategy for Beginners