US Dollar Collapse Theories: Unfounded and Misleading

Oct 7, 2024

Some individuals have mistakenly inferred from our discussions about geopolitical turbulence and emerging trends that America—and, by extension, the U.S. Dollar—is doomed. That’s pure rubbish and far from what we have been suggesting. For a long time, we’ve consistently stated that the BRICS currency is a ruse and the so-called “armchair generals” on the internet, who revel in confabulating stories and generating hype, are merely engaging in clickbait at its finest.

Some of the issues we’ve mentioned include the dollar’s anticipated loss of purchasing power and the diminishing ability of the U.S. government to wield the USD as indiscriminately as it once did. In some ways, this is beneficial, as commerce thrives better without the shadow of fear hanging over it.

The Changing Landscape of Global Power

Consider this: England lost its power race to the U.S. decades ago, yet it remained a strong place for investment and profit. Similarly, despite changes, the U.S. markets will still offer profit opportunities. What will shift is that the wealth-creating potential will be concentrated among a smaller group of individuals. The so-called American Dream won’t be as accessible to the average person as it once was.

Markets will experience wider swings, with stocks potentially falling much further than before. Ranges will expand; what used to be considered oversold will shift to neutral, extremely oversold will become oversold, and insanely oversold will become, for lack of a better word, ”unimaginably oversold.” This is because major players will have more money at their disposal. As their financial power grows, they will exert greater control over the markets, pushing them higher and lower than most can imagine. Boom and bust cycles will truly live up to their name, possibly evolving into “all or nothing” cycles where those on the wrong side risk losing everything.

New Opportunities Outside the U.S.

However, one key observation is that, just as the U.S. rose to prominence over England, the number of opportunities outside the U.S. will likely increase significantly. From a broader perspective, it will become easier to identify profitable ventures beyond the U.S. than in the past. The slogan “Go East, Young Man” may very well become the new mantra.

Once again, we will state the obvious: the BRICS currency remains a ruse—for now. It may hold significance in the future, but that is not the case. The focus should be on opportunity. The range of opportunities outside the West will expand considerably. While one can still make money in the U.S., the “American Dream” era is ending.

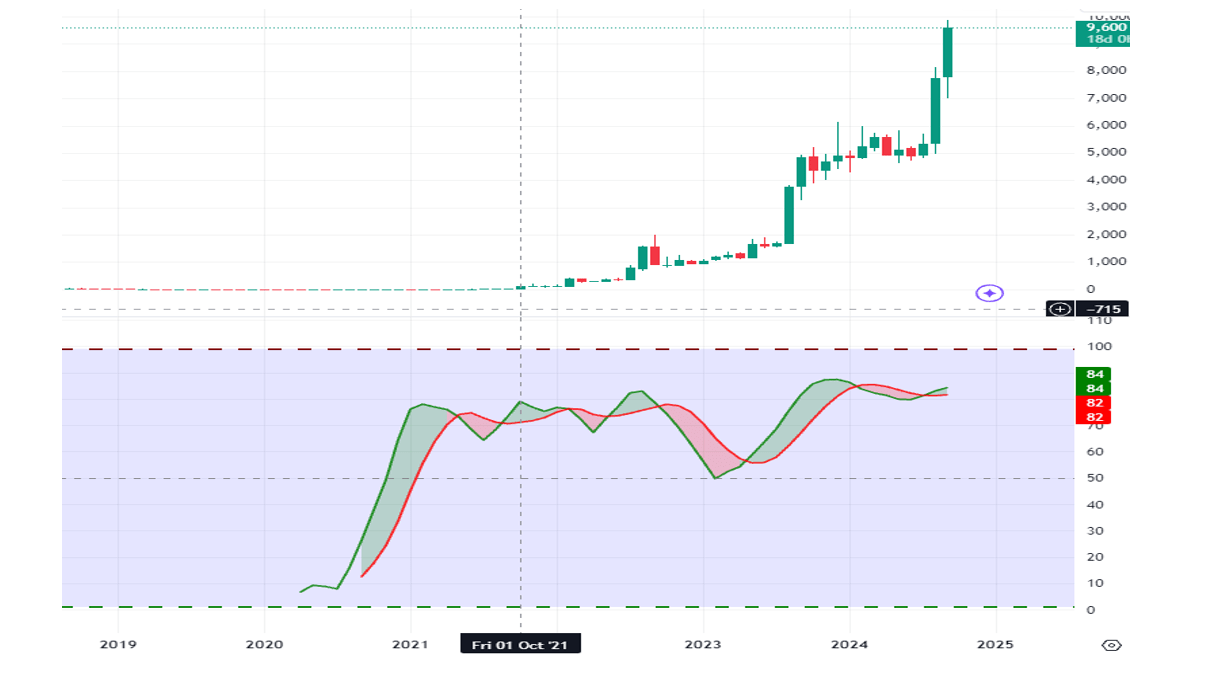

For instance, consider this stock in Asia. The specific market is less relevant because the major move phase is already behind us.

Profiting from Non-Western Markets

This stock surged from 5 to 9900 between September 2020 and September 2024—an astonishing 197,900% gain—far surpassing BTC in terms of returns over the same period. This example illustrates the kind of opportunities we are referencing. While not all opportunities will yield such extraordinary gains, the developing world will offer more opportunities for significant returns.

In summary, while conditions may deteriorate for the average American and Westerner, as evidenced by New Zealands record number of people leaving for greener pastures this year, opportunities will arise from these challenges. Those with the funds, resilience, and adaptability to navigate volatility will find new prospects where others see only difficulty.

The Role of Military Power in a Multipolar World

However, one small consideration is that humans are, by nature, violent, and the nation with the most advanced weaponry can set many rules. As the U.S. has fallen behind in the arms race, we are moving toward a multipolar world.

Why a multi-polar world? Despite the shift, the U.S. retains the dollar, a relatively powerful weapon. Consequently, the U.S. will now have to share the spoils with more players, whereas before, it could simply enter the room and take what it wanted. Hypersonic weapons have rendered many of the U.S.’s worldwide bases and aircraft carriers obsolete, and advancements in drone technology introduce new complexities.

However, the principle of Mutually Assured Destruction (MAD) means that no one will push the limits to the extreme. Ironically, this dynamic may contribute to a slightly more stable global environment.

Behavioral Psychology and Market Reactions

One cannot overlook the critical role of behavioral psychology when navigating the shifting dynamics of the dollar and global markets. Fear and greed drive market behaviour, and as the dollar experiences strong corrective phases, investors are likely to exhibit emotional responses that deviate from logic. Understanding the crowd’s psychology can present significant opportunities for the informed investor.

During these corrective phases, many will panic and exit dollar-denominated assets. However, this very panic creates an opportunity to strategically allocate funds to other currencies, equities, or commodities. The masses often react to short-term events, missing the long-term picture. By maintaining discipline and focusing on long-term trends, astute investors can capitalize on market overreactions driven by crowd psychology.

Mutually Assured Destruction and Stability

Anyone claiming that the dollar is dead is seriously misjudging the situation. While it might be true one day, it’s highly unlikely they’ll live to see their predictions come to fruition. For now, the USD is set to devalue faster than before, impacting the average person more than the astute investor.

What’s at stake is straightforward: the American Dream for everyone is over or near its end. It will now become the “American Dream” for a select few. A fitting cliché to reflect this shift might be “no money, no honey.”

Remember, we always discuss opportunities and evaluate situations based on risk-to-reward factors. The current risk-to-reward analysis indicates that the outlook is improving outside the West. Therefore, moving some assets or investing funds beyond Western borders might be worth considering.

Technical Analysis: Identifying Opportunities Amid Corrective Phases

From a technical analysis standpoint, the dollar’s correction presents a unique opportunity for those adept at reading market patterns. As the dollar experiences pullbacks, it creates room for entry into other currencies, precious metals, or stocks that are likely to inflate faster than the dollar deflates.

Rather than focusing on the noise surrounding the dollar’s decline, traders can use technical indicators to spot key support levels, oversold conditions, and potential reversal points. Patterns like the Relative Strength Index (RSI) and Moving Averages can help identify optimal entry points for selling the dollar and reallocating to better-performing assets. By adopting a disciplined approach and relying on technical analysis, investors can maximize their profits during these corrective phases rather than succumbing to the herd mentality.

Conclusion

The idea of a complete U.S. Dollar collapse is a sensationalist narrative designed to trigger panic and mislead investors. History shows that even in the face of corrections, smart investors who understand behavioral psychology and employ technical analysis can seize profitable opportunities. For example, during the 2008 financial crisis, gold surged by over 150% as the dollar experienced a significant devaluation. Similarly, while the dollar faces corrective phases today, those willing to pivot toward strong currencies, stocks, or precious metals could reap substantial rewards.

The key takeaway is that rather than fixating on the doom and gloom of dollar collapse theories, investors should strategically position themselves to take advantage of the market’s natural cyclical movements. Whether moving into international markets, capitalizing on the growth potential in Asia, or turning to precious metals that thrive when the dollar weakens, the opportunities are there for those who remain calm and calculated.

Escapes to Insight: Transcending Boundaries of the Mind

Stock market panic 2020: Could it happen again?

Fear of Investing Quotes That’ll Make You Laugh and Learn

What does average market volatility mean for investors?

Double Bottom Chart Pattern: Profit Like a Pro, Avoid Mistakes Like a Burro

Charlie Munger’s House: A Reflection of His Investment Genius

What can aspiring investors do to overcome the fear of investing?

Logical vs. Emotional Thinking: Deciphering the Dominant Force

Trading Journal: The invaluable tool for traders

Fear of Investing? Transform Anxiety into Financial Triumph with These Step

Stock Market Fear Meter: All Bark, No Bite

Financial Battle: Win the Game, Rule the Market

Unleash Your Financial Destiny: Defy the Herd and Win

Market Complacency: From Pain to Profit—Here’s How to Fix It

What triggered the stock market panic of 1873?