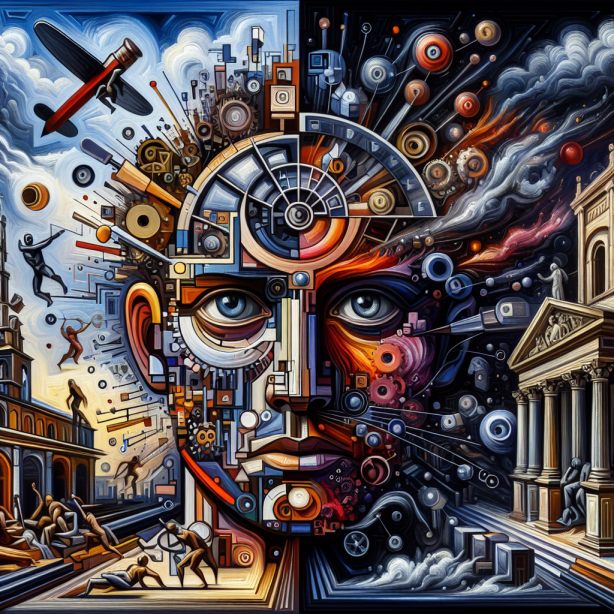

What is Behavioral Psychology in Investing: Buy When Fear Reigns, Sell When Euphoria Peaks

June 22, 2024

Behavioural psychology in investing studies how human emotions, cognitive biases, and social influences affect financial decision-making. This field bridges the gap between traditional economic theory and the often irrational behaviour observed in financial markets. By understanding these psychological factors, investors can capitalize on market inefficiencies and avoid common pitfalls.

The Wisdom of the Crowd vs. The Madness of Mobs

Gustav Le Bon, a pioneering sociologist, observed in his 1895 work “The Crowd: A Study of the Popular Mind” that individuals behave differently when part of a group. This insight is particularly relevant to financial markets, where mass psychology can create significant price movements divorced from fundamental values.

Le Bon wrote, “In crowds, it is stupidity and not mother wit that is accumulated.” This phenomenon is evident in financial markets when investors collectively rush into or out of investments based on emotion rather than rational analysis. The “wisdom of the crowd” can quickly devolve into the “madness of mobs,” leading to market bubbles and crashes.

Mass Psychology and Market Cycles

One of the most persistent patterns in financial markets is the tendency for the masses to buy during moments of euphoria and sell during panic – precisely the opposite of what savvy investors should do. This behaviour is rooted in several psychological biases:

1. Herding Instinct: Humans innately desire to conform to group behaviour. This manifests as following the crowd into popular investments, often at peak prices.

2. Fear of Missing Out (FOMO): When markets rise, investors fear being left behind, leading to impulsive buying decisions.

3. Loss Aversion: Investors feel the pain of losses more acutely than the pleasure of gains, often leading to panic selling during market downturns.

4. Recency Bias: People tend to excessively overweight recent events and indefinitely extrapolate current trends.

Contrarian Investing: Swimming Against the Tide

Successful investors often adopt a contrarian approach, going against the prevailing market sentiment. Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.”

This strategy requires emotional discipline and a deep understanding of market psychology. During market panics, contrarian investors identify undervalued assets and accumulate positions when the masses are selling indiscriminately. Conversely, when euphoria grips the market and valuations stretch, they trim positions and take profits.

The Challenge of Independence

Going against the crowd is psychologically challenging. Humans are social creatures, and the desire for social validation is strong. As John Maynard Keynes observed, “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.”

This explains why many investors prefer the comfort of following the herd, even when it leads to suboptimal outcomes. Breaking free from this mindset requires cultivating independent thought and the courage to act on one’s convictions.

Historical Examples of Mass Psychology in Action

1. Tulip Mania (1630s): One of the earliest recorded speculative bubbles, where Dutch tulip bulbs reached astronomical prices before crashing spectacularly.

2. The Great Depression (1929): Panic selling following the stock market crash exacerbated the economic downturn.

3. Dot-com Bubble (late 1990s): Irrational exuberance around internet stocks led to valuations disconnected from fundamentals.

4. Global Financial Crisis (2008): Widespread panic selling created opportunities for contrarian investors to acquire quality assets at deep discounts.

Practical Applications for Investors

1. Sentiment Indicators: Monitor indicators like the VIX (fear index), put/call ratios, and investor surveys to gauge market sentiment.

2. Contrarian Signals: Look for extreme pessimism or optimism as potential turning points in market trends.

3. Value Investing: Focus on fundamental analysis to identify undervalued assets during market panics.

4. Systematic Investing: Implement rules-based strategies to remove emotion from investment decisions.

5. Patience and Discipline: Cultivate the ability to wait for opportune moments and stick to your investment thesis despite short-term market noise.

The Role of Media and Information Cascades

In today’s interconnected world, the media plays a significant role in shaping investor sentiment. The constant stream of news and opinions can create information cascades, where a piece of information or opinion gains rapid acceptance simply because others believe it.

This phenomenon can amplify market trends and create self-fulfilling prophecies. Savvy investors learn to filter out noise and focus on fundamental data and long-term trends rather than short-term market movements.

Cognitive Biases in Investing

Several cognitive biases influence investment decisions:

1. Confirmation Bias: Seeking information that confirms existing beliefs while ignoring contradictory evidence.

2. Anchoring: Relying too heavily on one piece of information when making decisions.

3. Overconfidence: Overestimating one’s ability to predict market movements or pick winning stocks.

4. Availability Bias: Overweighting easily recalled or recent information.

Understanding these biases is the first step in mitigating their impact on investment decisions.

The Importance of Self-Awareness

Successful investing requires understanding both market psychology and one’s psychological tendencies. As Benjamin Graham, the father of value investing, stated, “The investor’s chief problem—and even his worst enemy—is likely to be himself.”

Developing emotional intelligence and self-awareness can help investors recognize when their decisions are driven by fear, greed, or other emotions rather than rational analysis.

Leveraging Options: The Put-Call Strategy

An innovative approach that combines conservative risk management with the potential for leveraged gains is selling puts and using the proceeds to purchase calls. This method offers a unique way to participate in market upside while mitigating downside risk.

Selling puts is inherently a conservative strategy. It typically involves writing options on stocks an investor would be willing to own at a lower price. The premium received from selling puts provides immediate income and reduces the effective purchase price of the stock if assigned.

By using the premium from put sales to purchase call options, investors create a form of “free” leverage. If the underlying stock price rises, the calls provide amplified upside potential. If the stock price falls, the investor may be assigned shares at a discount to the current market price, aligning with their original investment thesis.

This strategy is particularly appealing in volatile markets with higher option premiums. As legendary options trader Paul Tudor Jones noted, “The whole world is nothing more than a flow chart for capital.”

However, it’s crucial to understand the risks involved. While selling limits potential losses to the strike price minus the premium received, purchasing calls introduce the risk of losing the premium paid if the stock doesn’t move above the strike price.

Implementing this strategy requires careful stock selection, a thorough understanding of options mechanics, and disciplined risk management. As with any investment strategy, aligning this approach with your overall investment goals and risk tolerance is essential.

Conclusion: What is Behavioral Psychology

Behavioral psychology offers invaluable insights for investors seeking to navigate the complex world of financial markets. By understanding mass psychology, recognizing cognitive biases, and cultivating emotional discipline, investors can position themselves to profit from market inefficiencies created by collective behaviour.

Successful investors are known for their ability to remain calm and rational during market euphoria or panic periods. As Warren Buffett noted, “The most important quality for an investor is temperament, not intellect.”

Ultimately, mastering the psychology of investing is about developing the wisdom to see beyond short-term market noise, the courage to act independently, and the discipline to stick to a well-reasoned investment strategy. By doing so, investors can indeed learn to “profit from panic and cash out on joy,” turning the irrational behaviour of the masses into opportunities for long-term wealth creation.

Scholarly Escapades: Exceptional Reads for the Curious