China’s Middle Class: A Force to Reckon

Updated March 2023

China is now home to the largest middle-class population in the World and, at the same time, holds the undisputed heavyweight title for having the most billionaires in the world too.

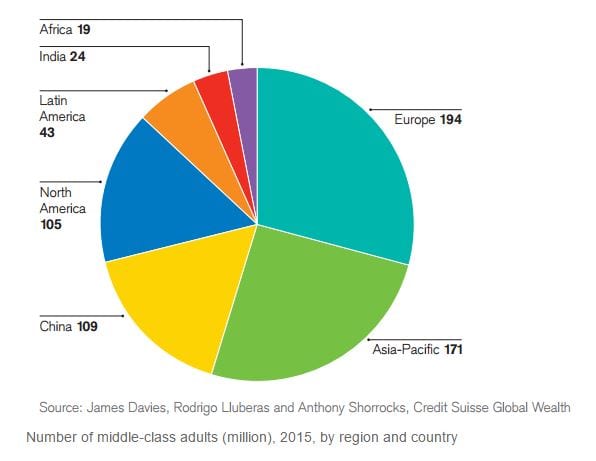

China’s Middle Class has grown at twice the U.S rate, and according to Credit Suisse109 million Chinese have a savings network that ranges from $50,000 to $500,000. These numbers are stunning when you consider that the average worker in the U.S does not even have $5,000 in savings. One suddenly starts getting the eerie feeling that the U.S is on the way to becoming a 3rd world country and China could be on its way to eventually regaining 1st world status.

China presently accounts for a fifth of the World Population and 10% of the Global Wealth. If it maintains this pace, it the size of this pie will increase significantly in the years to come, and it will eventually displace the U.S as the most significant contributor to Global wealth. The chart below currently illustrates how fast the Chinese Middle Class has grown.

China has the World’s second most Millionaires and is creating them faster than the U.S. Currently, China has more than one million millionaires. The number of millionaires in China is projected to surge by over 70% and could top 2.3 million by 2020.

A stunning new report from UBS and PricewaterhouseCoopers established that one new billionaire was being created every week. If that is not stunning, then we don’t know what is; note this is all going on during a supposedly strong recession. China added an incredible 242 billionaires in 2015, and if it maintains that pace, China now has 596 billionaires overtaking the U.S, which has 537 billionaires to take the top spot.

The Rising Power of China’s Middle Class

China’s middle class has emerged as a powerful force shaping the country’s economic trajectory. Over the past few decades, economic reforms and rapid industrialization have lifted millions out of poverty, creating an affluent middle class. Today, China’s middle class accounts for a significant portion of the country’s population, with estimates suggesting that over 400 million people fall into this category. This upward social mobility has driven consumer spending, investment, and economic growth.

The rise of China’s middle class has had a ripple effect on various sectors of the economy, ranging from retail to real estate. As disposable incomes increase, middle-class consumers seek higher-quality products and services, fueling demand in sectors such as e-commerce, tourism, and education. Luxury brands, in particular, have benefited from the growing appetite for premium goods among China’s middle class.

The Influence of China’s Middle Class on Global Markets

The sheer size and purchasing power of China’s middle class have not only impacted the domestic economy but also profoundly affected global markets. Chinese tourists now represent a significant portion of international travellers, with their spending habits influencing businesses worldwide. The rise in demand for imported goods and services from China’s middle class has opened up new opportunities for foreign companies looking to tap into this lucrative market.

Moreover, China’s middle class increasingly invests in overseas assets, such as real estate and financial products. This trend has been facilitated by the country’s gradual relaxation of capital controls, enabling Chinese investors to diversify their portfolios and seek higher returns abroad.

Future Prospects and Challenges

While the growth of China’s middle class has brought considerable economic benefits, it also poses certain challenges. As middle-class consumers become more discerning, domestic companies must adapt and innovate to meet their evolving needs and preferences. This could spur a shift towards a more consumer-driven economy, necessitating the development of stronger domestic brands and increased focus on quality and innovation.

In addition, the rise of China’s middle class has led to growing concerns about income inequality and social tensions. As the gap between rich and poor widens, addressing these disparities will be crucial to maintaining social stability and fostering sustainable economic growth.

The expansion of China’s middle class has driven the country’s remarkable economic growth, reshaping domestic and international markets. The influence of China’s middle class is set to grow even stronger in the coming years, making it essential for businesses and policymakers alike to understand and adapt to this powerful demographic group.

Capitalizing on China’s Middle Class: A Winning Investment Gameplan

The rapid growth of China’s middle class presents a unique opportunity for investors looking to capitalize on the country’s burgeoning consumer power. As the Chinese population becomes increasingly affluent, their appetite for investment and wealth preservation is set to grow. Traditionally, the Chinese have had a strong affinity for gold and stock market investments, driven by cultural factors and a propensity to “gamble” in search of higher returns.

Considering the data on China’s middle class, it’s evident that their love for gold and interest in the stock market will only continue to rise as they accumulate more wealth. To benefit from these trends, investors should consider incorporating physical gold and Chinese stocks into their long-term investment strategies.

Investing in Physical Gold

As a time-tested store of value, gold holds a special place in Chinese culture, symbolizing wealth, prosperity, and good fortune. The increasing purchasing power of China’s middle class is expected to result in a growing demand for gold, both as a form of investment and as a means of wealth preservation. Investors can consider purchasing physical gold or gold-backed investment vehicles such as gold exchange-traded funds (ETFs) or gold mining stocks to capitalise on this trend.

Tapping into the Chinese Stock Market

In addition to gold, China’s middle class is increasingly drawn to the stock market in search of lucrative investment opportunities. As Chinese consumers become more sophisticated and discerning, domestic companies will need to adapt and innovate to meet their evolving needs and preferences. This shift towards a more consumer-driven economy presents a significant opportunity for investors to gain exposure to Chinese stocks, particularly in e-commerce, tourism, education, and premium goods.

Investing in Chinese equities can be done through various vehicles, including individual stocks, mutual funds, or ETFs focused on China’s economy. Investors should consider combining fundamental analysis, mass psychology, and technical analysis to improve their odds of success in the Chinese stock market.

A Well-rounded investment game plan that takes advantage of China’s middle class’s growing wealth and investment preferences should include physical gold and Chinese stocks. By understanding the cultural and economic factors driving these trends, investors can position themselves for long-term success in the dynamic and rapidly evolving Chinese market.

Other Articles Of Interest:

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Is Value Investing Dead? Shifting Perspectives for Profit

Analyzing Trends: Stock Market Forecast for the Next 6 Months

Example of Groupthink: Mass Panic Selling at Market Bottom

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Unraveling the Enigma: The Dark Allure of Mob Mentality

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey