Chaos Theory: Investing in the Fractured Mirror of Disorder

Oct 10, 2025

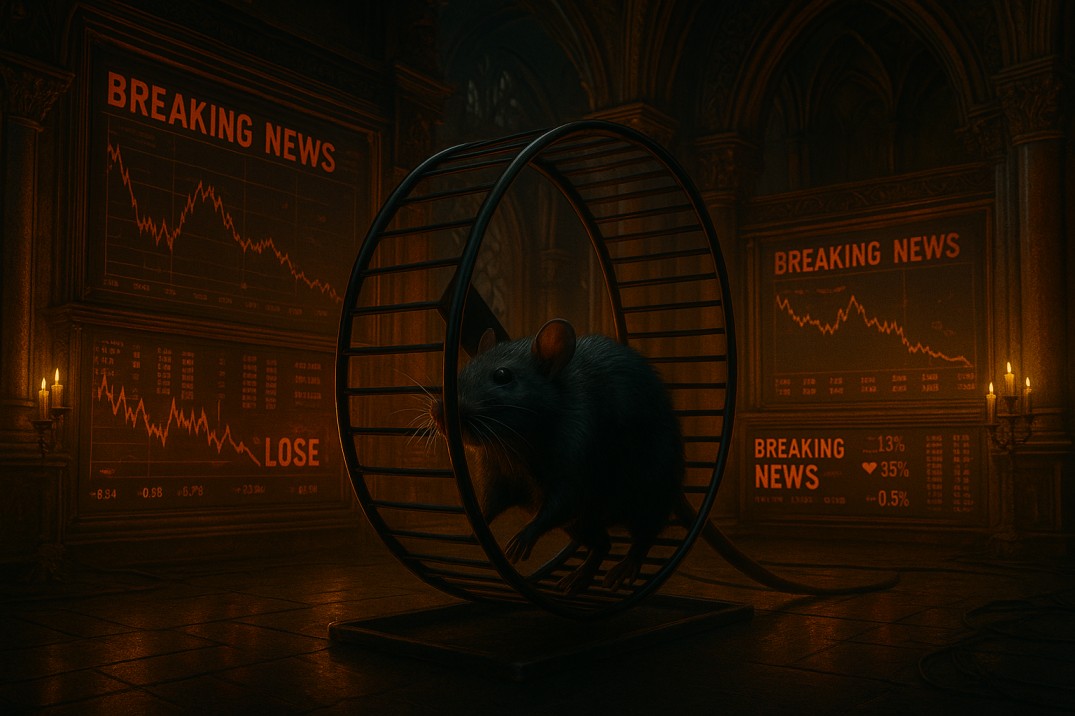

Step into the rupture. This isn’t your grandfather’s stock market sermon. The old gods—fundamental analysis, perfect information, rational actors—have been slain by their illusions. A splintered cosmos of patterns within patterns remains, where volatility isn’t the enemy—it’s the language of emergence.

The markets don’t flow. They stutter, glitch, spiral. They scream in pulses and whisper in feedback loops. And beneath that madness lies coherence—not order, but self-similarity. This is Chaos Theory, not as a metaphor, but as a weapon. What looks like randomness to the rigid mind becomes a signal to the fluid one. Investors who embrace volatility rather than fight it evolve. The rest drowned trying to tame the wave.

Butterfly Effect: When Dust Blows Up the Machine

Forget linear causality. In chaos space, a grain of sand flips the machine. A press release in Taiwan shifts a bond yield in Berlin, which ruptures a liquidity corridor in São Paulo. The 2010 Flash Crash wasn’t a glitch—it was the inevitable punchline of hyperconnected systems twitching under latency and leverage.

Chaos isn’t an error. It’s feedback amplified. A rogue algorithm nudging futures contracts set off a trillion-dollar air pocket in minutes. This isn’t an anomaly—it’s architecture. And if you know how the feedback ripples, you can front-run the cascade. You can position before the nodes synchronise and markets convulse.

David Paul, digging through the folds of neurobehavioral finance, showed how our pattern-hungry brains hallucinate structure. But what if the hallucination is the access point? In chaos, pattern recognition becomes a survival instinct. The key is filtering what’s signal and what’s cognitive residue. Noise becomes a tool.

Fractals: The Market’s Warped Skeleton

Mandelbrot cracked it: Markets are not linear, not even random—they are fractal. The Dow isn’t a trend; it’s an eddy. A 5-minute chart echoes a 5-year chart. Self-similarity isn’t aesthetic—it’s structural. The same psychological reflexes spiral at every time scale.

Bulkowski’s chart pattern bible is quaint by chaos standards. But hidden in his empirical catalogue of head-and-shoulders and wedges lies a dormant monster: fractal recurrence. A pattern doesn’t just repeat—it embeds. A triangle on the weekly chart could echo on the 15-minute chart with uncanny symmetry. But most traders miss this because they think in time, not dimension.

Enter the Fractal Dimension (FD). Think of it as the market’s heartbeat irregularity. A clean trendline is an FD of 1.00—dead simple. But the more the market twitches, reverts, coils? The closer it approaches FD 2. That’s complexity. That’s an opportunity. When the FD surges, the market whispers that it’s ready to bifurcate. That’s your entry.

Mass Psychology: The Hidden Algorithm in Chaos

Chaos without context is just noise. But chaos with human fingerprints—that’s where the real signal hides. Markets don’t just move because of math; they move because of fear, greed, hope, and denial. Mass psychology isn’t the enemy of chaos theory—it’s the amplifier. It bends probabilities. It steers the trajectory of “random” events toward predictable inflexion points.

Do you want to harness chaos? Study how crowds respond to it.

Take capitulation bottoms: statistically messy, technically volatile—but emotionally predictable. When enough traders puke out positions simultaneously, it’s not because the fractal hit some magic number. It’s because the herd snapped under emotional strain. That’s where chaos theory and crowd behaviour interlock. The stampede is the signal.

Smart money doesn’t run from chaos. It listens to its tone. It tracks the hysterics on social media, watches the spike in put/call ratios, and smells the blood in sentiment surveys. And then? It buys.

Fractal structures may set the stage, but mass psychology pulls the trigger. Chaos isn’t just physics—it’s theatre. And when the crowd screams “randomness,” that’s often when the script is at its most rehearsed.

The Strange Attractors of Fear and Greed

Chaos doesn’t mean everything is equal. It means a strange attractor—a vortex of behaviour—pulls systems into repeating turbulence patterns. In markets, that’s fear and greed. But not just any fear. Not just any greed. These are primed, cyclical, and triggered by subconscious cues and algorithmic mimicry.

Watch how retail sentiment floods into short squeezes right after quiet accumulations by the smart money. It’s not an accident. It’s rhythm. It’s the same attractor returning. Meme stocks in 2021? The early 2000s tech echo. Dot-coms were fractals, too. And they still are—look closer at AI, biotech, and clean energy. These are not trends—chaotic structures pulsing at different temporal wavelengths.

Savvy investors don’t predict—they position. They look for an emerging order from disequilibrium. Chaos thinkers don’t ask, “Will this stock go up?” They ask, “Is this sector near a bifurcation point?” They listen for turbulence.

Disruption Is a Signal

Most investors panic when the charts go nonlinear. But those jagged, unexplainable price actions? Those are moments of phase transition. Like a quantum system switching between spin states, the market is trying to organise itself at a higher level.

Flash rallies, sudden collapses, V-shaped recoveries—these aren’t to be feared. They are bridges between attractor states. Look at March 2020. Look at October 1987. Look at August 1998. Every violent rupture created an asymmetric opportunity. But only for those attuned to the tremors.

Here’s how you exploit it:

- Track volatility clusters — not as risk, but as pressure valves.

- Overlay timeframes — find where fractals align across scales.

- Use entropy metrics — higher entropy zones often precede breakout moves.

Quantum Investing: The Market Is a Probability Wave

What if the market is a quantum object—a waveform of probabilities collapsing only when you interact? Chaos Theory meets quantum cognition. Prices don’t exist in one state. They flicker between zones. The investor is Schrödinger’s cat: both early and late, depending on how they observe the trade.

You don’t need to predict the market—you need to interfere with it constructively. Enter when the wave peaks—exit when the coherence decays.

Think in interference patterns. Use chaos as radar.

Edge Cases: Where Chaos Dances With Truth

Most investors live in the fat middle of the bell curve. But the real money lives in the tails, on the edge, where volatility breathes.

Chaos theory doesn’t care about averages. It loves outliers. Flashpoints. Think of:

- The 1982 bull launch, when everyone was looking down

- The crypto boom emerging from sovereign mistrust post-2008

- Post-pandemic tech surges birthed from remote entropy

Each started as noise. Then became narrative. Chaos thinkers front-run the narrative by detecting phase transitions before the crowd smells them.

Chaos as Art Form: The Trader as Jazz Musician

Linear traders are sheet-music types. Chaos traders are jazz improvisers. You riff off tension. You detect the key change when the rest are playing the old progression.

To master chaos, train like a jazz musician:

- Repetition breeds intuition: trade the same pattern across fractals.

- Sensitivity over certainty: sense when structure wants to change.

- Embrace paradox: hold bullish and bearish scenarios simultaneously until the waveform collapses.

Chaos Tools: Weapons from the Wild

To dance with chaos, upgrade your arsenal. These are not standard tools. These are instruments of fractal war:

- Lyapunov Exponents: measure divergence speed. High values = unstable zone = opportunity.

- Entropy Indicators: spike before trend shifts.

- Multifractal Spectrum: reveals hidden structure in what looks like noise.

These aren’t for comfort traders. They’re for those who want an edge at the margin—where the signal gets strange and real.

Chaos is a Mindset

You cannot invest chaotically if you think linearly. You must rewire. Abandon control. Let go of perfect information. Embrace feedback loops. Feel the market breathe. You don’t surf the trend—you entangle with it.

Disorder is the doorway. Precision is born from ambiguity. Your best trades won’t make sense—until they do. That’s chaos.