Editor: Vladimir Bajic | Tactical Investor

Random Article of the Week

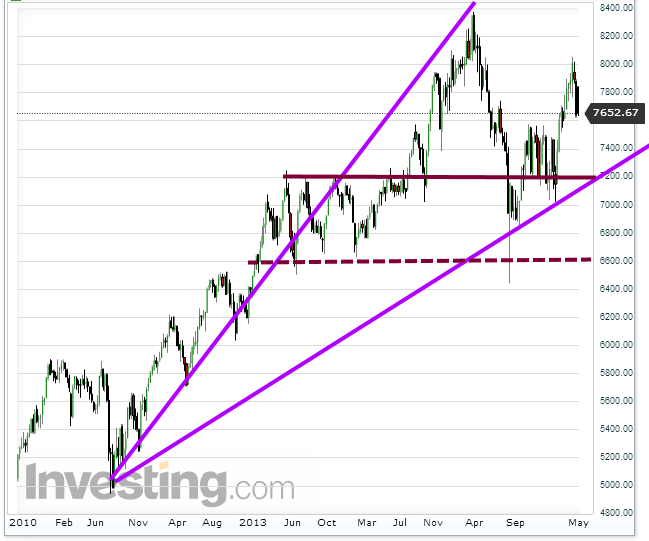

The one-year chart indicates that things appear to be going smoothly on the surface, and injecting large amounts of money into the markets seems to yield positive results. Even if the index were to decline all the way to 7200, the short-term outlook would still be optimistic. We acknowledge that this economic recovery may be deceptive, but merely complaining and expressing discontent does not offer any additional market insights.

While it is said that the truth can bring freedom, in many cases, it can prove detrimental to one’s health and wealth, particularly when it comes to the financial markets.

When examining the longer-term chart, it becomes apparent that the index is in a consolidation phase. As long as it does not consistently close below 6600 on a monthly basis, the overall outlook remains optimistic. In fact, one could make the case that the index is forming a solid foundation, potentially serving as a launching pad for a move towards and beyond 8400. The current pullback is ideally expected to conclude within the 7100-7200 range, with a potential overshoot into the 6900 range. BBC Global 30 Index Signals Dow Industrial Index will trend higher

Engaging Article Worth Exploring: Next Stock Market Crash Prediction: Hype Or Hope

Brexit Frees Britain From Carbon Taxes

In the UK, a proposed tax is set to replace the EU emissions trading system, where the prices for permits have surged close to €30/t ($33) and are projected to continue rising. Coupled with the depreciation of the pound, this scenario suggests the possibility of a considerably lower carbon price in Britain compared to that of the continent.

Implementing this tax will occur if the UK fails to secure a withdrawal agreement with the EU by the deadline of 31 October, which marks its departure from the bloc.

Lowering the carbon price below that of the EU would not be viewed favourably for the UK. It would establish an unfavourable precedent for carbon pricing, which is why caution is advised in such a decision. Full Story

Interested In Mass Psychology & The Markets

Stay informed and up-to-date with the latest developments by subscribing to our complimentary newsletter. Our coverage spans various topics, including financial markets and global food supplies. By incorporating the principles of mass psychology, we can identify trends in any market and provide valuable insights on navigating them successfully.

Join our community to gain access to this valuable information and ensure you’re on the right side of the market. Sign up for our free newsletter today.

Other Articles of Interest:

Why Is Apple Investing Chinese Uber Didi-running scared (May 21)

Copper & Baltic Dry Index Useless leading Economic Indicators, Better alternative is available (May 20)

Chinese Buyers Opting For Bigger Cars (May 19)

Real Reason Europe being flooded With Violent Immigrants (May 18)

Chinese Renminbi bullish long term outlook (May 8)

Sanctions backfire; Sberbank has gone from the threat of dollar famine to feast (May 5)

Gold Bugs think & stop listening to Fear mongers (April 29)

Alibaba poised for Strong New Growth; Don’t Listen to the Naysayers (April 29)

Fear Mongers Parasites that Profit from your Fear (April 27)

Why Gold Bugs got the Gold Market Wrong (April 17)

2 Trillion Mega fund; Saudi’s end of oil Era plan wishful thinking (April 16)