He that can have patience can have what he will.

Benjamin Franklin

Silver Price Forecast: Steer Clear of Panic and Opt for Rational Choices

Updated July 2023

When engaging with the precious metals sector, it’s advisable to employ historical examples to underscore the significance of specific subjects. This sector is one of the most manipulated throughout history, and its patterns consistently recur. Those who fail to learn from history are destined to relive it.

We are still not fully convinced that Gold is entirely out of the woods Peter Schiff has been telling everyone that it was unwise to have sold Gold in 2011 and that it would reach $2,000 by 2009 and $5,000 by 2013. However, the trend and price of Gold indicate otherwise. Gold never traded at $2,000, let alone $5,000, in those stated time frames. Schiff is presenting alarming scenarios, though not as dramatic as James Sinclair’s prediction of Gold moving to $50,000 per ounce. Even in our dreams, we struggle to envision such a price, so it’s remarkable he can propose such targets without strong influence. This appears to be fear-mongering, and markets are unforgiving toward those driven by fear or euphoria.

If Gold traded at $50,000 per ounce, you would likely be living in a cave with weapons, as the world as you know it would have collapsed. Individuals like this mislead the hard money enthusiasts into believing Gold is the solution to all their problems. We say “crowd” because they know just enough about hard money to endanger their health and wealth.

Individuals like this trick the idiotic fashion hard money crowd into thinking Gold is the solution to all their problems. We use the word fashion because they know just enough about hard money for it to be dangerous to their health and wealth.

Silver Prices Forecast: Separating Fact from Fear

As long as man does not evolve, man will find a way to rob Peter and Paul. So Gold standard or rubbish standard matters not. Sol Palha

The Hard Money crowd has been singing the praises of Gold and the Gold standard for decades. However, their understanding of fiat money is severely limited, making their opinions dangerous and unhelpful. The Fed proved this point by inflating the money supply, strengthening the dollar, and hammering Gold, all while the Hard Money crowd chanted that the Fed was backed into a corner. The truth is that the Fed is run by brilliant, albeit nefarious, individuals who have been able to control the velocity of money to their advantage.

Although Gold has not fared well in the face of a weak dollar, experts still say it will eventually experience another strong rally. However, the truth is that higher Gold prices are unlikely until the Fed allows it. At present, high-tech stocks make for a better investment.

The trend for Gold remains neutral, but it has shifted from negative to neutral. Investors will not be satisfied until it turns bullish. It is essential to note that Gold will experience another strong correction, and the only question remains whether the punishment will end with a higher low or a lower low on a monthly basis. A higher low will indicate that a bottom is in place, and the trend is likely to change direction.

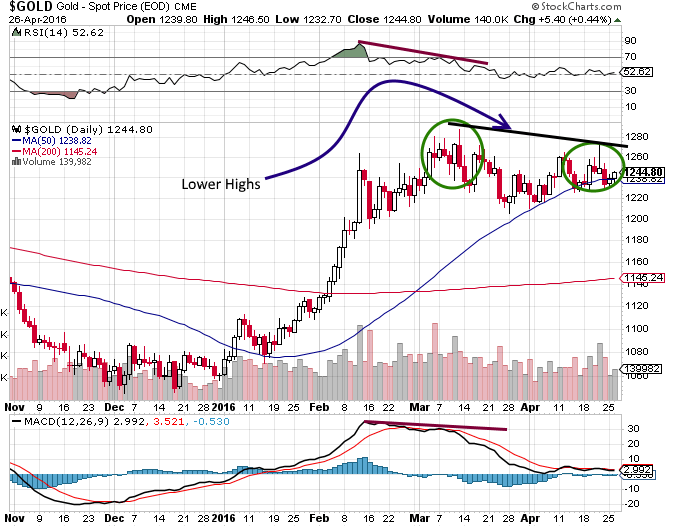

The charts provide some interesting data.

Note that Gold has been putting in lower highs since March, triggering several negative divergence signals on the chart.

Gold’s Changing Fortunes: Dollar Weakening and Investor Insights

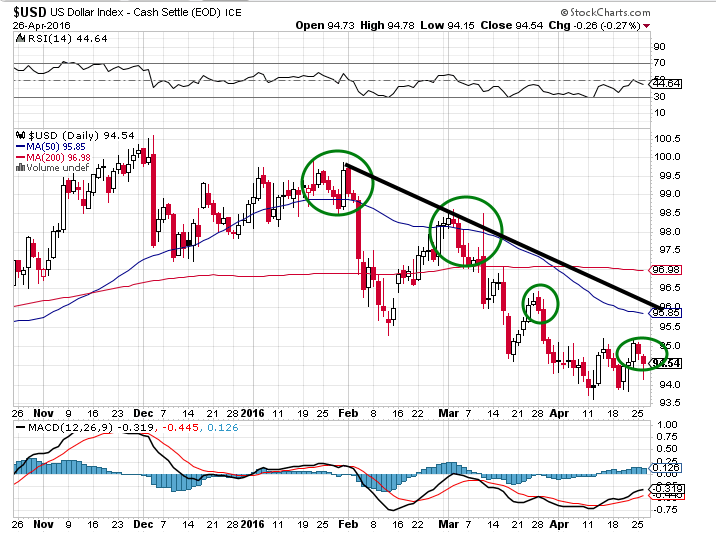

Gold responded positively to the weakening dollar from February to March of 2016. However, the trend has since undergone a shift. Gold has been establishing lower highs, whereas the dollar has been reaching new lows. This signals that Gold is currently out of sync with the market. There’s a likelihood that the dollar will reach its bottom and experience a rally, while Gold’s upward momentum is expected to wane.

The initial strength exhibited by Gold presents an opportunity for early bulls to be shaken out. There exists a potential scenario where Gold might encounter a final decline to the $ 1,000 range before stabilizing for several years. This juncture demands gold investors to remain vigilant and avoid succumbing to fear or hype. Emphasizing the long-term perspective over short-term fluctuations is imperative.

Silver Price Forecast and Gold Market Action Game Plan

The key takeaway from this analysis is that caution should be exercised when considering investments in Gold. While it may seem like a safe haven in times of economic uncertainty, the reality is that it is subject to the same market forces as any other investment. To make sound investment decisions, it is important to remain objective and informed about the current state of the market.

As with any investment, diversification is key. Allocating some funds towards Gold or silver bullion can be prudent, but it should not comprise the entirety of an investment portfolio. Investors should also pay attention to the performance of Gold stocks during corrections in the market, as those that hold up well could signal future opportunities for growth.

In the case of Gold, the trend is currently neutral, and there is a possibility that it could test the $1000 range again. However, for those who are willing to take a measured approach and exercise patience, there are opportunities for profitable investments in the future.

An ounce of patience is worth a pound of brains.

Dutch Proverb

Originally published on September 3, 2020, and continuously updated over the years, with the latest update completed in July 2023.

Other Stories of Interest

How will Gold fare in a negative interest environment (April 14)

Electric Vehicles set to wreak havoc on Crude oil market (April 13)

Negative Rates are Godsend for the Greedy, the unscrupulous corporate world (13 April)

Oops we are doing it again; Subprime Auto Loan Crisis party has begun (12 April)

Federal Reserve’s Game plan; create a new class of slaves (12 April)

I like the proverb how true. I’m not greedy & would take an ounce of brains.

As to Gold-what a difference 2 days make. Looks like Gold resynced[cc]. But when it looks good it should be sold sometimes. How’s that for an analysis. Where now brown cow?

The proverb is excellent and if put into practice the results are almost always positive. Gold did move higher, but from the noise in the Gold camp, you would think it was trading north of $1400. Oil is what has moved nicely, Gold well not yet. It should have put in a series of new 6 month highs, but instead only recently managed to breakout. Depending on your time frame and discipline Gold could be construed as a good investment now. However, we would rather wait for confirmation from several fronts before jumping in. The dollar could trade down to 90 without affecting the bullish pattern. If it were to break below that level decisively on a monthly basis it would alter the outlook.

It is also a matter of time before the US embraces negative rates, and that is an unknown area for Gold.

However, if the long term trend turned positive in Gold we would embrace Gold ASAP and that has not happened yet.

As for your analysis there is some truth to it. It is close to the saying “if it’s too good to be, then it usually is”

Having said, that we are not bearish on Gold and the majority who read this article assumed we are bearish on the metal. They let the headline dictate the way they interpreted the data