Dow 50,000 Looms: Who Wins, Who Bleeds, Who Vanishes

Oct 2, 2025

Introduction:

Every mania begins like a love story. It whispers before it roars. The Dow marching toward 50,000 is not a surprise, it’s a seduction. The rhythm builds in increments, not bursts. AI headlines fire like champagne corks. Crypto rises from each regulatory grave like Lazarus with a better lawyer. Foreign capital, thick and unblinking, pours into U.S. markets as if gravity has been repealed. Every uptick feeds the next, every disbelief converts another skeptic. This is how manias ripen—not in chaos, but in rhythm.

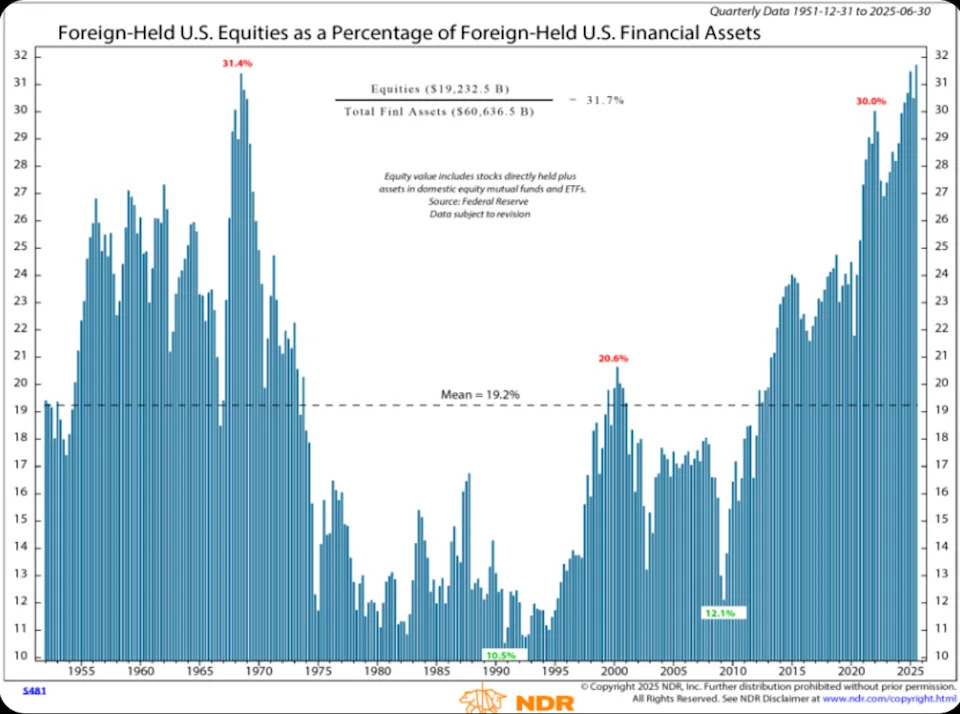

The chart of foreign-held U.S. equities is the quiet tell. At roughly 30–31 percent of foreign-held financial assets, we stand at mirror altitudes: 1970, 2000, and now. The mean is 19.2 percent, but manias are allergic to averages. Foreign capital has always been the accelerant—the marginal buyer that transforms a rally into a fever. In 1970, foreign portfolios were this concentrated, and the unwind that followed didn’t simply deflate prices; it shattered regimes. The same happened in 2000, though on a smaller scale. Each peak carried a promise of permanence. Each collapse revealed how fragile conviction becomes when it is bought with liquidity, not belief.

The Seduction Begins: Dow 50K as Love Story, Not Shockwave

The seductive part is that it feels earned. Earnings beats keep coming. AI productivity stories metastasize through every sector. Investors convince themselves this time the flows are structural. They call it “new global allocation,” “capital rotation,” “the dollar as fortress.” Beneath the vocabulary lies an ancient pattern: price strength validates itself until the narrative breaks. Liquidity sculpts the marble, valuation is the stone. When foreign money flows in, multiples expand. When it reverses, multiples compress before earnings adjust. That’s the historical rhythm.

This same rhythm played out in the late 1960s. Inflation doubled, deficits ballooned, war expenses mounted, yet the S&P 500 gained fifty percent from 1965 to 1972. Narratives overpowered arithmetic. The “Nifty Fifty” became untouchable. Top-heavy concentration defined the era. Today, the top seven U.S. stocks account for nearly 30 percent of the S&P. The rhyme is not poetic, it’s mechanical.

Mirror Altitudes: Foreign Flows, Policy Crosswinds, and Historical Echoes

Foreign inflows amplify every move. In the 1960s, swelling money supply juiced prices. Today, fiscal outlays and swollen balance sheets act as accelerants. Liquidity is abundant; conviction is thin. Everyone is betting that the foreign bid is permanent. But foreign flows are fickle allies. When Nixon severed gold convertibility in 1971, the dollar plunged 23 percent in two years. Foreign investors saw returns evaporate in currency losses and fled. Allocations collapsed from 31 percent to near 10–12 percent by the early 1980s. Valuations didn’t break because earnings collapsed first. Valuations cracked before profits fell. This is the first movement of reversal: multiple compression precedes earnings pain.

Policy crosswinds make the terrain even trickier. Then: alternating credit restraint and fiscal expansion, the crucible of stagflation. Now: deficits at six percent of GDP, sticky core services inflation, a central bank tightening with one hand and a fiscal arm spraying fuel with the other. It’s not a clone of the 1970s, but the direction rhymes. When narratives ride liquidity and policy drifts, the eventual snap is sudden.

If the 1920s Had Foreign Flows: A Hypothetical Detonation

Now stretch back further—to the Roaring Twenties. Imagine if foreign capital then could flow into U.S. equities as freely as it does today. Picture the jazz-infused optimism, the ticker tapes streaming, the radio crackling with bull stories—and then layer in foreign inflows at thirty percent of total financial assets. The bubble wouldn’t have been merely national; it would have been globalized leverage. When the break came, the cascade would not have stopped at the Hudson; it would have rolled across oceans overnight. The Great Crash was brutal enough without foreign amplifiers. With them, it might have been instantaneous—a synchronized detonation.

This is the hypothetical that today shadows the Dow’s ascent. We have the foreign accelerant now. Thirty percent of foreign-held financial assets sit in U.S. equities. That is not diversification. That is concentration at historical extremes. When foreign money decides to run, it doesn’t walk; it sprints. And when it does, the very sectors that are now engines of euphoria—AI, crypto, anything carrying a narrative halo—become liquidity traps. They’re crowded on the way up and abandoned on the way down.

The psychological seduction is that foreign flows feel invisible until they reverse. The headlines don’t say, “Foreign allocations hit critical altitude.” They say, “Dow nears record,” “Tech leads rally,” “Soft landing optimism grows.” That’s how euphoria cloaks itself: in the language of normalcy. The seduction is deep because it is quiet.

Round numbers act like psychological magnets. 50,000 is not just a number; it’s a threshold narrative. Investors don’t analyze round numbers—they feel them. The market tends to crest near psychological thresholds because collective euphoria reaches its fullest expression there. Everyone wants to be the genius who held through the number. Few want to be the fool who sold too early. That tension pulls capital into the vortex.

The Stronghold and the Outer Wall

This is why Dow 50,000 is both likely and dangerous. The flows, narratives, and policy environment can push it there. AI and crypto mania can spill into laggard sectors. Foreign allocations can keep feeding the rally. But the real game begins after 50,000. Once the number is hit, the narrative loses its forward vector. It shifts from “approaching” to “achieved.” Seduction gives way to strategy. Liquidity starts looking for exits.

Think like a general here. A stronghold is safest before the first breach. After that, every defense must adapt under pressure. The U.S. market is the stronghold. Foreign capital is the outer wall. If the dollar bends, if valuation compression begins, if margins tighten under inflation’s weight, the outer wall will crack first. Foreign allocations will not politely glide to the mean of 19.2 percent—they’ll overshoot on the way down, as they did in every prior episode.

What makes this moment unique is the scale? In the 1970s, the world was less integrated, flows less instantaneous. In 2000, foreign concentration was smaller, technology less dominant. Today, the scale and speed of capital movement are unprecedented. The unwind, when it comes, will not resemble a gentle rebalancing. It will be a sudden, collective flinch—a global reflex. Like the 1920s, but wired to high-speed rails.

This is where the seductive rhythm begins to warp. You can feel the coil tighten. The euphoria is real, and it can run. Dow 50,000 is not a mirage. But in the shadows of that number lies the unspoken truth: foreign capital is fickle, narratives are fragile, and history has a habit of ambushing the confident.

The crowd doesn’t sense the turn until it’s already begun. That’s always been the rhythm. That’s why the smart ones watch not the number, but the flows.

Crossing 50,000: When Narratives Lose Their Forward Vector

The moment Dow 50,000 is crossed, the narrative architecture shifts. The rally’s gravitational center has always been the approach. Investors speak in tones of inevitability: “We’re almost there,” “the breakout is real,” “the world has changed.” But the instant the number is achieved, the story changes tense. The future collapses into the present. The euphoria that fueled the climb doesn’t disappear—it curdles.

The round number becomes a mirror, not a magnet. What was once a vector pulling capital forward becomes a psychological plateau. Investors don’t consciously articulate it, but you can feel it: the subtle deceleration, the sideways churn masked by residual optimism. Markets rarely collapse at the number itself; they plateau, build pressure, then snap when an external vector—a dollar turn, an inflation shock, or a foreign flow reversal—hits the system.

This is why the real danger is not missing Dow 50,000. The danger is what happens in the stillness after the cheer. When the collective voice quiets, predators move. Liquidity doesn’t disappear gradually. It vanishes in pulses.

Three Paths Through the Storm

History sketches out three broad scenarios, each with different psychological contours. None are pleasant, but some are survivable.

1. Baseline: Mean Reversion

Foreign equity shares drift from 30 percent toward their long-term mean of roughly 19 percent. This happens through valuation compression and mild currency shifts. Multiples contract before earnings fall, trimming excess but avoiding panic. This is the least dramatic path, but it still implies significant drawdowns. In 1970, mean reversion erased years of gains.

2. Stress Scenario: Accelerated Flow Reversal

The dollar bends, foreign investors face eroding returns, and allocations unwind fast. Margins, already narrowed by input costs, begin to crack. Multiples collapse, and foreign equity shares plunge toward 10–12 percent, echoing the 1973–74 collapse. AI and crypto leaders—those once adored engines of expansion—become exit doors. Crowded trades unravel at speed.

3. Stabilisation Scenario: Managed Descent

Liquidity support floods in. The Fed opens swap lines, repo facilities, and QE windows. Fiscal measures coordinate. Inflation cools slowly. Valuations compress, but flows unwind in a measured rhythm. This path requires deft coordination and psychological control across global actors—a feat rarely achieved under stress.

The baseline is likely. The stress scenario is plausible. The stabilisation scenario is possible but fragile. In each, the critical trigger is foreign flows. Their direction sets the tone, their velocity determines the depth.

Airbags Don’t Move Walls: Liquidity Meets Panic

Central banks have more tools today than in the 1970s: QE, forward guidance, standing repo facilities, global swap lines. These can delay a funding crisis. They cannot, however, repeal valuation mathematics or override foreign psychology. Airbags cushion impact; they do not move the wall you’re crashing into.

When the dollar turns, foreign capital behaves like water escaping a cracked dam. The initial trickle is invisible. Then, suddenly, the dam fails. Margins compress as wage stickiness meets stubborn inflation. Input costs chew through earnings. Multiples drop, earnings follow, and foreign allocations cascade lower. It’s not a slow, polite exit. It’s a stampede.

Behaviorally, this is the phase where crowds stop thinking in narratives and start reacting in reflex. Investors who swore to “buy the dip” discover that dips turn into trenches. The psychological fracture happens fast: optimism → confusion → disbelief → capitulation. Each stage accelerates the outflows.

The AI and crypto sectors will not be spared. They are the narrative leaders now, just as the Nifty Fifty were in the early 1970s and dot-coms in 2000. Narrative leaders rise first, peak hardest, and fall fastest. Their liquidity is deepest on the way up and most treacherous on the way down.

Surviving the Bloodbath: Strategy Beyond Euphoria

The goal isn’t to predict the exact trigger—it’s to read vectors before they break. Once Dow 50,000 is reached, the clock starts ticking on the exit psychology. Smart capital watches for three signs:

Foreign Allocation Inflection

A flattening or reversal in foreign ownership share is the earliest tremor. It doesn’t scream. It whispers. When foreign exposure stops rising despite bullish headlines, you’re near the hinge.Dollar Vector Shift

A sustained dollar bend flips the calculus for foreign investors. Gains evaporate in translation. History shows foreign outflows accelerate after the second or third bend, not the first.Valuation Compression Preceding Earnings

When multiples fall while earnings still look solid, the game has entered its second act. The crowd usually mistakes this for “healthy rotation.” It isn’t. It’s the prelude to earnings adjustment and flow reversal.

Strategically, survival means resisting the gravitational pull of euphoria. It means rotating out of overcrowded narrative sectors before the music stops. It means understanding that foreign capital is not loyal. It’s opportunistic.

Think like a commander retreating from overextended lines. You don’t wait for the enemy to breach; you reposition before the encirclement closes. Dow 50,000 will draw headlines, but foreign flows will dictate fate.

The bloodbath that follows is not inevitable—but the conditions are set. Liquidity is abundant, conviction is thin, and narratives are stretched to breaking. Foreign concentration sits at mirror altitudes. Round numbers act like finish lines. When the music fades, those who treated Dow 50,000 as the end will be trapped. Those who saw it as a vector hinge will move first.