Latest Stock Market News: Unraveling Mass Psychology Insights

Updated Nov 16 2023

When discussing mass psychology blended with the topic of stock market news, it becomes apparent that the way news is processed from a mass psychology or contrarian perspective can significantly impact individuals’ investment decisions. The following subtopics can be derived from the provided data:

When discussing mass psychology blended with the topic of stock market news, it becomes apparent that the way news is processed from a mass psychology or contrarian perspective can significantly impact individuals’ investment decisions.

The Influence of Mass Psychology on Investing:

Mass psychology plays a significant role in shaping investor behavior and decision-making processes. Understanding the influence of mass psychology on investing is crucial for investors to make informed choices and avoid falling into common pitfalls.

One aspect of mass psychology is the tendency of investors to follow the crowd. Human beings are social creatures, and this social influence extends to the realm of investing. When a particular investment or asset class gains popularity and attracts media attention, there is a natural inclination for investors to jump on the bandwagon without conducting thorough analysis. This herd behavior can result in asset bubbles and market inefficiencies.

The fear of missing out (FOMO) and the fear of losing out (FOLO) are powerful emotions that can drive investor decisions. FOMO refers to the anxiety and desire to participate in an investment that appears to be generating significant returns. On the other hand, FOLO stems from the fear of missing out on potential gains and leads investors to make impulsive decisions based on short-term market movements. Both FOMO and FOLO can cloud judgment and result in irrational investment choices.

Mass psychology also contributes to the phenomenon of market sentiment. Investor sentiment refers to the overall mood and emotions prevailing in the market. Positive sentiment can lead to exuberance and overvaluation, while negative sentiment can trigger panic selling and market downturns. Investor sentiment often amplifies market movements, causing prices to deviate from underlying fundamentals.

Recognizing the influence of mass psychology on investing is essential for investors to adopt a disciplined and rational approach. It is crucial to conduct thorough research, analyze fundamentals, and make investment decisions based on individual goals and risk tolerance rather than succumbing to the emotions of the crowd. Developing a contrarian mindset can help investors avoid excessive optimism or pessimism and identify opportunities when market sentiment deviates from fundamentals.

Example: During a market rally, when everyone is optimistic and buying stocks, investors may be influenced by mass psychology and feel compelled to join the trend without considering the fundamentals of the companies they invest in.

The Impact of News on Investor Behavior:

The impact of news on investor behavior is significant, as it can shape market sentiment and influence investment decisions. Investors often rely on news sources to stay informed about economic, political, and financial developments. However, it is important to recognize the potential biases and sensationalism that can be present in news reporting.

Media outlets have a tendency to sensationalize negative news, as it tends to attract more attention and generate higher viewership or readership. This can create a sense of urgency and fear among investors, triggering emotional responses such as panic or anxiety. For example, a news article highlighting a potential economic crisis can lead investors to sell their holdings out of fear, causing a widespread sell-off and a decline in stock prices.

Investors who solely rely on news headlines without conducting thorough analysis may make impulsive investment decisions. News articles often provide a snapshot of a situation without offering a comprehensive understanding of the underlying factors or context. This can lead to hasty judgments and actions based on incomplete information.

It is crucial for investors to approach news critically and consider multiple perspectives. They should seek to understand the underlying data, conduct their own research, and analyze the potential impact of news events on their investment portfolios. By maintaining a long-term perspective and focusing on fundamental analysis, investors can avoid being swayed by short-term news fluctuations.

Furthermore, it is essential to diversify information sources and seek out balanced reporting. Relying on a single news outlet or a narrow set of sources can lead to a biased view of the market and potentially result in uninformed investment decisions. By considering different viewpoints and evaluating the credibility of news sources, investors can make more reasoned and well-informed choices.

In conclusion, news has a significant impact on investor behavior, as it can shape market sentiment and trigger emotional responses. Sensationalized negative news can create fear and panic among investors, leading to impulsive decisions. It is crucial for investors to critically evaluate news, conduct thorough analysis, and maintain a long-term perspective to make informed investment choices. Diversifying information sources and considering multiple perspectives can help mitigate the potential biases and limitations of news reporting.

Example: A news article highlighting a potential economic crisis can create panic among investors, leading to a widespread sell-off and a decline in stock prices.

The Time Lag Between News and Market Reaction:

The time lag between the release of news and its impact on the market is an important consideration for investors. By the time news reaches the general public, it is possible that the market has already incorporated the information into asset prices to some extent. This time lag can have implications for investment decisions and the potential profitability of reacting to news.

Professional investors and institutional traders often have access to news and data ahead of the general public. They employ sophisticated tools and technologies to analyze information quickly and make investment decisions based on their assessments. This gives them an advantage in reacting to market changes and exploiting any pricing inefficiencies that may exist.

On the other hand, retail investors who rely on delayed news sources may experience a significant time lag in receiving and processing information. By the time individual investors become aware of important news, such as quarterly earnings reports, professional investors may have already reacted and adjusted their portfolios accordingly. This can result in retail investors missing out on potential investment opportunities or reacting to outdated information.

The time lag between news and market reaction highlights the importance of timely access to information for investors. Retail investors should consider utilizing real-time news sources and market data to minimize the impact of the time lag. Staying informed and proactive in monitoring market developments can help individual investors make more timely and informed investment decisions.

Additionally, it is essential to recognize that the market’s reaction to news is not always immediate or predictable. While some news events may have an instant and significant impact on asset prices, others may have a more gradual or delayed effect. Investors should exercise caution and avoid making impulsive decisions solely based on the immediate reaction to news.

In conclusion, the time lag between the release of news and its impact on the market is an important factor to consider for investors. Professional investors often have access to news and data ahead of the general public, giving them an advantage in reacting to market changes. Retail investors who rely on delayed news sources may experience a time lag that can affect their ability to capitalize on investment opportunities. Timely access to information and proactive monitoring of market developments can help mitigate the impact of the time lag and enable more informed investment decisions.

Example: When a company releases its quarterly earnings report, professional investors may have already analyzed the data and made investment decisions before the public announcement. By the time individual investors receive the news, the stock price may have already adjusted according

Contrarian Investing and Going Against the Crowd

Contrarian investing is a strategy that involves taking positions opposite to prevailing market sentiment. Contrarian investors believe that the crowd is often wrong and that market overreactions can present opportunities for profitable investments. By going against the crowd, contrarian investors aim to capitalize on the mispricing of assets and take advantage of market inefficiencies.

Contrarian strategies typically involve buying assets when others are selling and selling when others are buying. During periods of market pessimism, such as market crashes or downturns, contrarian investors may see it as an opportunity to buy quality assets at discounted prices. Conversely, during periods of market exuberance and optimism, contrarian investors may choose to sell or reduce their exposure to overvalued assets.

Contrarian investing requires independent thinking and the ability to challenge popular opinions. It involves conducting thorough research and analysis to identify instances where the market sentiment may be detached from the underlying fundamentals of an asset. Contrarian investors look for indications of market overreactions, sentiment extremes, or situations where assets are undervalued or overvalued relative to their intrinsic worth.

One of the key challenges of contrarian investing is the ability to withstand short-term market volatility. Going against the crowd means that contrarian investors may experience periods when their investment decisions appear to be out of sync with the broader market. However, contrarian strategies are typically based on a longer-term perspective, with the belief that market sentiment will eventually align with the underlying fundamentals.

It is important to note that contrarian investing is not without risks. Market sentiment can persist for extended periods, and it requires careful judgment to distinguish between genuine market inefficiencies and situations where the crowd’s sentiment is justified. Successful contrarian investing also requires discipline, patience, and the ability to manage risk effectively.

Example: During a market crash, when most investors are selling their stocks in panic, a contrarian investor may see it as an opportunity to buy quality assets at discounted prices.

Focusing on Long-Term Goals and Enjoying the Present:

Focusing on long-term goals and enjoying the present is a mindset that can benefit investors in several ways. Oftentimes, investors become overly concerned with short-term market fluctuations and lose sight of their long-term investment objectives. By embracing a long-term perspective, investors can reduce the influence of mass psychology and make more rational investment decisions.

Short-term market movements can be driven by a variety of factors, including news events, market sentiment, and speculative trading. These fluctuations can evoke emotions such as fear, greed, and anxiety, leading investors to make impulsive and irrational decisions. However, by focusing on long-term goals, investors can avoid being swayed by short-term noise and develop a more disciplined approach to investing.

A long-term perspective allows investors to ride out short-term market volatility and take advantage of compounding returns over time. It enables them to build a diversified portfolio aligned with their financial goals, taking into account factors such as risk tolerance, time horizon, and investment objectives. By maintaining a long-term outlook, investors can better weather market fluctuations and stay focused on their overall investment strategy.

Moreover, it is important for individuals to prioritize living a fulfilling life and making the most of each moment. While financial security is essential, constantly obsessing over market news and portfolio performance can lead to stress and detract from the enjoyment of the present. By finding a balance between financial planning and personal fulfillment, investors can maintain a healthier perspective on their investments and overall well-being.

It is worth noting that maintaining a long-term focus does not mean ignoring market developments or neglecting portfolio management. Regular portfolio reviews and adjustments are still necessary to ensure alignment with changing market conditions and personal circumstances. However, a long-term mindset allows investors to approach these decisions with a steadier and more rational mindset, avoiding knee-jerk reactions to short-term market fluctuations.

In conclusion, focusing on long-term goals and enjoying the present can benefit investors in multiple ways. By adopting a long-term perspective, investors can reduce the influence of mass psychology, make more rational investment decisions, and ride out short-term market volatility. Prioritizing personal fulfillment alongside financial planning can help individuals maintain a healthier perspective on their investments and overall well-being.

It’s important to note that while mass psychology and news can impact investment decisions, each individual’s approach to investing may differ. Some investors may rely heavily on market sentiment, while others may employ contrarian strategies or focus on long-term fundamentals.

Latest Stock Market News: Using MP To Make Money

- There will always be room for another massive disaster.

- Stress is the most destructive force in the universe (at least as far as living things are concerned). Therefore, if you are part of the living dead, then this probably does not apply to you.

- The best and most effective trigger for stress is fear of the unknown. 99% of humans know nothing that could be termed as relevant, and or the little that they know is more destructive than useful. Most people selectively choose their stress (poison); if you can selectively choose your poison, you can also decide not to ingest any more of it. Hence, the disease and the cure lie within your hands. Do something about it or someone else will, and the outcome will not be the one you wish, want, or hoped for?

- There will always be fear mongers warning you that the end of the world is nigh (so far their record is dismal for the world has not ended). Your best option is to view their dire warnings in the same light as the ravings of a lunatic.

- There will always be people who say I wish I bought when the markets were falling apart, but when that situation finally presents itself, these very same individuals will be the first to head toward the exit.

- Ironically, people worry about dying, instead of focusing on how to make each moment of this finite life more memorable. Dead men tell no tales because the living is much better at it.

Winning the stock market game

Instead of focussing on the Latest Stock Market News, individuals should focus on determining the trend of the market. The easiest way to determine the is to put the basic principles of mass psychology into play. Determine on which side of the fence the crowd is sitting. If the crowd is euphoric then avoid the markets and vice versa.

To win in the markets, you need to combine MP with investing. It is essential that MP becomes part of your investing strategy. The crowd is always wrong, and the big players have their ways of manipulating the crowd. Crowd manipulation is the way you trigger sharp rallies and sharp declines in the markets. The masses are always on the wrong side because they let their emotions get in the way. If you want to make money when you buy and sell stocks, whether they are large-cap stocks or penny stocks, putting mass psychology to use could help you tremendously

Pushing Boundaries: Exceptional Insights

Decoding the Enigma: What Are Gold Bugs

Long-Term Gold Targets: Exploring the Path to the Moon

Capitalizing on the Oil to Gold Ratio: An Ideal Time to Invest in Oil

Trading Chart Patterns Cheat Sheet: Mastering the Key to Success

Abu Bakr al-Baghdadi: The Rise and Fall of the ISIS Leader

Gold bullion bars prices: Trend Projections

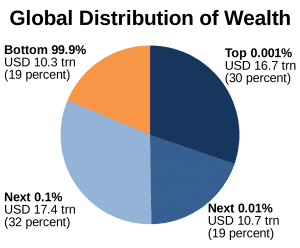

The Poor Get Poorer And The Rich Get Richer: Deepening Inequality

The Kurds: Defying Extremism and Paving the Path to Peace in Syria

Volatile Markets: Conquer Market Turbulence and Thrive

Is Religion Dying: Shaping Beliefs with New Discoveries

Exploring the Depths of the Unconscious Mind

Day Late and a Dollar Short: Lessons in Timing and Consequence

Fake Currency: Central banks Print money & buy bullion with it

Food for thought Archives

Is Religion a Scam? Unveiling Truths and Myths

Clear illustration of the mass mindset