The paranoiac is the exact image of the ruler. The only difference is their position in the world. One might even think the paranoiac the more impressive of the two because he is sufficient unto himself and cannot be shaken by failure. Elias Canetti

Bull vs Bear Market: The Battle Rages

Updated June 2023

The case for a stock market bull is much stronger:

Flashback; Dow today looks like Dow yesteryear. The pattern the Dow is tracing is jarringly similar to that of 2011. If history will serve as a guidepost, then the Dow could be ready to roar as opposed to being down for the count. When the markets were plunging in 2011, the same question was posed. Is the Dow going to crash, is the bull over? Turns out that the so-called crash was nothing but a hiccup in what turned out to be one of the most massive Bull Runs of all time.

Now we are faced with the same paradigm, and once again, the talking heads (many who have the audacity to call themselves experts) are marching to the same drumbeat and chanting the same song of doom. We have repeatedly stated over the years that we are living in an era of lies and deceit, where the laws of reality have been suspended, and masters of deception (A.K.A central bankers) have helped create an alternate reality. In this reality, savers are punished, and speculators are rewarded. Markets have been manipulated for an extraordinary period by artificially holding down interest rates for a record period of time.

Unveiling Deception: Navigating the Twisted Markets

As we live in an era of lies and deceit, where rampant manipulation is the order of the day; worse still, no one is contesting this manipulation. The masses have embraced that this is their destiny and surrendered to this new market norm.

This new norm rewards speculators and punishes savers. Under such circumstances, focusing on the Bull vs bear market argument makes no sense. Instead, focus on the Stock Market bull aspect only.

The laws of reality have been suspended (courtesy of the masters of deception, otherwise known as the friendly Fed), and the markets will only crash if access to easy money is eliminated. This hot money is the main driving force behind these markets and will continue to be so in the foreseeable future. Normal market rules cease to apply against this backdrop of trickery and dishonesty.

The Market’s Resilient Symphony: Beyond Bull and Bear

Therefore, our contention has been that every major correction for the past several years is nothing but the market letting out a well-deserved dose of steam; a massive crash is not the makings, at least not yet. One day the markets will crash, but as this market is being propped up by hot money, anything and everything will be done to prevent the needs from crashing. If there were any dose of freedom left in these markets, they would have crashed long ago. Therefore, again, do not waste time on the Bull vs bear market theme; instead, pay attention to the trend. As the trend is bullish, the markets are expected to trend much higher.

There is a stark difference between thinking you know what will happen and knowing what will happen. Mass psychology clearly states that markets usually run into a brick wall when the Crowd is Euphoric and chanting “Kumbaya, my love”. This is not the case yet, and the sentiment is far from the euphoric zone. This is one of the most hated bull markets in history.

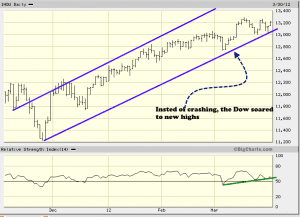

Bull vs bear market; actually, It’s 2011 all over again

The predictions that Dow was destined for destruction during the correction of 2011 might have appeared erudite. Those predictions, now in retrospect, sound more like the ravings of a lunatic. Be wary when the masses are joyous and Joyous when they are not; that is the most basic tenet of mass psychology.

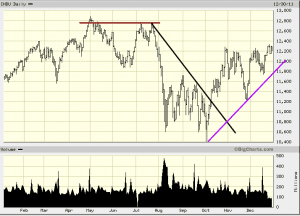

Dow Index Pattern in 2011

- In 2011, from high to low, the Dow shed roughly 16.2% or 2,070 points. Now, depending on your entry point, the experience could have ranged from mild to crash-like. If you purchased right at the top, the word crash probably flashed through your mind. Just because you think it’s a crash does not necessarily signify that your perceptions that are being overwhelmed by fear are correct.

- All media outlets were busy flooding the waves with stories that were extremely pessimistic in nature. Misery loves company, and stupidity demands it. Consumer confidence was not strong, and the U.S. credit rating was downgraded, manufacturing was slowing down, and so on. The 3rd quarter ended, and the 4th quarter began, and all those bogeyman stories well proved to be just that.

Markets climb a wall of worry and plunge a chasm of joy:

One can clearly see this in the chart below.

The Dance of Defiance: Dow’s Triumph and Vanishing Naysayers

In 2011, the Dow ended the year on a positive note, defying all the predictions of disaster. Three months into the new year (20120, the Dow soared to a series of new highs. Like cockroaches, the naysayers vanished into the woodwork, waiting for another day to sing the same old monotonous song, buoyant that time would make the masses forget the old proclamations and embrace the new ones; this falls dangerously close to the definition of insanity. Doing the same thing and expecting a different outcome. So far, the outcome appears to be the same, and if the pattern is repeated, these chaps will get clobbered.

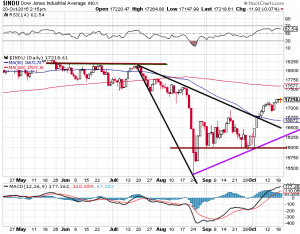

Market Outlook for the Dow 2015 and Beyond

During the so-called market crash phase in August, the Dow, from high to low, shed approximately 16.3%. Strikingly close to the 16.2% that the Dow gave up during the 3rd quarter of 2011. So far, in the 4th quarter, all the major market indices are faring much better than back in 2011. In the 4th quarter, the Dow has tacked on almost 5%.

Bull vs Bear Market; Chart Reveals No Case for a Bear Market

The VIX, which is an index that measures fear, blasted as the hounds of hell were chasing it. ItX surged to a new five-year high, indicating that the masses were hysterical. Panic is the secret code name for opportunity. Mass psychology indicates that when the crowds panic, the astute investor should be ready to jump in.

The bullish case for the Dow index in 2015

- A host of technical indicators are still trading in the extremely oversold ranges.

- Our trend indicator is dangerously close to triggering a new buy signal. The fact that it did not move into the sell zone validated that the correction was nothing but a market letting out some well-deserved steam.

- Retailers like Costco (COST), L Brands (LB), Fred’s (FRED), etc., all surprised analysts by reporting stronger than projected same-store sales.

Bull vs bear market scenario: here is our game plan

Fear has to be avoided under any circumstance when it comes to investing. It is a detestable emotion that sucks you dry. It takes and gives nothing back in return. When the crowd panics, one should resist the urge to become one with fear and the crowd. We are not in the jungle and fear is a useless emotion when it comes to making money in the markets. Please get rid of it or it will get rid of you. Fear is a parasitic emotion; the only good parasite is a dead parasite. So shoot to kill when it comes to fear

To break even for the year, the Dow only needs to trade approximately 600 points higher. If examines the entire journey (up and down) the Dow traversed from August to Oct, the count comes in at roughly 5000 points. Examined from this angle, 600 points does not amount to that much; the Dow still has roughly three months to achieve this objective.

Bull vs bear market; outlook supports a bull but expect Volatility

The V-indicator is trading well above the danger zone; 1100 points higher, to be precise. This means that extreme volatility will be the order of the day. One should not expect the ride up to be smooth. We have a fair amount of resistance in the 17300-17400 ranges. The ideal set-up would be for the Dow to trade in these ranges, with a possible overshoot to 17,600 and then test the 16,500-16,600 fields.

Bear in mind that the above targets should serve as rough guideposts. We never focus on identifying the exact bottom or top, a task we think is best left to fools with an inordinate appetite for pain. The game plan should be to view all strong pullbacks as buying opportunities. Line up the stocks you love, and then use strong withdrawals to open new positions.

Dow Dejavu? When one examines both patterns (2011 and 2015); the answer appears to be “yes.”

What will you do? Wait for this event to pass and then reminisce over what you should have or could have done, or will you muster the courage to act decisively?

Bull vs Bear Market. Jan 2020 Updated Views

There is no law or set rules for the markets other than being able to adapt to a given situation. We are dealing with emotions, and chaos is set free when feelings do the talking. And that is why like cattle, the lemmings always stampede when the markets sell off. The masses also tend to jump in when the markets are about to crash. Hundreds of years have passed since the Tulip Bubble, and nothing has changed.

The markets are volatile (Sept to Oct period), and the crowd tends to overreact to the news. Remember, every disaster becomes a disaster because the masses were conned into believing a false narrative. You say no way; how come reacting to disasters pays so poorly? The stock market is the best barometer for the disaster-prone. If disasters paid off well, the Dow should be closer to zero than 27K.

Navigating Panic and Overreactions in the Path of Market Trend

As always, the masses are panicking at precisely the wrong time. We also see new subscribers overreacting to the current pullback, which informs us that we are on the right side of the market. While the trend is up, there will be hiccups along the way, as no market trends are in a straight line. The higher it moves, the more volatility one can expect. Volatility is a Trend player’s best friend; in this case, it’s up so astute players can use strong pullbacks to add to current positions or open new positions

Random Reflections on the Market; July 2023

Prepare yourself for an impending state of utter turmoil surrounding news and data. We will strive to offer additional information in the forthcoming editions, subject to time constraints. It is imperative, however, to comprehend that easily accessible internet data will progressively lose its contrarian value. In essence, artificial intelligence (AI) will soon be able to meticulously analyze vast volumes of data, presenting it meticulously organised and elucidating it in simple terms for anyone’s understanding.

The ubiquity of a resource often leads to its devaluation. Consequently, the realm of investing is on the cusp of a profound transformation as previously invaluable data gradually diminishes in significance. In certain respects, we are reverting to an era reminiscent of independent pattern recognition akin to tape reading, which became obsolete during the late 1960s and early 1970s.

Numerous individuals fail to fully grasp that AI represents the subsequent monumental shock following COVID. While the anticipation of another virus or pandemic loomed, the extent of the repercussions stemming from this AI race remains widely underestimated. We firmly assert that AI will sow greater chaos than COVID. Therefore, let us appreciate these present times, wherein differentiating between reality and illusion remains relatively straightforward.

Market Skirmish: Bulls and Bears Dance

Prepare for a storm of chaos, news untamed,

Data swirling, elusive and unnamed.

In forthcoming issues, more we shall provide,

Time permitting, the truth we’ll confide.

Yet, grasp this truth, with elegance imbued,

Accessible data, once prized, subdued.

Artificial Intelligence shall rise,

Sorting through vast knowledge, unveiled to our eyes.

When abundance reigns, value fades away,

Investing transformed, a new game to play.

Patterns, once found in tape’s fading light,

Return anew, dancing in our sight.

But heed this warning, for few truly see,

AI, a shock, surpassing COVID’s decree.

Chaos it shall bring, in ways unforeseen,

Reality and illusion, a blurred screen.

In these present times, let clarity be sought,

Before the chaos, the reality is caught.

Originally published Oct 22, 2015, updated June 2023

Interesting Reads

Dow Transports Validating Higher Stock Market Prices (Dec 30)

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)