Harnessing Crowd Psychology for Explosive Stock Gains

April 9, 2024

Introduction: The Power of Crowd Psychology in Investing

Throughout history, influential figures like Julius Caesar, the Medici family, and even modern-day investors like Bernard Baruch have recognized the immense power of crowd psychology. Caesar, known for his famous quote, “I came, I saw, I conquered,” understood the importance of swaying public opinion in his favour. The Medici family, a powerful banking dynasty in Renaissance Italy, leveraged their understanding of crowd behaviour to maintain their influence and wealth for centuries.

Similarly, in the world of investing, Bernard Baruch, a renowned financier of the early 20th century, once said, “The main purpose of the stock market is to make fools of as many men as possible”. Baruch understood that the market is driven by its participants’ collective emotions and actions, and those who can harness this force stand to benefit greatly.

While crucial for our physical well-being, our survival instincts, such as fear and euphoria, can lead to disastrous investment decisions when left unchecked. By understanding the principles of crowd psychology, investors can learn to identify and capitalize on market sentiment, positioning themselves for success.

This article aims to demystify the often misunderstood concept of crowd psychology in investing, providing readers with the knowledge and tools necessary to navigate the complex world of financial markets. Through examining historical examples and applying psychological principles, we will demonstrate how mastering crowd behaviour can help investors make more informed decisions and potentially achieve explosive stock gains.

The Folly of Crowds: Insights from History and Modern Investing

Throughout history, the power of crowd psychology has been recognized by influential figures across various fields. The ancient Greek philosopher Aristotle once said, “The whole is greater than the sum of its parts,” emphasizing the collective strength of a group. Similarly, the 19th-century French sociologist Gustave Le Bon, in his seminal work “The Crowd: A Study of the Popular Mind,” argued that individuals in a crowd lose their sense of self and become more susceptible to the influence of others.

Warren Buffett, one of the most successful investors of all time, has often stressed the importance of going against the crowd. He famously stated, “Be fearful when others are greedy, and greedy when others are fearful” . This contrarian approach, rooted in an understanding of crowd psychology, has been a key factor in Buffett’s long-term success.

However, blindly following the crowd or even fashion contrarians can lead to disastrous results. As the renowned economist John Maynard Keynes once said, “The market can remain irrational longer than you can remain solvent” . This highlights the importance of understanding the nuances of crowd behaviour and not simply acting in opposition to the majority.

Recent developments in the field of crowd psychology have shed light on the complex dynamics at play in group settings. Researchers have identified various factors that influence crowd behaviour, such as social identity, emotional contagion, and the role of leaders. By understanding these underlying mechanisms, investors can gain valuable insights into market sentiment and make more informed decisions.

Ultimately, the key to success in investing lies in striking a balance between understanding crowd psychology and maintaining a disciplined, long-term approach. Benjamin Graham, the father of value investing, once said, “The intelligent investor is a realist who sells to optimists and buys from pessimists” . By combining insights from crowd psychology with a sound investment strategy, investors can navigate the complexities of the market and achieve long-term success.

Crowd Psychology: Lessons from Munger, Livermore, and Buss

Fashion contrarians often disregard the fundamental principles of mass psychology and investing, believing they are geniuses merely because they appear to be the least idiotic in a sea of idiots. However, as Charlie Munger, the vice chairman of Berkshire Hathaway, once said, “It’s not supposed to be easy. Anyone who finds it easy is stupid”. Munger’s words remind us that true success in investing requires a deep understanding of crowd behaviour and the discipline to act on that knowledge.

One of the most basic rules these so-called geniuses ignore is that mass psychology concerns the study of extreme behaviour. The legendary trader Jesse Livermore, who made and lost millions during the early 20th century, understood this concept well. He once stated, “The market does not beat them. They beat themselves because though they have brains, they cannot sit tight”. Livermore recognized that the key to success in investing is not simply opposing the masses for the sake of opposition but rather understanding when sentiment has reached a boiling point and acting accordingly.

A prime example of this principle in action can be found in the story of Jerry Buss, the former owner of the Los Angeles Lakers. In 1979, Buss made a bold move by purchasing the Lakers, the NHL’s Los Angeles Kings, and the Forum arena for $67.5 million, a record-breaking deal. Despite criticism and scepticism from the crowd, Buss recognized the potential for growth and success in the sports entertainment industry. His contrarian approach paid off, as the Lakers became one of the most successful and valuable franchises in sports history.

The lesson here is clear: true success in investing requires a nuanced understanding of crowd psychology and the ability to act on that knowledge when the time is right. As Munger once said, “The world is full of foolish gamblers, and they will not do as well as the patient investors” . By studying the principles of mass psychology and applying them with discipline and patience, investors can avoid the pitfalls of fashion contrarianism and position themselves for long-term success.

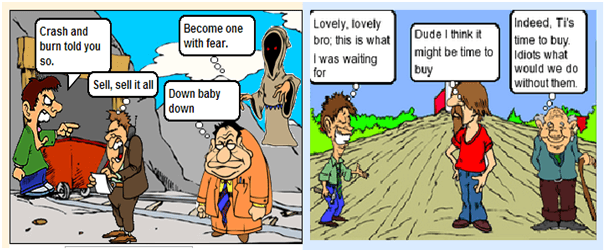

VisualizingMass Psychology: An Illustrated Exploration

The Perils of Crowd Psychology: Timeless Insights from Great Minds

Throughout history, great thinkers have recognized the powerful influence of crowd psychology on human behaviour and decision-making. The ancient Greek philosopher Aristotle once said, “The whole is greater than the sum of its parts,” emphasizing the collective strength of a group. This concept holds in the world of investing, where the emotions and actions of the masses can drive markets to extremes.

Legendary investor Warren Buffett has often stressed the importance of going against the crowd, famously stating, “Be fearful when others are greedy, and greedy when others are fearful” . This contrarian approach, rooted in an understanding of crowd psychology, has been a critical factor in Buffett’s long-term success. Similarly, Charlie Munger, Buffett’s long-time business partner, has noted that “It’s not supposed to be easy. Anyone who finds it easy is stupid”, highlighting the challenges of navigating market sentiment.

History is replete with examples of the dangers of succumbing to crowd psychology. The tulip mania of the 17th century, one of the earliest recorded market bubbles, demonstrates how collective euphoria can lead to irrational behaviour and disastrous consequences. More recently, the dot-com bubble of the late 1990s and the housing bubble of the mid-2000s serve as stark reminders of the perils of following the crowd.

In the current market environment, the prevailing belief that artificial intelligence (AI) will revolutionize the world has fueled a feeding frenzy, with investors disregarding prices and convinced that the upward trend will persist indefinitely. This mindset echoes the “it’s different this time” mentality that has preceded many market downturns.

As the renowned philosopher George Santayana once said, “Those who cannot remember the past are condemned to repeat it”. By studying the principles of crowd psychology and applying them with discipline and patience, investors can avoid the pitfalls of fashion contrarianism and position themselves for long-term success in the face of market extremes.

We trust this article offers clarity on this straightforward yet frequently misconstrued subject. We are committed to elucidating such topics and plan to enrich this series further. Please bookmark this page or subscribe to our updates and newsletter for ongoing enlightenment.

Unearth Extraordinary Articles for Your Curiosity

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Comic Strip Illustrating Mass Mindset