Bandwagon Effect Psychology: Win by Zigging When Others Zag

Sept 22, 2024

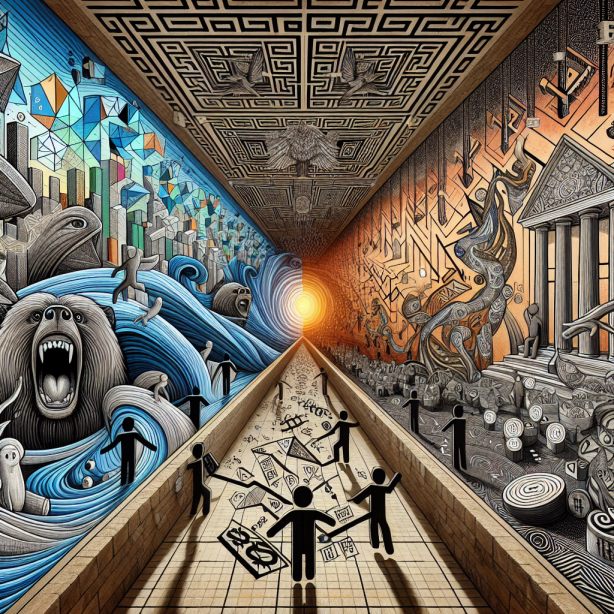

In the volatile dance of human behaviour, few forces are as powerful and pervasive as the bandwagon effect. This psychological phenomenon nudges individuals to align their choices and beliefs with the perceived majority, often without conscious awareness. Whether swaying political opinions, driving consumer trends, fueling financial market moves, or setting social norms, the bandwagon effect subtly dictates our decisions in ways we rarely recognize. But here’s the catch: by understanding this cognitive bias and learning to zig when others zag, we can carve out smarter, more independent paths, make better-informed choices, and even secure a strategic advantage in areas where conformity blinds others to opportunity.

The Nature of the Bandwagon Effect

At its core, the bandwagon effect is rooted in our innate desire for social acceptance and belonging. As social creatures, humans have evolved to seek safety and validation within groups. While often beneficial for survival and social cohesion, this instinct can sometimes lead us astray in our decision-making processes.

Gustav Le Bon, a pioneering social psychologist of the late 19th century, offers valuable insights into the psychology of crowds that help explain the bandwagon effect. In his seminal work “The Crowd: A Study of the Popular Mind” (1895), Le Bon posits that individuals in a crowd can experience a kind of psychological unity, where their identities become subsumed by the collective. This “group mind” can lead to heightened emotionality, reduced critical thinking, and increased susceptibility to suggestion – all factors contributing to the bandwagon effect.

Le Bon writes: “The most striking peculiarity presented by a psychological crowd is the following: Whoever be the individuals that compose it, however like or unlike be their mode of life, their occupations, their character, or their intelligence, the fact that they have been transformed into a crowd puts them in possession of a sort of collective mind which makes them feel, think, and act in a manner quite different from that in which each individual of them would feel, think, and act were he in a state of isolation.”

This collective mind that Le Bon describes helps explain why the bandwagon effect can be so powerful. When we perceive ourselves as part of a group or crowd, our judgment can become clouded by the prevailing sentiment, leading us to adopt beliefs or behaviours simply because they appear popular or widely accepted.

The Psychological Mechanisms at Play

Several psychological mechanisms contribute to the bandwagon effect. One of the most significant is social proof, a concept popularized by psychologist Robert Cialdini. Social proof suggests that in ambiguous situations, we look to others for cues on behaviour. When we see many people endorsing a particular belief or behaviour, we perceive it as the correct or desirable choice.

Another crucial factor is the fear of missing out (FOMO). This psychological state can drive individuals to conform to the crowd out of anxiety about being left behind or excluded. In today’s hyperconnected world, where social media constantly bombards us with curated glimpses of others’ lives, FOMO has become an increasingly potent force in shaping our decisions.

The power of repetition also plays a significant role in reinforcing the bandwagon effect. The illusory truth effect, a cognitive bias that causes us to perceive claims as more truthful when we encounter them repeatedly, can make popular ideas seem more valid simply because we hear them often. Advertisers, propagandists, and purveyors of misinformation can exploit this effect to shape public opinion and behaviour.

Examples of the Bandwagon Effect in Action

The bandwagon effect manifests in numerous areas of our lives. It can influence political voting behaviour as people gravitate towards candidates perceived as frontrunners. Political campaigns often try to create a sense of momentum and inevitability to capitalize on this effect.

The bandwagon effect is evident in consumer behaviour, particularly fashion trends and product crazes. When a particular item becomes popular, people often feel compelled to purchase it to fit in or signal their awareness of current trends. Marketers frequently leverage this phenomenon by creating hype around their products and using influencers to trigger a chain reaction of adoption.

Financial markets are particularly susceptible to the bandwagon effect, often leading to speculative bubbles. Historical examples like the Dutch Tulip Mania of the 1630s and the South Sea Bubble of 1720, and more recent cases like the Dotcom Bubble of the late 1990s and the Housing Market Bubble of 2007-2008 all demonstrate how the bandwagon effect can drive irrational investment behaviour on a massive scale.

The Pitfalls of Following the Crowd

While the bandwagon effect can sometimes lead to positive outcomes, such as the rapid adoption of beneficial technologies or social movements, it also carries significant risks. Blindly following the crowd without critical evaluation can result in poor decision-making and potentially harmful consequences.

One of the most dangerous aspects of the bandwagon effect is its ability to override individual judgment and critical thinking. When we allow ourselves to be swept along by popular opinion, we may ignore warning signs or contradictory evidence that could prevent us from making mistakes.

Moreover, the bandwagon effect can perpetuate misinformation and contribute to the formation of echo chambers, where people are exposed only to ideas that confirm their existing beliefs. This can lead to polarization and make it difficult for society to address complex issues that require nuanced understanding and diverse perspectives.

Zigging When Others Zag: Strategies for Overcoming the Bandwagon Effect

To avoid the pitfalls of the bandwagon effect and make more informed decisions, we must cultivate strategies to resist its influence. Here are some approaches that can help:

1. Create psychological distance: By stepping back and objectively evaluating situations, we can reduce the immediate social pressure to conform.

2. Slow down the reasoning process: Taking time to carefully consider decisions rather than making snap judgments can help us avoid being swept up in crowd behaviour.

3. Hold yourself accountable: Being prepared to justify your choices can encourage more thoughtful decision-making.

4. Visualize consequences: Considering the potential outcomes of your decisions can help you align your choices with your long-term goals and values.

5. Explore alternative options: Actively seeking out diverse perspectives and considering multiple viewpoints can lead to more balanced decision-making.

6. Develop media literacy: In an age of information overload, it’s crucial to critically evaluate sources and fact-check claims rather than accepting information at face value.

7. Cultivate self-awareness: Recognizing your motivations and biases can help you make decisions that align with your values rather than be driven by social pressure.

The Value of Independent Thinking

While the bandwagon effect is powerful, it’s important to remember that some of history’s most significant advancements and innovations have come from those who dared to think differently. By cultivating independent thinking and the courage to zig when others zag, we open ourselves up to unique opportunities and perspectives.

As Ralph Waldo Emerson famously wrote, “Whoso would be a man must be a nonconformist.” This sentiment underscores the value of maintaining individuality and critical faculties under social pressure.

However, it’s equally important to strike a balance. While blind conformity can be detrimental, reflexive contrarianism can be harmful, too. The goal should be to discern when to follow the crowd and when to chart your course.

Conclusion

The bandwagon effect is a fascinating aspect of human psychology that highlights our social nature and the power of collective influence. By understanding this phenomenon, we can become more aware of its impact on our decisions and behaviours. Armed with this knowledge and strategies to mitigate its influence, we can make more intentional choices that align with our values and goals.

In a world where the pressure to conform is ever-present, the ability to think independently and critically evaluate information is more valuable than ever. By learning to zig when others zag – not out of a desire to be contrary, but as a result of thoughtful analysis and self-awareness – we can navigate the complexities of modern life more effectively and potentially uncover opportunities that others might overlook.

Ultimately, the bandwagon effect reminds us of our interconnectedness and our profound influence on one another. By approaching this phenomenon with mindfulness and critical thinking, we can harness its positive aspects while guarding against its potential drawbacks, leading to more informed decision-making and a richer, more authentic life experience.