Overcoming Primal Fears in Volatile Markets

Updated Sept 29, 2024

The recent wild volatility in the Dow may feel unprecedented, but historical patterns suggest otherwise. The tendency for people to forget past events often leads to selling near market bottoms, a mistake of abandoning the market at precisely the wrong moment. Cash stockpiling is prevalent, and our newly introduced Gnosis Panoptes Index (GP Index) has already detected some notably unusual activity.

While the GP Index is still in its early stages, combining its findings with the significant rise in the “rage and discontent index,” the surging V readings, and the apprehension associated with October’s historical market crash in 1987 paints a concerning picture of the current market conditions.

Furthermore, most investors believe the markets are headed for a crash like 1987. However, it’s crucial to remember that this past event eventually proved a massive buying opportunity. Those who can overcome primal fears and invest with a clear head during a market downturn stand to reap the rewards. Unfortunately, history shows that most people may fail to do so. As always, the extent of irrational behaviour knows no bounds.

How Negativity Can Cloud Investment Decisions

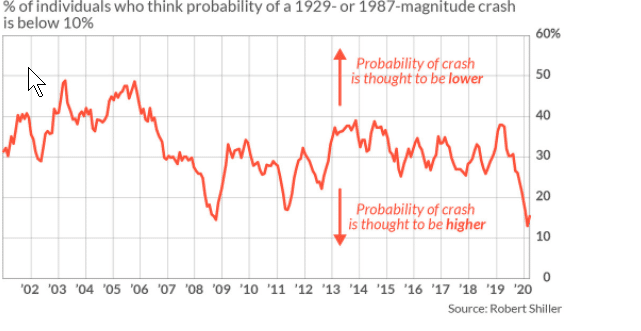

Primal fears of a market crash have once again gripped the crowd, with a reading of roughly 13% indicating that most investors believe a crash is likely. However, history has shown that the crowd is often wrong, and market crashes are unique buying opportunities for those willing to face their primal fears. The current market action, while volatile, is nowhere near a crash from the perspective of the Tactical Investor. Every baby bull market has been born after a market crash. The stronger the deviation, the better the opportunity for those willing to face their fears and take advantage of the opportunity presented.

Investors with the fortitude to hold through thick and thin after the 2008 market crash and deploy new capital at the right time would have been sitting on a fortune today. This proves that crashes are not the end of the world but the beginning of the next massive opportunity. So, investors should remain steadfast despite their primal fears and look for opportunities to buy when others are selling.

A crash is nothing but a perspective. Every baby bull was born after a crash, and the stronger the deviation, the better the opportunity. Tactical Investor

Volatility is going to be a significant issue, so be ready to deal with 1500-point moves. When the Dow breaches 33,000, be prepared to deal with 3000-point moves in either direction over a short period. In some cases, the market could shed 3000 points in one week, and the bears will growl that the end is nigh, but if the trend is up, the only thing that will be nigh is their pride and bank accounts. Market Update Oct 19th, 2020

The Fear Factor: Sell The Euphoria& Buy the Panic

Primal fears often drive investors to panic and make irrational decisions. This is especially true when the market experiences increased volatility, and the media excites the situation to increase fear. However, as discussed in previous updates, pullbacks should be considered bullish opportunities. The stronger the deviation, the better the chance for a significant buying opportunity. The problem is that not every correction will resolve itself quickly. The media, eager to attract attention and increase viewership, often creates a sense of chaos and turmoil that can lead individuals to panic and abandon their investments.

It’s important to remember that substantial pullbacks and corrections are not the ends of the world. The opposite is true. Crashes and corrections can provide excellent buying opportunities for those with a long-term perspective. However, it takes patience and a willingness to wait for the right moment to deploy capital.

The big players want individual investors to panic and sell, for that’s when they can pick up great bargains. By remaining calm and patient during market downturns, investors can take advantage of the panic and turn it to their advantage. The key is to overcome our primal fears and emotions and focus on the long-term game.

The Psychology of Market Crashes: Why Investors Are Hard-Wired to Fail

Primal fears can often lead investors to make irrational decisions, and timing the market can be particularly challenging for even the most seasoned investors. However, a few fundamental principles can help mitigate the effects of these fears.

One of the most important principles is to view market pullbacks as opportunities rather than threats. The stronger the pullback, the better the buying opportunity. Keeping a long-term perspective and not panicking when the markets experience turbulence is essential. Media-induced fear often leads to selling at the bottom, just when opportunities for buying are outstanding.

Another important principle is not to try to time the market, as this is a losing game for most investors. Instead, the big players typically deploy capital at various levels, considering that they may incur some initial paper losses, but the long-term gains will be significant. By dividing funds into multiple lots, investors can take advantage of opportunities as they present themselves and avoid trying to hit the exact bottom of the market.

In short, investors should face their primal fears and view market crashes as opportunities rather than threats. By keeping a long-term perspective, taking advantage of market aberrations, and avoiding attempts to time the market, investors can be better positioned to weather the storms and emerge more decisive in the long run.

we don’t try to time the bottom, we take advantage of aberrations, and the current action is nothing but an aberration when viewed through a long-term lens.

The Psychology of Market Crashes

The latest sentiment data indicates that the crowd is still uncertain, with bullish sentiment increasing to 3 but trading below its historical average. Bearish sentiment, on the other hand, remained unchanged, and neutral sentiment came in at 31. Interestingly, instead of shorting the markets, the crowd is moving into cash, meaning a tidal wave of funds is sitting on the sidelines. This could indicate that there is still some fear in the market, and investors are uncertain about the future direction.

However, as we’ve mentioned, the norm will be reversed. When that happens, this colossal war chest of money on the sidelines will hit this market like a tsunami, creating an epic melt-up. The fact that the crowd is uncertain and hoarding cash also suggests plenty of fuel for the next leg up in the market.

It’s worth noting that uncertainty trumps negativity from a Mass Psychology perspective and could be bullish for the market. When there is a lot of negativity and uncertainty, the markets will run a lot higher than even the most ardent of bulls could ever imagine. So, while the uncertainty in the market may be unnerving, it could be a sign that the market is set for an explosive move higher.

Harnessing Opportunity Amidst Uncertainty and Fear

If one utilises the most basic principles of mass psychology, the above data states that the masses are bloody lost. They don’t know what the hell is going on, and so, like blind rats, they are hopping from one sinking ship to another in the hope of buying just a little bit more time. Market update Oct 19th, 2020

In a highly uncertain and rapidly changing market environment, succumbing to fear and uncertainty can be tempting. However, this is precisely when a contrarian approach will most likely pay off. As the Fed continues to print unprecedented amounts of money and unprecedented levels of cash sit on the sidelines, there is no doubt that the markets will continue to behave in a highly unpredictable manner.

Rather than succumbing to negativity and fear, investors should focus on visualizing opportunities where others only see disaster. In this type of hybrid bull market, traditional indicators may not apply, and it may be necessary to adapt to rapidly changing market conditions. However, the potential rewards are undoubtedly significant for those who can maintain a long-term perspective and a willingness to take calculated risks.

This bull is a hybrid; it will not behave like a typical bull market, at times it might appear to act like a bear, at times like a dolphin and at times like a raging insane bull. However, if one plots a trend line through all these crazy gyrations, one will see that the markets are trending up. Tactical Investor Update Feb 2021

Conclusion: Primal Fears & their Impact on Financial Decision-Making

Research has consistently demonstrated the profound influence of emotions, particularly fear and greed, on investor behaviour and decision-making. These primal emotions have long been recognized as driving forces in financial markets, often leading to suboptimal choices and detrimental outcomes for investors.

The Data Speaks: DALBAR Study: A comprehensive study by DALBAR, a market research firm, analyzed the performance of the average equity mutual fund investor over 20 years from 1996 to 2016. The findings revealed that these investors significantly underperformed the S&P 500, achieving an average annual return of just 5.37% compared to the S&P 500’s 7.67%. This underperformance was attributed, in part, to emotional decision-making, with investors buying and selling at inopportune times driven by fear and greed.

Journal of Finance Study: Published research in the Journal of Finance examined the performance of individual investors over 20 years. The study found that these investors underperformed the market by an average of 1.5% per year. The primary reasons for this underperformance were overconfidence, poor diversification strategies, and excessive trading influenced by emotional factors.

Fear and Greed Index: Introduced by CNN, the Fear and Greed Index is a sentiment indicator designed to gauge the emotional climate of the market. It provides insights into how fear and greed influence investor behaviour. During periods of extreme fear, as reflected by the index, investors may be more prone to panic selling, while high greed levels can indicate a market top driven by excessive optimism. This tool can help investors recognize their emotional biases and make more informed decisions.

Dotcom Bubble and the 2008 Financial Crisis: Historical events such as the dot-com bubble burst in the late 1990s and the 2008 financial crisis serve as stark reminders of the impact of fear and greed on market dynamics. During the dot-com bubble, fear of missing out (FOMO) led many investors to pour money into overvalued tech companies, resulting in significant losses when the bubble burst. Similarly, in 2008, fear and panic selling contributed to a self-reinforcing downward spiral in stock prices, causing widespread financial turmoil.

Behavioural Finance Literature: A growing body of academic literature in behavioural finance is dedicated to understanding the role of emotions in investment decisions. This field recognizes that investors are not always rational and that fear and greed can lead to irrational behaviour, such as buying when prices are high and selling when they are low, contrary to fundamental investment principles.