Market Timing: The Secrets of Successful Stock Market Navigation

Updated Dec 30, 2023

The Unique Market Timing System epitomises strategic prowess, blending stark simplicity with lethal precision to produce results that will take your breath away. This system cuts through the complexity the average investor dreadfully wades through, offering a beacon of clarity they’ve desperately sought. Simplicity here is not synonymous with inaccuracy; instead, the sharpened blade carves profit with surgical precision.

Bear witness to the Unique Market Timing System’s raw power—it’s not just transparent, it’s alarmingly exact in its execution. Yet, our focus remains ruthlessly practical. We do not obsess over the fool’s errand of nailing the market’s elusive bottom. Instead, we strike when the market’s underbelly is exposed, signalling a looming bottom, and retreat when it bloats towards a top.

Those hapless souls who gamble on capturing the market’s nadir are masochists. They often find themselves chained to a sinking anchor of pain and suffering, only to be rewarded with catastrophic losses. Our system is the antidote to such masochism, a dark knight that guides you through the market’s treacherous shadows, ensuring you emerge not just unscathed but victorious.

We used over 20 years of real-time experience to continuously simplify our existing systems until we finally ended up with what we believe to be one of the most straightforward yet accurate systems we have ever developed. The whole process revolves around our extraordinary tool, known as the trend indicator. In a nutshell, we open long positions when the trend is up and advise aggressive investors to short the market and conservative investors to sit on the sidelines when the trend is down. It cannot get any simpler than that.

We do not develop complicated scenarios or issue multiple outlooks like many snake-oil salesmen. In this manner, no matter what happens, one of them will come to pass. No, the end game is simple. We buy when the trend is up and sell when it’s down; end of the story. For more details on the Trend Indicator, click here. Action speaks louder than words, so we have compiled an extensive list of calls we have made over the years.

The Fallacy of Market Timing

**Market timing is a fool’s errand.** The seductive idea of buying low and selling high is a trap that ensnares many into a cycle of poor decisions and subpar returns. The notion that one can predict market swings with precision is not just difficult; it’s near-impossible, even for the so-called experts.

**Making just one wrong move can be costly.** You need to nail two critical choices: when to pull out and when to dive back in. Get it wrong, and you’re looking at substantial financial damage. Exit the market to dodge a slump, and you could miss a surge. Wait too long for a dip to buy, and you’ve lost the prime moment.

**The reality is stark: consistent market prediction is a myth.** Even the most experienced professionals, armed with advanced tools, fail to crack the market’s code. The market is a beast fed by a complex mix of economic data, political events, and the whims of investor sentiment—all of which are notoriously fickle.

**The hidden costs of market timing are a silent killer of returns.** The more you trade, the more you pay in transaction fees and taxes, particularly if your gains are short-term. These aren’t just minor dents; they’re significant enough to take a big bite out of your investment growth.

In short, market timing is not just aggressive; it’s aggressively misguided. It’s a strategy that promises much but delivers little, except for increased risk and decreased returns.

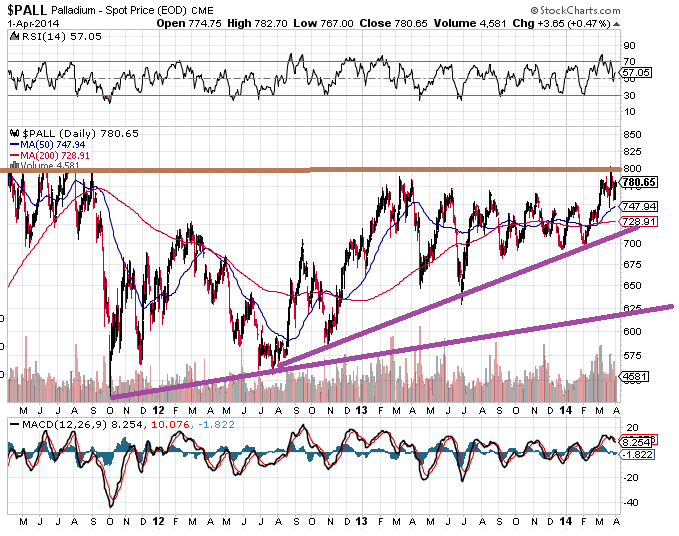

Market Timing: A Strategic Approach

As you can see by looking at the chart, Palladium needs to break past 800 on high volume; otherwise, it is bound to drop back to the lower support line, which falls in the 700-729 range. A monthly close above 800 on strong volume will propel palladium to test the 1000 range and set a new bull market in motion.  However, Palladium failed to trade past 800 on a monthly basis and is currently consolidating and building up momentum to sell to and past these very critical zones. While Palladium is a precious metal, it is also an industrial metal, so it is not trading in sync with Gold and Silver.

However, Palladium failed to trade past 800 on a monthly basis and is currently consolidating and building up momentum to sell to and past these very critical zones. While Palladium is a precious metal, it is also an industrial metal, so it is not trading in sync with Gold and Silver.

For now, industrial demand for Palladium is rising, and supplies cannot keep up with demand. Thus, we have a situation that could potentially push Palladium higher even though most other precious metals are trading well off their highs.

Past Market Timing Signals

Top in the Gold market predicted in 2011 before the Market topped out and broke down. Click here for full details.

The demise of the Japanese Yen was also predicted in 2011. Click here for the full scoop

Multi-Year Dollar Rally Predicted In September 2011

Imagine knowing when a correction or pullback should be viewed as a buying or a shorting opportunity. The ability to distinguish one from the other could mean the difference between a massive win or a devastating loss. We are in a new paradigm where almost all the traditional tools have ceased to work.

Thus, new tools are needed that are able to focus on the trend because the data is corrupted now. It is a monetary policy that is driving the markets higher, not fundamentals or technical and those who rely only on fundamentals or technical analysis are asking for trouble.

Standard technical analysis today is on par with toilet paper, as is fundamental analysis. Click here to learn why technical analysis no longer works.

The Art of Market Timing

The trend indicator is the most powerful and what we believe to be the Ultimate Market timing tool. Click here to find out why. Please do not confuse the concept of market timing with predicting the exact top or the exact bottom; that endeavour is best left to fools with plenty of time on their hands and whose main objective is to fail no matter what the end result is.

In other words, they will do the same thing repeatedly, hoping for a different outcome each time. In other words, the classic definition of insanity. We look for market-topping and market-bottoming action and never focus on identifying the actual top or bottom. This has worked out splendidly for us.

Aug 2019 Market Timing Update

Now, the markets are pulling back, and we are getting triggered into some of these plays. Don’t let market volatility change the angle of your perception. The masses complain about better prices when their wish comes true, they panic and flee to the hills, which is what they call investing. They are either oscillating between misery or euphoria, and both have a dangerously short lifespan.

Since the inception of this bull market, we have been stating that these guys would print more and more money. They would move from covertly supporting the market to overtly propping it up.

Now that we are moving to the era of negative rates, central bankers will become even more aggressive in attacking their respective currencies. We could go on, but the bottom line is to understand that in this era, back-breaking corrections should be viewed as manna from heaven.

To determine the trend, we examine the data from various angles and focus on the most critical data. News ranks right at the bottom regarding value; sentiment ranks at the top. Fiat money has compounded all the problems you see in the world by a factor of at least 100. All these problems you see today, immigration, wars, poverty, etc. directly result from Central Bankers inflating the money supply.

Nothing changes, and that is why the masses are destined to lose. If you examine every single bubble in history, the storyline is the same. If you are a new subscriber, this is the most important lesson you need to grasp. This is mass psychology in action; never follow the masses unless you are looking for a quick end. Market Update Aug 8, 2019

Originally published on May 27, 2015, this piece has undergone continuous updates over the years, with the most recent enhancement conducted in August 2023.

Discover Unique Articles for Your Interests

The Retirement Lie, The Masses, Have Been Conned Into Accepting

A Clear Illustration of the Mass Mindset In Action

Portfolio Management Suggestions

Contrarian Investment Guidelines

Stock Market Timing: does it work