Turkey’s henchman Erdogan picked a fight with the wrong leader; Trump is going to continue pushing Turkey until their economy implodes unless Endogen surrenders. However as Erdogan’s ego is enormous, he will not cave in immediately and will continue to use the press to claim that the US started this war. He needs an excuse to justify the bad investments Turkey made over the past years, the worst of which was pouring billions and billions into questionable construction projects. Its a repeat of the housing bubble only on a grander scale, at least for the average Turk. The fallout is going to be huge, and painful; only the smart Turks that hedged themselves by buying Gold and dollars will remain unscathed.

Root Of Lira’s collapse lies in Erdogan’s faulty economic logic

The roots of the lira’s collapse, however, lie in the policies of the country’s strongman president, who has run his economy hot to curry popular support and win nine votes in as many years. The roots of the lira’s collapse, however, lie in the policies of the country’s strongman president, who has run his economy hot to curry popular support and win nine votes in as many years. Thanks to a frenzy of the building by companies close to the government, Turkey’s $880 billion economy has expanded at an average annual rate of 6.8 per cent this decade.

“It was obvious this would implode. I have been telling my friends in the construction business for years to stop competing with each other, that there is a world out there to build in,” said Macit, age 53, at his family-owned company in Istanbul’s Bagcilar suburb, the name of which means “grape growers,” a nod to the past when the area was rolling farmland.

Today, a dozen apartment blocks frame the view from Macit’s boardroom. In them are some of the estimated 800,000 unsold new homes developers say have flooded the Istanbul market.

The building boom has transformed Istanbul’s historic skyline into a sprawling construction site. New mosques, bridges, roads, and shopping malls have fed a construction industry that accounts for almost 10 per cent of gross domestic product. Since 2001, imports of building materials and other goods have chronically outstripped Turkish exports, and the current account deficit (which counts net trade, income from abroad, and current transfers) ballooned to $50.2 billion. Debt piled up elsewhere in the economy, too; the government, banks, factories, restauranteurs, and homeowners all binged on cheap credit from abroad—to the tune of $460 billion, more than half of Turkey’s GDP. Full Story

Erdogan’s Numbers Racket going to crash Turkey’s Economy

Unfortunately, Turkey is not a “true democracy” any more. It has slid into the “illiberal democracy” camp. Erdogan’s grip on the media, the judiciary and the state bureaucracy ensured there would be nothing like a fair electoral fight, so the 52.5% is hardly impressive. Though under the new presidential system he engineered, he will be wielding unprecedented power despite that narrow margin

7.4%. That’s how much the Turkish economy grew last year, making it the top performer in the G-20. But don’t be fooled. The growth was greased by government financial incentives to businesses that were aimed at ensuring a quick recovery from the 2016 abortive coup. Economists are wont to call Turkey’s economy “unbalanced,” by which they mean, it resembles Humpty Dumpty in his final glorious moments.

$337 billion. That’s the amount of foreign-currency-denominated debt held by the Turkish private sector, the result of the cheap loans that have been fueling the economy. Corporate debt is equal to 70% of the economy and half of that is in foreign currencies.

$15 billion. That’s what it will cost to build a canal linking the Sea of Marmara and the Black Sea, the latest and most ambitious of Erdogan’s mega-projects. A stupid project considering the economy is on the precipes of collapsing Full Story

Erdogan’s faulty economic logic set to ruin Turkey

“Erdogan said yesterday interest rates must fall,” said a treasury desk trader at one bank. “This has been interpreted as a desire for a Turkish central bank rate cut at a time when additional tightening is expected and inflation has exceeded 15 percent.”

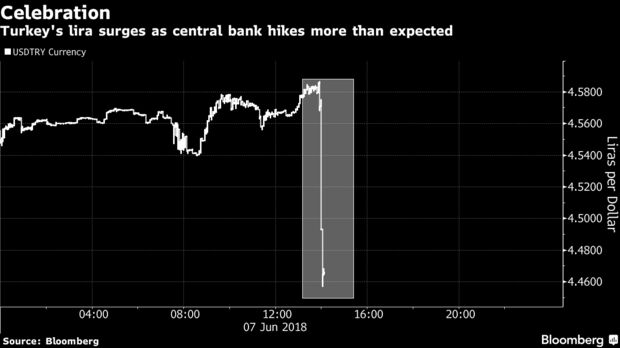

17.75%. That’s what Turkey’s benchmark interest rate is right now, which isn’t quite as high as it sounds, considering that inflation is running past 15%. But it’s high enough to spoil the secret sauce of Turkey’s growth:

When Turkey raised rates to 17.75%, the lira rallied initially, but the rally was short lived.

Erdogan instead of making peace with Trump decided to goad him and the consequences were swift and harsh. Trump is now going to chase Turkey until they give in and Turkey is going to lose this war very badly. Erdogan has an equally big ego but lacks the firepower that Trump possesses and his ego is going to ensure that the situation becomes unbearable before he caves in.

The Lira has shed as much as 45% this year (from high to low) and the brief rally is not going to last, if Turkey does not aggressively raise interest rates and make peace with Trump, the lira is likely to trade past 10.00

Alexandria Ocasio-Cortez Economic IQ is questionable at best

Now for a change, here is the democrats star proving that she that farm mouse has a higher IQ than her. Imagine the damage she could do in Congress

Other Stories of Interest

List Of Experts That Were Wrong On Trump’s 4 Percent GDP Target (Aug 2)

Stock Market Bull Still Healthy in 2018; follow the trend (July 20)

What if any are the Economic Consequences of Trump’s Trade War (July 19)

Trump to Unveil $1.5 Trillion Infrastructure Plan (Feb 18)

Oil majors strike it rich on rising crude prices (Feb 12)

When Will The Bull Market End? (Feb 10)

Forget About Higher US Rates; We Are Going Negative (Feb 09)

Stock market crash or healthy correction? (Feb 06)

Should you sell or stay put in the stock market? (Feb 02)

Huge Fifth Third stock buyback sends shares soaring (Jan 13)

Emerging Markets See Lowflation (Jan 11)

Why are most Americans not investing in the Stock market? (Jan 10)

Corporate Bond Bubble- AT&T Ups Bond Sale to $22.5 Billion (Jan 01)