Market Trend Analysis

Updated July 2023

No one is paying attention to the perilous similarities with past events, such as the dot-com bubble, the housing bubble, and the pattern observed in 1973-1974. This is because everyone believes that this time is different. We heard the same assertions during the housing crash. In reality, the markets actually reached their peak in 2007 but experienced a strong rebound in 2008, which deceived many, much like what is happening today. They got their lowest point in 2009, but because numerous individuals had entered the market during the robust rally phase, the subsequent drop shocked them to such an extent that they remained out of the market for years.

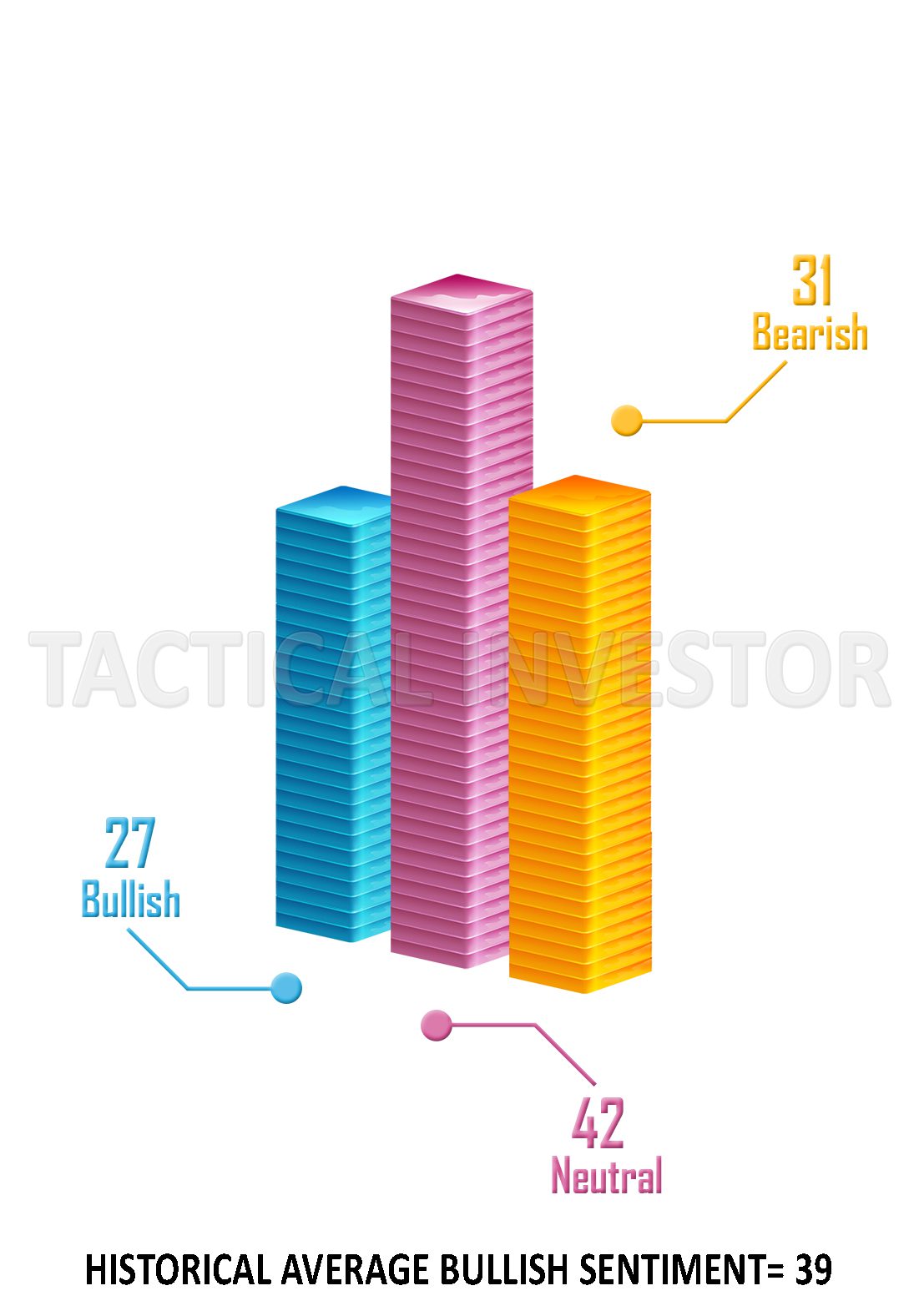

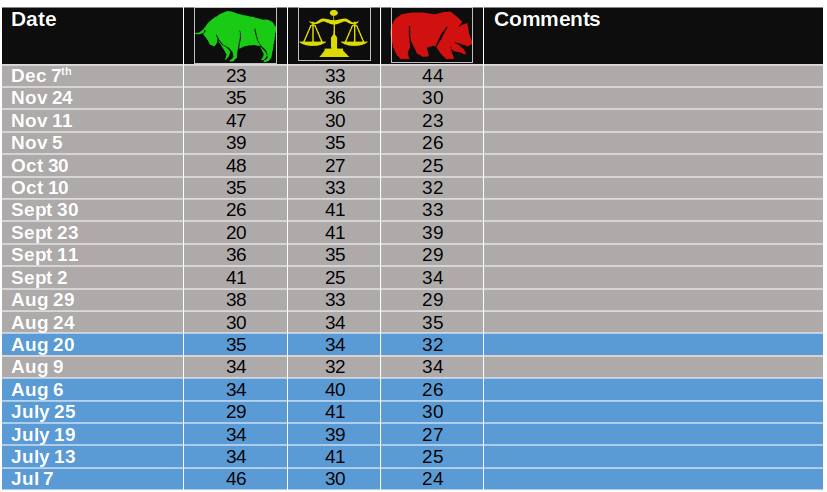

The number of individuals investing in the market today matches that of, and will soon exceed, the levels seen in 2008 (over 61% are playing the market). Even a significant portion of individuals over the age of 85 are nearly fully invested. This week’s bullish reading has finally reached the 50 mark. As a result, we now have five consecutive weeks of bullish lessons surpassing their historical average of 38.5 (having dropped from 39), after trading below this threshold for 18 months.

The story below also illustrates the mindset of today’s individuals.

The scarcity of sriracha hot chilli sauce has led to a price surge, reaching over $70 per bottle on the secondary market. The ongoing shortage, lasting more than a year, has created a high demand for the popular sauce. Resellers are taking advantage of the situation, with some selling bottles for even higher prices, such as $100 on Amazon and $70 on eBay. The issue highlights both the strong consumer demand for sriracha and the prolonged duration of the shortage. foxbusiness

Essentially, the collective mentality deceives the mind by misclassifying desires as needs. Once this happens, price becomes irrelevant until individuals exhaust their financial resources. Now, let’s apply this analogy to the markets. The belief is that AI will revolutionize the world, and investing in the markets is the surefire way to make money. Consequently, people dive in and buy, disregarding the price, convinced that it will continue to rise indefinitely. This resembles one of the earliest historical bubbles, the tulip mania.

This line of thinking establishes a foundation for a new way of thinking, making it easier to fall prey to the “it’s different now” theory. It also accelerates feelings of euphoria and joy, which will inevitably fuel intense levels of fear and panic when things take a turn for the worse.

History may not repeat itself exactly, but it often comes dangerously close. A highly plausible scenario is that the AI sector will experience a severe decline while cyclical stocks and key commodities put in higher lows during the next pullback.

If you are a low to medium-risk investor, it is advisable to proactively reduce a significant portion of your long positions in any stocks that are currently experiencing or have been part of the AI feeding frenzy mania.

With Bullish levels on the rise, the possibility of reaching 55 becomes apparent, which inherently indicates a significant surge in Bearish readings when the outlook shifts. When Bearish readings start to climb, it will be time to take action.

The following text offers a captivating historical context of market trends and provides valuable insights on overcoming fear:

Decoding Market Trends: Unlocking the Power of Analysis

Trending markets currently favour value stocks and growth stocks that took a beating in 2021. Certain commodities like Palladium and Gold should also hold up well.

The markets are trending higher, but many good stocks keep getting hammered. This is the first time so many high-quality stocks are trending opposite to the entire market. Our prediction that this disorder market will move into the next stage of its illness might be coming to pass earlier than anticipated.

At this advanced stage of the disease, two things will occur. Firstly, many experts of yesteryear will find it increasingly difficult to determine market direction and what stocks to get into (this has been in play for most of 2021). However, the more significant issue (for now, it’s a hypothesis) is that stocks will not always trend in the same direction as the overall markets. In other words, there will be dissonance not seen before. On the surface, it would appear to be a terrible development. For those who lack patience and discipline, the outcome will be awful. We at T.I. view it as a change in tactic by the big players.

Market Trend Analysis: The Trend is your friend

The weekly charts (of the Dow) continue to exert more pressure on the markets than the monthly charts. The bearish MACD crossover is more pronounced today than in the last update. Hence expect more volatility, and we will go on a limb and take an educated guess. One can add roughly five trading days for each week the MACDs remain in the bearish mode. If two weeks pass before the next bullish crossover materialises, one can add two weeks to the market rally. For example, if the markets were supposed to top at the end of January, the time frame would move to the middle of February.

The big players now have so much money that the average person would have difficulty envisioning it. Even some big players are probably stunned by the size of their war chests. This means that they can employ new tactics when manipulating the markets. Never before have individuals been as obsessed with money as they are today. 90% of individuals will sell their grandma to make a million bucks.

The fools game

Just looking at how the fools investing in cryptocurrencies and meme stocks think. Many of them made millions from chump change, and did they stop; they kept pushing for more, and so far, a sizable number have lost all their gains, and this number will rise. Eventually, 90% of these fools will lose all their profits.

The big players use this information to their advantage, for example, instead of paying individuals to use their social media accounts to push a rumour. They can hire them full-time and create any narrative they want. To make the story appear natural, they can also supply the facts (B.S. ones, but nobody checks the fact-checkers today) to support that narrative.

Taking it a step further, you control hundreds of social media accounts and then sites that push out a particular narrative that appears to be backed by solid facts. Now you use social media accounts to broadcast a specific theme. You support that storyline with links to websites you indirectly control, and you can trigger a stampede when the time is right. The big players can start the first downward leg by using funds from their war chests to ensure that the crowd stampedes. Combine the rumour with cash, and you can create a new theme out of fresh air. Social media will be used to engineer even more crashes in the future. We are working on a Social Media BS indicator. Still, this process will take time as immense amounts of data are needed.

Patience and Discipline

patience and discipline are essential components of Market Trend Analysis. The end game is always the same; the big players want to fleece the masses. The narrative changes, but the outcome is always the same. Hence expect higher levels of volatility and more acid. Still, as they say, when the going gets tough, that is precisely when opportunity starts knocking the hardest. Hence, bottoming and topping stages will last longer, falsely empowering the bulls and bears. If it takes longer for stock to put in a bottom, it will encourage the bears to remain aggressive and vice versa. Nothing pleases the big players more than having a replay of the killing fields, where both the Bears and the Bulls get whacked.

Next year will be the year of the hyper-killing fields game. Volatility will be high, and thin-skinned investors will be slaughtered mercilessly. Neutral investors will provide an early warning signal. When neutral readings trade consistently above 41, it will indicate that uncertainty will be the predominant force at play. Uncertainty is the best option for long-term traders to take advantage of, for it neuters both the bulls and the bears. While markets climb a wall of worry, they soar above a wall of uncertainty.

As the Dow closed below 34.8, the short-term trend is neutral, and the Dow could test the 33,6K to 33,9K ranges before surging higher. Our projected targets for the next 24 to 45 trading days are for the Dow to test the 37,2K to 37,8K ranges with a possible overshoot to the 38,4 to 39K ranges. Market Update Dec 7, 2021

A weekly close at or above 36,090 will turn the short-term trend to bullish, and the odds of the Dow testing the 37K plus ranges will rise to 75%.

Sentiment Analysis & Market Trend Analysis

And just like that, neutral readings rose. If they trend above 41 for several weeks (it does not have to be in a row), it will be a preliminary warning of what to expect next year. The current neutral score is the highest in over six months. We suspect that the predominant emotion dominating the markets next year will be uncertainty. Uncertainty is one of the essential ingredients necessary to trigger a MOAB and FOAB (mother and father of all buying signals). The FOAB is an “extremely rare” signal. If activated, it is one of the few times we would condone using margin to leverage one’s position.

The cryptocurrency market is the first place they are likely to get hammered in. Right now, there is a mountain of resistance in the 60 ranges (we are using GBTC as a proxy for bitcoin). Bitcoin will experience another brutal correction. These chaps will then hop into high flyers in the stock market. They will also get creamed there for cycle investing is about to make a massive comeback. Cycle investing is a term that we at T.I. use to reference stock picking. In other words, stock picking will play a central role next year. Market Update Dec 7, 2021

So far, many paper millionaires have already lost their millions, and more carnage lies in store for them. Pigs always get slaughtered, and the squeals from this slaughter will be deafening. There is a 24% to 27% chance that BTC could soar to new highs, and if this comes to pass, the pullback will be even more substantial. If GBTC closes below 33 for three days, 24 will likely be tested with a possible overshoot of 18.00. Long-term support resides in the 13.50 to 16.50 range.

Historical Sentiment values

Historical sentiment data provides clues as to which Trending markets one should invest in. At this point, we can see that bearish and neutral sentiments are rising. So, consumables, value-based stocks will tend to do well this year. However, the long-term Trending markets data still favours hi-tech companies.

This gauge has moved into the bullish zone, confirming that the markets are still expected to rally next year.

Market Trend Analysis: Conclusion

While the situation looks rough to grim, from a long-term perspective, we see the first signs of another long-term opportunity in the makings. The old way of trading/analysing the markets is history. At least until this market is completely ripped apart, a ripped-apart event means it must shed 90% of its gains. While this is a possibility, it will not happen anytime soon. Hence, until then, the old way of trading stocks or doing business is forever over.

One will have to purchase the right stock and the right time. Those that jump in and follow the crowd are going to be smashed. After the Covid Crash, following the crowd has worked (to some degree), but the strategy is now falling apart. Market Update Dec 7, 2021

Expert after expert will drop into the dustbin of time because they refuse to embrace the new paradigm. The big players have so much money now that they will take delight in ripping all the old models that used to operate into pieces. Investors that fail to grasp the basic principles of Mass Psychology will lose immense amounts of money over the next 24 to 36 months. Most investors will be shocked to discover they have made next to nothing when the Dow trades at 45K. Hence, it is now vital to understand the basic principles of Groupthink psychology.

Furthermore, one must incorporate patience and discipline in trading activities to use M.P. effectively. Without patience and discipline, one will be a paper M.P. tiger. Having knowledge but no power to put it into use.

Bottom line: despite high levels of volatility and this rough patch we are going through. Over the long term, we see nothing but splendid opportunities, and there is a decent chance we might get a MOAB signal next year.

The day of reckoning is close at hand for these spoilt amateur brats that demand more and more. Market Update Dec 7, 2021

The days of just jumping into crap are over, and many traders will get whacked over the next 6 to 12 months. A stock pickers market that most traders have never seen before is about to come into play. Master the arts of patience and discipline now. For that, M.P. is all that will save you in the months and years to come.

We are in the forever Q.E. era, and in this era, the Fed has only one mantra, Print or kill everyone that resists. Market Update Dec 7, 2021

Whatever rubbish the naysayers state next year, remember the above statement. The Fed will drop everyone on the board before allowing the markets to really crash. A real crash is when the indices shed over 60% and remain at this level for at least six months.

We will post updates on how close we are to a MOAB once we hit the 50% mark. In other words, we will post that information in future updates once we have enough data indicating that the likelihood of a MOAB being triggered is 50% or more. To date, a MOAB signal has never failed to generate spectacular profits. The last MOAB signal was triggered after the COVID crash of 2020, and boy, did it lead to spectacular gains.