Sol Palha, Chris Sanders, George Paulos, Gale Bullock, Bill Murphy

Ed Bugos, John Tyler, Peter Spina and Antal Fekete

The Rich Get Richer, And The Poor Get Poorer

Updated Dec 31, 2023

In the relentless tug-of-war between the rich and the poor, a pressing question echoes: Why do the rich get richer while the poor get poorer? The answer lies in the subtle machinations of central bankers, who, it seems, have emerged victorious in their declared war on Gold. To comprehend the battlefield, we must scrutinize the current state of affairs.

A glance at the global landscape reveals a significant drop in gold bullion across robust currencies—a trend that has persisted over time. While it may seem like a defeat for central bankers on the home front, this perception is a deceptive illusion for those unfamiliar with the intricacies of the inflation process. The reality is that central bankers retain a firm grip on the reins, steering the financial narrative.

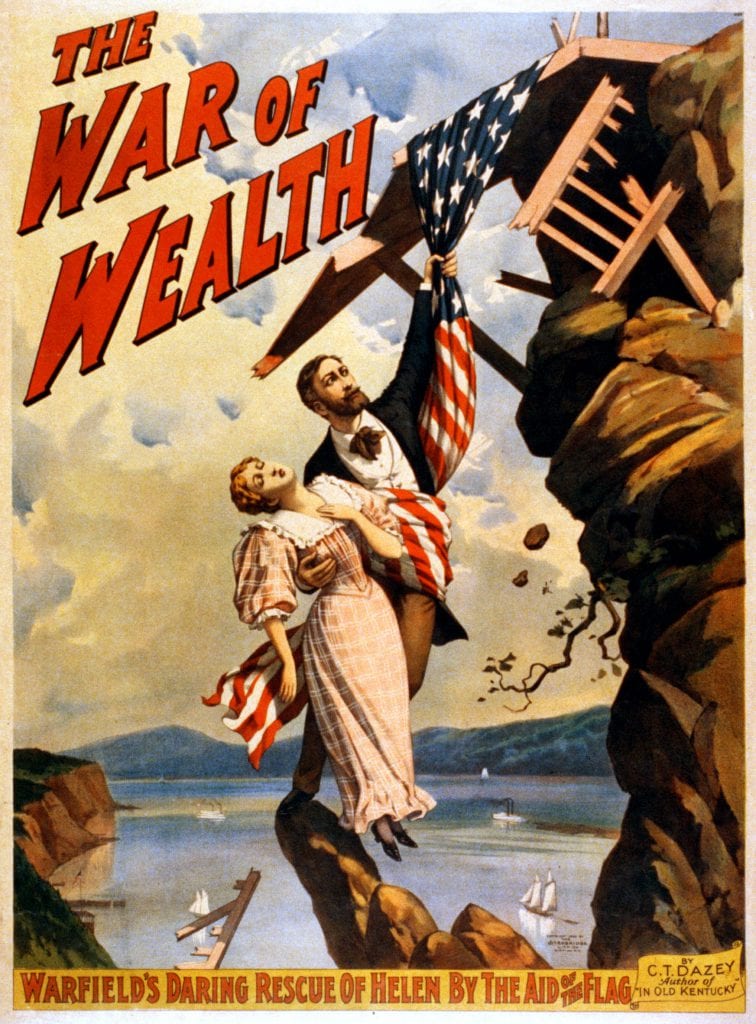

The battlefield unfolds with nuanced complexity, and charts serve as silent witnesses, capturing the essence of the ongoing struggle. Each day, the central bankers are perilously close to the edge of a cliff, a precipice where the delicate balance they maintain teeters on the brink. The visuals encapsulated in three charts illuminate the narrative, offering a glimpse into the multidimensional chess match shaping the dynamics of wealth distribution.

As we navigate this economic chessboard, the dichotomy of wealth creation and depletion underscores the profound impact of central banking decisions. The narrative unfolds not in words but in charts that vividly depict the ever-shifting dynamics between the rich and the poor. The question lingers: Will the central bankers maintain their precarious balance, or are we on the brink of a paradigm shift in the age-old battle for economic equity? The charts, our visual storytellers, stand as a testament to a complex and evolving financial saga.

The Rich Get Richer, And The Poor Get Poorer Conclusion by Sol Palha

In the grand theatre of wealth disparity, the closing act delivers a stark and uncomfortable truth—central bankers have emerged triumphant in the war on Gold. The evidence is not a mere suggestion but an undeniable reality that bites and stings, refusing to yield to excuses or justifications.

Confronted with the unvarnished truth, one cannot afford to blink in search of convenient explanations. The harsh reality stands tall, demanding acknowledgement. The rich continue to amass wealth while the poor face a dwindling fortune—a tale woven into the fabric of a financial landscape devoid of a Gold standard.

The absence of a Gold standard has paved the way for a stark reality: the rich exploit this void to extract a substantial portion of the poor’s hard-earned wages. The intricacies of inflation, a labyrinth understood by the affluent, serve as a weapon to saddle the less privileged with insurmountable debt. In this skewed system, honest and hard work fails to reap just rewards, leaving the poor trapped in a cycle of economic servitude.

The narrative of “The Rich Get Richer, And The Poor Get Poorer” finds its roots in the absence of a Gold standard, creating a breeding ground for exploitation. The struggle for economic equity continues, with the stark reality of wealth disparity remaining an enduring feature of our financial saga. The question lingers: Will the script ever be rewritten, or are we condemned to perpetuate a tale as old as time?

“Fear has its use but cowardice has none.”

Mahatma Gandhi 1869-1948, Indian Political, Spiritual Leader

The Inevitable Ebb and Flow: A Glimpse Beyond Central Bankers’ Dominance

The question echoes in the corridors of financial foresight: Will the central bankers continue their reign indefinitely? The resounding answer is a defiant no. The saga of war, a grand composition of myriad battles, holds within it the seeds of change and the inevitability of shifting tides.

Thus far, the central bank penguins have orchestrated a symphony of victories, conquering each battle on the economic battlefield. Yet, in the intricate dance of financial warfare, the day looms when victories transform into defeats, and the seemingly invincible penguin warriors will face a cascade of setbacks.

Far from a foregone conclusion, the war unfolds as an ongoing narrative of twists and turns. The stakes are heightened, and the element of unpredictability permeates the atmosphere. As seasoned observers, we must brace ourselves for the unforeseen, for in financial warfare, anything is possible.

Resilient and determined, the central bankers will cling to their dominion, fighting with every resource at their disposal. The battle drums continue reverberating, signalling that the war has only just commenced. As the narrative unfolds, we stand on the precipice of uncertainty, prepared to witness the ebb and flow that shapes the destiny of economic warfare.

Central Bank Penguin Warriors: A Battle with Finite Victories

While formidable, the relentless march of central bank penguin warriors faces the harsh truth—they cannot claim perpetual victory. Though currently dominated by these stalwart players, the battlefield of financial warfare holds the seeds of limitations and an eventual reckoning within it.

As the central bank penguins wage their economic battles, a cautionary note emerges—beware of the perpetual gold enthusiasts, the so-called advisors who incessantly tout bullish sentiments on gold stocks. In the complex dance of economic forces, blind allegiance may prove to be a precarious stance.

The narrative unfolds with an acknowledgement of the central bank’s prowess and recognition that their victories are finite. The ever-shifting dynamics of the financial landscape hint at a future where the penguins may face challenges beyond their control.

Thus, while the central bank warriors march confidently, the astute observer remains vigilant, aware that no battle can be won indefinitely. In this intricate dance of economic forces, the future holds uncertainties that may alter the trajectory of the penguin warriors, reminding us that even the most dominant forces face battles they cannot win forever.

The Rich Get Richer And The Poor Get Poorer: Cautions in Speculation

As we conclude the exploration of the ever-pertinent question—the widening gap between the wealthy and the less privileged—a note of caution arises. For those inclined to tread the speculative waters, discernment becomes paramount.

In financial counsel, particularly when seemingly free advice permeates the airwaves to a massive audience, scepticism becomes a wise companion. Market movers, entities wielding substantial influence and followership, can sway sentiments effortlessly. Thus, even seemingly innocuous statements can spark market movements, leaving the unsuspecting investor in a whirlwind of uncertainty.

Speculation, while an avenue for potential gains, demands a tempered approach. Even when seemingly free, advice has the potential to shape market dynamics. A collective surge based on influential statements can turn even the most dubious investments into momentary successes.

Individuals or corporations with that kind of power are known as market movers. This means they could shout out that it is a good time to invest in horse manure, and the price would spike just because of their large following.

Therefore, as the narrative unfolds, the takeaway lies in a measured reception of advice, mainly when a multitude hangs onto every word. In market movers and their potential sway, scepticism emerges as a valuable shield against the unforeseen consequences of mass influence.

Navigating the Economic Battlefield: A Call for Vigilance

As we navigate the intricate landscape of the financial war, a resounding call echoes—to scrutinize, research, and verify every piece of information, including the counsel provided. In this expansive conflict, casualties are inevitable, and unfortunately, those least equipped to weather the storm often bear the brunt—the middle class and the economically disadvantaged.

The fundamental truth persists the rich amass more incredible wealth while the less privileged face increased challenges. The linchpin of this disparity lies in an understanding of inflation—a knowledge the affluent wield to their advantage. Conversely, the working class, engrossed in daily struggles, finds little time to anticipate and strategize amidst the complexities of economic warfare.

Essentially, the call for the rich to get richer and the poor to get poorer reverberates through a backdrop of asymmetrical information. Those attuned to the nuances of inflation can fortify their positions, leaving the working class grappling with immediate concerns, like putting food on the table and saving for unforeseen hardships.

The economic battleground demands financial acumen, a commitment to diligent research, and a discerning eye on the advice dispensed. As the war unfolds, the imperative lies in safeguarding one’s financial interests amidst the evolving dynamics, ever mindful of the stark reality that the casualties of this economic warfare will disproportionately affect the most vulnerable.

Let’s take a moment to step back in time and revisit the wisdom of historical commentators. Numerous authors have shared their insights over the years, and reviewing their thoughts offers a treasure trove of knowledge and wisdom worth unearthing.

Gold in South African Rand

880 Rands or a whopping 124 US dollars

“Gold makes the ugly beautiful.”

Moliere 1622-1673, French Playwright

“Gold’s father is dirt, yet it regards itself as noble.”

Yiddish Proverb

“Gold like the sun, which melts wax but hardens clay, expands great souls.”

Antoine Rivarol 1753-1801, French Journalist, Epigrammatist

Namibian Dollar

800 Namibian Dollars less or a whopping 123.24 US dollars

Lesotho Loti

800 Loti less or a whopping 125.26 US dollars less

Is it not coincidental that all three countries are neighbours and show the most significant price differential in gold when priced in US dollars? We are entering a new era in the financial markets. I would guess that 90% of the analysts out there have no clue how to price currency wars into the economic equation. I will attempt to provide you with some clues as to how this war progresses.

So far, looking at gold in 13 different currencies, it appears to be losing the battle in 12. I am able only to show three charts here. The rest will be shown in my follow-up essay. In my next article, The Sneak Fed Attack on the Metals Market, I will examine specific schemes whereby the central bankers could have made and probably have made a fortune due to the rise in the price of Gold in US dollars. This is an all-out war on wealth for the central banker to continue deflating our currency and, in doing so, reduce the value of the dollar.

“An education obtained with money is worse than no education at all.”

SocratesBC 469-399, Greek Philosopher of Athens-

Must Read: DJI History: Profiting from the Past Market Trends

“If money could talk, it would say Goodbye!”

…Unknown

Chris Sanders on The Rich Get Richer, And The Poor Get Poorer

Principal, SandersResearch.com

Buy others for news. Buy us for judgment.

Have Central Bankers Won the Fight Against Gold and Silver Bullion?

The question of whether or not the US Treasury and Federal Reserve can successfully suppress the price of gold on the open market is, by its nature, not susceptible to a yes or no answer. The reason for this problem lies at the intersection of politics and economics. The fact that the government and its quasi-governmental allies in banking, brokerage and mining have been “successful” in gold price manipulation has resulted mainly from a long-term shift in the consensus of politically acceptable fiscal and monetary behaviour.

It should be immediately apparent from the preceding paragraph that I accept the idea that a consortium of interested parties, including the Federal Reserve, the US Treasury, assorted hedge funds, bullion banks, central banks, and mining companies has manipulated the gold price. Absent the ability to subpoena records and the officials responsible, it is doubtful that it will ever be possible to prove that such deceitful manipulation has occurred systematically over several years.

The reason for this is that since the government defaulted on the gold clause of its bond obligations in the 30s, the American courts have consistently supported the government in cases of “national interest” as defined, of course, by the government. The legal issues notwithstanding, there is also a broad consensus in economics that accepts gold price manipulation because it can be equated to intervention in the currency markets.

False Equations: Unraveling the Myth of Gold’s Monetary Significance

However widely accepted this equation is, it is nevertheless false. In the wake of the United States’ abrogation of the Bretton Woods Agreement, gold was demonetised and relegated to status as a commodity like any other. Now, government intervention in, say, the coffee market might be countenanced under certain conditions. Still, it is hard to imagine it being conducted under strict secrecy and questionable accounting surrounding its gold operations.

Moreover, central banks print fiat money; they do not print gold or even mine it. What is desired by those who control them is a situation in which they are released from the burden of accountability, the last vestiges of which were shed with apparent impunity with the destruction of the Bretton Woods edifice of law and transparency.

Unveiling the Holy Grail: Infinite Leverage and Zero Accountability

The holy grail of infinite leverage relates to the desire for zero accountability. Authoritarian regimes from remotest antiquity have attempted to debase the coinage they issued. In our age, technology, in the form of dirt-cheap processing power, has made a high-tech form of coin clipping via the derivatives markets possible. Not only can a derivative not be touched, smelled or seen, but the banks that use them are not even required to report their derivatives books on a balance sheet.

Banks have many regulators, but these are all concerned with the on-balance sheet borrowing and lending businesses that are their “traditional” businesses. The banking industry self-regulates derivatives with the enthusiastic support of the Federal Reserve, a private corporation that they, the banks, own.

This confers enormous power to manipulate quarterly earnings by altering the assumed discount rate to calculate the net present value of expected future cash flows. In tandem with the regulatory tower built over the past thirty years, this constitutes a formidable engine to drive the consolidation of the world banking industry.

Basel’s Influence: Self-Regulation Empowers Giants, Drives Global Banking Consolidation

The model for this was the first Basel agreement on capital adequacy, which allowed the right of self-regulation to the handful of large financial institutions that operated interest rate swap warehouses and granted them higher credit ratings on the basis that they could hedge their balance sheets. At a stroke, this gave them a strategic funding advantage and forced anyone else who wished to compete to come to them for the tools to do it. Today, something similar is happening thanks to Basel Two, which will confer similar advantages on the same cast of characters, except this time with respect not to market-related risk but to credit itself. This can be expected to drive yet another wave of international banking consolidation.

Derivatives: The Invisible Power Shaping the World Banking Industry

Yale economist Robert Shiller has drafted what must count as the manifesto of infinite leverage. This is his book, The New Financial Order: Risk in the 21st Century. In Shiller’s New Order, cash will be criminalized; it is better to canalise all money flows. Derivative contracts on all “risks” will be traded, and citizens must use them to hedge their incomes, careers, etc. It doesn’t take a genius, much less an economist, to prove that such a system is workable only by compulsion and that with Shiller, Orwell’s nightmare is set to become ours.

The technology to drive this world is already with us, and the bureaucracy is not far behind. The regulatory edifice created to combat “money laundering” is no such thing. It will not catch the Enrons of the world because it is not meant to, but it is admirably suited to control individuals.

Married to this are a handful of firms such as AMS, Dyncorp, Lockheed and IBM that manage most of the Federal government’s software development, financial control, and accounting functions. For example, AMS took over HUD’s internal financial control and accounting systems in 1996 and, within two years, racked up $60 billion in “undocumentable transactions.” It was then brought into the Treasury, presumably working the same magic.

The Rich Get Richer and the Poor Get Poorer: Unveiling Economic Inequality

It is not if this seems a little far afield from the gold market. Physical gold flows into the hands of those with the cash to buy it, as evidenced by more than a decade of a widening disparity between demand and mined supply of physical gold. That gap has been financed as it can only be funded by the recycling of scrap and by the collection of physical gold from national reserves. This is the point. I suppose Robert Shiller’s of the world can criminalize cash, but they cannot suspend the workings of the international economy.

Outsourcing Control: Unveiling the Risks and Erosion of the Social Compact

Audit and control functions can be subcontracted to “safe” hands, but this does nothing to alter the fundamental relations of value and risk. Indeed, all this represents an invitation to racketeering, tax evasion, fraud, and, ultimately, a breakdown in the social compact. Gold is flowing out of national reserves and into the hands of individuals. Who are they, one wonders? Can it all satisfy the desire for jewellery in China, India and the Middle East? I think not.

The question that should be asked is not whether the gold “intervention” has worked but how long it will work. The answer is presumably until citizens of the democracies restore the rule of law and accountability. Barring that, it will continue until all of those reserves are gone, and all that is left is the question, cui bono.

© 2003 Chris Sanders

Principal, SandersResearch.com

Email

George J. Paulos on The Rich Get Richer, And The Poor Get Poorer

Editor/Publisher

Alternatives for Financial Freedom

Proprietor, www.freebuck.com

Central Banks Have Lost the War on Gold

Since Nixon closed the so-called “gold window” in 1971, effectively defaulting on the US government’s obligation to redeem dollars for gold, the world has been operating on a “fiat” currency standard with the US dollar as the prime reserve currency. Previously, international currency transactions were ultimately payable in gold. Now, all payments are made with currencies that are not backed by anything but the government’s authority.

After some fumbling around with various international currency standards, the world’s significant economies settled on the “Basel Accord”, which stipulated that central banks would diversify their assets away from gold and into baskets of national currencies. This process necessitated liquidating large quantities of gold from central bank coffers in exchange for currency and treasury securities. Since central banks initially held much of the world’s gold bullion, this ample supply of gold in the markets depressed the price for many years.

Now, however, world central banks do not have the vast gold reserves of years past and have slowed down liquidation. In 1999, an agreement (the Washington Agreement) was signed that limited central bank gold sales and leasing. Reduced gold supplies coming to the markets from central banks have lessened their influence over the gold price.

Shifts in Financial Markets: Gold Bear Market Ends as Central Bank Practices Evolve

This fact, combined with trend changes in global financial markets, has ended the bear market in gold. Many practices, such as the “gold carry trade” and gold mining company “hedging,” relied heavily on central bank leasing of gold. In the gold carry trade, investors can “lease” gold from central banks at very low interest rates (often under 1%), sell the gold, and invest the money in higher-yielding securities.

As a hedge against declining prices, gold mining companies can lease metal from the central bank and sell it for current operating income, agreeing to return the gold from future production. Both the carry trade and hedging further depressed the gold price. However, these same practices cause big losses when the gold price rises, so they have been discontinued. The Washington Agreement expires in 2004, and there will be much debate on the future of central bank gold when it comes time to renew.

“Soap and education are not as sudden as a massacre, but they are more deadly in the long run.

Training is everything. The peach was once a bitter almond; cauliflower is nothing but cabbage

with a college education.” Mark Twain 1835-1910, American Humorist, Writer

Central Banks and the Gold Price: Stability, Currency Regimes, and Monetary Management

Why do central banks care about the gold price? I don’t think that they care about the cost of gold as much as the stability of the current currency regime. Gold is not so much an enemy of the central bankers as it is an annoyance. A strongly rising gold price implies trouble with the currency regime. However, rising gold does not constitute a crisis for central bankers unless they have leased out too much of their gold inventory and the gold loans default. This would be a public relations fiasco but not an economic disaster since no economically significant transactions are currently made in gold.

Indeed, central banks would prefer a stable gold price. But they have squandered their only tool to control it: their gold supplies. The central banks should be able to coexist quite well with a much higher gold price; they have already survived a tenfold increase since the 1970s. The natural enemies of the central banks are their monetary mismanagement and the spendthrift fiscal policies of their associated governments. If there is still a significant bank war on gold, then they have run out of ammunition.

The Widening Wealth Gap: The Rich Get Richer and the Poor Get Poorer

It is just incredible that central banks are slowly liquidating their gold. This means they are returning their paper in exchange for real gold. Gold is a tool for individuals to defend their wealth against the paper hurricanes of the central bankers. Gold in the hands of central bankers is an instrument of oppression. The less gold possessed by significant banks, the better gold will perform its wealth preservation function. One ounce of gold in your hands is worth at least two in the bank!

George J. Paulos

Editor/Publisher

Alternatives for Financial Freedom

Proprietor, www.freebuck.com

Email

December 11, 2003

Copyright 2003 George J. Paulos, All rights reserved.

John Tyler The Rich Get Richer, And The Poor Get Poorer

Quantal Theory

Proprietor: www.infognome.com

The Fed’s War on Gold

“The sinews of war, unlimited money”

– the Fifth Philippic.Cicero 106-43 BC

War is an organised conflict, rather than the skirmish you might have with the IRS or parking officer. Some see it as a stimulus to social and technological progress, and Nietzche even saw it as honoring. Others condemn war as a destroyer of material wealth and, ultimately, civilisation. Is this at stake with the Fed’s war on gold?

There is always something at stake, and it’s usually not what is stated. The name war is given is to act as a container for our thoughts: nothing more, nothing less. “The War of the Roses”, “The Vietnam War”, and “The War on Terror” are examples. Every war has victors, victims and collateral damage.

Polemics aside, what are we to make of “the War on Gold”? What is at stake?

Let me state clearly that it is not gold itself. Gold is just the battleground.

In his classic work “The Art of War”, Sun Tzu recognizes nine varieties of the ground over which a battle is fought. The tactics must vary according to the ground. The last of these nine types of ground is called “desperate ground.” This is ground on which we can only be saved from destruction by fighting without delay, and it is desperate ground.

Gold, for the Fed, was desperate ground. It had to be conquered for the Fed to survive and retain its master franchise over money. It is this master franchise that is at stake.

Sun Tzu’s strategy: “On desperate ground, fight.”

Who fought to hold gold’s ground as a means of exchange? GATA and a few gold bugs?

A later commentator on “The Art of War,” Chia Lin, remarks: “If you fight with all your might, there is a chance of life, whereas death is certain if you cling to your corner. A lofty mountain in front, a large river behind, advance impossible, retreat blocked.” Another commentator, Ch‘en Hao, says: “To be on ‘desperate ground’ is like sitting in a leaking boat or crouching in a burning house.”

My friends, we have been burnt. We are sunk. The Fed has won the war, for now. They have maintained their franchise of total control over the monetary system.

However, by winning this war, the Fed is creating the means of its own destruction. Conquering Gold’s territory as a means of exchange is the loss of one more restraint on this group of despotic profligates who are destroying the value of their own stock of trade money!

The Fed’s Victory and the Fragile Future: Reflections on Monetary Control

What can we do? When discussing the probabilities of victory in the Second World War with King George VI, Joseph Hertz said: “ All the same, Sir, I would put some of the Colonies in your wife’s name.” In other words, he was even telling the King to spread his bets!

This will earn the ire of every actual gold bug, but I doubt whether a gold standard will ever return. Times have changed; the battleground has moved on. Gold can still be a good investment, but like every investment, we should not become attached and regard it as a saviour.

I will leave the final words to Sun Tzu:

“One war cannot make sure of conquering.”

© 2003 John Tyler

www.infognome.com

Email

Gale Bullock on The Rich Get Richer, And The Poor Get Poorer

(AKA Ole Bear)

Proprietor, www.pgtigercat.com

RMS Titanic

Heavy Metal Ain’t No Rock Band…

My answer is no… the central bankers have not won the war against heavy metal. Since most prominent bankers, in our view, fall into the category of Monetary Charlatan Greenspan and his Jackass Buddies, McTeer, who predispose couples to hold hands and buy an SUV, and Bernanke, who thinks he’s Gutenberg reincarnate, we suppose that their age is generally 55-60 or older.

Although we feel that the younger jackasses probably do know who Elvis Presley was and can recognize Jailhouse Rock. You Ain’t Nothin’ But a Houndog, and that they may realise such lyric persuasion as Iron Butterfly’s In a Gadda Da Vida (however, you spell it), they probably don’t understand much in the way of the Rollin’ Stones’ Jumpin’ Jack Flash or Get Off of My Cloud.

Although we can envision Mr. Greenspan being able to recognize the 3rd Beethoven Eroica Symphony as possibly Beethoven?, (his Fed$peak would convince us that it was Haydn’s rework of Mozart in a new productivity paradigm?), we find it hard to believe that any of these central bankers, or their other G7 or G50 counterparts, ever heard of Commander Cody and the Lost Planet Airmen, Dream Theater, or Yngwie Malmsteen. For them, heavy metal is the electronic Ka-Khing of electronic funny money created out of thin air. Well…heavy metal is music to my ears, and not all heavy metal is a rock band, Sports Fans!

Dumb, Dumber, and Dumbest? But The Rich Get Richer, And The Poor Get Poorer

Indeed, central bankers aren’t dumb or dumber, but they take my vote for dumbest…

Let’s talk about dumb… the Federal Reserve system and its tentacles created in 1913 have been able to rewrite history books, influence the economic curricula at every major college and university in the USA, influence elections, produce economists who pontificate on the virtues of the FED and have dumbed down a Nation under the once Constitutional Republic.

The American People don’t understand economics, money, heavy metal, or bullion as money or as a commodity (it is both), and everyone in this country believes Abraham Lincoln was the second Jesus Christ. That’s dumb. Well, it has been going on for 90 years since 1913. Secession, and the right to secession from the federal union of the United States, was guaranteed to the states in the U.S. Constitution, or did you miss that one in the 8th Grade, Sports Fans? If you missed that one, you probably missed the money issue; the U.S. Dollar is defined in the Constitution as a measure of weight at 371.25 grains of fine silver, as well. Ho, Humm! Ho! Ho! Hilarious! Merry Federal Reserve!

Being from the Mississippi Delta, Ah didn’t…

Now let’s talk about dumber…. There are a lot of folks in this country and on the planet who are a helluva lot smarter than I, who just don’t get it—creating money out of thin air under the Mandrake Mechanism? Money backed by debt is sheer lunacy. That’s what central bankers do.

They create money out of thin air. Federal Reserve Notes are the most excellent Ponzi shell game in the history of the world, and very few Americans in this country know the smell of bacon (Bernanke and that printing press smokin’ the bacon, aka inflating the currency, and destroying your wealth, dear reader) that’s burnt to a crisp. Mr. T says it best: “You Fool!”

The dumbest? That’s easy. The central bankers. All legal tender fiat paper funny money currencies, which are not backed by specie, aka heavy metal or bullion if you wish, ultimately inflate ‘til they disintegrate into thin air, as they were initially created. That is written in stone as the history of paper money unbacked by species, and it will repeat, according to our study of the Histories of the Markets. Central bankers are merely re-arranging the deck chairs in our view on the RMS Titanic. Our politicians inside the Beltway should also take heed to our following sentence.

There are a helluva lot of pick-them-up trucks with gun racks, little ole ladies with 38 snub noses, and other folks who firmly believe in the right to bear arms under the Constitutional Republic.

Central Bankers and the Unraveling Reality: A Warning Amidst Public Discontent

The corollary is that a helluva lot of tar and feathers is available in all 50 states, but I am not so sure about Iraq. The dumbest position, in our view, is the cigar-smoking potbellied silk suit Gucci shoe position that the central bankers are going to hoodwink a nation in perpetuity. Perpetuity means forever or until the twelfth of Never. Sports Fans, it just isn’t going to happen.

The days of central banking are numbered. Dumbest are central bankers not coming to grips with reality… there are not enough police, sheriff departments, or military in the United States of America to protect them from the Mob of Citizenry that may have the propensity to chase them with the Second Amendment… and the unwritten amendment of tar and feathers when all hell breaks loose, and folks realize their Ponzi shell game of wealth stealing and destruction. That’s a fact, Jack.

McTeer and Bernanke, wake up! Just how fast are your SUVs? Maybe you Fat Cats need to phone home to the Roadrunner at Warner Bros. and get some extra tips for more ponies for those gas guzzlers? You, Kool Kats, may need them unless you run faster than your SUVs.

Et Tu Brute, et al Cronius Americanus?

Central bankers, to be sure, and our privately owned banking cartel linked to the Bank of Rome, the House of Rothschild, and the House of Rockefeller, et al. Cronius Americanus have won many ignoble battles over the past 90 years, destroying the Bill of Rights, the U. S. Constitution, and the Constitutional Republic. This cartel is so linked to the current moral decay of our DemoPublican (See: Nelson Hultberg) political fabric that it makes me sick of the deception. (See McFadden’s 1934 Speech and 1932 Speech on the Federal Reserve)

When our Nation under God, whom I implicitly Trust, wakes up and smells the foul stench caused by the federal reserve as the ultimate destruction of our fundamental freedoms (the root of liberty is sound money), the final battle will be in the streets. It will not be a good time to have ever been associated with banking, or central banking, whatsoever. “What difference does it make if a market is a bull or bear? What’s important are your options in playing the cards dealt and winning the war against the monetary charlatans at the federal reserve.” – Miss Paula Bear.

Heavy metal music is always part of my bride’s and my listening pleasure…

Conclusion on The Rich Get Richer, And The Poor Get Poorer

Heavy metal is not generally well-understood music, akin to bullion or the physical ownership of commodity and fiduciary money. We have been dumbed down and tricked into believing that pictures of Washington, Lincoln, Jefferson, Jackson, Hamilton, Grant, and Franklin on pieces of green paper imprinted as FEDERAL RESERVE NOTES are real money. They are not true notes of any kind, as they lack redeemability on demand to the bearer in specie, aka heavy metal.

They are a Ponzi shell game…. The biggest in economic history. Our Forefathers who created the Constitutional Republic understood sound money systems in creating the Republic (eh… these are the same Forefathers that despised the word Democracy, all of which have failed since ancient Athens)…. The Constitution defines the US dollar as a measure of weight at 371.25 grains of fine silver based on the Spanish Piece of Eight in circulation in Colonial Times. They understood what we do not as a Nation dumbed down by the central banking cartel called the Federal Reserve…. Sound money is economic freedom and liberty.

The Battle for Main Street: Central Bankers vs. Ma and Pa Kettle

It is our position that central bankers have so far been most victorious in the 90-year war on economic freedom… the final battle on Main Street America remains to be fought by all those that I affectionately call Ma and Pa Kettle and their kids, Joe Six-Pack and Sally SUV. These Main Streeters aren’t dumb at all… they haven’t yet been given suitable educational materials.

This Bull market in heavy metal, caused by the manipulations of the global market of the central bankers themselves, is to be believed in our view. I love it when fractional reserve bankers wet their silk suits and Gucci shoes. Jackasses, McTeer and Bernanke… just how frigging fast can you turkeys run in a Gold Derivative Banking Crisis? Heavy Metal? Be in it, or lose it!

© 2003 Ole Bear

www.pgtigercat.com

Email

Bill Murphy on the War On Wealth:

Chairman, Gold Anti-Trust Action Committee (GATA)

Proprietor, Le Metropole Cafe

Economic Inequality Unmasked: The Rich Get Richer as the Poor Get Poorer

The Gold Anti-Trust Action Committee (GATA) was formed five years ago to take on a Gold Cartel, which has been manipulating the gold price since the mid-1990s. Gold was trading below $300 then, and the price artificially suppressed hundreds of dollars an ounce below where it would have been in a free trading market.

GATA received support from some of the major gold producers, primarily South Africans, and many individuals around the world. With a substantial amount of funds, we retained one of the top antitrust law firms in the US, placed ads in various newspapers, held our GATA African Gold Summit in Durban, South Africa, in which five sub-Saharan nations attended, and presented our case around the world to all those who would listen.

During the past five years, we accumulated substantial evidence the gold price was manipulated by a Gold Cartel consisting of various bullion banks such as JP Morgan Chase and Goldman Sachs, the Exchange Stabilization Fund, the Fed, the IMF and the BIS in Switzerland. Former Treasury Secretary Robert Rubin put the scheme to rig the gold price into high gear. It was the essence of his “strong dollar policy.” His underling at the time, future Treasury Secretary Lawrence Summers, co-authored a paper, as a professor at Harvard, titled “Gibson’s Paradox and The Gold Standard.”

Unveiling the Manipulation: Central Banks, Gold Reserves, and Price Suppression

To accomplish their mission, they surreptitiously dumped 10,000 tonnes of gold into the marketplace to suppress the price. Most of the gold world believes the central banks still have 28,000 to 32,000 tonnes of gold reserves in their vaults. They do not. They only have about half that much. Frank Veneroso, Reg Howe and James Turk used different methodologies and discovered that the central banks have lent/swapped out around 15,000 tonnes of gold.

They have hidden this fact from the world. We know that is because the IMF has instructed its member central banks to count lent/swapped gold as gold reserves. In other words, various central banks count gold sold into the marketplace as gold reserves on their books. This is blatant deception. The gold is gone. Much of this gold has been hoarded by people all over the world. There is only one way they can get it back: for the price of gold to go high enough that the world’s citizens turn it back in as scrap to be refined.

Unveiling Socioeconomic Disparity: When the Rich Prosper and the Poor Suffer

This is very important. The central banks only have around 17,000 tonnes of gold left in their vaults. Gold demand exceeds supply by about 1500 tonnes per year. The gold price was suppressed for many years because The Gold Cartel fed enough gold into the marketplace to satisfy the yearly supply/demand deficit. But now they are hitting a wall.

Much of the remaining gold still in the vaults is unavailable for their scheme. Meanwhile, demand for gold is picking up in various parts of the world. For example, China has just opened up the gold market to its citizens. The surging demand for physical gold is eating the cabal’s lunch and is the main reason the gold price has rallied $140 per ounce in the past two years.

The price of gold is close to breaking into 14-year new high ground, which will stun many people. What will stun them more is when the price explodes like a volcano. This is going to occur because many of the price riggers will be forced to cover.

They and others have massive short derivatives positions which will blow up. It could happen at any time. The Gold Cartel did all they could the past two weeks to take gold back down below $400 and failed. Bullion closed above $400 for ten days in a row. This has to have the big shorts extremely nervous. Some of the big ones will run for the hills very soon.

Unleashing the Golden Explosion: Central Bankers’ Defeat and the Rise of Gold

- The gold fundamentals don’t get much better than this. Besides an enormous short position out there, part of which must be covered, we have:

- Interest rates are not far from zero in the US, which makes gold a compelling investment

- Negative interest rates – inflation is greater than the Fed Funds rate, which has always been gold-bullish

- Surging gold demand led by the Indians, Turks, Koreans, Arabs, Russians and Chinese

- A disappearing dollar

Gold producers covering their hedges with Barrick Gold declare they will no longer be hedging, which means they will not be bombing the market with gold supply.

Meanwhile, a New Orleans Federal Court judge is allowing Blanchard & Co. to sue JM Morgan Chase and Barrick Gold for manipulating the gold price. The case is now in Discovery. The ramifications from this trial alone could send the price of gold soaring.

Have “Central Bankers Won the War Against Gold and Silver Bullion?” Hardly! The reverse is true. The gold price is going to explode, and when it does, it will expose the nefarious scheme of some of those central bankers. This includes the US, Britain and Germany, among others. It is going to be quite a scandal. These central bankers are about to go down to their worst defeat ever. It can’t happen soon enough for me.

© 2003 Bill Murphy

Ed Bugos on The Rich Get Richer, And The Poor Get Poorer

Editor, The Golden Bar Report

Proprietor, www.GoldenBar.com

Have central bankers won the war on gold and silver bullion? An Existential Matter

The central bankers’ war on gold is a war on money. It is a war on markets, discipline, and progress. The need for cash arises in any society based on private property and free exchange. It’s a market phenomenon, the market’s choice, if you will.

Central banks, however, exist to protect a monopoly on banknotes – a banking cartel – from the discipline of the market, to control the process of inflation… to fool the market about its consequences… to redistribute incomes… and to finance the welfare/warfare state.

On the Federal Reserve’s website is the slogan, “The Federal Reserve, the central bank of the United States, was founded by Congress in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system.”

By this graph, they’ve failed. Or maybe stability isn’t their true aim. Maybe it’s their biggest lie.

Unmasking the Fallacy: Debunking the Myth of Market Instability in the Pre-Fed Era

Indeed, the reason that the banking system failed in the panic of 1907 (which was the rationale for the creation of the FRB) had nothing to do with the vagaries of the market. A market is indeed inherently unstable in the sense that it is constantly changing. However, it is a false claim to suggest that the volatility of the pre-Fed banking system in the United States was the result of the inherent weakness of a free market banking system (see Rothbard’s many works on this).

It was but a system of State banks whose inflation policies were decentralized. There was some centralization due to the National Bank Act after the Civil War, but most banks operated outside of its jurisdiction. 1907 proved only that a central bank was necessary to control this process – i.e. too many different kinds of banknotes produced at different rates proved disastrous. Thus, a central bank was the next step in the war on gold.

Indeed, while the annual production of gold is not fixed, the concept of sound money is not in the least intended to mean the “unattainable idea of stable money.” It just means excluding the government from influencing money and empowering the banking cartels in the process. It suggests that a free market and an unregulated banking system would produce money (and a financial environment) much more stable than it has become since the Fed.

The Unwinnable War: Central Bankers and the Struggle Against Market Preferences

This truth is what the Fed wages its war on! If people knew that a free, unhampered market – or banking system – could produce more stable money, central banking would roll over and die.

However, unlike wars between nations, the battles that Statists wage on markets are unwinnable.

Winning the war on any market is possible as long as it doesn’t bite back. Even the outlawing of markets (or exchange) within entire societies has historically resulted in the same, which is why communist economies ultimately collapse. We don’t have to engage in war to defeat communism. We have to sit back and wait – if that’s at all possible.

However, to the extent the unhampered market does not choose gold as its money today, it would appear that central bankers have won their war on gold since their banknotes enjoy a wider circulation than gold does (as money), and owing to the size of government.

But in reality, this war is not winnable because it is a war on the market’s preference. At best, it can only be prolonged. That is the closest that central bankers and Statists will ever come to winning their war on gold – by keeping it alive. It is possible, after all.

The Endless Warfare: Central Banks and the Battle for Monetary Control

The war can be prolonged so long as governments can grow in size without producing a crisis and so long as the central banks can find new ways to centralize banking and monetary policy to solve the problems they produce and extend their life span – or the war. Yes, I believe it’s an existential question. The existence of a central bank implies a constant state of warfare with the market in matters of money.

For a current real-world example of increasing centralization, look no further than the gradual dismantling of Glass Steagall and the global implications for banking under the Fed’s revamped Basel Accord, as well as recent activities surrounding the BIS—which many fear may become the world’s next lender of last resort or central bank.

The central banks’ current war on gold reached its pinnacle of apparent accomplishment in 1999 with the announcement that the Bank of England planned to auction off its remaining gold and with the speculative bubble on Wall Street – fueled by a manic expansion of fiduciary media – reaching a climax of its own, one of historic proportions I might add.

But rather than exemplary of their true success, it produced positive consequences that could not be sustained and negative consequences that, in many instances, remain invisible to this day—in the extent of resulting dislocation and systemic risk that has accumulated in the economy, the banking system, and the value of (confidence in) the Federal Reserve Note.

The Unwinnable War: Central Banks’ Battle Against Gold

In short, given what has been happening to the value of gold since 1999, we can only surmise that they are gradually giving up ground in this war. This has produced conditions that appear to be biting them in their proverbial behinds (conditions increasingly working against their policy aims).

Measuring the success of this war by what has happened to the value of the dollar against gold during the entire 20thcentury relative to its value in pre-Fed days, it could be argued that central bankers have been losing their war on gold all along despite their success in restricting free coinage, advancing legal tender laws, and persuading commercial agents that a consistently devaluing banknote is still a superior medium of exchange to gold-based money.

In the final analysis, although it may ebb and flow, this war on gold is no more winnable than a war on money or markets. It is winnable so long as it can be prolonged. If it appears that central banks have won, it is only because they are still in the game.

Hence, central banks are winning this unwinnable war because they live solely to fight it.

© 2003 Edmond J. Bugos

Editor of The GoldenBar Report

www.GoldenBar.com

Email

Peter Spina on The Rich Get Richer, And The Poor Get Poorer

Proprietor, www.GoldSeek.com

Gold is money! For over 2,000 years, gold has served a purpose as a medium of exchange. In the history of the United States, the U.S. Dollar was directly redeemable from the U.S. Treasury for gold. During the 1930s depression, gold was outlawed by Presidential Executive Order 6102 (April 5, 1933), making it illegal for U.S. citizens to own gold bullion coins, bullion or certificates. Months later, the dollar was devalued from $20.67 per troy ounce to $35 (i).

In 1944, the Bretton Woods Agreement set the U.S. Dollar as the world’s Reserve Currency and officially adopted the $35/ounce to one dollar ratio. Decades later, with growing international gold demand for their debt-note obligations, President Nixon was forced to close the “Gold Window.” In early 1973, the global reserve currency lost its official link to gold, and the price began to rise, soon reaching the $200 mark.

Then, in 1975, Presidential Executive Order 6102 was reversed, allowing the private ownership of gold once again by U.S. citizens. Demand grew, and to satisfy this golden appetite, the Treasury Department and other Central Banks sold off large amounts of their holdings, plunging the value of gold vs. the dollar by nearly 50%. Yet, the inflationary era of the late 1970s destroyed the dollar’s value by ¼ against other global currencies, sending a surge of demand for even more yellow metal. In just a few years, gold soared to a high of $850 an ounce in early 1980 (in 2003 dollars, an inflation-adjusted high of gold translates into about $2,000 an ounce).

Volcker’s Battle: The Rise and Fall of Gold in the Global Financial System

With the global financial system teetering in total financial disarray, Federal Reserve Chairman Volcker led a charge to save the falling value of the U.S. Dollar against international currencies, including gold. A series of rate increases were instituted to combat rampant inflation. Eventually, the prime rate reached 20%! This resulted in the soaring demand for U.S. Dollars, and the gold rally was crushed.

Chart courtesy of Kitco.com

Over 20 years have passed with gold in a bear market decline. Central Bank selling, forward selling by producers, gold leasing by Central Banks and a return to the U.S. Dollar as the gold standard of the financial system sent gold to a low of $250 an ounce in 2000. In 1999, the Washington Agreement, which was up for renewal in September of 2004, capped the amount of gold the participating Central Banks could sell into the market at 400 tones per year.

This is the shabby secret of the welfare statists’ tirades against Gold. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism towards the Gold Standard.”

Alan Greenspan – Gold and Economic Freedom (1966)

Central Banks and Gold: Manipulation, Suppression, and the Paper Currency Dilemma

Central Banks have been a significant force in the history of gold. In a monetary system where gold acts as a checks and balance tool, revealing the value of the paper currency no longer backed by it, gold is revered as a barometer of the health of a paper currency, thus its economy it represents. It should be of no surprise central banks would be inclined to keep gold’s value in check to avoid any hints of financial tribulation.

GATA has discovered evidence that supports the suspicions that central banks were involved in a policy to suppress the price of gold. One piece of evidence GATA uses is a paper by former Treasury Secretary Lawrence Summers from 1988. Mr Summers’ report refers to Gibson’s Paradox and discusses the effects of declining accurate interest rates and the positive impact on the price of gold. During his reign as Treasury Secretary under the Clinton administration, such an event occurred as the Federal Reserve created trillions of dollars. So why did the price of gold not reflect this event in financial history?

The Manipulation Game: Central Banks, Gold Sales, and the Price Control Battle

We already know of the documented gold sales by global central banks during this period. If the allegations by GATA can be proven correct, the central banks were victorious in their attempt to control, manipulate and depress the gold price. In a market with a supply deficit, the central bank selling their gold reserves has been a significant attribute to artificially maintaining the global price of the metal subdued.

The question posed whether central banks have successfully controlled the gold price is yes in this author’s view. In the brief history introduced above, one can see central bankers’ intervention in the gold price. Yet, it is a question of short-term success. As the significant bank’s supply of gold is limited and their ability to print paper currency does not apply to gold, eventually, free-market forces will prevail. The true value of gold related to the price of paper currencies will ultimately be revealed, yet patience may be required.

© 2003 Peter Spina

www.goldseek.com

Email

Antal E. Fekete on The Rich Get Richer, And The Poor Get Poorer

Professor Emeritus

Memorial University of Newfoundland

Central bankers are paid hands hired by governments to speculate on their behalf in volatile markets, including the gold market. There, they face not other straw men but flesh-and-blood speculators who risk their own money and cannot pass on their losses to the taxpayer. The incompetent speculator is eliminated quickly, and only the most astute ones survive. In contrast, central bankers have job security, and their losses are not personal as the government underwrites them. Thus, the confrontation between them and real speculators is one-sided and becomes ever more so as time passes.

There is no wonder that central bankers are virtually always on the losing side. They are like dull-witted and clumsy bears competing with clever and elegant foxes. Long is the list of battles lost by central bankers. Every currency devaluation is a landmark of one, and they number in the hundreds. Preceding each devaluation, the central banker must shout from the rooftop that his currency will never be devalued. The louder he shouts, the more convinced the speculators become that the central banker will soon have to eat his word. Accumulated profits made by speculators at the expense of the central bankers defy counting, so huge are the numbers.

The Battle between Central Bankers and Speculators: Lessons from History

Take the celebrated case of the Bank of France, which ended up with an enormous hole in its balance sheet in 1931 in the wake of the devaluation of the British pound. Employees were scurrying like mice to find assets to plug the hole. They added the value of the building, the desks in the building, and the paper clips on the desks to the asset column — in vain.

Eventually, the French government had to print up non-marketable bonds to make the Bank of France more solvent. Central bankers learned their lesson from this episode and never again allowed their accounting practices to become the focus of publicity. The Deutsche Bundesbank never disclosed how it plugged the hole in its balance sheet after the dollar devaluation in 1971.

The central bankers’ battle with the speculators over gold is not substantially different. Speculators have been playing cat and mouse with the central bankers, and the role of the mouse has been assigned to the latter. After each highly publicized gold auction (whether by the U.S. Treasury, the IMF or, more recently, by the Bag Lady of Threadneedle Street otherwise known as Me-Too Bank of England) the central bankers have become the laughing stock of the world.

The Fragile Alliance: Central Bankers, Speculators, and the Battle for Gold

The speculators have allowed the gold price to come down nicely to accommodate the central banker’s desire to unload. But no sooner had the last bar been sold than speculators bid up the gold price to ever-higher levels to allow their newly acquired wealth to shine.

Central bankers have indeed tried to enlist the loyalty of the speculators by using bribes and blackmail for the first time. They did not mind squandering the nation’s inheritance, the gold under their control, in defence of an indefensible position. As a result, speculators have abandoned their traditional perch on the long side of the gold market and switched to the short.

Central bankers laughed heartily, congratulating themselves that they had finished off gold for good. They have forgotten that the loyalty of the speculators is ephemeral. At a point — no one knows where it is — speculators will decide that the central banks no longer have sufficient gold under their control to call the shots and will switch sides again. He laughs best; who laughs last? © 2003 Antal E. Fekete

Email

Originally Published in 2003 and updated over the years

Unlocking Ideas: Articles That Inspire Fresh Thinking

Dividend Capture ETF: The Lazy Investor’s Dividend Strategy

What Was the Panic of 1907: A Triumph of Folly Over Reason

What Time is the Best Time to Invest in Stocks? When Fools Panic

The Volatility Paradox: Calm Markets but Soaring ‘Fear Gauge’ Trading

Which of the Following is a Characteristic of Dollar-Cost Averaging

Synthetic Long: Unlock Extreme Leverage Without the Risk

Best Ways to Beat Inflation: Resist the Crowd, Gain Insight

Gambler’s Fallacy Psychology: The Path to Losing

Dividend Harvesting: A Novel Way to Turbocharge Returns

Capital Market Experts: Loud Mouths, No Action

Modern Investing: Innovative Approaches in the Stock Market

Adaptive Markets Hypothesis: Master It to Win Big in Investing

Stock Market Crash Michael Burry: Hype, Crap, and Bullshit

Mainstream Media: Your Path to Misinformation and Misfortune

Market Dynamics Unveiled: Stock Market Is a Lagging Indicator

Mass Media Manipulates: Balancing Awareness & Trend Adoption

What Are Two Ways Investors Can Make Money from Stocks: A Holistic Approach

The Dow has never been in A true Bear Market

Contrarian Round Table II- Central Bankers

the Level Of Investments In A Markets Indicates