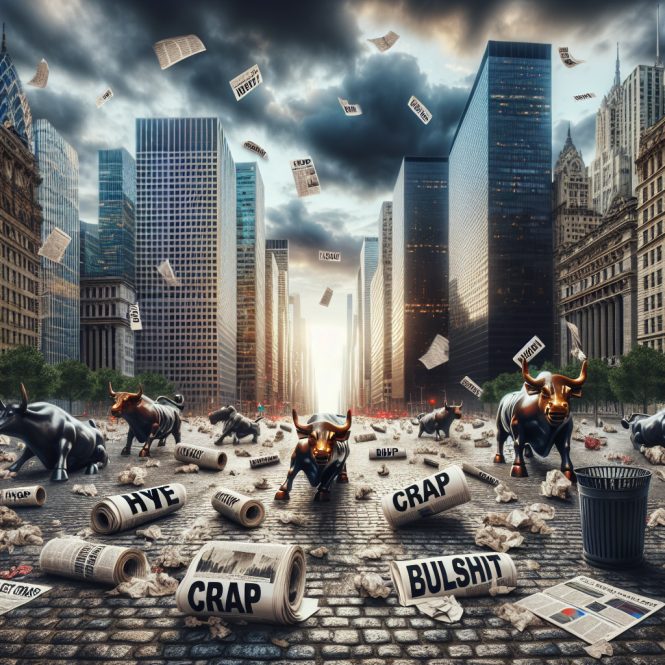

Michael Burry and the Market Crash Obsession: Insight, Noise, or Just Another Doom Loop?

March 31, 2025

The Enigma of Michael Burry—Then and Now

Michael Burry isn’t just a name; he’s a symbol. A walking paradox. Lauded genius, doomsday prophet, misunderstood contrarian, or serial alarmist—depends on who you ask and when.

He nailed 2008 with surgical precision, shorted a system built on sand, and walked off with glory while the herd got slaughtered. Since then? A lot more noise, a lot less signal. But here’s the thing—when someone calls the Big One once, the world never stops listening. Even when they probably should.

The market doesn’t just react to data; it reacts to story. Mythology. Burry became a myth the moment he won big. But myths have a half-life. And what follows is often just echoes.

From ‘Big Short’ to Big Shrug

That infamous 2008 play? Legendary. No argument there. But one kill doesn’t make a predator. Since then, Burry’s calls have veered toward serial catastrophism. A passive investing bubble. Crypto implosions. Stimulus-driven meltdowns. He’s warned, tweeted, deleted, reappeared, and warned again. Yet markets kept marching.

What’s going on? A few things:

- Recency bias—when your greatest hit was a black swan, you start scanning the sky daily for feathers.

- Authority distortion—investors start to lean not on evidence, but on reputation.

- Echoes of genius—every future forecast gets wrapped in the halo of a past victory.

In other words, he’s not just trading markets anymore—he’s trading legacy. And legacy trades on emotion, not precision.

Mass Behaviour: The Real Market Mover

Forget spreadsheets for a second. Markets aren’t mathematical—they’re psychological. Herds don’t move because of Burry—they move because of what Burry represents. Certainty. Defiance. Control in chaos. People aren’t following the analysis—they’re following the myth. It’s not Burry the analyst. It’s Burry the archetype.

His tweets make headlines even when they’re just cryptic one-liners or meme posts. They don’t need substance—they just need to rattle the cage.

Predictions vs. Performance

Here’s the scorecard post-2008: lots of bearish signals, few major payoffs. That doesn’t make him wrong—it makes him early. Maybe too early. And in markets, being early often looks exactly like being bad.

Case in point—his 2017 passive investing warning. Valid in theory. Still not validated in practice. Or his repeated warnings about artificial bubbles propped up by the stimulus. Sound the alarm enough times, and you’ll be right again one day. But that’s not strategy—it’s shouting into a storm.

Influence Is a Weapon—Double-Edged

Burry doesn’t just invest. He moves others. Whether he means to or not, that’s power—but it’s also risk. His public predictions shape expectations, tilt sentiment, and sometimes spark panic trades. And most of the people hanging on his words? Don’t have a plan. They’re just looking for a hero in a headline.

Call it the cult of pessimistic authority. He warned once, was right, and now some think he’s never wrong. But markets aren’t loyal to past wins. They’re loyal to adaptability, to flow, to timing. And timing can’t be crowdsourced.

Technical Analysis and Market Complexity: More Art, Less Algorithm

Technical analysis gets romanticised. Candlesticks, trendlines, RSI signals—they seduce investors into thinking there’s a code to crack. But the deeper truth? Most charts are Rorschach tests. What you see depends on what you want to see.

Sure, patterns exist—but interpretation mutates in real-time. That’s why two seasoned traders can look at the same S&P 500 chart and draw opposite conclusions. Noise dressed as clarity.

Even Ben Graham—the original value sage—nailed it: “In the short run, the market is a voting machine; in the long run, a weighing machine.” Most people obsess over the votes. Burry, to his credit, tries to weigh—but his scale is tilted by past trauma and an audience that now craves doomsday like oxygen.

Burry’s red flags—overleverage, inflated valuations, dumb economic policy—are all real. But markets aren’t cause-and-effect machines. They’re mood rings powered by liquidity, narrative, and the speed of capital. His 2021 inflation alarm? Yes, prices rose. But the markets didn’t unravel. They adjusted, digested, rerouted.

Why Some Experts Keep Yelling ‘Crash!’

Now let’s pull the curtain. Why do figures like Burry keep warning of an apocalypse?

Enter behavioural psychology.

Skinner said behaviour is shaped by reward. Burry was handsomely rewarded—financially and reputationally—for spotting a monster before it attacked. That kind of reinforcement creates a loop: Find the next monster, sound the alarm, get praise, and repeat.

Then layer in cognitive dissonance. Once you’ve gone public and tweeted “SELL,” you’re invested—not just in trades, but in identity. Admitting the monster isn’t coming? That’s not just a wrong call—it’s ego death.

And the crowd? They’re no better. People who buy into a prophet’s narrative often need to believe it. They’ll rationalise misses. “He’s just early.” “The system’s rigged.” Anything to avoid admitting they bet on fear, not fundamentals.

Real Strategies in Unreal Times

So what now? Ignore experts altogether? No. Just stop waiting for them to save you.

Start treating volatility as a tool, not a terror. One hybrid strategy worth its weight:

- Dollar-cost averaging: No timing games, just steady entry into chaos.

- Sector rotation: Shift into beaten-down areas while everyone else is panic-selling.

- Options overlays: Think strategic hedging, not YOLO leverage.

This combo won’t make headlines, but it builds wealth through the cracks.

Chaos Isn’t the Enemy—It’s the Engine

Market chaos is a reset button. Don’t run from it—use it. Forget annual rebalancing. Set volatility triggers instead. When the VIX screams, it’s time to review and pivot. Rebalance portfolios when the world is tilting, not when it’s calm.

For the bold, take a page from Templeton: “Buy at the point of maximum pessimism.” When the newsfeed bleeds red and CNBC sounds like a funeral, that’s the soil where long-term gains are buried. Most won’t dig. But contrarians will.

The Myth and the Mirror

Michael Burry remains one of the most fascinating characters in the investing world—not because he’s always right, but because he makes us question the definition of right. He’s a mirror held up to the market’s insecurity, a reminder that even brilliant predictions can curdle into narratives that outlive their utility.

Beware the prophet who speaks in absolutes. And beware the crowd that listens with blind faith. Because sometimes the market’s biggest trap isn’t ignorance—it’s memory.

Final Shot: Stop Worshipping Experts—Start Becoming One

Michael Burry is a cipher. At his best, he sees around corners. At his worst, he’s haunted by a ghost crash that already happened. Either way, his voice should inform, not dictate.

Markets are complex, slippery, and psychological. Nobody—nobody—can predict them with consistent precision. That includes Burry, Buffett, or anyone paraded out on TV with a title and a chart.

Build your own system. One that uses psychology, history, and discipline. Because in the end, it’s not about finding the perfect forecast—it’s about becoming antifragile in a world addicted to noise.

You want the real play? Stop obsessing over whether a crash is coming. Focus instead on what you’ll do when it does.

And remember this:

The market condition you’re panicking about today?

That’s the one you’ll wish you took advantage of tomorrow.

Worry less. Act more.

Eureka Moments: Capturing Insights That Ignite the Mind