By: Aussie John

Updated Jun, 2023

Reviving the Glory: The Renaissance of Australian Gold Miners

We have closely monitored many promising gold junior companies entering the market in recent months, capitalizing on the rebound of gold prices to advantageous levels. What was once considered unprofitable ventures have suddenly become attractive opportunities for development once again.

Empire Resources (ASX:ERL) has formulated a clear-cut gold mining strategy, collaborating with renowned mining contractor NRW Holdings (ASX:NRH), a company valued at $179 million. NRW Holdings will oversee all open pit mining operations at ERL’s Penny’s Find gold mine.

As per the agreement, ERL now possesses ample funds to sustain mining activities until the commencement of gold production.

Penny’s Find represents a joint venture between ERL and Brimstone Resources, with ERL holding a favorable 60/40 split. The project boasts a resource of 470,000 tonnes at an impressive 4.42g/t gold, and initial samples have already yielded shallow, high-grade gold. Additionally, an open pit mine is currently under construction.

However, it’s important to note that this is still an early-stage investment. Potential investors should seek professional financial advice for further information before considering this stock for their portfolio.

An exciting development is the realignment of the road passing through the pit, which is nearing completion. The Kurnalpi-Pinjin Road previously ran directly over the open pit location, necessitating the rerouting of the road before excavation could begin.

Furthermore, an Underground Feasibility study is underway to supplement ERL’s existing Bankable Feasibility Study (BFS) based on the open pit approach.

According to the BFS, the total production cost is estimated to be AU$1,086/oz., while projected revenues in the first year of full production are expected to range between AU$29.6m and AU$33.6m. If all goes according to plan, the company could achieve positive cash flow within eight months and generate $7.6M in free cash flow within a year. Moreover, for every AU$100/oz. An increase in the gold price above AU$1,500/oz., an additional AU$2 million in free cash flow is anticipated.

The encouraging news for ERL is that the project is entering its final stages before production commences in the next quarter.

Recent accomplishments include:

– Timely and budget-compliant road realignment (scheduled to be completed within days)

– Completion of site earthworks for the laydown area, site offices, and workshops

– Completion of site earthworks for a dewatering dam and water supply

With the project’s advanced stage of development and impending results over the next few months, acquiring a stake in this ‘Empire’ could prove to be a wise decision, aligning with the recommendations of your bank manager.

Keeping track of:

Empire Resources Limited

ASX: ERL

Empire Resources (ASX: ERL) is an up-and-coming gold exploration company that is swiftly approaching the production phase, capitalizing on the favourable conditions in the gold market.

Entering the highly lucrative gold market is a challenging endeavour. Gold enthusiasts know this precious metal has a scarce and finite supply. Despite enduring considerable market fluctuations in recent years, the value of gold has once again stabilized at levels that foster robust cash flow.

Let’s examine the prices of gold, measured in Australian dollars:

Despite its volatility, this year has proven to be favourable for gold. Starting the year at approximately AU$1,500 per ounce, spot gold prices soared to an all-time high of AU$1,857 in June.

However, it is important to note that, like any commodity, the price of gold can just as easily decline. Therefore, it is essential to approach investments in gold stocks with caution and a prudent mindset.

Australian gold miners have demonstrated notable performance this year:

The Renaissance of Australian gold miners

A new generation of Australian gold miners has spearheaded a remarkable resurgence that is capturing global interest.

As the market undergoes a critical phase, strategically investing in junior gold miners like ERL could prove to be a wise decision. This is especially relevant as gold maintains its support and continues its gradual upward trajectory.

The HUI Gold Index, which experienced significant losses since the Global Financial Crisis (GFC), has finally reached a bottom and is steadily recovering its previous losses.

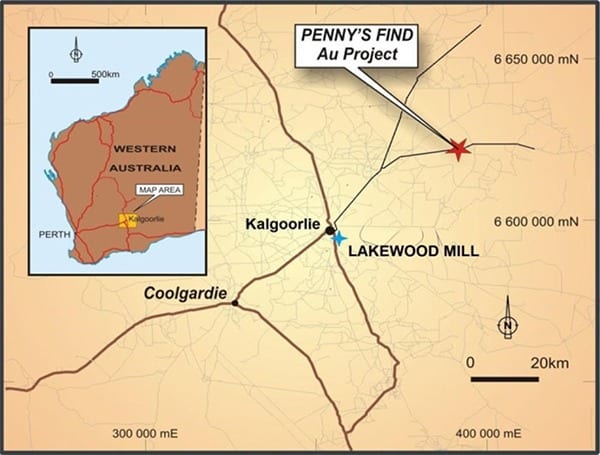

If ERL achieves its first revenue from the prominent Penny’s Find gold project near Kalgoorlie, it has the potential to pave the way for further development. The generated cash flow could be utilized for additional exploration or to acquire other gold projects, positioning ERL for increased valuation as it progresses towards production.

Regarding resource investments, attention to detail is crucial, and in the case of ERL, its gold project boasts distinctive features that set it apart from other gold junior companies in the region.

Let’s examine the geographical significance of the land under Empire Resources’ control. ERL operates in Western Australia, specifically in Kalgoorlie and Coolgardie’s renowned gold fields. The Penny’s Find Project, an integral part of ERL’s portfolio, is located northeast of Kalgoorlie.

If ERL successfully produces gold in this region of Australia, Penny’s Find has the potential to be a highly lucrative revenue generator during the early stages of ERL’s development.

Currently, ERL operates Penny’s Find as part of a 60/40 joint venture with Brimstone Resources. Consequently, once this asset begins production next year, ERL will benefit from the majority of the returns.

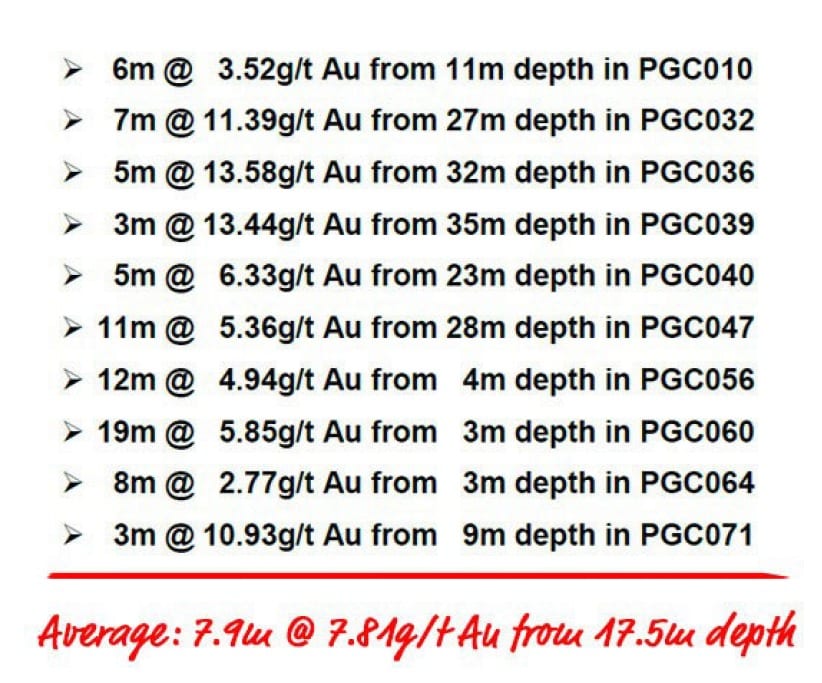

One of the key factors that gold explorers focus on is the quantity and grade of the gold deposits. In the case of Penny’s Find, initial samples have already demonstrated the presence of shallow, high-grade gold. Additionally, an open-pit mine is currently under construction, offering further potential.

Furthermore, there is potential for underground mining, which is being evaluated through a Feasibility study that supplements ERL’s existing Bankable Feasibility Study based on the open-pit approach.

Here are some of the most recent results obtained by ERL:

In the second quarter of 2016, the initial round of RC grade control drilling was carried out at Penny’s Find, comprising 86 holes drilled, covering a total distance of 2,534 meters. This drilling campaign marked the first of three planned grade control programs within the intended 80-meter-deep open pit. The objective was to refine understanding the gold zone’s position from the surface to approximately 30 meters depth and enhance confidence during the early mining phase.

Let’s take a closer look at Penny’s Find to understand its significance and potential for Empire Resources.

ERL’s initial drilling efforts have yielded positive results. The grade control drilling has shown relatively strong outcomes, with intersections at shallow depths surpassing expectations. These early-stage results are highly promising, with substantial drilling already conducted, setting the stage for production to commence in the very near future.

Another noteworthy aspect is that ERL’s Penny’s Find project has already completed a Bankable Feasibility Study (BFS), which provides investors with valuable insight and mitigates the uncertainty often associated with early-stage ventures. ERL shareholders can rely on the findings of independent estimates, adding further confidence to the project.

Engaging Article Worth Exploring: Next Stock Market Crash Prediction: Hype Or Hope

This content was originally published on Nov 12, 2016, but it has been continuously updated over the years, with the latest update conducted in Jun 2023.