Black Wall Street; The real Dirty Dancing Movie

These elections will be one of the most polarised elections in the history of the US; when people let emotions do the talking, they are easy to manipulate. Market Update July 2, 2016

The term Black Wall Street is used here to illustrate just how dirty Wall Street really is. There is nothing good about it, as it is run by the most corrupt of individuals and it helps foster greed and desperation in regular individuals. These individuals are drawn to Wall Street with the lure of striking it big; most lose their savings but like addicts, they think the next hit will lead them to salvation. Black Wall Street should also not be confused with the situation in Tulsa Oklahoma that took place in 1921. The excerpt below provides a brief overview of the student of history

June 1st, 1921 will forever be remembered

As a day of great loss and devastation. It was on this day that America experienced the deadliest race riot in the small town of Tulsa, Oklahoma. Ninety-four years later, that neighbourhood is still recognized as one of the most prosperous African American towns to date. With hundreds of successful black-owned businesses lining Greenwood Avenue, it became a standard that African Americans are still trying to rebuild. The attack that took place in 1921 tore the community apart, claiming hundreds of lives and sending the once prosperous neighbourhood up in smoke.

In the early 1900s, Tulsa, Oklahoma experienced a major oil boom, attracting thousands. Many African Americans migrated from southern states hoping to escape the harsh racial tensions while profiting off of the oil industry. Yet even in Tulsa, Oklahoma, Jim Crow laws were at large, causing the town to be vastly segregated with most African Americans settling in the northern section of the town. From that segregation grew a black entrepreneurial mecca that would affectionately be called “Black Wall Street”. The town was established in 1906 by entrepreneur O.W. Gurley, and by 1921 there were over 11,000 residents and hundreds of prosperous businesses, all owned and operated by black Tulsans and patronized by both whites and black Full Story

Back To The Tactical Investor’s Black Wall Street Story

Our stance has not changed; have you noticed how everybody is getting in on the act. Even a supreme court Judge (Ginsburg) did the unthinkable and publicly made comments that are unbecoming of a Judge. She needs to take a look in the mirror next time she decides to make such colourful statements. Regardless of whether they are true or not, the game here is to polarise the masses. Hence, be ready for several laws to be passed that would normally be unpalatable but will be easily passed because everyone is frothing over the wrong issue. Monsanto has already scored a few nice victories; the latest of which is the “Monsanto protection act”.

Expect Polarization and More Black Wall Street Action

Expect more unscrupulous companies to make gains that will ensure that their profits surge at the expense of the average Joe. Hot money fosters terrible deeds, and we are in a world that is being flooded with hot money. We would not be surprised if the groundwork is already being laid to repeal Dodd-Frank.

Regardless of who wins the presidency, the markets will continue to soar higher, though if the candidate is Trump, we could get a nice strong pullback, because of the uncertainty a Trump Presidency would create. I suppose from an investment perspective (if you are contrarian or someone that likes to use mass psychology) that a Trump win would be more favourable as it would provide you with a good chance to pick up some great names.

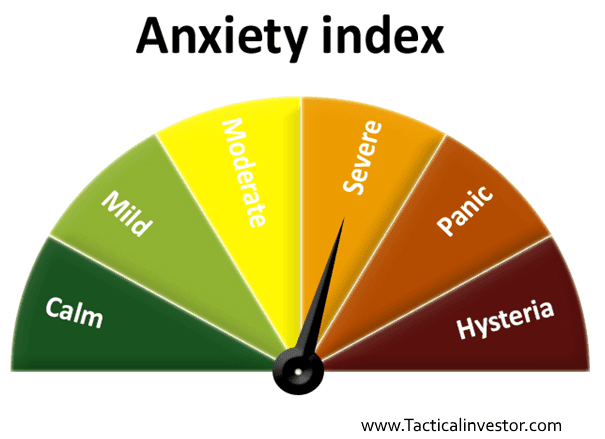

Remember these elections are just a show, nothing is going to change because the real power brokers are 100’s of times stronger than any US president will ever be; things will only change if Fiat Money comes to an end. The majority are still very anxious; the current reading illustrates that the Neutral and Bears still add up to over 65%; the current combined score is still well over 65%.

Black Wall Street is Still too Anxious

As you can see above Wall Street is still too anxious so the overall theme calls for higher prices over the next 12-18 months. However as per latest article Mass Media Turns bullish: Stock Market Correction likely, we expect the markets to let out some steam before trending higher. In the world of hot money and fraud, the only thing you need to understand is that the Fed will do whatever it takes to maintain the illusion that the economy is thriving, even though it’s not. Reality does not matter anymore; what matters is controlling the perception of the masses and in that aspect, the Fed has done a marvellous job. The masses are quite and complain silently but like good slaves, they continue to do as they are instructed; for now, resistance is futile, the markets will trend higher.

Game Plan to Deal with Black Wall Street Crooks

Learn how to invest in the markets and make sure you don’t end up depending on your corporate pension or government-controlled social security. Subscribe to our free newsletter to keep abreast of the latest developments; we cover everything from the financial markets to the World’s food supplies. Mass Psychology knows no limits, utilized properly it can spot trends in any market, and we can show how to protect yourself and benefit from these new trends.

Other Articles Of Interest

What’s making this stock Market bull So resilient? (Aug 22)

Violence Stupidity & religious intolerance will continue to soar (Aug 22)

Mass Media Turns Bullish: Stock Market Correction likely (Aug 19)

Crowd Control market Manipulation & Pensioners forced to Speculate (Aug 18)

China Following America’s lead: Exports Bad Debt Globally (Aug 13)

Crude oil bottom likely to Propel Dow Industrials higher (Aug 12)

Wall Street Journal States that Russia Bombed US-Syrian Base (Aug 9)

Why won’t this cursed Stock market bull market crash (Aug 8)

Investor Anxiety; Rocket Fuel for Unloved Stock Market Bull (Aug 6)