Unveiling the Crystal Ball: Expert Stock Market Predictions for 2018

Updated Jan 28, 2024

As we stand on the precipice of a new financial year, the echoes of history’s greatest minds offer us a lens through which to view the potential upheavals and opportunities. Much like the vast and unpredictable seas navigated by ancient mariners, the stock market presents a horizon filled with promise and peril.

The art of prediction has always been akin to gazing into a crystal ball, seeking clarity amidst the mists of uncertainty. The ancient philosopher Seneca reminds us that “Luck is what happens when preparation meets opportunity.” As we consider the stock market predictions for 2018, it is essential to arm ourselves with the discernment to sift through the cacophony of the day-to-day and identify the true signals amidst the noise.

The Debt Colossus: A Modern Leviathan

The Institute of International Finance (IIF) reported a staggering global debt of $233 trillion at the end of 2017. This figure dwarfs the combined GDP of all nations, a modern Leviathan of fiscal proportions. In the words of John Maynard Keynes, a luminary in the field of economics, “If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it becomes the bank’s problem.” The enormity of this debt suggests that it may never be fully repaid, and the only resolution would be a systemic collapse, a scenario that would make the Great Depression seem like a mere footnote in history.

The Inevitable Fall: A Question of When, Not If

The financial system’s collapse is a spectre that looms over the future, its arrival uncertain yet seemingly inevitable. It will occur when the masses lose faith in fiat currencies, a sentiment far from fruition. Drawing from the strategic insight of Sun Tzu, we understand that “Amid the chaos, there is also opportunity.” As such, every market crash should be viewed not as a cataclysm but as a chance for long-term investment opportunities.

The Long View: Market Crashes as Opportunities

The cyclical nature of markets is a testament to the wisdom of history’s great investors, such as Benjamin Graham, who taught us, “The intelligent investor is a realist who sells to optimists and buys from pessimists.” With this perspective, we can view market downturns as fertile ground for strategic acquisitions, where the seeds of future growth are sown in the soil of today’s crises.

In conclusion, as we unveil the predictions for the stock market in 2018, let us do so with a blend of historical wisdom and modern strategic thought. Looking back through the annals of time, from the astute observations of ancient philosophers to the calculated risk-taking of today’s financial giants, we can navigate the fiscal year with a compass that points beyond the immediate horizon, towards long-term prosperity.

Navigating Market Polarization: Finding Clarity Amidst Disarray

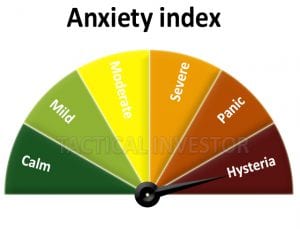

If this is a one-time development, we can ignore it, if it is a new trend, then we will pay more attention to the individuals in the neutral camp and the anxiety index.

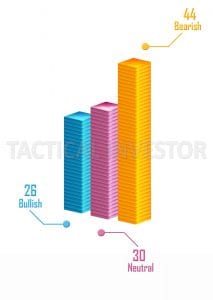

The bullish sentiment edged up slightly this week to 38%, but the neutral sentiment is still trading above its historical average; the current reading is 36%, so other than the extra volatility we stated the markets are going to experience as a result of very high V-readings, the game plan is the same. Market Update Aug 23, 2018

So while the bulls and bears are being whipped, the Neutral camp is holding steady; these readings match those of the Aug 23 update. Remember that neutrals are nothing but bears with no teeth and bulls with no B***S; in other words, they do not know which direction to run in.

One week later, The Crowd is in Panic mode.

My, my, what a big difference one week can make; first, the crowd was happy, but now it’s in panic mode, and everything we stated in advance is coming to pass.

The masses always sit on the wrong side of the fence

This excerpt sent out to our paid subscribers on the 15th of October illustrates this point quite succinctly. Don’t focus on Stock Market Predictions For Tomorrow as that is the wrong angle to focus on. Instead, focus on building a list of stocks you would love to own and use the fear factor to your advantage. Buy when the masses are in a state of panic and sell when they are happy.

Downside volume surged, but that data has lost its value over the years, especially post 2008. The most significant development this week is that bullish sentiment dropped down to 29; to put this into perspective remember that last week bullish sentiment came in at 47. This is a massive drop and well below the historical average.

Such a massive drop in sentiment indicates that no matter how sharply this market pulls back it should be viewed as a bullish development. The combined score of the bears and neutrals now stands at 71%. The anxiety index has also experienced a new sharp swing, indicating that the crowd is now in a precarious state; no bull market has ever ended on a sour note, and we do not think this will be the start of a new trend.

Dow Utilities Painting Bullish Picture?

The picture emerging from the Dow utilities is very bullish, almost ensuring that the Dow will be trading close at or above 27K within six months or less. Now you can worry and join the experts who are predicting an end to this bull and, in doing so, follow the same pattern of leaping before looking. Keep a journal for this trading journal will prove to be far more valuable than any other lesson you will ever learn when it comes to the market.

We have been through these shakeouts before, the weak hands always fold and then when the markets bottom out they scream with anger promising never to repeat the same mistake but end up doing precisely the same thing they did before.

No market trends up in a straight line, and it is very healthy (especially for such a mature bull market) to let out a healthy dose of steam. In Feb, the Dow shed over 3k points from high to low, but after all the noise, the markets bottomed out, the bears got hammered, the neutrals waited and only the astute investors who did not let their emotions do the talking benefited. Stock market crashes are buying opportunities as long as the primary trend is up and the primary trend is up. Market Update Oct 15, 2018

Key Stock Market Predictions for 2018: Conclusion

As we stand at the crossroads of another financial year, the clamour of market predictions rings loud, often inciting a chorus of concern. Yet, in the words of the ancient Chinese strategist Sun Tzu, “Amid the chaos, there is also opportunity.” The current atmosphere, thick with the pensiveness of so-called experts urging panic, calls for a moment of reflection, a deep breath to centre oneself amidst the storm.

In their perpetual ebb and flow, the markets offer a dance of numbers that can bewilder even the most seasoned of investors. Yet, as the legendary investor Warren Buffett counsels, “Be fearful when others are greedy, and greedy when others are fearful.” The contrarian approach, grounded in the principles of mass psychology, suggests a celebration in times of panic and caution when others are complacently content.

The Cycle of Market Sentiments

Have the markets not weathered storms before, emerging stronger and more resilient? Reflect upon your past reactions to market downturns. Is history not repeating itself in your responses? The great philosopher Aristotle once said, “We are what we repeatedly do. Excellence, then, is not an act but a habit.” If seeking quality stocks at lower prices was your past intent, why should the script change amidst current fluctuations?

As we conclude our contemplation of the stock market for 2018, let us not be swayed by the prophets of doom who perennially predict the world’s end. Instead, let us heed the advice of the wise investor Benjamin Graham, who saw in every crisis not a portent of doom but an opportunity ripe for the savvy investor. The essence of our prediction is simple: follow the trend, ignore the noise, and remember that in the orchestra of the financial markets, it is the calm and collected investor who often writes the symphony of success.

Lost in Reflection: Stimulating Perspectives

Market Psychology and Crowd Dynamics: Adapt, Adjust or Vanish

Five-Year Freedom Blueprint: Empower Your Journey to Liberty

Digital Puppeteers: Unveiling How Social Media Manipulates Your Mind

The Myth Debunked: Can You Really Lose Cash with Covered Calls?

Financial Freedom Awaits And Exploring Top Personal Loans for Debt Consolidation

Empowerment: Unleash Your Potential: A Bold Guide to Achieving Financial Freedom

Warren Buffett Investment Tips for Beginners: Unveiled

Unraveling Market Psychology: Impact on Trading Decisions

Cultivating Cryptocurrency Acumen: Investing for Dummies with Style

Finessing the Secrets to Financial Freedom: The Art of Elegant Wealth

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Breaking Free: How Avoiding Debt Can Lead to Financial Freedom and Hope

The Allure of Uncertainty: Decoding the Fed Pivot Meaning in Today’s Economy

Simplicity: Tax Lien Investing for Dummies: Simplified Success in Property Stakes

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

The Ideal time to Buy Stocks is when the Masses are Panicking.