Stock Market Tips For Beginners: Best Time To Buy

Updated Feb 28, 2024

Pursuing the perfect setup in the financial markets, where fortunes are won and lost in moments is akin to the quest for the Holy Grail. As Julius Caesar once proclaimed, “Veni, Vidi, Vici” (I came, I saw, I conquered), the astute investor must approach these rare alignments with the same boldness, unfazed by the ominous portraits painted by pundits and the media.

The Dow’s Dance with Destiny

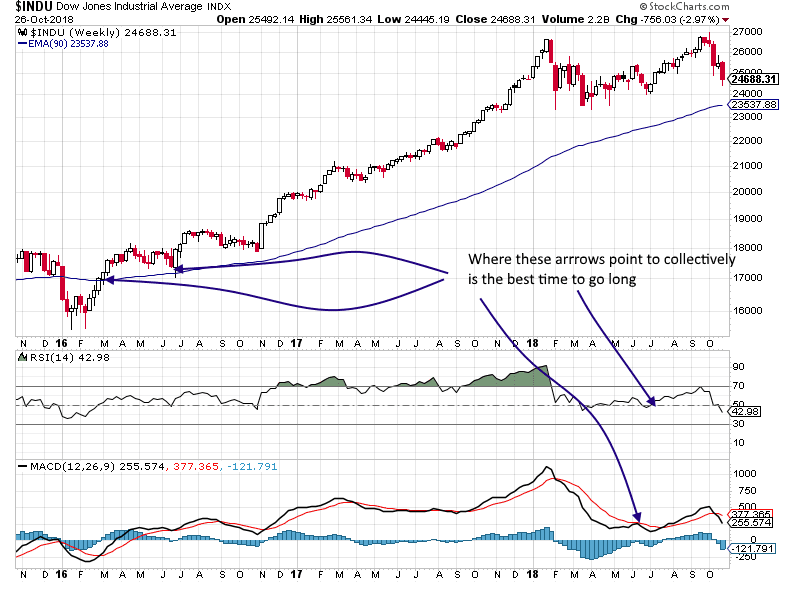

Updated to reflect the latest market dynamics, the Dow Jones Industrial Average is a barometer for the discerning investor. Observing its interactions with the 90-day Simple Moving Average (SMA) remains valuable. The golden moments typically arise when the Dow is in proximity to, or just beneath, this moving average, especially when indicators like the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) signal extreme undervaluation. These conditions, though rare, are the crucible within which market victories are forged.

The Medici family, who shaped the destiny of finance in the Renaissance, knew that to achieve enduring wealth, one must first invest in knowledge. They would likely advise that a positive trend, amidst the backdrop of a nervous populace, is an investor’s canvas. Such was the case during the tumultuous periods of 2008-2009, November 2015, early 2016, and the Covid-induced crash.

The Law of Market Cycles

John Law, the controversial financier who understood the cyclical nature of markets, might suggest that while the perfect entry point is a rarity, a vigilant investor will find rich opportunities even in less-than-perfect conditions. This insight is validated by historical finds such as VIPS, EDUC, and CRON, which yielded returns of up to 110% when seized at opportune moments.

The Rothschild Maxim: Timing and Information

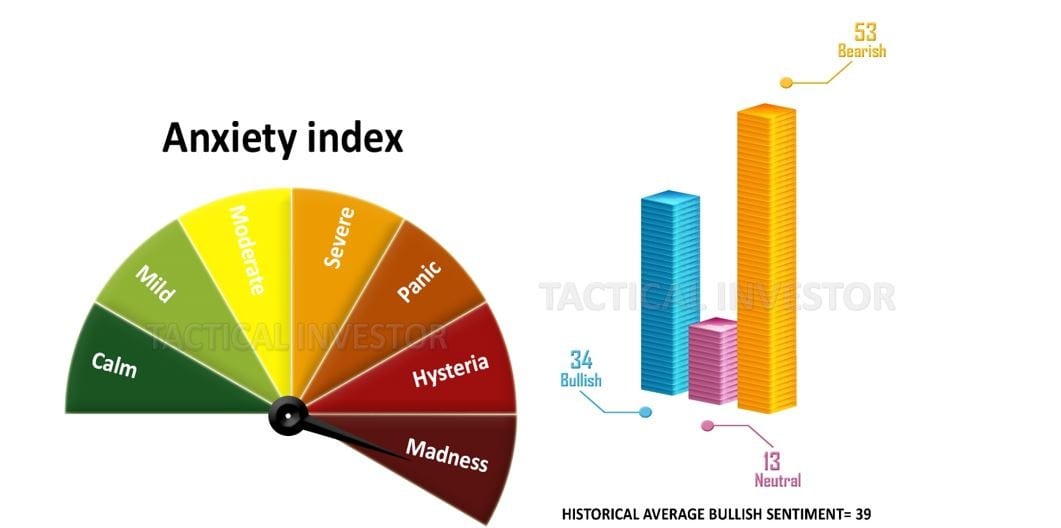

Nathan Rothschild, synonymous with wealth and market acumen, lived by the creed that information and timing are the twin pillars of market success. He believed that understanding the pulse of the masses could unlock great fortunes. Thus, knowing when to act—when the market’s heartbeat quickens with fear or slows with complacency—can differentiate between a missed chance and a legendary victory.

In conclusion, as we venture forth in the quest for market triumphs, let us take a page from the playbooks of history’s financial titans. From Caesar’s audacity to the Medici’s wisdom, from Law’s insights into market cycles to Rothschild’s mastery of timing, these lessons form a mosaic of strategic prowess. Embrace the perfect setup with courage, and remember that the potential for greatness lies in every market’s ebb and flow.

Investing with the Sages: Wisdom for the Market Novice

The sages of investment have long preached the gospel of simplicity and discipline. Benjamin Franklin, a polymath and a cunning investor of his era, understood that “An investment in knowledge pays the best interest.” It is about choosing the right stock and being patient when the market’s fear becomes your opportunity. When stocks plummet, the pattern of panic often presents the most significant opportunities, especially among renowned companies.

The Stoic philosopher Epictetus taught, “It’s not what happens to you, but how you react to it that matters.” As markets tumble and experts prophesy doom, the wise investor does not follow the masses towards the proverbial cliff but instead consults a pre-prepared list of coveted stocks, ready to seize the moment. As the old wisdom goes, the early bird catches the worm, but the wise bird has already mapped out the field.

Financial Fortitude: The Art of Opportunistic Acquisition

In the theatre of modern economies, where central banks play the role of both playwright and actor, the concept of “helicopter money” is taking centre stage. As the Federal Reserve extends its patronage beyond traditional measures, embracing ETFs and potentially more, the scene is set for a demonstration of Mass Psychology in full force. With his invisible hand, Adam Smith might argue that the market forces are being nudged by an all-too-visible hand of policy.

Manufactured Consensus: Navigating the Narrative

The power of narrative in shaping public perception is not lost on the student of history. Niccolò Machiavelli, whose name is synonymous with cunning political strategy, would likely nod in approval at the chess moves of central banks moulding market sentiment. This is a world where, as David Ricardo, the British political economist, would suggest, the sheer scale of monetary intervention overshadows the principles of comparative advantage.

Long before the current crises, we posited that the United States might run a deficit reaching the unfathomable sum of $100 trillion before the public would stir from their slumber—an estimate that now appears conservative. As the pandemic has accelerated the gears of fiscal machinery, the government may indeed roll out colossal stimulus measures and infrastructure programs, as John Maynard Keynes, the father of macroeconomics, might have advocated, to rescue both the economy and the ordinary citizen from financial peril.

In weaving together the threads of wisdom from the most intelligent investors and philosophers across the ages, the novice investor is reminded that the tumultuous world of the stock market is not merely a game of numbers, but a tapestry of human behavior, policy, and foresight. It is within this complex milieu that the seeds of opportunity are sown, waiting for the patient and prepared investor to harvest.

Stock Market Tips For Beginners Tip 3: Buy The Fear

The crowd is panicking, but insiders are loading up on stocks. Who should you listen to? You should not be in the stock market if you don’t know the answer.

The Vickers’ benchmark NYSE/ASE One-Week Sell/Buy Ratio currently stands at 0.33, while the Total one-week reading is at 0.35. These readings indicate a notable trend of insiders not only buying shares but doing so effectively. Similar behaviour by insiders was observed in late December 2018, following the stock market crash on Christmas Eve, during early 2016 when stocks experienced a correction, and in late 2008/early 2009. https://yhoo.it/2TV0cE2

Other Stories of Interest

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Digital Puppeteers: Unveiling How Social Media Manipulates Your Mind