Updated Nov 12 2023

When will the stock market bottom, and how should we plan for it?

In the world of investing, understanding the behaviour of the masses is crucial for making well-informed decisions. While determining the exact market bottom can be elusive, paying attention to the emotions and actions of investors provides valuable insights into market sentiment.

Buying Opportunities Amidst Panic

When panic and fear grip the masses, it often signals a potential market reversal. Historical trends show that the masses tend to be on the wrong side of the market in the long run. This presents a favourable opportunity for contrarian investors willing to go against the herd mentality. By stepping in and buying during periods of widespread selling, they can take advantage of oversold conditions and potentially profit from the subsequent market recovery.

Conversely, exercising caution and patience becomes crucial when the masses are not panicking and fearing. Deploying large sums of money into the market during periods of uncertainty carries higher risks. Waiting for clearer market direction and favourable entry points can help mitigate risk and avoid potential losses.

Panic as a Market Reversal Signal

Furthermore, euphoria among the masses should serve as a warning sign for investors. Excessive optimism often leads to an overvaluation of assets and an unsustainable market rally. In such situations, considering a shift to cash or exploring short-selling strategies can provide protection against potential market downturns.

Focusing solely on identifying the market bottom may not provide a complete picture of the market direction. Various factors influence the market, and investor sentiment plays a significant role. By understanding and observing the behaviour of the masses, investors gain insights into market sentiment and can make more informed investment decisions.

It is important to note that understanding mass behaviour is not a foolproof strategy. Successful investing requires a combination of market psychology, technical analysis, and a deep understanding of the underlying factors driving the market.

In summary, by shifting the focus from solely determining the market bottom to understanding and considering the behaviour of the masses, investors can navigate the complexities of the investment landscape more effectively. Observing investors’ emotions, actions, and sentiments provides valuable clues about potential market reversals, buying opportunities, and the need for caution. While no strategy guarantees success, incorporating the behaviour of the masses into investment decision-making increases the likelihood of making profitable decisions.

Getting into the Meat of Buying at the Bottom

Buying at the market bottom is a desirable objective for investors, but precisely timing it is challenging.

The Elusive Nature of Market Timing

Timing the market bottom precisely is challenging, even for experienced investors and financial experts. The market’s complexity, influenced by many factors, makes it a dynamic and ever-changing environment.

Market timing, especially trying to identify the exact bottom or peak of the market, is widely regarded as challenging. The complexity and volatility of financial markets, influenced by many factors such as economic indicators, geopolitical events, investor sentiment, and unexpected news, make it difficult to consistently and accurately predict short-term market movements.

Here are a few reasons why market timing is elusive:

1. Unpredictability: Financial markets are complex systems with countless participants, each driven by their motives, strategies, and information. The interactions between these participants create a highly dynamic and unpredictable environment. Market movements are influenced by many variables, many of which are difficult to anticipate or quantify accurately.

2. Efficient Market Hypothesis: The efficient market hypothesis suggests that financial markets quickly and accurately incorporate all relevant information into asset prices. In other words, it assumes that market prices reflect all market participants’ collective knowledge and expectations. If markets are efficient, consistently outperforming the market through market timing would be challenging, as prices would already reflect available information.

3. Emotional Bias: Investor psychology and emotions play a significant role in market movements. Fear, greed, and herd behaviour can lead to exaggerated price movements and create market inefficiencies. However, accurately predicting when these emotions will drive market movements is extremely difficult, as they can be influenced by various factors and can change rapidly.

4. Transaction Costs and Taxes: Attempting to time the market involves frequent buying and selling of assets, leading to increased transaction costs (such as brokerage fees) and potential tax implications. These costs can erode the returns from successful market timing strategies and make them less profitable.

Instead of trying to time the market, focus on the long-term, disciplined approach to investing. This typically involves developing a well-diversified portfolio, focusing on asset allocation, regularly contributing to investments, and staying invested for the long term. By taking a more strategic and patient approach, investors can benefit from the market’s long-term growth while mitigating the risks associated with short-term market timing.

Analyzing Market Indicators

Investors often rely on market indicators and analysis to increase their chances of buying at the bottom. Moving averages, trend lines, and volume patterns are technical indicators that can give insights into market behaviour and possible turning moments. Fundamental analysis, including evaluating economic data and company fundamentals, also plays a role in assessing market conditions.

Here are a few commonly used methods:

1. Moving Averages: Moving averages are calculated by averaging the closing prices of a security or index over a specific period. They help smooth out short-term price fluctuations and provide a trend-following indicator. Traders often look for “crossovers” between different moving averages, such as the 50-day and 200-day moving averages, to identify potential shifts in market sentiment.

2. Trend Lines: Trend lines are drawn on price charts to identify and analyze the direction and strength of a market trend. An uptrend is formed by connecting a series of higher lows, while a downtrend is formed by combining lower highs. Breakouts above or below trend lines can signal potential trend reversals or continuations.

3. Volume Patterns: Volume analysis examines the trading volume accompanying price movements. An increase in volume during price advances or declines may indicate the presence of buying or selling pressure. Analyzing volume patterns can help confirm the strength of a price move and identify potential turning points.

4. Fundamental Analysis: Fundamental analysis involves evaluating economic data, financial statements, and other factors that affect the intrinsic value of an investment. It helps investors assess the health and growth potential of companies, industries, or economies. Fundamental indicators, such as earnings reports, economic indicators (e.g., GDP, inflation rates), and interest rates, can provide valuable insights into market conditions and potential turning points.

5. Sentiment Indicators: Sentiment indicators gauge market participants’ overall mood and sentiment. These indicators can include surveys, market breadth measures, put-call ratios, or the Volatility Index (VIX). Extreme bullishness or bearishness can suggest market tops or bottoms, respectively, as sentiment tends to revert to the mean over time.

Contrarian Investing and Market Bottoms

Contrarian investing is a strategy those seeking to capitalize on market bottoms embrace. By buying when the masses sell, contrarian investors aim to take advantage of undervalued assets and potential future market recoveries.

Contrarians believe that market sentiment tends to swing to extremes, and they seek opportunities to go against the prevailing sentiment.

During market bottoms, when fear and pessimism are rampant, most investors may be selling their assets, leading to a price decline. Contrarian investors see this as an opportunity to buy undervalued assets that may have significant upside potential in the future. By going against the herd and buying when others are selling, contrarians aim to take advantage of the potential for future market recoveries.

Contrarian investing is based on the belief that markets often overreact to short-term news or events, causing prices to deviate from their intrinsic value. Contrarians conduct thorough research and analysis to identify assets that they believe are undervalued or oversold due to market sentiment. They look for signs of excessive pessimism, such as extreme negative sentiment indicators or high market fear levels.

Contrarians understand that timing market bottoms precisely is challenging and that markets can remain volatile even after reaching a bottom. Therefore, they often take a long-term perspective and are willing to hold their investments for an extended period. They aim to buy assets at a discount to their intrinsic value and wait for the market to recognize and reflect their true worth over time.

Contrarian investing can be a successful strategy with discipline and a long-term perspective. By buying when the masses sell during market bottoms, contrarian investors aim to identify undervalued opportunities and position themselves for potential future market recoveries.

Dollar-Cost Averaging

Another approach to buying at the bottom is through dollar-cost averaging. By spreading investments over time, investors can reduce the impact of short-term market fluctuations and potentially benefit from buying at lower prices during market downturns.

With dollar-cost averaging, an investor invests a fixed amount of money at regular intervals, regardless of the asset’s price. For example, instead of investing a lump sum all at once, an investor may invest a fixed amount every month or quarter.

During market downturns, when prices are lower, the fixed investment amount can purchase more shares or units of the asset. Over time, this can lead to a lower average cost per share or unit. By consistently investing over a more extended period, dollar-cost averaging reduces the risk of making a large investment at a market peak and potentially experiencing significant losses.

Additionally, dollar-cost averaging helps instil discipline in investors by removing the pressure to time the market perfectly. Instead of trying to predict market bottoms or tops, investors focus on the long-term accumulation of assets and take advantage of the potential benefits of compounding returns.

Dollar-cost averaging is often considered a prudent strategy for long-term investors who prefer a systematic and disciplined approach to investing. By spreading investments over time, investors can potentially reduce the impact of short-term market fluctuations, take advantage of lower prices during market downturns, and benefit from the long-term growth of their investments.

Long-Term Investment Horizon

Investing at the market bottom requires a long-term perspective. By maintaining a disciplined approach and staying focused on their investment horizon, investors can ride out market fluctuations and potentially benefit from buying at favourable prices.

Complexities Of Market Timing

Navigating the complexities of market timing and buying at the bottom can be daunting. Buying at the market bottom is a desirable objective for investors, but precisely timing it is challenging. By incorporating a combination of market indicators, contrarian strategies, dollar-cost averaging, and a long-term investment horizon, investors can increase their chances of making prudent investment decisions.

Remember, successful investing is not solely about buying at the market bottom but rather adopting a comprehensive approach that considers various factors, including market behaviour, risk tolerance, and long-term goals.

Mass Psychology Take on Getting in at the Bottom

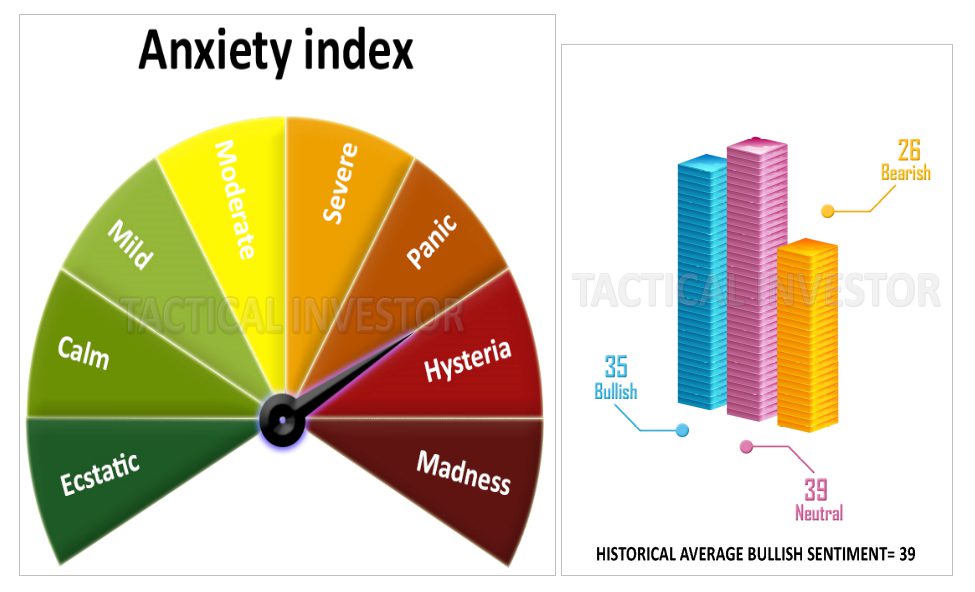

In this market analysis, a stock market bottom is a crucial factor in determining the future trend of the market. It is suggested that a long-term stock market bottom will not be in place until one of the three sentiment measures experiences a sharp move and the market reaches the hysteria zone. Despite a robust market rally, the failure of bullish sentiment to meet its historical average is surprising, leading to two plausible explanations.

One explanation is that investors remain shell-shocked and fearful, indicating a possible stock market bottom. The other explanation is that traders are awaiting better prices, but the issue is that the expected prices have already been reached. The article also discusses the possibility of achieving FOAB or MOAB, depending on the fulfilment of certain criteria. Understanding the stock market bottom is critical for making an informed investment decision.

It takes a significant shift in one of three sentiment measures to propel the gauge into the hysteria zone, such as a sharp drop in bullish readings to the 10-12 range or a surge in neutral readings to 55. This observation was made in the latest market update issued on January 30th, 2023. Without such a shift, it is improbable that a long-term stock market bottom will be established.

Despite a strong market rally since October 2022, it is rather surprising that bullish sentiment has not yet reached its historical average, remaining below 39 persistently. By now, one would have expected it to at least be in the 45 range. Two possible explanations come to mind. Firstly, the crowd may be shell-shocked and stay in this zone for years, as suggested by subscriber data indicating fear and worry levels comparable to those seen in October 2008.

Sentiment and Stock Market Bottoms: Anxiety as a Signal

As past experiences suggest, high anxiety levels are usually associated with a stock market bottom. The fear and uncertainty levels among subscribers are now almost on par with those readings of October 2008. What happened next, you might ask? There was one final downward spike, and the markets bottomed out, but investors remained shell-shocked for almost ten years.

Should the fear level among T.I. subscribers reach an all-time high, it will be added to the criteria for FOAB (Father of All Buys). Additionally, we have three more conditions to fulfil, and if these are met, we will achieve the highly elusive FOAB. In such a scenario, almost everyone at T.I. would invest everything we have and more (via leverage) into the Market. However, we strongly advise against using leverage/margin unless you are willing and able to take on additional risk. Two criteria are dangerously close to being met; should they indeed materialize, it will trigger a MOAB (Mother of All Buys) by default.

The second possible explanation for the failure of bullish sentiment to reach its historical average is that traders are waiting for better prices. The problem is that the prices they hoped for have already been reached. If the Market pulls back again, it remains uncertain whether traders will jump in or continue to wait, assuming that even better prices will follow.

FAQ on When will the Stock Market Bottom?

Q: When will the stock market bottom, and how should we plan for it?

A: Timing the exact market bottom is challenging, but understanding investor behaviour and market sentiment can provide valuable insights. Buying opportunities often arise when panic and fear grip the masses, signalling a potential market reversal. Contrarian investors can exploit oversold conditions and buy when others are selling. On the other hand, exercising caution and patience is crucial when the masses are not panicking. Waiting for clearer market direction and favourable entry points can help mitigate risk. The euphoria among the masses serves as a warning sign, indicating an overvaluation of assets and an unsustainable market rally. It is important to shift the focus from solely determining the market bottom to understanding and considering the behaviour of the masses.

Q: How can market indicators help in buying at the market bottom?

A: Market indicators and analysis can provide insights into market behaviour and potential turning points. Technical indicators like moving averages, trend lines, and volume patterns help assess market conditions. Fundamental analysis, including evaluating economic data and company fundamentals, also plays a role in analyzing market indicators. While market indicators can increase the chances of buying at the bottom, it is important to note that they are not foolproof and should be used in conjunction with other strategies.

Q: What is contrarian investing, and how does it relate to market bottoms?

A: Contrarian investing is a strategy embraced by investors seeking to capitalize on market bottoms. Contrarians go against the prevailing market sentiment and actively seek opportunities when others are fearful or pessimistic. By buying when the masses sell, contrarian investors aim to take advantage of undervalued assets and potential future market recoveries. This strategy requires careful analysis and understanding of market psychology to identify favourable buying opportunities.

Q: What is dollar-cost averaging, and how does it relate to buying at the market bottom?

A: Dollar-cost averaging is an investment approach that involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of short-term market fluctuations. During market downturns, investors can benefit from buying at lower prices, effectively lowering their average cost per share over time. While dollar-cost averaging does not guarantee to buy at the market bottom, it can be a disciplined approach to long-term investing.

Q: Why is a long-term investment horizon important when buying at the market bottom?

A: Buying at the market bottom requires a long-term perspective. Markets go through cycles of ups and downs, and short-term volatility should not deter investors from pursuing their long-term investment goals. By maintaining a disciplined approach and staying focused on their investment horizon, investors can ride out market fluctuations and potentially benefit from buying at favourable prices. Patience and a long-term view can help capture the potential returns from investing at the market bottom.

Q: Should I seek professional guidance to time the market bottom?

A: Navigating the complexities of market timing and buying at the market bottom can be challenging. Many investors seek the guidance of professional financial advisors who have expertise and knowledge in analyzing market trends. Professional guidance can provide valuable insights, help assess risk tolerance, and assist in making informed investment decisions. However, it’s important to remember that even with professional guidance, timing the market bottom remains challenging, and no strategy guarantees success.

Q: Is buying at the market bottom the only factor to consider in investing?

A: Buying at the market bottom is a desirable objective for investors, but it should not be the sole focus. Successful investing requires a comprehensive approach considering various factors, including market behaviour, risk tolerance, and long-term goals. Combining market indicators, contrarian strategies, dollar-cost averaging, and maintaining a long-term investment horizon can increase the chances of making prudent investment decisions. It’s important to note that buying at the market bottom is just one aspect of a successful investment strategy. Other factors such as diversification, asset allocation, and staying informed about economic and industry trends also play crucial roles in achieving long-term financial objectives.

Q: What is the role of mass psychology in understanding the market bottom?

A: Mass psychology, or the behaviour of the masses, provides valuable insights into market sentiment and can help understand the market bottom. When panic and fear grip the masses, it often indicates a potential market reversal. Conversely, excessive optimism and euphoria among the masses can signal an overvaluation of assets and an unsustainable market rally. Observing investors’ emotions, actions, and sentiments can gain valuable clues about potential market reversals and make more informed investment decisions.

Q: Can understanding mass behaviour guarantee successful investing?

A: While understanding mass behaviour is an important aspect of investing, it does not guarantee success. Successful investing requires a combination of factors, including market psychology, technical analysis, and a deep understanding of the underlying factors driving the market. It is essential to conduct thorough research, stay informed about market trends, and seek professional advice when needed. By incorporating various strategies and considering multiple factors, investors can navigate the investment landscape more confidently and potentially increase their chances of making profitable decisions.

Q: How can investors navigate market complexities using mass behaviour insights?

A: By understanding and considering the behaviour of the masses, investors can gain insights into market sentiment and navigate market complexities more effectively. Observing whether panic, caution, or euphoria prevails among the crowd can provide valuable clues about potential market reversals, buying opportunities, and the need for caution. However, it is important to supplement these insights with thorough analysis, risk management strategies, and a long-term perspective. The goal is to make informed investment decisions that align with individual financial goals and risk tolerance.

Q: Is market timing the most critical aspect of successful investing?

A: Market timing, including identifying the market bottom, is challenging and should not be considered the most critical aspect of successful investing. Timing the market perfectly is difficult, if not impossible, even for experienced investors and financial experts. Instead, a prudent investment approach focuses on long-term goals, diversification, and a disciplined strategy considering various factors. Building a well-balanced portfolio, staying informed, and following a consistent investment plan is often more important than trying to time the market bottom.

Q: What risks are associated with trying to time the market bottom?

A: Attempting to time the market bottom carries several risks. First, accurately predicting market movements is challenging; even experienced investors can make incorrect predictions. Second, market timing often increases trading activity, transaction costs and potential tax implications. Third, emotions can cloud judgment and lead to impulsive decisions. Lastly, focusing solely on timing the market can distract investors from developing a disciplined investment approach and considering long-term goals. It is important to assess one’s risk tolerance, diversify investments, and maintain a long-term perspective to mitigate these risks.

Q: How can investors incorporate the concept of market bottoms into their investment strategy?

A: Investors can incorporate the concept of market bottoms by understanding and observing mass behaviour, considering market indicators, and adopting a long-term investment horizon. By paying attention to market sentiment, investor emotions, and the actions of the masses, investors can gain insights into potential market reversals and buying opportunities. Additionally, analyzing market indicators and technical analysis can provide further guidance. However, it is crucial to remember that market bottoms are not guaranteed, and a comprehensive investment strategy that considers various factors is essential for long-term success.