From time to time we create videos for our viewers. We have created many videos over the years, as it would be impossible to post the whole list here we are going to provide a small sample of the most pertinent videos. The videos posted below should prove to be helpful to the novice investor. If you watch these videos and read all the suggested material, it is just a matter of time before your trading skills improve. The two most important factors in investing are patience and discipline.

Investment video 1 on how to sell puts

Investment video 2 on how to view disasters as opportunities

Investment video 3. How to focus on the Trend

Random thoughts on Investing

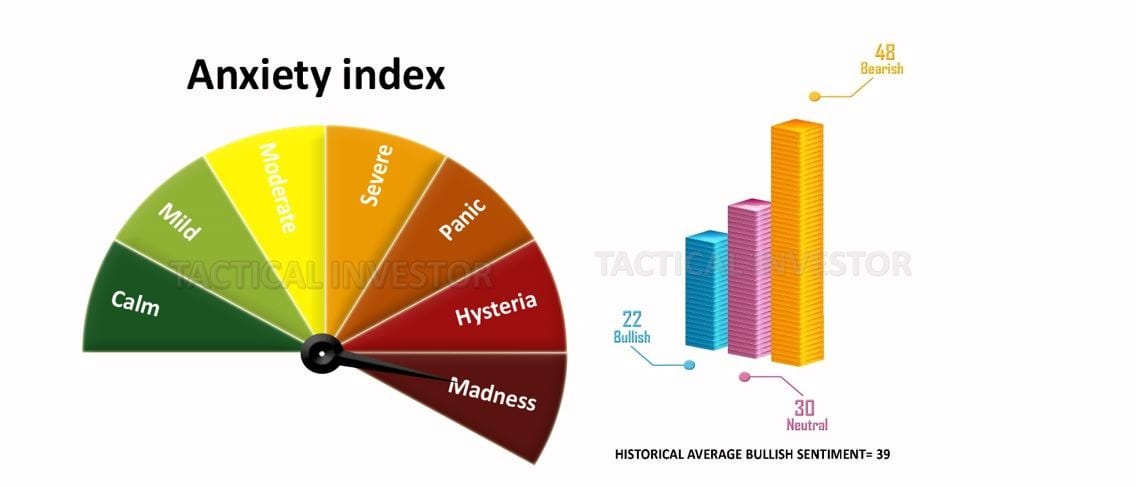

How can anyone explain the above Sentiment Chart using old school logic? You can’t. As we stated in the last update only in the twilight zone, does a negative sentiment surge while the markets are trending higher. Market Update July 31, 2020

What is even more remarkable, and would fall under the category of “unimaginable” only a few months ago is that the bullish sentiment is trading below its historical average. Consider this for a moment, the Nasdaq is trading at new highs, the Dow has recouped most of its losses and will take out its old highs sooner or later and yet the bullish sentiment is at levels one would associate with a severe correction. It’s time to keep notes, for this is the only way one will be in a position to understand what is yet to come. The “market of disorder” is going to drive everyone insane; by everyone, we refer to those that refuse to accept that the old way of doing things (90% of players) is dead. We are warning all our subscribers early on in the cycle, the cycle of insanity has just begun, so be prepared for things you would have once deemed unimaginable to come to pass.

Bullish sentiment is low because the Masses Think they know better

However, the Fed knows better, and there’s only one reason for this; they control the strings to the purse, and anyone that has that kind of power can alter and redefine reality. Regardless of all the rubbish, the experts might claim as to the Fed overplaying its hand, and that the Fed is running out of power; take those statements with a barrel of salt and jar of whiskey. For at best, they are worthless and at worst a member of ward 12 could come up with a better projection. Remember this statement. Oppose the Fed and wind up dead; in this instance, dead refers to dead broke.

Until the world is ready to give up on fiat and our analysis reveals that at best only 3 to 6 per cent of the populace is willing to do this, fiat is here to stay regardless of the misery it inflicts on humanity. Hence the TI saying, misery loves company and stupidity simply demands it.

Suggested reading material

Tactical Investor Stock & Option Selection Process

Important Info To Read Before Getting into Options

How to Purchase Options on Stocks we have not issued any plays on

Deeper Insights: Reading Material that provides better insights into the Mass Mindset