Update July 5, 2024

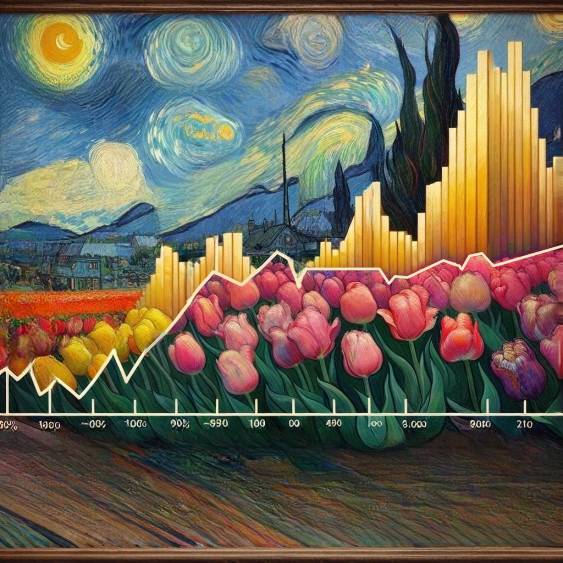

Tulip Mania Unveiled: Decoding the Tulip Bubble Chart Phenomenon

The Tulip Bubble Chart encapsulates a financial frenzy and the psychological contagion that can grip an entire population. It is a testament to the first major recorded speculative bubble in history. The chart’s steep ascent and precipitous fall trace the outlines of a phenomenon where the enthusiasm of speculation overtook rationality. The Dutch Tulip Mania, which peaked in the winter of 1636-37, saw the value of tulip bulbs rise to extraordinary levels, only to collapse dramatically in weeks.

This essay draws upon the insights of Charles Mackay, author of “Extraordinary Popular Delusions and the Madness of Crowds,” who vividly described the tulip mania as a classic example of the madness that can infect the minds of otherwise rational individuals when caught in the throes of a market bubble. In addition, we look to the work of economist Hyman Minsky, who outlined the stages of a financial bubble: displacement, boom, euphoria, profit-taking, and panic. The Tulip Bubble Chart visually represents these stages, from the initial boom fueled by widespread participation to the inevitable panic that led to a crash.

Didier Sornette’s research, which specializes in financial bubbles and crash dynamics, provides further insights. Sornette’s work on the log-periodic power law singularity, which suggests that a system’s super-exponential growth is unsustainable and indicative of a bubble, helps to decode the Tulip Bubble Chart. When analyzed through Sornette’s framework, the chart’s trajectory hints at the mathematical certainty of the tulip market’s collapse.

Real-life historical examples echo the patterns observed in the Tulip Bubble Chart. For instance, the South Sea Bubble of 1720 in England followed a similar arc, as did the recent Dot-com Bubble of the late 1990s and early 2000s. These events showcased the cycle of displacement, boom, euphoria, and eventual panic, underscoring the recurring nature of speculative bubbles throughout history. The Tulip Bubble Chart thus serves as a graphical chronicle of human behaviour in the financial markets. This pattern repeats itself in various forms despite the passage of centuries.

Seeds of Speculation: The Genesis of a Mania

At its peak, a single tulip bulb could sell for more than the cost of a luxurious Amsterdam house, illustrating the extreme heights of speculative fervour.

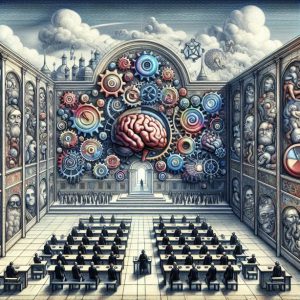

To understand the mechanics of this bubble, we turn to the insights of renowned behavioural economist Daniel Kahneman. Kahneman’s research into heuristics and biases illuminates how overconfidence, herd behaviour, and loss aversion fueled the Tulip Mania. Investors, seduced by the allure of quick profits, disregarded rational valuation methods. Kahneman’s work helps us comprehend how the Tulip Bubble Chart reflects prices and investors’ collective euphoria and ensuing panic.

Anthony Giddens’ theory of structuration may shed light on how social structures and individual actions interplay in creating economic phenomena like Tulip Mania. Giddens emphasizes the duality of structure, where human agency and social structure are not separate entities but one dynamic, iterative process. This perspective helps us understand how individual decisions and societal norms can collectively spiral into speculative bubbles.

Niccolò Machiavelli offers a more strategic lens, focusing on the cunning aspects of human nature. His insights into political manoeuvring can be paralleled with market speculation, where foresight and strategy play crucial roles. Machiavelli’s advice might suggest that understanding the intentions and strategies of other market participants is critical to navigating and potentially profiting in speculative markets.

The Tulip Mania is a vivid tableau of speculative excess and a lesson in the cyclical nature of markets and human behaviour. As we analyze this historical event through the lenses of Kahneman’s behavioural economics, Giddens’ structuration theory, and Machiavelli’s strategic advisements, we gain a multidimensional understanding of how speculative bubbles form and burst.

Blooming Optimism: The Ascent of the Chart

The Tulip Bubble chart is a classic depiction of speculative mania and its eventual unravelling. As the chart’s ascent began, the tulip, a simple flower, was transformed in the 17th century into a coveted luxury item and a status symbol. The early adopters who recognized the potential of tulips as an investment were revered for their seemingly astute financial acumen. They had become wealthy as the market price of tulips skyrocketed, and their success stories fueled a blooming optimism that drew more participants into the market.

This euphoric phase, captured by the rising curve of the Tulip Bubble chart, was characterized by a widespread belief that the price of tulips would only continue to ascend. Historical accounts suggest that at the peak of the tulip mania in the Netherlands, some bulbs were being traded for the price of a house. The chart’s upward trajectory signifies the increasing asset values and the burgeoning optimism that gripped society.

Robert Shiller’s concept of ‘irrational exuberance’, coined in the dot-com bubble, is a potent explanation for this phenomenon. Shiller posited that the media and cultural endorsements play a significant role in fueling the fire of speculative bubbles. This can be seen in how tales of ordinary people earning fortunes overnight from tulip sales were sensationalized. A similar pattern could be observed in the dot-com bubble, where the media’s glorifying internet companies led to a massive influx of investment into an overvalued sector.

Mass psychology was indeed at the heart of the Tulip Bubble. It represents the collective belief in the infallibility of tulip investments, which seemed to defy conventional economic principles. The entire society was caught up in the enthusiasm, from skilled artisans to wealthy merchants, hoping to strike it rich with tulips. This psychological undercurrent is a crucial component in understanding the Tulip Bubble chart, as it illustrates a shared mindset among the masses that prices could only go up—until they didn’t.

The Tulip Bubble chart reflects not only a financial but also an emotional journey. As Shiller’s framework suggests, these speculative episodes are narratives of human emotions mapped onto market data. It serves as a historical warning for modern markets, highlighting the danger when speculative fervour overrides rational investment behaviour.

Though fictional, a hypothetical scenario to illustrate this point could involve a modern-day equivalent such as cryptocurrency. Imagine a cryptocurrency named ‘Floracoin’ suddenly becoming a cultural phenomenon, much like the tulip once did. The Floracoin chart skyrockets as media outlets and social influencers tout its potential. This prompts a collective belief that investing in Floracoin is a surefire path to wealth, mirroring the irrational exuberance once seen in the Tulip Bubble. While the details differ, the underlying psychology and market behaviour remain strikingly similar, offering a cautionary tale that transcends time.

The Fragrance of Fear: Signs of Wilt

The third authority to guide us through the descent of the Tulip Bubble Chart is renowned technical analyst John Murphy. Murphy’s expertise lies in identifying patterns within charts that signal shifts in market sentiment. As tulip prices began to falter, technical indicators such as moving averages and trading volumes would have shown early warning signs of a reversal. Murphy’s approach to technical analysis allows us to dissect the chart and understand the transition from greed to fear.

Contrarian investors, who swim against prevailing market sentiment, see such moments as opportune. They interpret the collective fear and the subsequent price drop as a signal to invest, anticipating a recovery once the panic subsides. This stage of the Tulip Bubble Chart reflects the contrarian philosophy: where others see disaster, they discern potential.

As the bubble burst, the high prices of tulips could no longer be justified, leading to a rapid and ruinous decline. Fortunes dissipated as quickly as they had appeared, leaving a trail of financial ruin. In its complete form, the Tulip Bubble Chart is a stark reminder of the transient nature of speculative wealth.

The aftermath of the Tulip Mania offers vital lessons for modern investors. Studying this chart, one can appreciate the cyclical nature of markets and the psychological undercurrents that drive them. It also serves as a cautionary tale for those who ignore the warning signs of history.

Blooms Revisited: Lessons Learned and Paths Forward

To navigate the investment cycles of today, one must heed the lessons of the past. The Tulip Bubble Chart is more than a historical curiosity; it is a blueprint for recognizing the stages of a financial bubble. By blending the insights of Kahneman, Shiller, and Murphy, investors can develop a more nuanced understanding of market psychology, enabling them to anticipate and react to the ebbs and flows of speculative manias.

Today’s markets are complex and interwoven with global events, yet the fundamental human emotions that drive investment behaviour remain constant. The Tulip Bubble Chart continues to resonate because it encapsulates the perennial dance between fear and greed, boom and bust.

In conclusion, the Tulip Bubble Chart phenomenon is a testament to the enduring patterns of human behaviour in financial markets. By studying its rise and fall through the lenses of mass psychology, contrarian investing, and technical analysis, we can equip ourselves to navigate better the investment cycles that shape our world. As we tread the paths carved by our speculative forebears, let us do so with a keen awareness of the blooms and busts ahead.

Drawing on the wisdom of historical and philosophical figures can further enrich our understanding. Gustave Le Bon’s insights into crowd psychology illuminate how collective behaviour can drive market trends, often irrationally. Emile Durkheim’s studies on social cohesion and collective enthusiasm can help us understand the societal impacts of market movements. Plato and Solon remind us of the importance of foundational principles and laws in governing states and markets. Charlie Munger’s reflections emphasize the value of understanding the underlying principles that govern business and investment, advocating for a disciplined approach that resists the allure of quick gains.

These thinkers collectively underscore a critical lesson: while markets evolve and technologies advance, the fundamental aspects of human nature and societal behaviour remain constant. By applying these timeless insights, we can foster a more disciplined, informed approach to investment that respects the cycles of history and the psychological underpinnings of market movements.

Intellectual Delights: Engage Your Mind

Overtrading: A Foolproof Recipe for Becoming a Burro in the Markets

What is the Bandwagon Effect? Exploring Its Impact

Hidden Positive Divergence: Harness Its Power to Dominate the Markets

Stock Market Correction History: Decoding Illusions Behind Crashes

Why Saving and Investing Matter: Avoid Ending Up Broke and Stranded

Why You Should Not Panic During a Market Crash: Unraveling Mass and Behavioral Psychology

The Pitfalls of Fear Selling: A Path to Pain and Financial Miser

Debunking the Myths: Why US Dollar Collapse Theories Are Nonsense

Stock Market Timing: Unlocking Hidden Strategies for Lasting Success

Psychology of Investing: Escape the Herd, Avoid Financial Destruction

Contrarian Definition: Buy When Others Flee in Fear

The Power of Negative Thinking: How It Robs and Bleeds You

Collective Psychology: Master Market Sentiment and Maximize Your Gains

The Cycle of Manipulation in Investments

Buy When There’s Blood in the Streets: Adapt or Die