Perception Manipulation & Investing: Sentiment Indicators Unveiled

Jan 1, 2025

By the ripe age of 18, the average person is just a walking zombie having amassed so many filters that the top players can manipulate these individuals with ease.

Our world is a vast network of interwoven perceptions, all determined by the filters we create over the years. Our minds are shaped by various forces – from public education and peer pressure to society, religion, social media, and the ubiquitous presence of mass media. As we journey through life, we accumulate layer upon layer of these false filters until we become walking zombies, unable to think for ourselves.

But what if we could break free from this web of perception? What if we could strip away these filters and see the world with fresh eyes? One of the most effective ways to do this is to switch off the TV for at least six weeks. We can still consume information through print media during this time, but we should avoid social media and TV. Doing so allows our brains to reset and compare these powerful forces’ before and after effects.

The results can be eye-opening. After a few weeks, we may find that our perceptions have shifted, and our minds are more precise and focused. We may even begin to question the value of mass media altogether, realizing that it is little more than a source of the poison that pollutes our thoughts and dulls our senses.

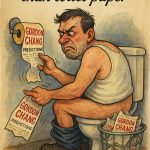

After such a transformational experience, many individuals with even a shred of common sense may come to realize that the so-called essential items of TV and mass media are worth no more than the cheapest roll of toilet paper on the market, for they do little more than dull the mind and erode our actual perception of the world.

Navigating the Market Chaos: Unveiling the Essence of Perception Manipulation

Alter the angle of perception and in doing so you alter the outcome. Sol Palha

The human mind is a curious thing. Despite all the data and evidence to the contrary, the masses continue to seek guidance from supposed “experts”, who are often anything but. It’s as if they are drawn like moths to a flame, even though they know it will lead to their destruction.

When it comes to the markets, this is particularly evident. Instead of seeking advice from someone with genuine insight and expertise, the masses continue to listen to self-proclaimed “gurus” who peddle their wares with little regard for the consequences. In truth, one would be better served seeking investment advice from a member of Ward 12 than most of these so-called experts.

We are confident, though, that compared to most experts, monkeys with darts would provide better guidance. Sol Palha

It’s a strange phenomenon but not altogether surprising. After all, the perception that experts know everything, even when they have repeatedly demonstrated their ignorance, is deeply ingrained in our culture. It’s as if we are all begging for a beating, doing the same thing repeatedly and expecting a different result. Smart investing implies a change of tactics. Do something new, for example use Mass Psychology to guide you or combine it with technical analysis.

Pitfalls of Following Popular Opinion in Investing Strategies

Experts love to use a lot of fancy words, describing nothing in the process and arriving at a conclusion that would make a jackass look like a genius.

It’s curious how the masses seek advice on matters they don’t understand, only to reject the knowledge of true experts – such as yourself – and listen to charlatans and hacks, despite their record of failure, and then wonder why they suffer in the end. It’s a kind of madness, a Gambler’s Mindset that defies all logic and reason.

We could, of course, delve into the minutiae of why this is happening, but that would be the path of the expert. They love to use big words to describe nothing, concluding that even a jackass would recognize as folly. Instead, let us acknowledge the truth in the face: the masses are lost, wandering in a wilderness of their own making. They don’t understand the markets, and they don’t know where to turn for help. They can only cling to their false beliefs and hope for the best.

But there is a better way. The answer is staring at us in the mirror. We must educate ourselves and put in a little effort. Without the desire to be proactive, we will constantly hop from one expert to another, albeit with less money. This task is not easy, but it’s not too difficult either. It’s like shooting yourself in the foot and wondering why you can’t walk.

Experts are nothing but Jackasses pretending to be genius. Tactical Investor

Adapt or Die: Navigating the Terrain with Perception Manipulation

According to the basic principles of mass psychology, the data presented above suggests that the masses are lost and have no idea what’s happening in the market. They are like blind rats, hopping from one sinking ship to another, hoping to buy more time. This is why we have assigned the label “the market of disorder” to this particular market. Unlike most markets where we assign new labels every 12 to 24 months, this label will likely stick until the market runs into a brick wall. However, we must remember that not even one brick has been laid yet, so that brick wall has a long way to go before it’s completed. In other words, this bull market is going to drive everyone, including bulls, bears, and neutrals, insane. Only the trend player will survive.

It’s important to note that even if you are a seasoned investor, keeping an eye on the trends and adjusting your strategy accordingly is still critical. In a market like this, where disorder is the norm, it’s essential to be adaptable and prepared to change your approach at any time. This is where trend players have an advantage, as they have the flexibility to adapt quickly and stay on top of the latest market movements. Ultimately, the key to wise investing in this market is to remain vigilant, stay informed, and be ready to act quickly when necessary.

Following the Herd: A Recipe for Investment Disaster

Various research studies on market psychology and investor behaviour suggest the masses often exhibit irrational decision-making when investing. For example, the concept of herd behaviour, where individuals follow a more extensive group’s actions without fully understanding their actions’ implications, has been extensively studied in behavioural finance.

Additionally, studies have shown that many investors overestimate their knowledge and ability to beat the market, leading to overconfidence and poor investment decisions. This phenomenon is often referred to as the Dunning-Kruger effect.

Overall, research in the field of behavioural finance has shed light on the various biases and tendencies that can impact investor decision-making, leading to market volatility and potential financial losses.

Mastering Financial Strategy: Unleashing the Power of Cash with Precision

Harnessing Mass Psychology for Strategic Timing:

Proficient investors adept in mass psychology discern when market sentiments are irrationally exuberant or overly pessimistic. Take, for instance, the dot-com bubble of the late 1990s, where astute individuals recognized the unsustainable overvaluation of tech stocks. Opting for a cash position, they skillfully sidestepped the subsequent 2000 crash. Similarly, during the 2008 financial crisis, those armed with cash reserves seized the opportunity to invest in undervalued assets when the market hit rock bottom.

Strategic Machiavellian Tactics in Investment:

Applying Machiavelli’s philosophy, savvy investors strategically deploy cash to amplify financial gains, employing calculated planning and patiently awaiting the optimal moment to strike. A prime historical illustration is John D. Rockefeller, who, in the early 20th century, utilized his cash reserves to acquire competitors and consolidate the oil industry, significantly augmenting his financial prowess.

Precision in Action:

Holding cash is a strategic move, but its potency lies in knowing precisely when to deploy it. This demands a Machiavellian blend of patience and decisiveness. Consider mass psychology Warren Buffett’s Investing Strategy: Mastering the Game of Investings Berkshire Hathaway, renowned for maintaining substantial cash reserves and enabling strategic investments during market downturns. For instance, acquiring Goldman Sachs stocks at favourable terms during the 2008 crisis exemplifies this astute approach.

Mastering strategic cash management entails leveraging Crowd psychology insights to navigate market complexities. Employing Machiavellian thinking, investors can pinpoint optimal moments to deploy cash reserves, demanding discipline, a profound comprehension of market dynamics, and the ability to act decisively when the opportune time arises.

Contemplative Journeys: Stimulating Articles

Contrarianism and Mass Psychology: A Dynamic Duo for Market Success