Percentage of Americans that Own Stock Reaches Highest Level Since 2008

Updated April 3, 2024

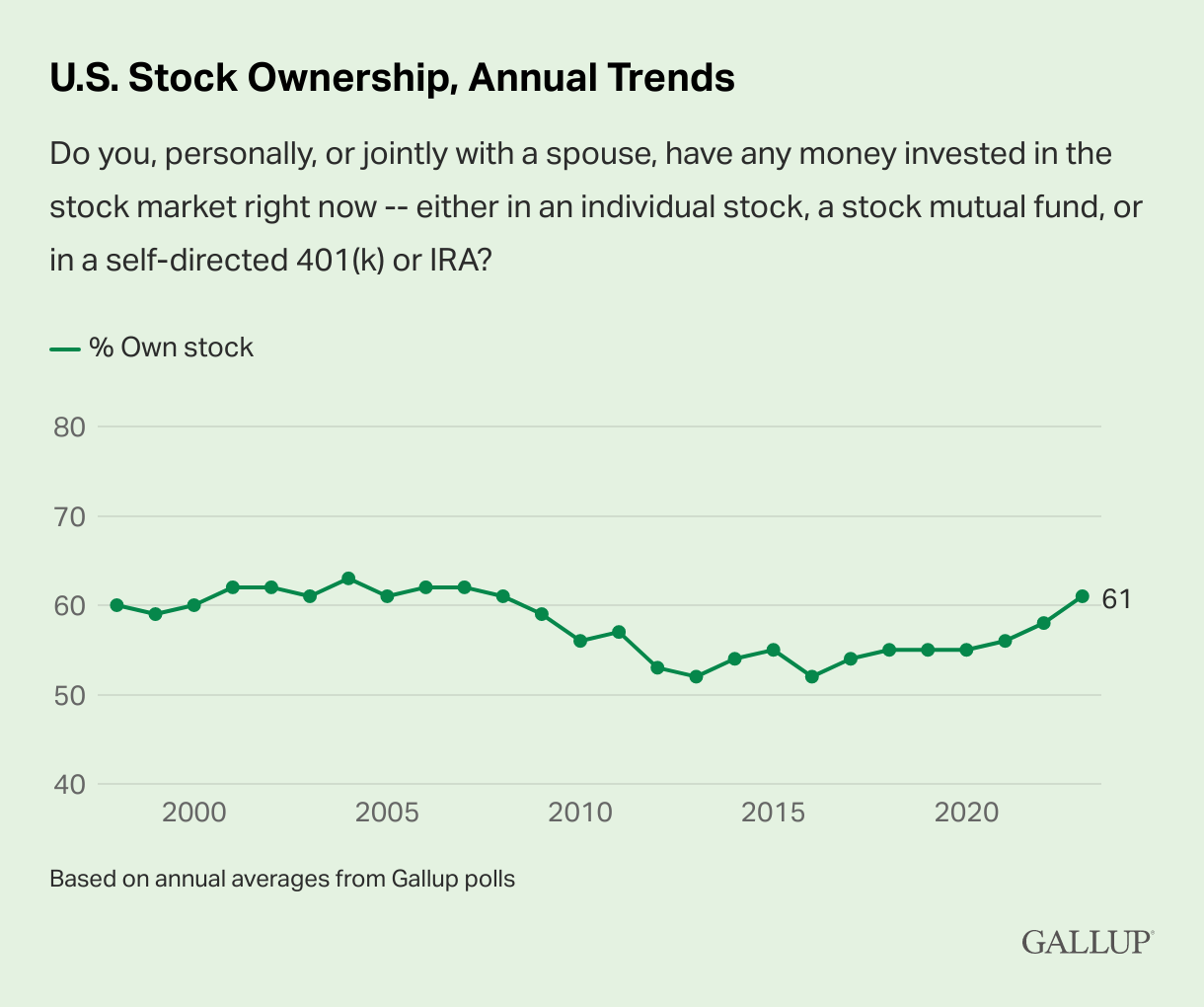

Stock ownership among Americans has rebounded significantly, reaching a 16-year high. A recent Gallup survey reveals that 63% of U.S. adults now own stocks, a notable increase from the 61% reported in July 2023. This upward trend reflects growing confidence in the stock market as a vehicle for securing financial futures.

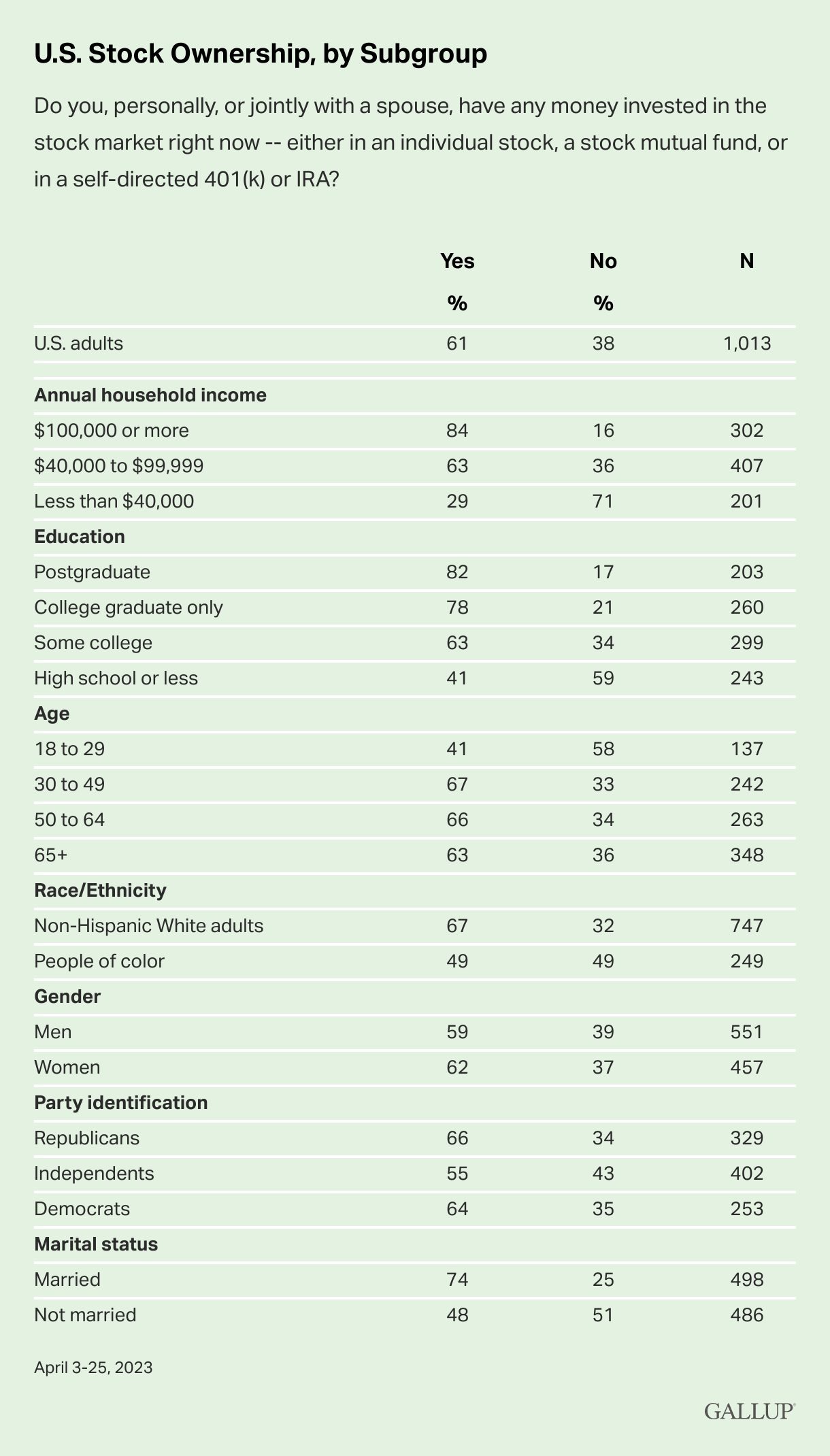

However, disparities in stock ownership based on income, education, and demographics persist. According to the Federal Reserve’s Survey of Consumer Finances, in 2019, only 15.2% of families in the bottom 20% of income owned stocks, compared to 92.1% of families in the top 10% income bracket.

Despite these challenges, the overall increase in stock ownership is a positive sign for the economy and individual financial well-being. As legendary investor Jesse Livermore once said, “The market is never wrong. Opinions are.” This wisdom underscores the importance of focusing on market trends rather than personal biases when making investment decisions.

The Importance of Financial Literacy

The rise in stock ownership also highlights the need for improved financial literacy. The renowned journalist and satirist H.L. Mencken once quipped, “No one in this world, so far as I know … has ever lost money by underestimating the intelligence of the great masses of the plain people.” While Mencken’s words may seem harsh, they underscore the importance of educating the public about financial matters to enable informed decision-making.

Initiatives such as the Financial Literacy and Education Commission, established under the Fair and Accurate Credit Transactions Act of 2003, aim to promote financial education and help Americans make better-informed financial choices. As more individuals participate in the stock market, the need for accessible, high-quality financial education becomes increasingly critical.

Looking Ahead

As the U.S. economy continues to recover from the impact of the COVID-19 pandemic, the growing participation in the stock market is an encouraging sign. However, it is crucial to remember that investing in stocks carries inherent risks, and individuals should carefully consider their financial goals, risk tolerance, and investment horizons before making investment decisions.

By promoting financial literacy, addressing wealth disparities, and encouraging responsible investing practices, we can work towards a more inclusive and sustainable economic future for all Americans. In the words of Jesse Livermore, “The game of speculation is the most uniformly fascinating in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor.”

Bridging the Gap: Income, Education, and Stock Ownership

A deeper analysis of the data reveals significant disparities in stock ownership based on income, education, and other demographic factors. According to the latest Gallup survey, households earning over $100,000 annually have the highest ownership rate at 84%. Similarly, 80% of college graduates own stocks, highlighting the correlation between education and stock ownership.

In contrast, individuals earning under $40,000 annually have a much lower ownership rate of just 29%. These figures emphasize the need for increased participation among lower- and middle-income Americans to truly democratize capital ownership.

The Pew Research Center notes that income inequality has increased, with upper-income households experiencing more rapid growth in recent decades. This trend has led to a shrinking middle class and a more significant share of the nation’s aggregate income going to upper-income households.

Renowned economist Joseph Stiglitz once said, “The top 1 per cent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn’t seem to have bought: an understanding that their fate is bound up with how the other 99 per cent live.” This statement underscores the importance of financial inclusion and the need to address the widening wealth gap.

Increasing stock ownership among lower- and middle-income households is crucial for promoting financial stability and reducing wealth inequality. As Robert Shiller, Nobel laureate in economics, stated, “Finance is not merely about making money. It’s about achieving our deep goals and protecting the fruits of our labour. It’s about stewardship and, therefore, about achieving a good society.”

Strategies for Success: Long-Term Investing and Patience

Historical data has consistently shown that the stock market tends to outperform other asset classes over the long term. Benjamin Graham, often known as the father of value investing, advocated for an investment approach focusing on intrinsic value and long-term growth. He emphasized the importance of patience and a disciplined investment strategy rather than frequent trading, which aligns with modern research suggesting that a buy-and-hold approach can lead to more favourable long-term returns.

Adam Smith, the 18th-century economist, also recognized the virtues of patience in economic activities. His insights into the market’s ‘invisible hand’ suggest that long-term investment strategies, which rely on market efficiencies, can be more successful than attempting to time the market.

Dollar-cost averaging and Market Timing

Dollar-cost averaging, the practice of regularly investing equal amounts of money over time, has been shown to mitigate the risks of market volatility. This strategy aligns with the teachings of John Maynard Keynes, a prominent economist of the early 20th century who understood the importance of mitigating risk through strategic financial planning.

Keynes, who was also an investor, knew the dangers of speculation and the benefits of a more measured, long-term approach to investing. His work suggests that investors increase their chances of success by focusing on long-term investment goals and weathering short-term market fluctuations.

Across Generations: Millennials and Baby Boomers Embrace Stock Ownership

Now aged 30-49, millennials are increasingly participating in the stock market as they advance in their careers. This demographic’s 67% stock ownership rate reflects a recognition of the stock market’s potential for wealth generation. Graham’s investment philosophy once again resonates here, as he advised investors to look beyond short-term trends and focus on the long-term prospects of their investments.

Baby Boomer Investment Trends

Baby boomers have maintained a significant presence in the stock market, with over 60% holding onto their stock investments since 2001. This enduring engagement suggests a shared understanding across generations of the stock market’s role in financial stability. David Dodd, Graham’s collaborator, also emphasized the importance of a disciplined approach to investing, reflected in the steady investment habits of the baby boomer generation.

Cross-Generational Recognition of Stock Market Potential

The cross-generational participation in the stock market underscores a collective acknowledgement of its potential to secure financial stability. The principles of Graham and Dodd, focusing on fundamental analysis and a long-term perspective, have permeated through the investment strategies of both millennials and baby boomers.

In conclusion, the teachings of past economic and investment experts continue to be relevant today. They advocate long-term investment strategies and patience, which are embraced by both younger and older generations in the pursuit of financial security.