Decoding the Dynamics of Executive Compensation Packages

Updated Dec 1 2023

Introduction: Decoding the Wealth Dynamics in Corporate Realms

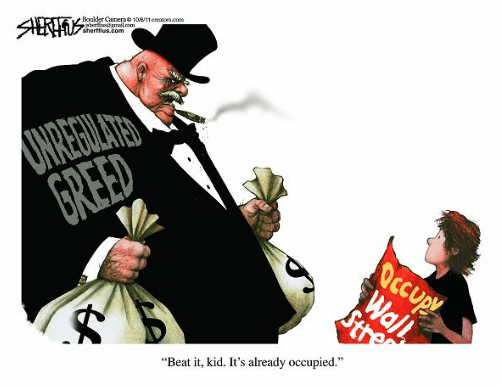

In the ever-evolving terrain of contemporary corporations, the distribution of wealth takes centre stage, sparking fervent discussions and broad debates. Nowhere is this more evident than in executive compensation, where the eye-catching figures tied to CEO pay packages fuel conversations about fairness, income inequality, and the ethical foundations of capitalism.

The substantial gap between the earnings of top executives and the average worker within a company thrusts issues of fairness and societal balance into the limelight. As the numbers unfold, it becomes increasingly clear that the wealth divide within corporations is widening, creating a significant rift between those at the helm and those propelling day-to-day operations.

This sets the scene for a thorough exploration of the complex landscape of corporate wealth, where the consequences of income inequality and societal dynamics take centre stage. As we embark on this journey, the following subtopics will act as guiding lights, shedding light on specific aspects of this landscape. Our focus will delve into executive compensation’s intricacies, corporate governance’s nuances, and the far-reaching societal implications intertwined with the expanding wealth gap within organizations. Get ready to peel back the layers of this intricate tapestry, gaining profound insights into the multifaceted dynamics shaping the corporate world and its broader impact on the fabric of society.

Executive Compensation and the Buyback Boom: A Symbiotic Relationship

In the dynamic landscape of corporate finance, stock buybacks have emerged as a powerful tool, often fueling the wealth of executives. This financial manoeuvre, where companies repurchase their shares, has gained traction, becoming a prevalent strategy that can significantly influence executive compensation.

**Stock buybacks** reduce the number of shares available in the market, potentially boosting the company’s earnings per share (EPS) and, consequently, its stock price. This elevation in stock price is particularly beneficial to executives whose compensation packages are frequently tied to the company’s stock performance through stock options or restricted stock units (RSUs).

Consider a hypothetical example to illustrate how executive compensation can drive share buybacks. Imagine a CEO with a compensation package with numerous stock options exercisable at $50 per share. If the company’s stock is currently trading at $45, those options are out of the money and essentially worthless. However, if the company initiates a stock buyback program that helps push the share price above $50, the CEO’s options suddenly become valuable, providing a direct financial incentive to the executive.

Moreover, executives may have performance targets set around specific financial metrics, such as EPS, directly affected by share repurchases. By reducing the number of outstanding shares, EPS can be artificially inflated even without an actual increase in net income, potentially triggering bonuses and other performance-related pay.

While the alignment of interests between executives and shareholders can be beneficial, it raises questions about the long-term value creation for the company. Critics argue that the resources spent on buybacks could be invested in research and development, employee growth, or other areas contributing to the company’s sustainable success.

The debate around stock buybacks and executive compensation is multifaceted. On the one hand, buybacks can be a legitimate method for companies to return excess cash to shareholders and can reflect confidence in the company’s financial health. On the other hand, there is growing scrutiny over whether these repurchases are being used to manipulate market perceptions and unduly enrich executives at the expense of broader corporate growth and investment.

In recent years, the conversation has intensified, with some calling for reforms to ensure that buybacks are conducted to balance the interests of all stakeholders. Proposals for increased transparency, restrictions on the timing and volume of buybacks, and tying executive compensation more closely to long-term corporate performance are part of the ongoing discourse.

The interplay between executive compensation and stock buybacks remains critical as the corporate world evolves. It’s a narrative that encapsulates the complexities of modern finance, corporate governance, and the quest for a fair and equitable distribution of corporate profits. While a boon for executive wealth, the mechanics of stock buybacks continue to be a subject of intense debate and analysis, as stakeholders strive to understand and optimize their impact on companies and their shareholders.

Buybacks Explained

But what if there’s more to the story? What if stock buybacks are not just about fueling executive wealth but also a strategic move that can benefit the company and its investors unexpectedly?

In recent years, data has emerged that challenges the conventional narrative surrounding stock buybacks. According to a study conducted by Harvard Business Review, companies that engage in share repurchases tend to outperform the market in the long run. The study analyzed a dataset of over 4,000 buybacks from 2004 to 2014 and found that these companies experienced higher returns on assets and equity and increased earnings per share growth.

This finding suggests that stock buybacks may not be purely driven by executive self-interest but can be a wise business move. By reducing the number of outstanding shares, companies can enhance their earnings per share, making them more attractive to investors. This, in turn, can lead to an increase in stock price, benefiting all shareholders, including executives.

Moreover, stock buybacks can signal to the market that a company believes its stock is undervalued. This can create a sense of confidence among investors, attracting new shareholders and potentially driving up the stock price even further. In a way, it’s a self-fulfilling prophecy, where buying back shares sends a powerful message about the company’s prospects and value.

Contrarian investors, in particular, may find stock buybacks intriguing. Contrarian investing is based on the belief that going against the crowd can lead to profitable opportunities. When a company announces a buyback program, it often faces scepticism and doubt from market participants. This scepticism can create a buying opportunity for contrarian investors who see the potential for value creation and are willing to take a calculated risk.

So, while it’s true that stock buybacks have been associated with executive wealth accumulation, there is more to the story. These buybacks can be a strategic move that benefits the company, its investors, and even contrarian-minded individuals seeking unique investment opportunities. The allure of stock buybacks lies in their potential to inflate executive wealth and their ability to generate excitement and intrigue in the market, inviting investors to delve deeper into the mechanics of this intriguing financial strategy.

The Impact on Corporate Profits

However, it is crucial to examine the impact of stock buybacks on corporate profits from a broader perspective. While it is true that a significant portion of profits has been allocated to shareholders through buybacks and dividends, it does not necessarily imply a negative consequence for workforce investment and innovation.

Firstly, stock buybacks can enhance corporate profits indirectly. By reducing the number of shares outstanding, companies can boost metrics such as earnings per share (EPS). This can make the company more attractive to investors, potentially increasing stock price and market capitalization. As a result, the company may have more financial resources, which can be reinvested in various areas, including workforce development and innovation.

Secondly, stock buybacks can be seen as a mechanism for capital allocation. When a company repurchases its shares, it signals that it believes its stock is undervalued. Instead of spending the excess cash on less productive investments or acquisitions, the company chooses to invest in its shares, which it views as a favourable use of capital. This strategic allocation of resources can contribute to long-term profitability and sustainability.

Furthermore, the relationship between stock buybacks, workforce investment, and innovation is not necessarily a zero-sum game. Companies can prioritize shareholder returns and investments in human capital and research and development. A robust workforce and innovative practices can increase productivity and profitability, benefiting shareholders in the long run.

It is essential to consider the dynamic nature of corporate finance. Companies make decisions based on many factors, including market conditions, competition, and growth prospects. While stock buybacks have gained attention, they are not the sole determinant of a company’s investment in its workforce or innovation efforts.

There has been a growing recognition of the need for a balanced approach to capital allocation in recent years. Some companies have responded by incorporating environmental, social, and governance (ESG) considerations into their decision-making processes. This includes evaluating the impact of buybacks on stakeholders beyond shareholders, such as employees, customers, and the broader community.

Executive Compensation and the Buyback Connection

The transformation of CEO pay structures in the 1990s significantly impacted executive compensation and the relationship with stock buybacks. With the introduction of a legislative cap on deductible CEO salaries, companies had to explore alternative ways to incentivize and reward their top executives. Stock-based compensation emerged as a popular solution, aligning the interests of executives with those of shareholders.

By tying executive compensation to stock performance, companies aimed to link the business’s success and its leaders’ wealth directly. Stock buybacks became a means for executives to influence their pay by manipulating stock prices. By reducing the number of shares outstanding, buybacks can inflate earnings per share (EPS) and, consequently, drive up stock prices. This can result in higher stock-based compensation for executives as the value of their equity-based incentives increases.

Critics argue that this emphasis on stock-based compensation and pursuing executive wealth maximization through buybacks can lead to short-term thinking and neglect long-term corporate health. Executives may prioritize immediate gains and stock price performance over investments in research and development, employee compensation, or other forms of sustainable growth. This can hamper innovation, hinder organisational talent development, and negatively impact the company’s ability to adapt to changing market conditions.

However, it is essential to note that not all executives engage in buybacks solely for personal gain. Many executives genuinely believe that buybacks are an effective capital allocation strategy that can benefit the company and its shareholders. They may argue that buybacks are a prudent use of excess cash when there are limited investment opportunities or the stock is undervalued. Moreover, executives often have a fiduciary duty to act in the best interests of shareholders. It can be considered a responsible decision if they genuinely believe that buybacks will maximize shareholder value.

Recently, a growing focus has been on aligning executive compensation with long-term performance and broader stakeholder interests. Shareholder activists, institutional investors, and regulatory bodies have called for greater executive pay structure transparency, accountability, and balance. Efforts have been made to link compensation more closely to sustainable growth metrics, corporate social responsibility, and other non-financial performance indicators. These measures aim to ensure that executives are incentivized to create long-term value for the company and all its stakeholders rather than solely focusing on short-term financial gains.

The Conflict of Interest at the Corporate Apex

Indeed, the surge in stock buybacks has raised concerns about the conflict of interest at the corporate apex. Critics argue that by prioritizing stock buybacks over investments in growth and innovation, top executives may be neglecting the long-term health of their companies in favour of short-term gains.

At the heart of this conflict is the allocation of capital. As an economic system, capitalism promotes the reinvestment of profits for future prosperity. By channelling resources back into the business, companies can fuel growth, create jobs, and drive innovation, ultimately benefiting shareholders and society.

However, the prevalence of stock buybacks has shifted capital allocation in favour of immediate shareholder returns. Instead of deploying profits towards research and development, expanding operations, or investing in human capital, a significant portion of capital is being directed towards buying back shares. While this may benefit shareholders in the short term, it raises questions about companies’ long-term sustainability and growth potential.

Critics argue that pursuing stock buybacks can lead to various detrimental effects. It can hinder a company’s ability to invest in innovation, crucial for maintaining competitiveness in a rapidly evolving business landscape. It can also limit resources available for employee compensation and development, potentially impacting morale and talent retention. Furthermore, the concentration of wealth among a select few can exacerbate income inequality, which has broader societal implications.

Moreover, the conflict of interest becomes particularly pronounced when executive compensation is tied to stock performance. Executives may have a personal incentive to prioritize buybacks, as it can boost stock prices and increase the value of their stock-based compensation. This narrow focus on short-term financial gains can undermine the company’s and its stakeholders’ long-term interests.

Addressing this conflict of interest requires a reevaluation of corporate priorities and governance. Stakeholders, including shareholders, employees, customers, and communities, must be actively engaged in shaping the direction of a company. This includes promoting a more balanced approach to capital allocation, where the long-term health of the business and the interests of all stakeholders are given due consideration alongside short-term shareholder returns.

Regulatory measures can play a role in curbing excessive stock buybacks and ensuring greater transparency and accountability in corporate decision-making. For instance, some propose stricter regulations on the timing and volume of buybacks or the requirement for companies to disclose their intentions and justifications for engaging in buybacks.

Determining the right balance between short-term shareholder returns and long-term corporate health is a complex challenge. It requires a collective effort from executives, shareholders, regulators, and other stakeholders to foster a more sustainable and inclusive approach to capitalism, where the reinvestment of profits for future prosperity takes precedence over short-term gains for a select few.

The SEC’s Role: Enabler of Executive Excess

The U.S. Securities and Exchange Commission (SEC) is crucial in regulating and overseeing the securities industry, including corporate governance practices. While the SEC’s “business judgment” rule allows corporate executives to make business decisions, it is essential to consider this regulatory stance’s broader context and purpose.

The “business judgment” rule is a legal principle that grants deference to corporate executives in making decisions on behalf of the company. It recognizes that executives are generally in the best position to make informed judgments about the company’s operations and strategic direction. This rule allows executives to exercise discretion and take calculated risks without constant interference or second-guessing from shareholders or regulators.

However, it is essential to note that the “business judgment” rule does not give executives carte blanche to prioritize their interests over those of the company and its owners. The rule is not intended to enable executive excess or allow the diversion of resources from productive investments without accountability.

The SEC is mandated to protect investors and ensure fair and transparent markets. While the “business judgment” rule acknowledges the authority of executives, it does not absolve them from their fiduciary duties to act in the best interests of shareholders. Executives are expected to exercise their discretion responsibly, with due care and loyalty to the company and its owners.

Furthermore, the SEC has implemented various regulations and disclosure requirements to enhance corporate transparency and accountability. Companies must disclose financial performance, executive compensation, and significant corporate transactions, including stock buybacks. These disclosures allow shareholders and the public to evaluate the actions and decisions of executives and hold them accountable for their stewardship of company resources.

It is worth noting that executive compensation practices, including stock-based incentives and the impact of stock buybacks, are subject to scrutiny and evolving regulations. In recent years, the SEC has taken steps to promote additional transparency and align executive compensation with long-term performance and the interests of shareholders. For example, the SEC has required companies to disclose the relationship between executive pay and financial performance and the ratio of CEO pay to the median employee pay.

The Consequences of Executive Greed

The consequences of executive greed, which can be reflected in prioritising stock buybacks and executive compensation over investments in the workforce and innovation, can dampen economic growth.

When companies overly emphasize short-term gains, they may allocate a significant portion of their resources towards stock buybacks, which can inflate stock prices and benefit shareholders, including executives with stock-based incentives. While buybacks can provide immediate returns to shareholders, they do not directly contribute to the company’s productive capacity or long-term growth. This focus on short-term financial engineering, at the expense of investments in research and development, employee training, and capital expenditure, can hinder a company’s ability to innovate, improve productivity, and remain competitive in the long run.

Investments in the workforce, such as competitive wages, employee benefits, and training programs, are essential for attracting and retaining talented employees. By prioritizing executive compensation and stock buybacks over investments in the workforce, companies may struggle to attract and retain skilled workers, leading to lower employee morale and productivity. This, in turn, can hinder overall economic growth as companies become less efficient and innovative.

Moreover, innovation plays a crucial role in driving economic expansion. Investments in research and development, new technologies, and product development are essential for creating new markets, improving productivity, and fostering economic progress. When companies prioritize short-term gains over long-term innovation, they may miss opportunities to develop new products or services, adapt to changing consumer needs, or invest in transformative technologies. This can result in a slower pace of innovation, reduced productivity gains, and an overall dampening effect on economic growth.

Furthermore, the consequences of executive greed can extend beyond individual companies and impact the broader economy. When a significant portion of resources is diverted towards stock buybacks and executive compensation, less capital may be available for productive investments in other sectors or entrepreneurial ventures. This can limit the availability of funding for innovative startups and small businesses, which are often drivers of job creation and economic dynamism.

Addressing the consequences of executive greed requires a shift in corporate priorities and a broader perspective on value creation. Companies need to consider the long-term interests of all stakeholders, including employees, customers, communities, and shareholders. Balancing short-term financial returns with investments in the workforce, innovation, and sustainable growth can contribute to long-term competitiveness, economic prosperity, and shared value creation.

Government policies, such as tax incentives for productive investments, regulations that encourage long-term thinking, and measures to promote income equality, can also play a role in incentivizing companies to prioritize sustainable growth over short-term gains.

The Social Implications of Executive Compensation Packages

The disparity in executive compensation and the concentration of wealth at the top have significant social implications and can contribute to growing social inequalities.

The widening gap between executive compensation and average worker wages has been a cause for concern. While administrative salaries and benefits have risen significantly, many workers have experienced stagnant wage growth and increased financial insecurity. This disparity can lead to a sense of injustice and frustration among workers, as they perceive their contributions as undervalued compared to those of top executives.

When workers’ wages fail to keep pace with the rising cost of living, it can create financial hardship and limit opportunities for social mobility. Workers may struggle to meet basic needs, save for the future, or invest in education and skills development. This can perpetuate cycles of poverty and exacerbate social inequalities, as individuals and families face limited economic opportunities and reduced access to resources and social benefits.

The concentration of wealth at the top can also have broader societal implications. It can contribute to social divisions and a sense of societal unrest. The perception that economic rewards are disproportionately distributed can erode trust in institutions and undermine social cohesion. It can fuel resentment and heighten tensions between different socioeconomic groups, potentially leading to social and political instability.

Moreover, the concentration of wealth can impact social and public services. When a select few accumulate a significant portion of resources, there may be reduced funding available for vital public investments in education, healthcare, infrastructure, and social welfare programs. This can hinder social progress and limit access to opportunities and essential services for marginalized communities.

The ethical considerations surrounding the distribution of resources and executive compensation have become subjects of public debate. There is a growing recognition that businesses have a broader responsibility beyond maximizing shareholder value and should consider all stakeholders’ interests, including employees, customers, and communities. This includes addressing income inequality, providing fair wages, and investing in the well-being of workers and society.

Efforts to address the social implications of executive compensation and wealth concentration can take various forms. This includes policies promoting income equality, such as progressive taxation, minimum wage regulations, and measures to enhance workers’ bargaining power. It also involves fostering a corporate culture that values long-term sustainability, responsible business practices, and the well-being of employees and communities.

Furthermore, transparency and accountability in executive compensation can help address concerns of unfairness and excessive rewards. Shareholders, employees, and the public should have access to information on administrative pay practices and be able to engage in constructive dialogue to ensure that compensation aligns with company performance and the interests of all stakeholders.

The Future of Executive Compensation Packages

There is a growing call for reevaluating executive compensation rules and practices. Many advocates argue for a more balanced approach that aligns the interests of executives with those of their companies and society as a whole.

One area of focus is addressing the link between executive compensation and company performance. Some argue that executive pay should be more closely tied to long-term performance metrics rather than short-term financial indicators. This approach incentivises executives to make decisions that promote sustainable growth and value creation rather than focusing solely on immediate financial gains.

Additionally, there is a push for greater transparency and accountability in executive compensation. Shareholders and the public advocate for increased disclosure of organisational pay practices, including the relationship between pay and performance and the CEO pay ratio to the median employee pay. This transparency allows stakeholders to evaluate whether executive compensation is justified and aligned with company performance and societal expectations.

Furthermore, there are proposals to strengthen shareholder rights and improve governance practices. This includes giving shareholders a more significant say on executive compensation through “say-on-pay” votes, where shareholders can approve or reject executive pay packages. Increasing shareholder input ensures executive compensation is more closely aligned with shareholder interests.

Advocates for change also emphasize the importance of considering a broader range of stakeholders in executive compensation decisions. This includes considering executive pay’s impact on employees, customers, and communities. By aligning executive compensation with the interests of all stakeholders, companies can foster a more inclusive and sustainable business model.

Regulatory bodies, such as the SEC, have the authority to implement changes to the rules governing executive compensation. They can introduce new regulations or amend existing ones to promote a more balanced and responsible approach. These changes may include requirements for greater disclosure, establishing more apparent performance metrics, and reinforcing shareholder rights.

It is worth noting that the future of executive compensation is likely to involve ongoing discussions and debates among various stakeholders, including regulators, shareholders, executives, and the public. Balancing the need for attracting and retaining top talent with concerns about excessive compensation and social equity will require thoughtful and nuanced approaches.

The Role of Shareholders and Activism

Shareholders are essential in pushing back against excessive executive pay and advocating for more equitable distribution of corporate profits. Activist investors and socially conscious funds have been particularly active in this area, using their influence to drive change and promote long-term value creation.

Activist investors are shareholders who take an active role in influencing corporate decision-making. They may acquire significant stakes in companies and use their voting rights and engagement strategies to push for changes in executive compensation practices. These activists often argue for aligning executive pay with long-term performance, promoting transparency, and advocating for a fairer distribution of resources.

Socially conscious funds, also known as responsible or sustainable investment funds, consider environmental, social, and governance (ESG) factors when making investment decisions. These funds prioritize investments in companies that demonstrate responsible business practices and align with their investors’ values. As part of their approach, they may engage with companies to address concerns about excessive executive compensation and advocate for a more equitable distribution of profits.

Activist investors and socially conscious funds increasingly use their influence to promote policies prioritising long-term value creation over short-term financial engineering. They argue that executive compensation should be tied to sustainable performance metrics, such as long-term growth, innovation, and ESG goals. By advocating for these changes, they aim to ensure that executive pay aligns with the long-term interests of shareholders and broader societal expectations.

Furthermore, shareholders, including institutional investors, have voiced their concerns through “say-on-pay” votes. These votes allow shareholders to approve or reject executive pay packages, allowing them to express their views on compensation practices. While these votes are typically non-binding, they signal to companies and boards of directors about shareholders’ expectations and can influence future compensation decisions.

In response to shareholder activism and demands for more equitable distribution of corporate profits, some companies have reformed executive compensation practices. This may involve revising pay structures, setting more challenging performance targets, increasing transparency, or enhancing shareholder engagement.

However, it’s worth noting that shareholder activism and demands for change in executive compensation practices are not without controversy. There may be differing opinions among shareholders, and companies may face challenges in striking the right balance between attracting top talent and addressing concerns about excessive pay.

Conclusion on Executive Compensation Packages

The debate over executive compensation transcends mere numerical figures; it delves into the fundamental values and principles that underpin our economic systems. Striking a balance between rewarding leadership and innovation while promoting broader sharing of corporate success is a crucial challenge as we move forward.

A fair and sustainable economic growth model necessitates considering the interests of all stakeholders, including employees, shareholders, customers, and communities. It involves aligning executive compensation with long-term performance, promoting transparency and accountability, and addressing social inequalities that arise from wealth concentration.

By implementing policies and practices that reward executives based on sustainable performance metrics, we can encourage a focus on long-term value creation rather than short-term gains. This approach incentivizes responsible decision-making and promotes companies’ overall health and stability.

Transparency and accountability are vital in addressing concerns about excessive executive pay. Providing clear information on administrative compensation practices and ensuring that shareholders and the public have a voice in decision-making processes can foster trust and promote a more inclusive approach to compensation.

Furthermore, addressing social inequalities requires a broader perspective on wealth distribution. Companies can embrace their social responsibility by considering the impact of executive compensation on employees, customers, and communities. This may involve investing in fair wages, employee benefits, and social initiatives that support the well-being of all stakeholders.

Ultimately, balancing rewarding leadership and innovation while promoting broader sharing of corporate success requires a collective effort. It involves ongoing dialogue and collaboration among stakeholders, including executives, shareholders, policymakers, and the public. By collectively shaping our economic systems, we can strive for a more just and sustainable economic growth model that aligns with our values and aspirations.

In the golden embrace of ancient Greece, let’s conclude with a captivating narrative that unfolds against the backdrop of the classical era, weaving a tale that delicately illuminates the perils entwined with insatiable greed.

Divine Redemption: Balancing Wealth in Olympus

In the opulent halls of Olympus, where gods and goddesses feasted, a tale of greed unfolded. Zeus, the thunderous king, watched with growing unease as his divine brethren indulged in extravagant displays of wealth.

Hermes, the swift-footed messenger, boasted of his golden sandals, studded with precious gems, that allowed him to traverse the realms in a flash. His caduceus, a staff entwined with serpents, was adorned with shimmering diamonds, symbolising his power and status.

Aphrodite, the beauty goddess, adorned herself with jewels that rivalled the stars’ brilliance. Her robes were woven with threads of pure gold, and her hair was crowned with a diadem encrusted with rubies and emeralds.

Poseidon, the lord of the seas, commanded a palace of coral and seashells, where he reclined on a throne of glistening pearls. His trident, a symbol of his authority, was crafted from the finest silver, inlaid with lapis lazuli and turquoise.

As the gods revelled in their luxury, the mortal realm suffered. Famine and poverty ravaged the land as the people struggled to make ends meet. Uses, burdened by his subjects’ suffering, called a council of the gods.

“My fellow Olympians,” he thundered, “we have become consumed by greed. Our extravagance has blinded us to the plight of mortals. We must find a way to balance our divine wealth with the needs of those who worship us.”

The gods listened in silence, their hearts heavy with guilt. They realized that pursuing material possessions had led them astray from their true purpose.

Athena, the goddess of wisdom, proposed a solution. “Let us create a system of executive compensation,” she said, “where our rewards are tied to the well-being of the mortal realm. If we prosper, so too shall our subjects.”

The gods agreed to Athena’s proposal and established a new order based on merit and service. As the supreme ruler, Zeus received the most significant share of the divine wealth, but he also bore the greatest responsibility for the welfare of mortals.

The other gods were rewarded according to their contributions, with Hermes, Aphrodite, and Poseidon receiving substantial compensation for their roles as messengers, healers, and protectors.

As the gods embraced this new system, the mortal realm began to flourish. The people prospered, and their devotion to the Olympians grew stronger. Zeus, seeing the positive impact of their actions, smiled with contentment.

And so, the gods of Olympus learned the folly of greed and the importance of balance. They became wise and benevolent rulers, guiding the mortal realm with compassion and justice, forever mindful of the lessons they had learned from their past excesses.

“Initially published on May 27, 2016, this content has undergone periodic updates over the years, with the most recent one completed on December 2023.”

Beyond Basics: Engaging Stories Await

Maximizing Wellness: Exploring Zinc Carnosine Benefits