Understanding the Market Cycle Psychology: Navigating Market Volatility

May 31, 2024

Introduction:

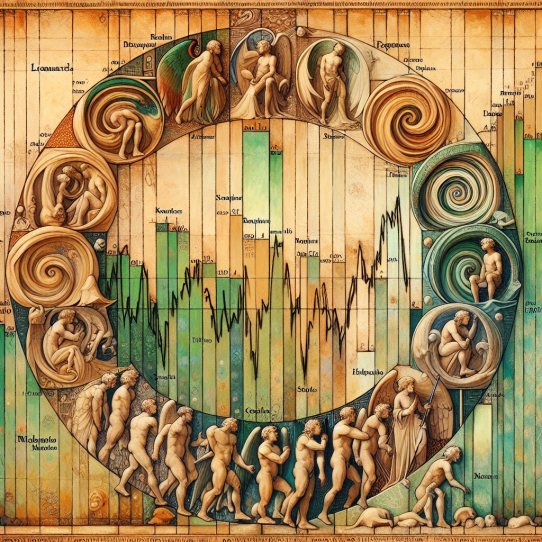

The stock market is a dynamic, ever-changing landscape characterized by recurring market cycles. Navigating these cycles can be daunting for investors, as emotions and behaviours can heavily influence decision-making. However, by understanding the psychology behind market cycles and learning from the wisdom of legendary investors, one can develop strategies to navigate market volatility successfully.

The market cycle consists of four primary stages: accumulation, markup, distribution, and markdown. Each stage is characterized by distinct investor sentiments, ranging from fear and despair to euphoria and greed. Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.” This contrarian approach is a hallmark of successful long-term investing.

To fortify your investment strategy, consider the insights of renowned investors like Benjamin Graham, Peter Lynch, and Sir John Templeton. Graham, the father of value investing, emphasized the importance of maintaining a margin of safety by purchasing assets at a significant discount to their intrinsic value. Lynch, the legendary manager of the Magellan Fund, advocated for investing in what you know and understanding the businesses you invest in. Templeton, a pioneer of global investing, stressed the importance of having a long-term perspective and avoiding the pitfalls of short-term market fluctuations.

By incorporating these timeless principles and maintaining a disciplined approach, investors can successfully navigate the ups and downs of market cycles. Strategies such as diversification across asset classes and sectors, dollar-cost averaging, and focusing on quality companies with solid fundamentals can help mitigate risk and optimize returns over the long run.

In conclusion, mastering market cycles requires a deep understanding of investor psychology and a commitment to time-tested investment principles. By learning from the wisdom of legendary investors and developing a robust, adaptable strategy, investors can confidently navigate the stock market’s ever-changing landscape and achieve their financial goals.

Navigating the Four Stages of the Market Cycle: Insights from Historical Investors

The stock market is a cyclical entity that undergoes various stages, each characterized by distinct investor behaviours and market trends. While the market cycle can be divided into 14 stages, we will focus on the four primary phases: accumulation, markup, distribution, and markdown. By understanding these stages and their psychology, investors can make more informed decisions and potentially avoid common pitfalls.

1. Accumulation Phase

The accumulation phase is the initial stage of the market cycle, where savvy investors, often called “smart money,” begin to acquire undervalued stocks. Prices are typically low during this phase, and public interest in the stock is minimal. As far back as the 17th century, Dutch investor Joseph de la Vega noted the importance of patience during this stage, advising investors to “wait for the right moment” to enter the market.

2. Markup Phase

In the markup phase, stock prices rise as more investors become interested. Momentum builds, and prices continue to climb. A growing sense of optimism and excitement among investors often characterizes this stage. British economist David Ricardo, active in the early 19th century, emphasized the importance of understanding market sentiment during this phase, stating that “the market can remain irrational longer than you can remain solvent.”

3. Distribution Phase

The distribution phase marks a turning point in the market cycle, as intelligent money investors begin to sell their holdings, and prices start to level off. The stock may experience some volatility as investors take profits. In the late 18th century, Japanese rice trader Munehisa Homma, widely regarded as the father of candlestick charting, stressed the significance of recognizing this stage and adapting one’s strategy accordingly.

4. Markdown Phase

During the markdown phase, investor sentiment turns pessimistic, and prices continue to decline. This is when savvy investors look to buy back shares from average investors at a lower price, positioning themselves for potential future gains. The Rothschild family, renowned for their financial understanding in the 18th and 19th centuries, famously advised investors to “buy when there’s blood in the streets,” highlighting the potential opportunities that can arise during this stage.

By understanding the psychology behind each stage of the market cycle, investors can make more informed decisions and potentially avoid common pitfalls. As the ancient Greek philosopher Aristotle noted, “Patience is bitter, but its fruit is sweet.” This timeless wisdom remains relevant for investors navigating the ups and downs of the market cycle.

In addition to the four primary stages, the market cycle can be further broken down into 14 stages, which will be discussed next.

The Emotional Rollercoaster: Navigating the 14 Stages of Market Psychology

1. Disbelief

– Most market participants view any upswings as temporary “bull traps” and oppose upward movements.

– Baron Rothschild (1840s): “The time to buy is when there’s blood in the streets.”

2. Hope

– The first step in a new bull market, with the hope that a price recovery from the lows is possible and will hold.

– Jesse Livermore (1920s): “The market does not beat them. They beat themselves because though they have brains, they cannot sit tight.”

3. Optimism

– The bull market trends higher as optimism builds that the new upswing in price is accurate.

– John Templeton (1950s): “Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.”

4. Belief

– Investors start believing the bull market rally is sustainable and investing more aggressively. Prices rise steadily.

– George Soros (1970s): “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

5. Thrill

– Investors experience a thrill from rising prices. Sentiment becomes very bullish as investors rush to buy in.

– Paul Tudor Jones (1980s): “The most important rule of trading is to play great defence, not great offence.”

6. Euphoria

– A state of euphoria sets in as investors feel invincible. Speculative bubbles can form as greed drives prices to unsustainable levels. This is the bull market peak.

– Warren Buffett (1990s): “Be fearful when others are greedy and greedy when others are fearful.”

7. Complacency

– Investors remain complacent even as the market stops meeting expectations of excessive returns. Warning signs are ignored.

– Bernard Baruch (early 1900s): “The main purpose of the stock market is to make fools of as many men as possible.”

8. Anxiety

– As prices start falling, anxiety creeps in. However, many investors remain confident that the bull market will soon resume.

– Peter Lynch (1980s): “The key to making money in stocks is not to get scared out of them.”

9. Denial

– Investors are in denial as the market drops, seeing it as a temporary setback. They hold on to losing positions.

– Philip Fisher (1950s): “The stock market is filled with individuals who know the price of everything, but the value of nothing.”

10. Panic

– Panic sets in as prices plummet. Investors realize the bull market is over and engage in panic selling to cut losses.

– Benjamin Graham (1930s): “The intelligent investor is a realist who sells to optimists and buys from pessimists.”

11. Capitulation

– Investors give up and sell assets near the bottom during peak fear. The downtrend stops as selling is exhausted.

– John Maynard Keynes (1930s): “The market can stay irrational longer than you can stay solvent.”

12. Despondency

At market bottoms, investors experience a state of hopelessness. They are depressed and believe markets will never recover. Smart money starts accumulating.

– Nathan Rothschild (early 1800s): “Buy on the cannons, sell on the trumpets.”

13. Depression

– The market is depressed and trades sideways for an extended period. Negative sentiment keeps most investors away despite attractive valuations.

– Howard Marks (2000s): “The greatest risk doesn’t come from low quality or high volatility. It comes from paying prices that are too high. This isn’t a theoretical risk; it’s very real.”

14. Disbelief

– The cycle begins anew as initial bullish moves are met with disbelief. Most investors remain bearish while smart money continues accumulating.

– Sir John Templeton (1990s): “The four most dangerous words in investing are: ‘this time it’s different’.”

While these additional stages provide a more granular view of the market cycle, focusing on the four primary phases can help investors develop a solid foundation for understanding market dynamics and making informed investment decisions.

Conclusion

Understanding the psychology behind market cycles is crucial for investors seeking to navigate the ups and downs of the stock market successfully. By recognizing the four primary stages of the market cycle – accumulation, markup, distribution, and markdown – and the emotions that drive investor behaviour, such as greed, fear, confirmation bias, herd mentality, and loss aversion, investors can make more informed decisions and potentially avoid costly mistakes.

Legendary investors throughout history, from Joseph de la Vega in the 17th century to Warren Buffett in the present, have emphasized the importance of patience, discipline, and a long-term perspective when investing. Employing strategies such as maintaining a diversified portfolio, focusing on quality companies with solid fundamentals, and utilizing dollar-cost averaging can help minimize risk and maximize returns over time.

Through the contagion theory and market panics, it becomes evident that the stock market reflects not only economic realities but also a complex ecosystem of human emotions, technological systems, and information flows. Understanding and navigating this ecosystem requires a multidisciplinary approach, combining insights from psychology, technology, philosophy, and economics.

H.L. Mencken’s observation that “For every complex problem, there is an answer that is clear, simple, and wrong” is a fitting caution against oversimplification. Market panics, in all their complexity, defy simple explanations or solutions. However, by approaching them with analytical rigour, innovative thinking, and philosophical depth, we can hope to develop more robust strategies for managing and potentially benefiting from these tumultuous events.

In the end, the investor who can maintain their composure and clarity of thought amidst the chaos of a market panic – who can, in essence, be the calm eye in the storm of spineless rats – is best positioned to emerge not only unscathed but potentially strengthened by the experience. As we navigate the ever-evolving landscape of financial markets, let us strive to be not the panicked masses but the clear-headed few who can see opportunity in crisis and rationality in apparent chaos.

Enrich Your Knowledge: Articles Worth Checking Out

Why Diversification Is an Important Part of Investing: It’s Critical to Success