Black Monday Crash: Separating Hype from Reality

Dec 11, 2024

The infamous Black Monday crash of 1987 significantly impacted financial history. However, it’s important to note that today’s landscape is different. While there have been subsequent market downturns, such as the dot-com bust, the financial crisis of 2008, and the COVID crash, it’s crucial not to rely solely on the predictions of naysayers and self-proclaimed experts.

If individuals had blindly followed the advice of these so-called experts over the years, they would likely have faced multiple bankruptcies. It’s time to tune out the constant “death to the markets” song that some individuals have played for decades. One such example is Marc, who remains adamant that the market will crash, echoing sentiments he voiced back in 2016 when he predicted a Stock Market Crash in 2017. However, history has shown that the market’s resilience often surprises.

While a stock market crash could happen someday, it’s essential to recognize that today is not that day. Such an event may be a long way off. Astute investors should focus on the prevailing trend, just as they did during the Black Monday crash of 1987, rather than getting caught up in constant predictions of impending doom.

Navigating Contrarian Waters: Avoiding the Herd Mentality

In today’s financial landscape, it’s a familiar story—media headlines herald impending doom, backed by well-paid financial pundits ready to say anything for a price. This narrative may briefly rattle the markets, but it’s all part of the game. For astute investors, it presents a chance to snag well-managed companies at significant discounts.

History shows that markets have a knack for bouncing back from these episodes. While some might point to Japan’s long recovery, it’s crucial to recognize we’re now in the era of currency devaluation. Every nation seems eager to debase its currency, driven by economic pressures. In this environment, the usual rules don’t apply, and central banks often respond by injecting money into the markets.

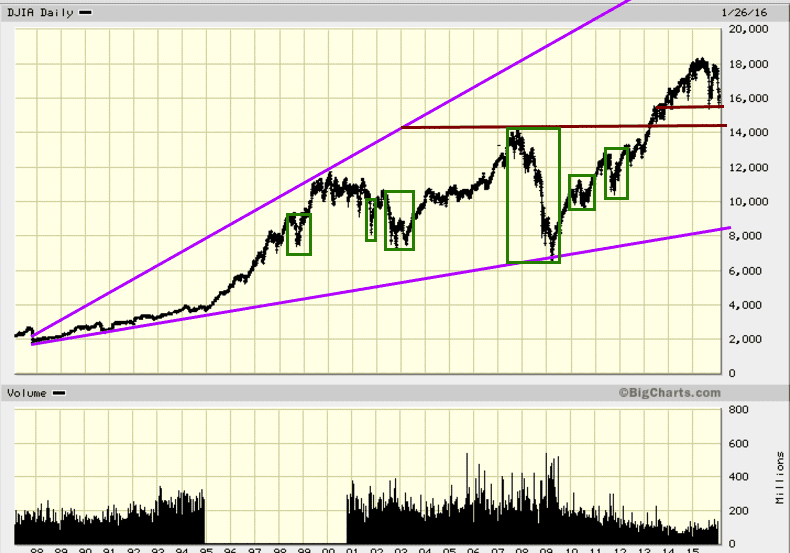

Amidst these uncertainties, a glance at the long-term Dow chart reveals a consistent pattern—every so-called disaster was, in reality, a buying opportunity. The lesson? Don’t follow the herd; trust in the resilience of well-run companies and the market’s ability to rebound.

Plato once advised, “Wise men speak because they have something to say; fools because they have to say something.” This wisdom rings true in today’s market dynamics, where the crowd’s noise often drowns out rational discourse. Similarly, Machiavelli’s observation that “Whosoever desires constant success must change his conduct with the times” underscores the importance of adaptability in investment strategies. Charles Munger, a modern sage in the investment world, echoes this sentiment with his philosophy of “invert, always invert,” urging investors to think differently from the masses to achieve superior results. These guiding principles from past and present thinkers fortify the contrarian approach: observing quietly, adapting strategically, and acting independently when opportunities arise.

Amidst these uncertainties, a glance at the long-term Dow chart reveals a consistent pattern—every so-called disaster was, in reality, a buying opportunity. The lesson? Don’t follow the herd; trust in the resilience of well-run companies and the market’s ability to rebound.

Crashes as Opportunities: Black Monday and Beyond

Our investment strategy is straightforward: never buy at the peak. Instead, we adhere to a simple rule – buy during panic and sell when euphoria reigns. Will anything change this year or in the future? Unlikely. Masses tend to panic when purchasing and become euphoric when they should sell.

As our Volatility Indicator reaches record levels, we anticipate increased market volatility. But here’s the key: This should be seen as a positive sign, as the trend is upward. Market crashes, including the infamous Black Monday, equate to buying opportunities for those who follow this contrarian approach.

Market volatility is a two-way street characterized by significant price swings in both directions. Considering the markets’ upward trajectory over the past seven years, the current correction, while robust, is not a cause for panic.

In navigating these turbulent waters, the wisdom of historical figures can be particularly enlightening. Warren Buffett, a modern investment guru, famously advised, “Be fearful when others are greedy, and greedy when others are fearful.” This aligns perfectly with our strategy of buying during panic. From a philosophical standpoint, Aristotle’s notion that “Knowing yourself is the beginning of all wisdom” encourages investors to understand their risk tolerance and investment philosophy deeply. This self-awareness is crucial when deciding to buy during market lows. Additionally, Benjamin Graham, often considered the father of value investing, emphasized the importance of an analytical approach and defensive investing, especially during market turmoil. His principles reinforce our strategy of seeking undervalued securities in downturns.

By integrating these timeless strategies with our understanding of market cycles, we position ourselves to capitalize on opportunities others might miss due to fear or misunderstanding. This approach aligns with historical wisdom and practical investment strategies that have stood the test of time.

Unravelling the Enigma of Mass Psychology in Financial Markets

Mastering the principles of mass psychology in financial markets is a Herculean task. It requires shedding the stale skins of outdated financial dogma and learning to swim in the murky, unpredictable waters of human emotion—where reason often sinks and panic swims. In the world of finance, the emotional pulse of the masses drives market chaos. Sell-offs, bubbles bursting—it’s a drama we’ve seen before, stretching back to the heady days of Tulip Mania. Yet, despite all the lessons history has imparted, irrational behaviours continue to steer market movements with alarming consistency.

Therefore, the crux of successful investing lies not just in numbers but in the psychological tapestry woven into the market’s movements. Identifying and following trends is the secret sauce—but even the most seasoned investors will tell you, this task is no walk in the park. It demands a nuanced understanding, a keen eye to see beyond the noise, and the courage to move in the face of uncertainty.

Embracing the Trend: Your Investing Companion

Once a trend is spotted, the investing path becomes considerably clearer. But this is no simple stroll; it’s more akin to finding a faint trail through a dense, overgrown forest. It requires patience, discipline, and willingness to depart from the safety of conventional thinking and explore uncharted territories.

As you step away from rigid, outdated strategies and adopt more modern, dynamic approaches, keeping a few things in mind is critical. One: it’s uncomfortable. The terrain of the financial market is littered with quicksand for the unprepared, and you’ll have to be adaptable. Two: you don’t need to leap into the deep end immediately. We offer various investment opportunities, each tailored to various trading styles and risk appetites. It’s about taking small, deliberate steps—each investment a calculated stride towards deeper understanding and greater confidence.

Wisdom from the Masters: Navigating the Psychological Maze

In this journey, the wisdom of historical and modern thinkers becomes indispensable. Take Daniel Kahneman, the father of behavioral economics, who teaches us that our biases and mental shortcuts—the same ones that fuel our gut reactions—often lead us astray. Kahneman shows us that understanding these cognitive traps can help us make more rational decisions, even when the markets are in a frenzy.

Then, there’s Friedrich Nietzsche. The German philosopher’s immortal line, “He who has a why to live can bear almost any how,” resonates deeply with investors. In times of market uncertainty, when the storm rage,s and all seems lost, it’s having a clear why—a solid investment philosophy—that keeps you grounded. That sense of purpose, that long-term vision, is your anchor in a world of market turmoil.

And lastly, the timeless wisdom of Sun Tzu, who famously instructed in The Art of War, “Know when to engage, and when to avoid the battle.” The same holds for investing. There are times when the market is a battlefield—chaotic and treacherous—and knowing when to stand aside rather than jumping in blindly is as crucial as knowing when to strike.

Mastering the Market’s Psychological Underpinnings

These perspectives offer a toolkit for navigating the psychological maze of financial markets. By blending historical insights with modern strategies, you’re better equipped to transform the vulnerabilities of market psychology into your greatest strengths. The key is this: when you understand the market’s mind, you’re not just reacting to its moods—you’re anticipating them, turning knowledge into strategy, and moving in ways that others won’t.

Ultimately, markets are driven by emotion, but successful investors don’t succumb to it. They master it. They harness it. And in doing so, they turn the unpredictable tides of financial fortune into something far more predictable—success.

Mastering Black Monday: Sell-Off Strategies with Psychology & Contrarian Wisdom

In the kaleidoscopic world of investments, few specters haunt investors more than the looming threat of a “Black Monday Crash.” The mere mention of it can send shivers down the spine of even the most seasoned market players. But here’s the secret they don’t tell you: in the aftermath of these sell-offs, hidden treasures of untapped opportunity are waiting to be unearthed—provided you have the insight, the patience, and the nerve to capitalize on them.

The key to seizing these opportunities lies in understanding the psychology of the masses and the power of contrarian investing. When fear and panic grip the markets, it’s often the time for savvy investors to open their eyes wider, not their wallets. In fact, these market convulsions, while jarring, often present the most fertile ground for financial growth, if you know how to harness them.

The Wisdom of Contrarian Investing and Mass Psychology

Contrarian investing is a concept as old as the market itself, but it is mass psychology that truly fuels its power. The trick is not simply opposing the crowd’s sentiment for the sake of rebellion—but understanding the emotional undercurrents that shape market movements. It’s about knowing when to swim with the current and when to let the wave crash against you.

When the masses stampede in one direction, whipped into a frenzy by irrational exuberance, a shrewd investor might not flee the scene. Instead, they may lean into the crowd’s optimism—recognizing that, in the euphoria of the moment, the market often overlooks the underlying risks. This is where the contrarian investor moves from cautious observer to active participant, riding the wave up, but always with an eye on the exit.

Conversely, when the market turns its back on a sector, abandoning it in a fit of collective fear, a master of mass psychology takes a different approach. Rather than succumbing to panic, they step back and observe—waiting for fear to reach its peak. In these moments, when the crowd has overreacted, opportunities to acquire undervalued assets emerge. Fear doesn’t evaporate overnight. The crowd’s collective anxiety lingers, but for the patient investor, these moments of fear often become the springboard for later success.

Turning Market Volatility into Strategic Advantage

Navigating the potential chaos of a Black Monday Crash requires more than a sharp mind—it demands the wisdom to recognize the opportunities buried beneath the surface of mass hysteria. By understanding the emotional dynamics of the market, investors can use volatility not as a warning signal but as a clarion call to action.

The truth is, it’s not about avoiding the storm but about knowing when to set sail. The principles of mass psychology and contrarian investing teach us that the most profitable moments often come when the market seems its most irrational. When fear dominates, when panic reigns, when the crowd is wrong—those are the times when the smartest investors seize the day, knowing that fortunes are made by those who can see beyond the chaos.

So, as the spectre of Black Monday looms, remember this: While others tremble, those who understand the psychology of the market are already planning their next move. In the tumult of sell-offs and crashes, the truly adept investors recognize that volatility is not their enemy. It’s their playground.

Other related stories