Inflation Tax: The Stealthy Nemesis Eroding the Middle Class in America

Inflation, according to the Merriam-Webster online dictionary, is defined as follows: a continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services.

Most of us have experienced the impact of inflation in our lives in some shape or form. However, economists and central bankers have defined inflation as an increase in the prices of goods. This definition is a clever way to hide the truth as the actual definition of inflation is an increase in money supply. By inflating the money supply and managing the cost of certain goods, they create the illusion that all is well, and most people associate inflation with a rise in prices.to control the cost of everyday goods by providing massive subsidies to companies.

The idea behind this is simple – by offering subsidies, the prices are kept in check, and the cost of certain goods is controlled to mask the effects of inflation. For instance, if a farmer needs to sell a gallon of milk for $1.50 to earn a profit, the government can manipulate the price and bring it down to $1.00 per gallon. However, to sustain the farmer’s livelihood, they can offer 50 cents per gallon subsidy.

The consumer might think that everything is excellent, as the milk price appears to be low, and the farmer is happy because he is making a profit. However, the cost of other essential things like college education, rent, etc., will increase much faster. The net result is that you will end up becoming poorer than you were before.

Inflation can be used to one’s advantage.

As an investor, it’s important to find investments that outpace inflation. For instance, investing in key stocks now can lead to significant gains. But why have the markets been so volatile lately? One reason is that central bankers have injected large amounts of money into the market after each disaster. While a disaster can be seen as something terrible, it can also be viewed as an opportunity waiting to be discovered, depending on one’s perspective. As long as fiat currency exists, market crashes will continue to be long-term buying opportunities – a view supported by historical data.

The poor become poorer.

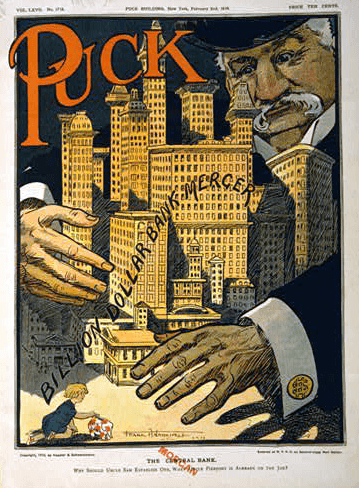

The only problem with inflation is that, for the most part, the poor become poorer and the unprepared move down 1-2 ranks. That is why the “poor become poorer, and the rich get richer” while the middle class gets wiped out. We have bloodsuckers at the helm of the banking system; their inflationary tactics are designed to produce different benefits. Generally, if one inflates and spreads the money equally, individuals won’t feel the pinch as the price will rise proportionally to reflect this increase in the money supply.

That would be too nice for central banks; their idea is to make a killing and to do that, the masses have to be milked. They want to inflate as much as possible and, simultaneously redistribute as little as possible of the new money they have just created out of thin air. The masses don’t understand that inflation is a silent killer tax, and at the end of the day, they will pay the tax. A once full purse is now ¾ full; in other words, a particular portion of your money has been confiscated, and most are none the wiser.

China’s Cheap Goods Masking Inflationary Pressures: A Market Insight

The current scenario reveals a paradox: while manufactured goods from China remain remarkably affordable, housing prices are soaring. Despite commodity price fluctuations, housing affordability, especially in major cities, is becoming increasingly challenging. Salaries lag behind monetary inflation levels, and the apparent affordability of houses is often an illusion created by artificially low interest rates, leading new buyers to accumulate unsustainable debt.

Although inflation disproportionately affects the majority, savvy investors can thrive by identifying opportunities in an inflationary environment. Contrary to some gold enthusiasts’ claims, the stock market stands out as a prime avenue for capital growth surpassing inflation rates. Comparing the trajectory of gold prices since 1980 with the Dow Jones reveals the superior returns achievable through strategic investments in key blue-chip stocks. While gold holds a place in a diversified portfolio, prudent investors diversify across multiple vehicles rather than relying on a single investment.

Gold: Not the Sole Solution to Financial Challenges

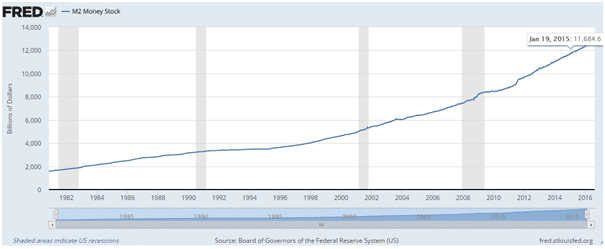

It’s crucial not to view gold as a universal remedy for financial concerns. Since 2011, despite a substantial increase in national debt, gold has faced challenges. Investing in gold makes sense during specific periods, such as the bullish trend observed from 2003-2011. Currently, gold appears to be forming a bottom, hinting at a potential upward trend. While markets, including gold, operate in cycles, it’s essential to recognize that every investment has its phases. In 2017, gold is anticipated to perform better than in 2016, reflecting the cyclic nature of market trends. Despite the surge in the money stock, gold prices have declined since 2011, underscoring the reality that, like any other sector, gold cannot sustain an upward trend indefinitely.

Turning Inflation to Advantage: Strategic Moves Beyond Gold

An insightful investor recognizes opportunities beyond gold, leveraging inflation for strategic gains. Notably, the housing market saw a significant price surge at the close of 1999 and early 2000, making real estate a lucrative investment until around 2003. Sensibly, in 2006, as the crowd enthusiastically embraced real estate, astute investors exited the market.

The dot-com bubble serves as another illustration. From 1996 to 1999, owning dot-com stocks proved profitable, but when euphoria swept the crowd, a wise move was to exit. These examples underscore the importance of timing and adaptability in investment strategies, showcasing how perceptive investors capitalize on inflationary trends beyond traditional assets like gold.

If you thought education was expensive, try a lifetime of ignorance

The simple steps mentioned above can help one find ways to deal with the evil effects of inflation

Why Gold Enthusiasts, Even Goldbugs, Secretly Cheer for Inflation

The irony persists: nearly every Gold bug quietly hopes for inflation. The rationale becomes clear when anticipating Gold to surge to $1,500, $2,000, or even $3,000; in essence, they are betting on inflation. Gold prices serve as a leading indicator, signalling underlying issues within the banking system and a potential loss of control over the monetary supply. In the later stages, fear amplifies, propelling Gold prices into the stratosphere as investors seek refuge for their assets. The final phase is marked by euphoria, where the crowd, convinced of Gold’s infallibility, enters the market, often signaling a prolonged peak before a downward spiral for the masses ensues.

Inflation’s Silent Allies: Real Estate and Stock Investors

Real estate investors, like their counterparts in the stock market, quietly root for inflation, hoping for a surge in property prices. Upon reflection, it becomes evident that inflation offers substantial benefits to astute investors. Loose monetary policies, driven by inflation, propel individuals and businesses to take on more market risks, driving the market to new highs. The persistent climb is fueled by ultra-low interest rates that fail to cover inflation costs, pushing investors to seek higher yields and embrace increased risk.

For those savvy enough to choose the right investments, returns outpace the rate of inflation by several orders of magnitude. This phenomenon perpetuates wealth inequality, with a select group of elite investors and central bank associates reaping substantial rewards. The stark reality emerges: a small cadre of insiders, armed with privileged information, capitalizes on market shifts long before the broader public becomes aware.

Combatting Inflation: Seize Opportunities in the Marketplace

Life is a vast marketplace, where success for some often means a loss for others. In this dynamic, not everyone can emerge victorious, nor should everyone bear the brunt of defeat. The reality is that wealth accumulation often involves a redistribution rather than a true loss. Money, in essence, merely shifts from numerous pockets into a consolidated, prosperous one.

Reflecting on the NASDAQ crash in 2000 dispels the myth of wealth loss. Trillions of dollars didn’t vanish; instead, they migrated from the pockets of hundreds of thousands, if not millions, into the hands of a select few thousand. The key lies in recognizing and navigating these market shifts, leveraging them to safeguard wealth and potentially flourish even in the face of inflationary pressures.

Navigating the Perception of Inflation: Focusing on Trends Over Noise

While we don’t condone or celebrate inflation, the reality is that public perception shapes the narrative. What we individually think might not hold weight; it’s the collective belief that matters. Governments recognize the power of public education in shaping perceptions, and manipulating information to align with their agendas.

Today’s youth, often unaware of gold as currency, label it an ancient relic due to a lack of understanding about hard money. Many are unfamiliar with the true definition of inflation, focusing on its symptoms rather than the underlying issue. Advising on how to deal with inflation becomes challenging, as false definitions abound.

The key lies in concentrating on the trend rather than getting lost in the noise. Understanding that trends are allies while noise serves as a distraction allows for a more informed approach to navigating the complexities of inflation in the broader societal mindset.

Decoding Central Banks: Unveiling Contrarian Insights into Mass Psychology

While the prevailing sentiment accuses central banks of exploiting the masses, adopting a contrarian perspective reveals a nuanced reality. Central bankers, seasoned in their strategies, maintain a consistent approach. Though a day may come when they appear to falter, predicting this moment is uncertain, possibly beyond one’s lifespan. Rather than subscribing to the naysayers’ club, characterized by loud proclamations of pessimism, a more strategic approach involves focusing on trends and discerning opportunities amid the complexities of inflation.

Contrarian thinking suggests that central banks’ actions, perceived as exploitation, may be strategic moves within the broader game. Mass psychology often amplifies negativity, creating a narrative where central banks are solely fleecing the masses. By steering away from the noise and concentrating on discerning trends, investors can potentially uncover opportunities hidden within the prevailing perceptions. In this intricate dance between central banks and the masses, understanding the psychological dynamics offers a unique perspective for strategic decision-making.

Inflation Tax: A Silent Wealth Eroder Revealed

Inflation Tax silently erodes the wealth of Middle-Class America, where rising prices outpace stagnant salaries. Unveiling the true definition of inflation — an increase in money supply — exposes the cunning tactics of economists and central bankers. The illusion of affordability, created by managing select goods’ costs through subsidies, masks the broader impact of inflation on essential items like education and housing.

Turning the tables, strategic investors can thrive by aligning with inflation’s dynamics. Market crashes, often viewed as disasters, become long-term buying opportunities when seen through a historical lens. However, the bitter truth lies in the widening wealth gap; inflation tends to make the rich richer while the middle class dwindles. Recognizing inflation as a silent killer tax is essential, as the masses unwittingly pay the price. As China’s cheap goods obscure inflationary pressures, market insights reveal the paradox, offering a glimpse into the complexities of inflation and its varied impacts on different sectors.

Inflation’s allies, real estate, and stock investors, quietly root for its surge, leveraging the market’s response to loose monetary policies. A discerning investor recognizes opportunities beyond gold, understanding the cyclic nature of market trends. Illustrations from past market dynamics, such as the dot-com bubble, underscore the importance of timing and adaptability in investment strategies.

Education becomes a vital tool to combat the pervasive effects of inflation, with strategic moves beyond traditional investments providing avenues for financial growth. Even as Gold enthusiasts secretly cheer for inflation, a contrarian perspective unveils the intricate dance between central banks and the masses. By focusing on trends over noise, investors can navigate the complexities of inflation and uncover opportunities hidden within prevailing perceptions. The path to financial resilience lies in strategic decisions, adapting to market shifts, and seizing opportunities in the ever-evolving marketplace.

In spite of the cost of living, it’s still popular. Kathleen Norris, 1880-1966, American Novelist

“Originally Published on: Dec 5, 2016, Updated with the latest information, Last Update: Oct 2023”

Discover Unique Articles for Your Interests

Mass Psychology & Financial Success: An Overlooked Connection