Financial anxiety: Short-term market outlook

Feb 2, 2023

The following projections were curated from the November 28th Market Update, providing an overview of our trading methodology. We also focus on the long-term outlook; however, as those cycles are still in play, long-term outlooks are only posted six months after publication.

Stock Market

Barring another black swans event like the Fed coming out with the intent of purposely killing this rally or some massive change on the geopolitical frontier, the momentum has changed, and the path of least resistance is up. Market update October 31, 2022

The next obstacle for the Dow would be to finish the week at or above 32,910. If the Dow can do this, it would further cement the outlook, calling for a test of the 34,300 to 34,650 range. Risk takers should limit their exposure to the long side after the Dow trades to 32,910 or risk significantly less money. Market Update November 9, 2022

It ended the week above 32,910 and then mounted a powerful rally that took it to 34,386K before it reversed course. Bullish sentiment readings have been below their historical average for 12 months, indicating that the markets are still climbing a wall of worry.

In a surprise move, the MACDs on the weekly charts of several indices have experienced bullish crossovers, suggesting that the Dow is on course to test the 35K range, barring a black swan event. It also indicated that the Nasdaq (the weakest of the pack) could pull a Houdini and mount a powerful rally over a short period. This is discussed in more detail in the Advanced section, under the sub-heading “random musings.”

Only traders willing to take on higher amounts of risk should consider opening new longs. Consider waiting for the Dow to test the 32,910 to 33,000 range before committing new money.

The Dollar Index (https://cutt.ly/JBIKyxY )

So far, 109 continues to hold. We suspect there will be a swift move to the 105 range when it gives way. Market Update November 9, 2022

This has come to pass; the dollar traded as low as 105.15 before reversing. As it is still in a corrective mode, all rallies will fail until the dollar is trading in the oversold ranges on the weekly charts. There is still a good chance it could test the 101 to 102 range with a possible overshoot to 99.00. On a separate note, a weak dollar is bullish for the markets as it negates the effects of higher rates.

Bitcoin

A weekly close below 18k will lead to a series of new lows, and a move to new lows at this stage would equate to a selling climax. Market Update November 9, 2022

A break below 15K will lead to a test of the 12K ranges with a possible overshoot to 9K. Until it closes above 17,550 on a weekly basis, the short-term outlook will remain bearish.

Bonds (https://cutt.ly/2BIKcqC )

TLT must close at least above 104.10 on a weekly basis (the ideal level would be 105.00). Market Update November 9, 2022

A weekly close at or above 105 should lead to a test of 120-123 with a possible overshoot to the 128.00 to 132 range. Until then, the action will remain volatile.

Oil

Oil ended the week above 90, so the outlook has turned positive. For the bias to remain positive, it should not close below 84 on a weekly basis. Market Update November 9, 2022

It ended the week below 84 and could test the 74-75 ranges before attempting to trade past 84.00. The long-term outlook still calls for a possible test of the 2022 highs. In the interim, a test of the 69 to 72 ranges is possible before a bottom takes hold. The China COVID façade will end. China is using soft power to show the West that the world economy can’t operate smoothly without it (the factory of the world). Oil is still expected to test the 102 to 105 ranges before a long-term top is in place.

Conclusion

Investing in the stock market is not for the faint of heart. While many blindly follow the bullish trajectory, it is essential to consider the often ignored yet crucial elements that can drastically impact the markets, such as the state of the economy and geopolitical events. These “black swan events” can instantly turn the tide and leave those who failed to prepare to hold the bag.

Contrary to popular belief, blindly following the crowd is not always wise. Those willing to challenge the status quo and take calculated risks may find new opportunities by opening long positions while others wait for the Dow to test a specific price range.

Dollar Index

A deep dive into the analysis of assets like the Dollar Index, Bitcoin, bonds, and oil can provide valuable insights into the actual state of the markets. For example, the current corrective mode of the Dollar Index may present a unique opportunity for those willing to challenge the norm. Similarly, despite the current bearish phase of Bitcoin, a daring few may see this as an opportunity to buy the dip.

However, it must be acknowledged that the markets are subject to constant change and unexpected events. Staying informed and adapting to shifting market conditions is crucial for success in this ever-changing landscape.

In conclusion, for those not satisfied with blindly following the herd, a contrarian approach to investing in the stock market may lead to new opportunities and potential rewards.

The Dangers of Financial Anxiety in Investment Decisions

Here are some studies and articles that show that financial anxiety can lead to wrong investment decisions:

The Psychology of Investing” by John R. Nofsinger (2002) – This book explains how emotions and biases can impact investment decision-making, including the impact of anxiety on investments.

Financial Anxiety and Household Saving Behaviour by Michael Haliassos and Thomas J. Michaud (2015) – This paper examines the relationship between financial anxiety and saving behaviour and how stress can negatively impact investment decisions.

Investor Behavior: The Psychology of Financial Planning and Investing” by H. Kent Baker and Victor Ricciardi (2013) – This book explores the impact of psychological factors, such as anxiety, on investment behaviour and decision-making.

Fear and Greed in Financial Markets: A Clinical Study of Day-Traders” by Sven-Åke Nilsson and others (2010) – This study explores the impact of fear and greed on financial decision-making, including how anxiety can lead to impulsive, poorly thought-out investment decisions.

Links to the above resources:

The Psychology of Investing

Financial Anxiety and Household Saving Behaviour

Investor Behavior: The Psychology of Financial Planning and Investing

Fear and Greed in Financial Markets: A Clinical Study of Day-Traders

Financial Anxiety: buy when the crowd is scared

- “Sentiment and Stock Return Evidence from the Brazilian Stock Market” by Fernanda Geremia and João Frois Caldeira, Revista de Administração Contemporânea (2017): This article examines the relationship between investor sentiment and stock returns in the Brazilian stock market. The results suggest that buying when investors are anxious can lead to higher returns.

- “Investing in times of uncertainty: How to avoid panic and stay focused on your goals” by Marianne Bertrand and Luigi Zingales, Chicago Booth Review (2020): This article discusses the benefits of investing during times of uncertainty and provides strategies for avoiding panic. The authors suggest buying when others are anxious can lead to long-term success.

- “Anxiety, attention, and investment performance” by Suzanne B. Shu, John W. Payne, and Namika Sagara, Journal of Behavioral Finance (2019) examines the relationship between anxiety, attention, and investment performance. The results suggest that anxious investors tend to pay more attention to their investments, which can lead to better performance.

Sources:

- https://www.scielo.br/j/rac/a/nyTtTgcTswsJy9sGhNt22RG/?lang=en

- https://review.chicagobooth.edu/finance/2020/article/investing-times-uncertainty-how-avoid-panic-and-stay-focused-your-goals

- https://www.tandfonline.com/doi/abs/10.1080/15427560.2019.1627296

Other Articles of Interest

Permabear: The Unique Mindset of Challenging Optimism

Stock Market Cycle Dynamics: From Fear to Fortune in the QE Era

Embracing Contrarian Meaning: The Magic of Alternative Perspectives

Market Bear: Unraveling the Myths and Realities of a Bear Market

The Level of Investment in Markets Often Indicates Key Trends

Stock Market Bull 2019: Embrace the Trend, Ignore the Noise

The Paradox of Life: Mastering the Art of Harmonious Balancing.

Peak Oil Theory: Unmasking a Potential Price Gouging Scheme

Profits Unlimited: Myth or Money-Making Reality?

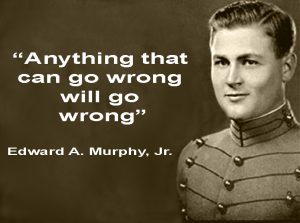

Murphy’s Law and the Stock Market Fear Index: A Cautionary Tale

Vanguard High Yield Dividend Fund: Elevate Your Returns

Random Thoughts: Web of lies Woven by Powerful Individuals

History of Financial Markets: Masses in the Dance of Destiny

Nasdaq TQQQ: Amplified Returns and Double-Edged Risks