Fed’s only option to lower inter

Money Saving Challenge

Updated Dec 2022

How Can I Save Money When Fed Wants to Lower Rates:

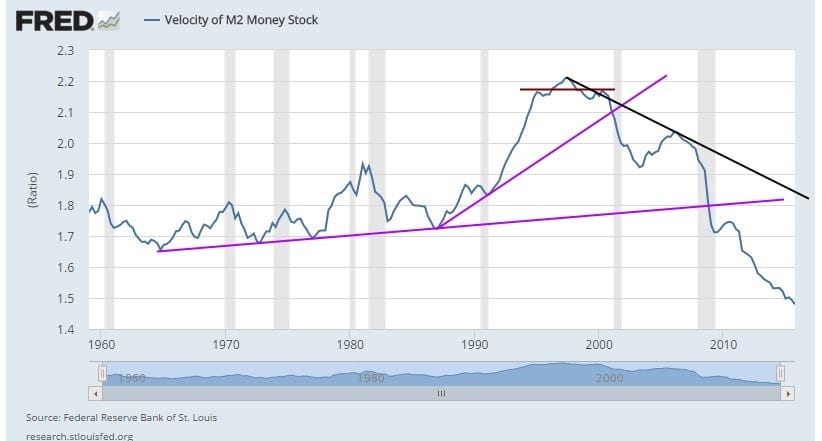

The straightforward and easy-to-understand chart below clearly illustrates why the Fed has no option but to lower interest rates. Central bankers worldwide have already embraced negative rates, so it is just a matter of time before our central bankers are forced to walk down the same path.

The Fed is trying to put on a brave act, but you can already see them backtracking from the firm stance they took last year. They state that all is not well, and the economic outlook is weaker than expected. Rubbish, we already said in several articles that they would take this path and that they only raised interest rates to come out with an excuse to lower them again.

Economic Boom Equates To Increase In the VM

As demonstrated in the chart below, the velocity of money (VM) has been in a precarious decline, which implies that the market is being propped up solely by hot money. This illusory economic recovery is highly reliant on the continuous inflow of hot money, and the moment that support is withdrawn, the economy will crumble.

The chart shows that VM peaked in 2000, forming a double-top formation. Although we did see a small rise when Greenspan flooded the market to create the housing bubble, the VM failed to reach its previous high. Since then, the velocity of money has continued to decline, which has resulted in a decrease in gold prices. Even though the money supply has increased, the funds are not being circulated. The general public doesn’t have access to these funds yet.

If the Fed wants to create a massive bubble, it needs to get the money into the hands of the masses. Only the public is foolish enough to push markets to unimaginable heights, which is why we’re confident that the Fed will release another stimulus plan. The current economic recovery is solely being sustained by hot money and nothing else.

Fake Recovery Limits Feds Options

If the recovery were natural, interest rates would not be held low for so long, and the Fed would need to support the stock market. After it stopped, the corporate world stepped in via the illegal usage of Stock Buybacks. Now instead of trying to improve the bottom line, they focus on only buying back more shares and, in doing so, artificially boosting the EPS. It’s a perfect scam, no work and big pay, and as interest rates are low, the incentive to borrow large sums of money to do these dirty deeds is more significant than ever. As a result of this policy, investors should expect stock buybacks to surge to levels that will appear insane one day.

The answer to How can I save money question is straightforward. Invest in the stock market and view all pullbacks ranging from mild to wild as opportunities.

Negative Interest Rates and the War on Cash

Overview of Money Saving Challenge

Inflationary times can be challenging for individuals and families to make ends meet. Rising prices can lead to a decrease in purchasing power and an increase in financial stress. One way to combat the effects of inflation is by participating in a money-saving challenge. A money saving challenge is a structured program designed to help people save money over time.

Many different types of money-saving challenges can be adapted to inflationary times. For example, a 52-week savings challenge involves saving a set amount each week for a year. The amount saved each week can increase over time to account for inflation. Another option is the envelope method, where cash is divided into different envelopes for different expenses, such as groceries and transportation. This method can help control spending and prevent overspending during times of inflation.

Participating in a money saving challenge during inflationary times can provide many benefits, such as building an emergency fund, reducing debt, and increasing financial security. It can also help individuals and families adjust to the rising cost of living and develop good financial habits for the long term.

To get started with a money-saving challenge, setting specific goals and tracking progress over time can be helpful. Many online resources, such as blogs and websites, provide tips and strategies for saving money during inflationary times.

Other articles of interest

For as long as the Fed has existed its only mandate has been to defraud the populace and gain control of the Government and in those two areas it has succeeded. The only way to end this system is for the masses to rise otherwise the pain will continue.

I never see any dates on these articles so I am not sure if this was written prior to the election or after?