Perception Management: The Rich Get Richer at the Expense of the Poor

Like every other Federal reserve bank, they have a mission only; Inflate the money supply or die trying.

Perception Management 101: Why the So-Called Economic Recovery is Just Smoke and Mirrors

The current state of the global economy is a result of central governments worldwide pumping in cheap money, which businesses are using to expand, leading to a rise in overall spending and increased employment. However, this situation creates a potential house of cards scenario, where the removal of hot money could cause the entire system to collapse. While some experts argue that the end of the flow of hot money will lead to chaos, there are several holes in this argument.

Firstly, governments have a vested interest in maintaining the economy’s stability, and they will likely take steps to mitigate any negative impacts. Secondly, the current low-interest-rate environment and the excess liquidity in the system may persist for a more extended period than anticipated, allowing businesses and investors to adjust to the new normal. Finally, ongoing technological advancements and innovation may provide new opportunities for growth and stability in the economy.

Overall, while the situation is not without risk, it is crucial to consider the broader context and the potential opportunities that could arise from the current state of the global economy.

The Rich Get Richer: Central Bankers’ Mission to Inflate or Die

Central bankers are experts in perception management. They understand that if they pull back on the cheap money flooding the economy, everything will collapse. Therefore, they will continue to flood the system with money while occasionally pretending to ease off to create the impression that they are worried about inflation. But this is just a façade, as they see the masses as cannon fodder and couldn’t care less about what happens to them.

Their overall goal is to destroy the currency or die trying to do so. This process allows the rich to become even richer, while it crushes most of the middle class and imprisons the underprivileged. It’s a game of perception, and the central bankers are the masters of this game, manipulating the masses into believing that what they are doing is in their best interest. But in reality, it’s a well-orchestrated plan to maintain power and control. The sad truth is that most people are unaware of this manipulation and continue to trust the system, never realizing that they are being played for fo

Random Musings on Investing

You buy during times of uncertainty and bank profits during times of certainty. Markets never climb a wall of joy; they climb a wall of worry and plunge down a cliff of Joy. Sol Palha

It’s interesting to observe how investors behave in the market, especially when it comes to taking a position. When the markets were plummeting last year, we were urging investors to buy, but many were hesitant. Now, with the markets on an upswing, some investors are eager to jump in, despite the market conditions being less favourable for buying. This seems to be a classic case of the “secret desire to lose” syndrome, where investors are wired to make poor decisions and suffer losses.

It’s important to understand that the average mindset is wired to lose, and certainty about the markets is usually a signal that it’s time to be cautious. In contrast, times of uncertainty can be the best times to buy, while times of certainty may be a signal to take profits. The markets tend to climb a wall of worry, and when investors become too complacent, they can fall off a cliff of joy.

Emotional investing can lead to losses – check your feelings at the door

As an investor, it’s crucial to check your emotions and biases and look at the market objectively. A disciplined approach to investing, using technical analysis to identify trends and opportunities, can help you stay ahead of the curve. By remaining patient and taking a long-term view, you can avoid falling prey to the desire to make hasty decisions that could lead to losses.

In conclusion, to be a successful investor, it’s essential to understand the market’s cycles and the importance of taking a disciplined approach. As the market sentiment shifts, it’s crucial to remain objective and avoid falling prey to the “secret desire to lose” syndrome. By keeping your emotions in check and following a sound investment strategy, you can weather the market’s ups and downs and achieve long-term financial success.

The madness gripping the bitcoin sector indicates that when this market corrects, it is likely to shed at least 50% from its highs if not more. The Dumb money is now chasing the tail end of the move; they always buy high and sell low. Market Update Jan 10, 2021

The Power of Perception Management in Financial Markets

Perception Management is the act of shaping or influencing public opinion by managing how information is presented to the public. It is a tool that is often used by governments, corporations, and individuals to control the narrative and manipulate public opinion.

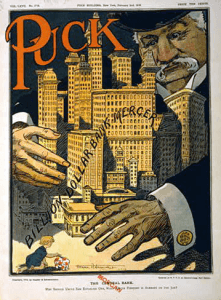

One area where Perception Management is particularly evident is in the economy. Central banks around the world have flooded the economy with cheap money, creating the illusion of economic growth and stability. However, this growth is artificial and unsustainable, and the resulting economic boom will eventually turn into a bust.

Shaping Public Perception to Protect the Wealthy

Investors must be careful not to get caught up in the hype of the perceived economic recovery. Emotions must be checked at the door to avoid risking losses. Investing in the stock market requires a disciplined approach, and the use of technical analysis can provide valuable insights into market trends and opportunities.

In short, Perception Management plays a crucial role in shaping our understanding of the world and influencing our decisions. To avoid falling victim to its influence, it is essential to remain disciplined and objective in our analysis and decision-making.

Summary on the subject of Perception Management

Investors’ eagerness to jump into the markets is a classic example of the secret desire to lose syndrome, as the average mindset is wired to lose. Certainty about the markets is often the best signal that one will get hammered, and markets climb a wall of worry and plunge down a cliff of joy.

While some experts argue that central bankers flooding the economy with cheap money will lead to a collapse when they eventually stop, the reality is that they know full well that if they pull back, everything will crumble. Their overall theme is to destroy the currency, regardless of the impact on the masses. The result is that the rich get richer, while the middle class disappears and the impoverished are imprisoned. The central bankers’ perception management tactics, such as occasional easing off to create the impression of concern about inflation, are a smokescreen to maintain control and protect the wealthy.

Research

Here are some articles that provide support for the thesis of this article

- “The Fed has flooded the economy with cheap money. Why?” – The Week Link: https://theweek.com/articles/971911/fed-flooded-economy-cheap-money-why

- “The Fed Has Created an Unprecedented Disaster for Pension Funds” – The Street Link: https://www.thestreet.com/mishtalk/economics/the-fed-has-created-an-unprecedented-disaster-for-pension-funds

- “The US is heading towards a reckoning between the haves and have-nots” – The Guardian Link: https://www.theguardian.com/business/2021/mar/14/the-us-is-heading-towards-a-reckoning-between-the-haves-and-have-nots

- “The Fed’s Debt Bomb” – The American Conservative Link: https://www.theamericanconservative.com/articles/the-feds-debt-bomb/

Other Articles of Interest

Embracing Challenges, Seizing Opportunities: Investing in China

Euro ETFs: Navigating the Investment Landscape

Short Dollar ETF: Navigating the Financial Markets

Why Is Freedom of Speech Important? Embracing It as Our Birthright

BBC Global 30 Index: Forecasting Profit or Peril

Enhancing AI Dangers Awareness: Understanding the Risks

Digital Currency Group: Leading the Way in Cryptocurrency Innovation

Denmark Anti-immigrant Ads: U.S. helpless against Russian hardware

Artificial Intelligence Investing is transforming investment strategies

The Patient Investor: Unveiling the Realm of the Strategist

Ishares robotics and artificial intelligence etf: A Financial Odyssey

Inflation Tax: Stealthy Threat to Middle-Class America

Mastering The Boom and Bust cycle: Buy High, Sell Smart

Unveiling Banking Scams: Deceitful Schemes Targeting the Masses

BIIB Stock Price Analysis: To Bet or to Fold the Cards

Musk Feuds With Coal Company Exec who call him out