March 12, 2024

Emotions in Investing: Transforming Pain and Misery into Strategic Success

Understanding the cyclical nature of market psychology is a cornerstone in mastering emotions in investing. The investment landscape often reflects alternating periods of investor panic and contentment, with the market acting as a pendulum that swings between these emotional extremes. It is through recognizing that rationality will prevail after periods of heightened volatility, allowing markets to stabilize. For example, during the inflated dot-com era, emotions ran high, and many investors were driven by a fear of missing out, leading to poor investment choices. However, those who held steadfast to their long-term investment strategies and refrained from emotional decision-making could endure the downturn and benefit from the subsequent market correction.

Embracing Long-Term Emotional Resilience

The investing journey is often a test of emotional endurance as much as financial acumen. Emotional resilience in investing is the ability to maintain a long-term perspective, focusing on enduring principles such as valuation, dividends, and competent management, especially during times of crisis. This resilience separates successful investors from the rest, allowing them to see beyond the immediate turmoil and recognize the potential for recovery and growth.

Historically, top-notch investors from different eras have demonstrated this emotional fortitude. Let’s consider two examples to illustrate how mastering emotions in investing has always been a timeless strategy for success.

Benjamin Graham, often known as the father of value investing, was a beacon of resilience during the Great Depression. While others were driven by fear and despair, Graham’s focus on intrinsic value and the margin of safety principle allowed him to identify undervalued stocks that would eventually rebound. His disciplined approach, which he later taught to Warren Buffett, was rooted in the belief that the market’s emotional swings provided opportunities for those who could assess value with a clear mind.

Going further back, Baron Rothschild, a British financier from the 19th century, famously said, “The time to buy is when there’s blood in the streets.” He understood that emotional extremes in the market could lead to mispriced assets. During the panic following the Battle of Waterloo, Rothschild bought while others were selling in fear. His ability to detach from the prevailing emotions of the market and make calculated decisions based on potential value rather than current sentiment led to substantial wealth accumulation.

These historical figures exemplify the importance of mastering emotions in investing. They show that while the market may be susceptible to emotional cycles of pain and misery, the individual investor need not be. By adopting a long-term view and focusing on the fundamentals, investors can overcome emotional challenges and turn them into opportunities for significant financial gain.

Patience as an Emotional Anchor in Wealth Cultivation

Investment chronicles are studded with tales of individuals who have harnessed the power of patience to cultivate wealth. This patience is a testament to their ability to master their emotions in investing, a quality that has distinguished them in the annals of financial history.

From the 20th Century: Sir John Templeton

Sir John Templeton is a prime example of a 20th-century investor who demonstrated remarkable patience. Templeton’s global investment perspective led him to buy undervalued stocks worldwide, famously purchasing 100 shares of every stock trading below $1 per share on the New York and American Stock Exchanges during World War II. While others were consumed by short-term fears about the war’s outcome, Templeton’s patient approach paid off handsomely in the post-war boom. His tempered emotional response to market fluctuations allowed him to invest with foresight and discipline.

From the 18th Century: Thomas Jefferson

Rewinding to the 18th century, we see the patience of Thomas Jefferson, the third President of the United States and an astute land investor. Jefferson believed in the potential of agricultural land and its ability to produce wealth over time. Despite his era’s political and economic uncertainties, he remained focused on the long-term potential of his investments, often ignoring the speculative bubbles that distracted less patient investors.

These two figures underscore the timeless nature of patience as a crucial element in managing emotions when investing. By staying their course amidst market hysteria, they realized gains that those succumbing to short-term panic could not. It’s the investor who can wait out the market’s emotional storms who often reaps the greatest rewards, proving that patience is indeed more than a virtue in investing—it’s a strategy for enduring success.

Avoiding Impulsive Decisions

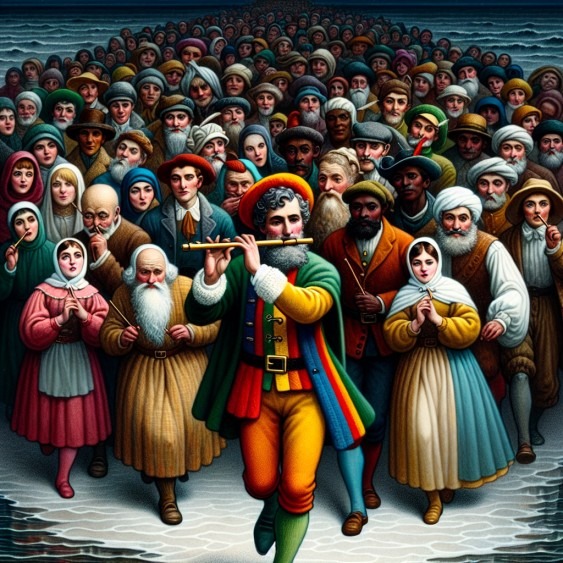

Patience is the bulwark against the siren song of impetuosity. It equips investors with the fortitude to transcend the ephemeral lures of market swings and emotional upheavals. A long-term outlook fortifies investors against the winds of change, anchoring them to their ultimate financial aspirations and safeguarding them against transient losses.

The patient investor is akin to a seasoned hunter, biding their time to strike when the moment is ripe. Market downturns and undervaluation periods are the hunting grounds for such investors, who, through their prudence, discern the opportune juncture to secure assets at bargain prices, setting the stage for future gains.

Harnessing the Power of Compounding

The magic of compounding is patience’s most profound gift. It is the silent multiplier, the force that turns a trickle into a torrent. Growing quietly but firmly, compound interest can transform modest initial investments into substantial wealth over extended periods, exemplifying the adage that time is money.

The ebb and flow of markets are as natural as the cycles of nature. Patient investors are the mariners who, rather than fighting the storm, ride out the waves. By maintaining their investment course through the storms of volatility, they emerge in calmer waters, often with their assets intact and primed for growth.

Historical data commend the virtues of longevity in investment. Buffeted by fewer extremes, long-term performance often yields a more predictable and favourable outcome. Investors who adhere to their strategies through thick and thin are more likely to reach their financial summit.

Recognizing the Cyclical Nature of Market Psychology

Amid the market’s transitory turbulence, it is crucial to maintain patience and prudence. Market psychology often behaves like a pendulum, swinging between panic and placidity. It is essential to understand that volatility normalizes after abnormal intervals by its very nature, as rationality inevitably reasserts itself, even in turbulent markets.

For example, during the dot-com bubble of the late 90s, many investors succumbed to the fear of missing out. They invested heavily in internet-based companies, many of which were significantly overvalued. When the bubble burst in 2000, these investors suffered heavy losses. However, those who maintained their focus on long-term views and value investing principles could weather the storm and even capitalize on the market correction.

Conclusion

In conclusion, investing is not just about the numbers and the analysis—it’s also about understanding and mastering one’s emotions. The investors who have thrived over centuries have cultivated emotional resilience, allowing them to withstand the market’s inevitable fluctuations and capitalize on the opportunities that arise from them. Whether it’s the Great Depression or the financial crisis of 2008, the lesson remains the same: emotional resilience is key to long-term success in investing.