Dow Theory Forecasts: When Market Psychology Breaks the Chart, Not the Cycle

April 09, 2025

Introduction: Vector-Based Premise:

Picture the Dow Theory not as an eternal law, but as an old radio trying to decode satellite signals—an echo from the industrial age wandering in the digital wilderness. Its linear signals, once sacred, are now scrambled by the noise of high-frequency speculation and algorithmic hallucination. In a market ruled by dopamine loops and liquidity jets, the old ways don’t just fail—they mislead.

So let’s step off the rails and onto a spiral—where time folds, logic unravels, and indicators like Dow Utilities emerge not as supporting actors but as the main characters rewriting the narrative.

History Isn’t a Straight Line—It’s a Mirror Maze

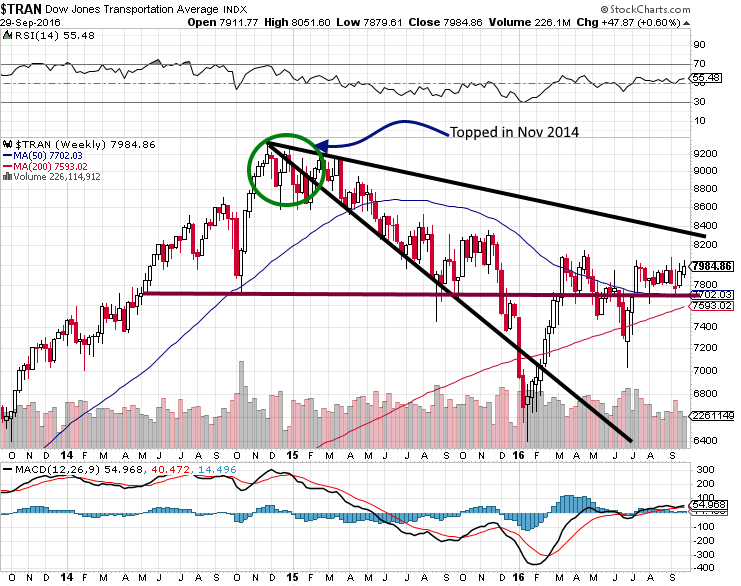

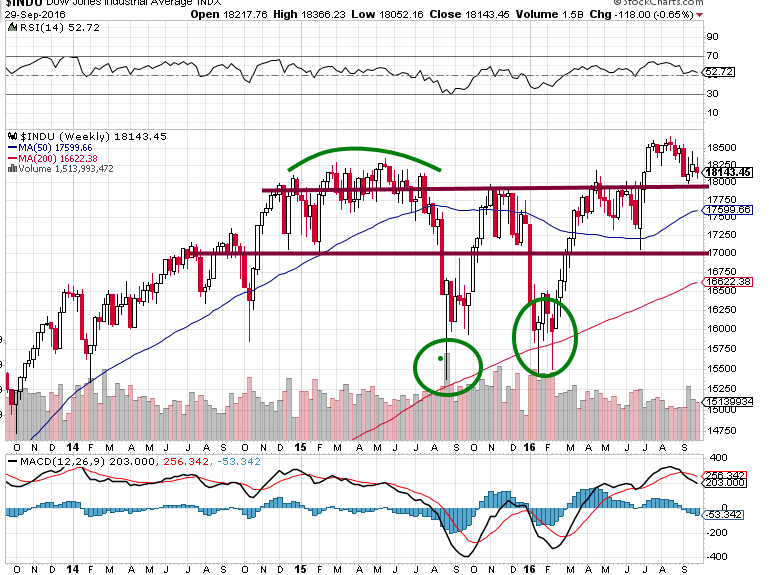

Take 2014. Transports peaked in November. Dow Theory screamed, “Danger.” The Industrial Average should have obeyed and rolled over. Instead? The Dow danced higher, like a teenager breaking curfew. This wasn’t noise. It was structural defiance. Proof that the original theory—designed for steam engines and ticker tape—was blind to the new market architecture.

By 2006, we’d already planted the seeds of rebellion: an alternative that abandoned the Transport obsession and instead spotlighted Utilities—the slow, steady current underneath the chaos. While analysts clung to the old gospel, we pivoted. And the results? Stark, accurate, ignored by the mainstream, embraced by those listening to signals beneath the noise.

A Theory is Just a Ghost with a Good Publicist

Let’s not romanticize. A theory, by definition, is a supposition—a narrative scaffold that explains something until it no longer can. It’s only sacred to those too afraid to discard the map when the terrain changes. Markets are not physics equations. They’re social organisms. In this ecosystem, the transports are lagging indicators. Nostalgia props them up; the data does not.

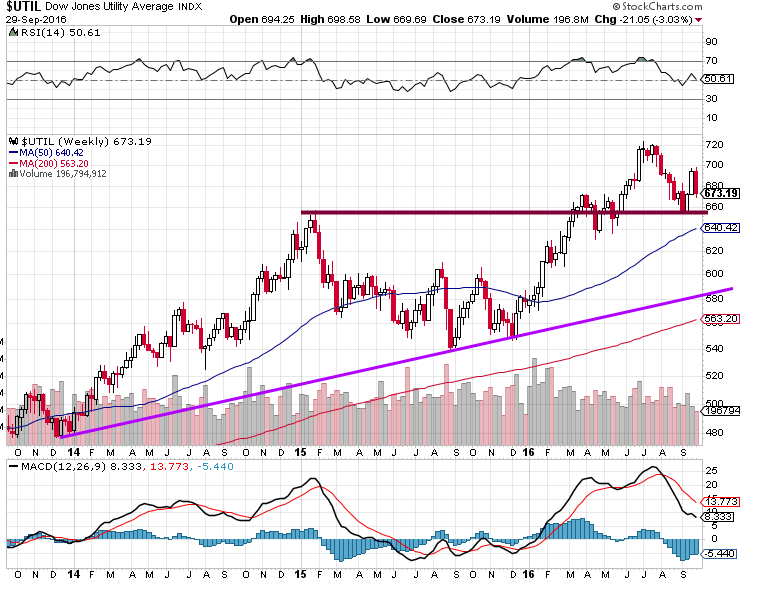

Utilities, on the other hand, tell a different story. In early 2015, they peaked. The Dow stalled. When Utilities found a bottom in late August, the Dow followed—but with a delay, like a shadow catching up to its source. Again and again, this pattern repeated: Utilities moved first. Dow obeyed. Transports? Mere static.

The Anti-Linear Pattern Emerges

Let’s collapse the timeline and treat history as a feedback loop:

- Feb 2015: Utilities top → Dow hesitates

- Aug 2015: Utilities bottom → Dow hits low five months later

- July 2016: Utilities peak → Dow peaks weeks later

This isn’t correlation. It’s choreography.

And now? Utilities are gathering strength again. The silent bull charges not with a roar but with a whisper through power grids and yield curves. Miss that, and you’re not contrarian—you’re asleep.

The Dow climbed until August 2016—trailing the lead of the utilities like a shadow chasing its source. This wasn’t a coincidence. It was confirmation: Utilities—not transports—were setting the tempo. Once again, the old Dow Theory was caught looking in the wrong direction.

Now, utilities are gathering strength, coiling like a spring. If history rhymes, the next surge could ignite the Dow once more.

After years of stagnation, even the transports start stirring, as if waking up to a tune they no longer compose.

Ignore the utilities at your own risk. When they start to climb decisively, it won’t be a suggestion—it’ll be a signal. One that whispers before the Dow roars.

The Machinery is Broken—Stop Worshipping It

The sacred triangle of the Dow Industrials, Dow Transports, and volume is no longer a compass. It’s a sundial under fluorescent lights. Outdated. Deceived by the very forces it fails to predict.

Modern money doesn’t move linearly. It flows in nonlinear pulses: ETFs, AI-trading, gamma squeezes, narrative volatility. In its original form, the Dow Theory is a casualty of this evolution. It’s still referenced, like an incantation—but it no longer commands the storm.

Rewiring the Forecast Engine: The Tactical Investor’s Alternative

March 2024 wasn’t a turning point—it was confirmation. The Tactical Investor’s framework doesn’t just update Dow Theory. It rewires it.

Here’s the new schema:

- Utilities lead — Ignore this, and you miss the early tremors.

- Oversold utilities = Future rally — The moment Utilities bottom, risk-on assets follow.

- Data fusion > Traditional charting — Integrate sentiment, options flow, yield curve shifts. Forget waiting for two indices to “confirm” each other like lovers in an outdated romance.

This approach embraces uncertainty as information. It’s tactical, not theological. Adaptive, not ceremonial.

Why Dow Theory Misfires: Structural Weaknesses & Psychological Oversights

The traditional Dow Theory leans heavily on pattern recognition and cycle repetition—but the market is no obedient machine. It mutates, adapts, and reacts to catalysts far outside the narrow scope of industrial averages and lagging price signals. At its core, the Dow Theory suffers from five fatal weaknesses:

- Over-simplicity in a Complex World – The market doesn’t move in clean, mechanical cycles. It’s an entangled mesh of tech flows, geopolitical tremors, and algorithmic reflexes.

- Neglect of Emotion – It disregards investor sentiment—manias, panics, crowd hysteria. In extreme conditions, it’s like using a sundial during a thunderstorm.

- Lagging Signals – Dow indicators often flash after the fact. By the time they trigger, the move is already underway.

- Dependence on the Past – It assumes the future rhymes with the past. But new narratives, tools, and players rewrite the script constantly.

- Blind to the Outside World – It ignores black swans, policy shocks, wars, pandemics—any sudden input that doesn’t fit its structure.

This rigid framework failed spectacularly during the 1987 crash, the dot-com implosion, and the 2008 crisis. In all cases, Dow Theory lagged or misfired completely.

To elevate accuracy, one must widen the aperture—integrating groupthink psychology and contrarian investing. These are not buzzwords; they’re behavioral realities. Markets often misprice due to mass emotional surges. The crowd overreacts. That’s where the edge lives.

By positioning against extremes—buying into despair, fading euphoria—investors can sidestep collective blindness and lean into structural inefficiencies. Pair this behavioral lens with the Tactical Investor’s focus on utilities as leading indicators, and you get a multidimensional toolkit, not a one-note signal.

Mass Behavior Isn’t Noise—It’s the Market

Most analysis fails because it denies the emotional circuitry underneath the charts. Herd behavior isn’t a bug. It’s the operating system.

Crowds panic before the facts. They chase stories, not numbers. And that’s the leverage point. You don’t fight the crowd head-on—you track where its hallucinations will lead it, then position yourself one step ahead.

Utilities, in this model, are the slow-breathing signals that capture this deeper rhythm—more stable, less prone to mass hysteria. They act not as hype indicators but as gravitational wells around which sentiment eventually orbits.

Contrarianism: The Art of Thinking in Reverse

The market doesn’t punish the uninformed—it punishes the overconfident. Consensus is where alpha goes to die. So when everyone’s watching Transports, we ask: What’s being ignored?

That’s why contrarianism isn’t just about being contrary. It’s about finding the blind spot in the collective perception—where logic fails, emotion reigns, and opportunity blooms.

And in that void, Dow Utilities sit quietly, ignored until they roar.

Dow Theory Isn’t Dead—It’s Just Misunderstood

It’s tempting to declare it obsolete, toss it in the dustbin of history. But maybe the truth is more nuanced: it’s not what you use—it’s how you use it.

If the Transports are fading, and the Utilities are whispering the truth, then perhaps the theory isn’t broken. Maybe it’s just wearing the wrong mask.

So don’t bury the Dow Theory. Decouple it. Rewire it. Let it evolve. The Tactical Investor’s version doesn’t break tradition—it reinterprets it, like jazz does to classical.

Final Thought: A Symphony, Not a Signal

You’re not decoding a binary system. You’re listening to a symphony of chaos and structure, crowd behavior and hard data, dreams and despair. The market isn’t a problem to solve. It’s a story unfolding in spirals, reversals, and echoes.

And in that story, the utilities hum beneath the surface—guiding the Dow’s rhythm, if you know how to hear it.

So step out of the line. Think in vectors. Listen sideways. And when the crowd leans one way—check where the electricity flows.

That’s where the future lives.

Impiety. Your irreverence toward my deity. Ambrose Bierce