Dollar to Ruble: Sanctions Not Having Desired Effects

American and European sanctions have helped Russia more than the harm they were intended to inflict. The agriculture sector is booming, the country is producing more at home, and they have come out with a viable alternative platform to SWIFT that China and host of nations have signed onto. The lower dollar to ruble exchange rate makes Russian products cheaper on the world market. for example, Russia is now the worlds largest exporter of wheat.

Russia also imposed countersanctions on a host of products and this lead to huge growth in many sectors that would have been impossible were it not for the sanctions America imposed on Russia.

The countersanctions were a gift to the Russian agrifood industry. They legitimized and catalyzed an import substitution strategy whose broad objective had been in place since the late 2000s: to become self-sufficient in food. In other words, the sanctions paved the way for Putin to overcome a long-standing embarrassment dating back to the collapse of the sector in the 1990s. The timing of the countersanctions—announced just a couple of days after the sanctions—led many observers to wonder whether the lists of banned products had been planned beforehand, specifically as a measure intended ultimately to boost domestic production

The Minister of Agriculture, Alexander Tkachev, summed it up neatly in 2015: “We are thankful to our European and American partners, who made us look at agriculture from a new angle, and helped us find new reserves and potential.” Full Story

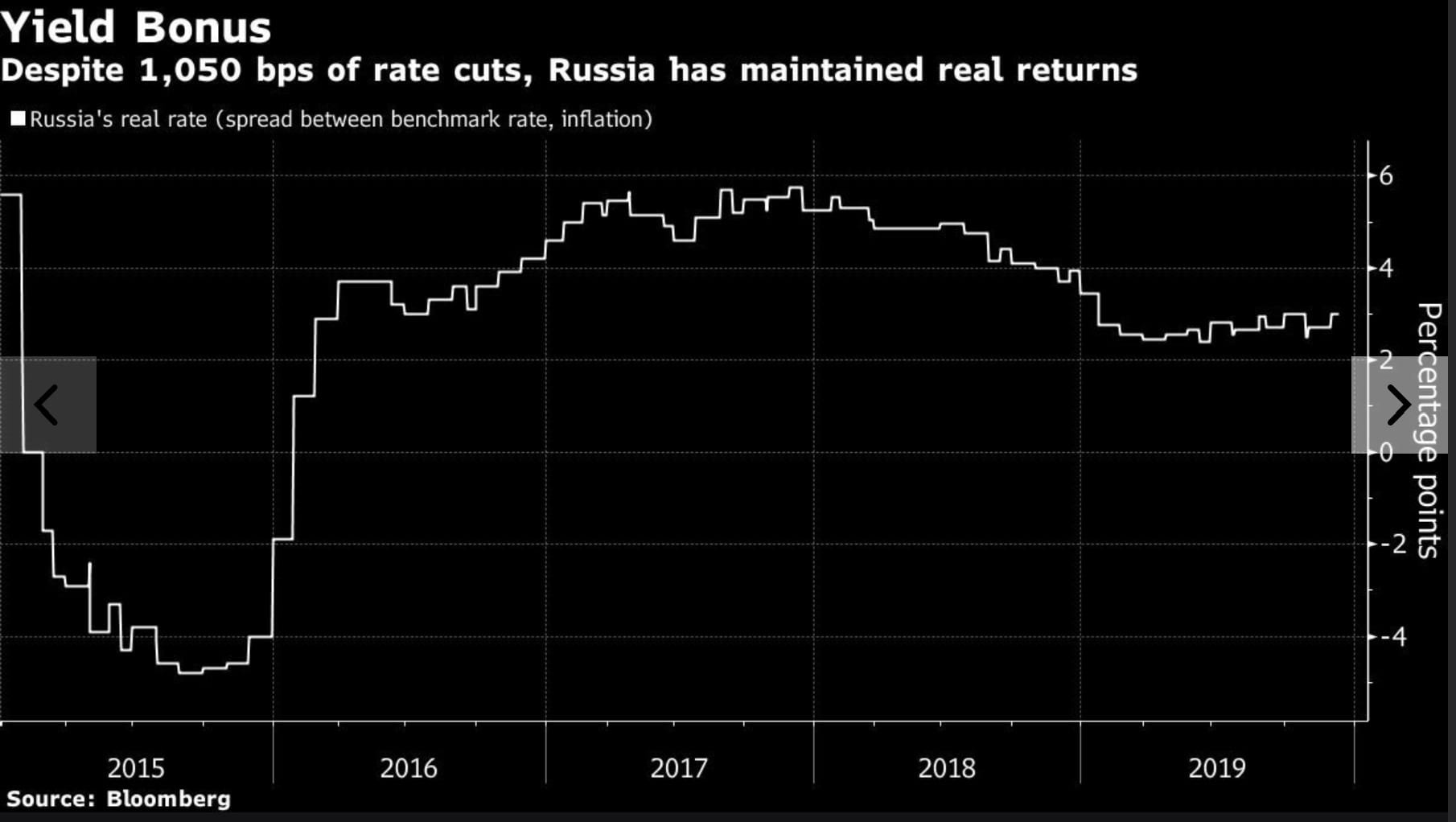

The government’s decision to abandon currency interventions, a cautious interest-rate policy, and tighter budget rules, means it enters 2020 with more than half a trillion dollars of reserves and one of the world’s most lucrative carry-trade currencies.

The Ruble Is Set to lead the Pack again in 2020

And the ruble is set to top the pack again in 2020, offering a safe haven amid concerns over the trade war between the U.S. and China, according to a Bloomberg survey of 57 global investors, strategists and traders. Analysts at HSBC Holdings Plc see the currency gaining as much as 7% from current levels, calling it a “beacon of light” in emerging Europe, the Middle East and Africa.

A high interest-rate differential relative to U.S. borrowing costs and ruble strength has combined to yield the best carry-trade returns in emerging markets. In fact, investors profited from ruble assets more than twice as much as the second-best performer, the Egyptian pound, which which was floated in 2016.

The Bank of Russia started cutting within weeks of its emergency hike at the end of 2014, which, for a while, led to negative real rates in the ruble. However, falling inflation has restored those adjusted returns, which are almost as good as when the benchmark rate was at 17%.Yahoo.com

Dollar to Ruble: US Restrictions Fuelling Deals That Bypass USD

“There’s been a strong incentive to change, not just for Russia but for its trading partners too,” said Dmitry Dolgin, an economist at ING Bank in Moscow. “The European Union is also now facing trade pressure from the U.S.” pushing it to try to reduce dependence on the dollar, he said.

The euro’s share also increased in Russia’s $108bln in annual trade with China, jumping to more than a third of export settlements in the first quarter from almost nothing at the start of 2018. The euro came close to replacing the dollar as the currency of choice for Russian exports to the European Union, with its share climbing to 42% in the first quarter from 32% a year earlier.

The most dramatic shift is visible in Russia’s $11bln in trade with India. The ruble accounted for three-quarters of total settlement in exports between the two emerging markets after they agreed on a new payment method through their national currencies for multi-billion-dollar defence deals. Moscow Times

Other Articles of interest

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)