CNQ Stock Outlook: Diversified Energy Producer

July 16, 2023

Before we assess the investment potential of CNQ Stock, let’s delve into its core operations and revenue generation methods.

Canadian Natural Resources Limited (CNQ) is an independent oil and gas company with a diversified portfolio of assets in North America, the U.K. portion of the North Sea, and Offshore Africa. CNQ explores for, develops, produces, markets, and sells a wide range of energy resources, including light and medium crude oil, heavy crude oil, bitumen, synthetic crude oil, natural gas, and natural gas liquids. With headquarters in Calgary, Canada, and approximately 10,035 full-time employees, CNQ has established itself as a prominent player in the industry.

CNQ’s production mix is well-balanced, comprising approximately 44% light and synthetic crude oil, 29% heavy crude oil, and 27% natural gas. The company’s operational efficiency and low maintenance capital requirements contribute to its ability to generate substantial and sustainable free cash flow. This factor, combined with CNQ’s diversified asset base, positions the company for long-term growth and financial stability.

Recognizing the importance of environmental stewardship, CNQ has set ambitious goals to reduce its total corporate absolute Scope 1 and Scope 2 greenhouse gas emissions by 40% by 2035, based on a 2020 baseline. The company is actively involved in carbon capture and storage projects, exemplified by its leadership in the Pathways Alliance initiative. By prioritizing sustainability, CNQ aims to mitigate its environmental footprint while continuing to meet global energy demands.

CNQ Stock: Growth, Valuation, and Sustainability

From a financial perspective, CNQ has demonstrated consistent earnings growth, averaging around 11% annually over the past five years. Analyst estimates for 2023 project earnings per share ranging from $4.25 to $9.63, indicating potential growth of 4-18% compared to 2022. The average estimate of $6.63 highlights the positive outlook for the company.

In terms of valuation, CNQ currently has a price/sales ratio of approximately 2.0, suggesting a reasonable market valuation. Additionally, the company enjoys low short interest, with only around 3.47% of the float being held in short positions as of the latest data. This indicates a favourable sentiment among investors and a potential lack of negative market speculation.

Overall, CNQ is a major player in the oil and gas production industry, operating across multiple regions and boasting a diversified portfolio of energy resources. The company’s commitment to sustainable practices, steady earnings growth, favourable valuation multiples, and positive market sentiment make CNQ an intriguing prospect for investors interested in the energy sector.

According to Macrotrends, CNQ’s revenue for the twelve months ending March 31, 2023, was $30.484 billion, marking a 12.1% increase compared to the previous year. Furthermore, CNQ’s annual revenue for 2022 reached $32.536 billion, reflecting a substantial 35.66% increase from 2021. These figures underscore the company’s continued growth and financial performance in recent years.

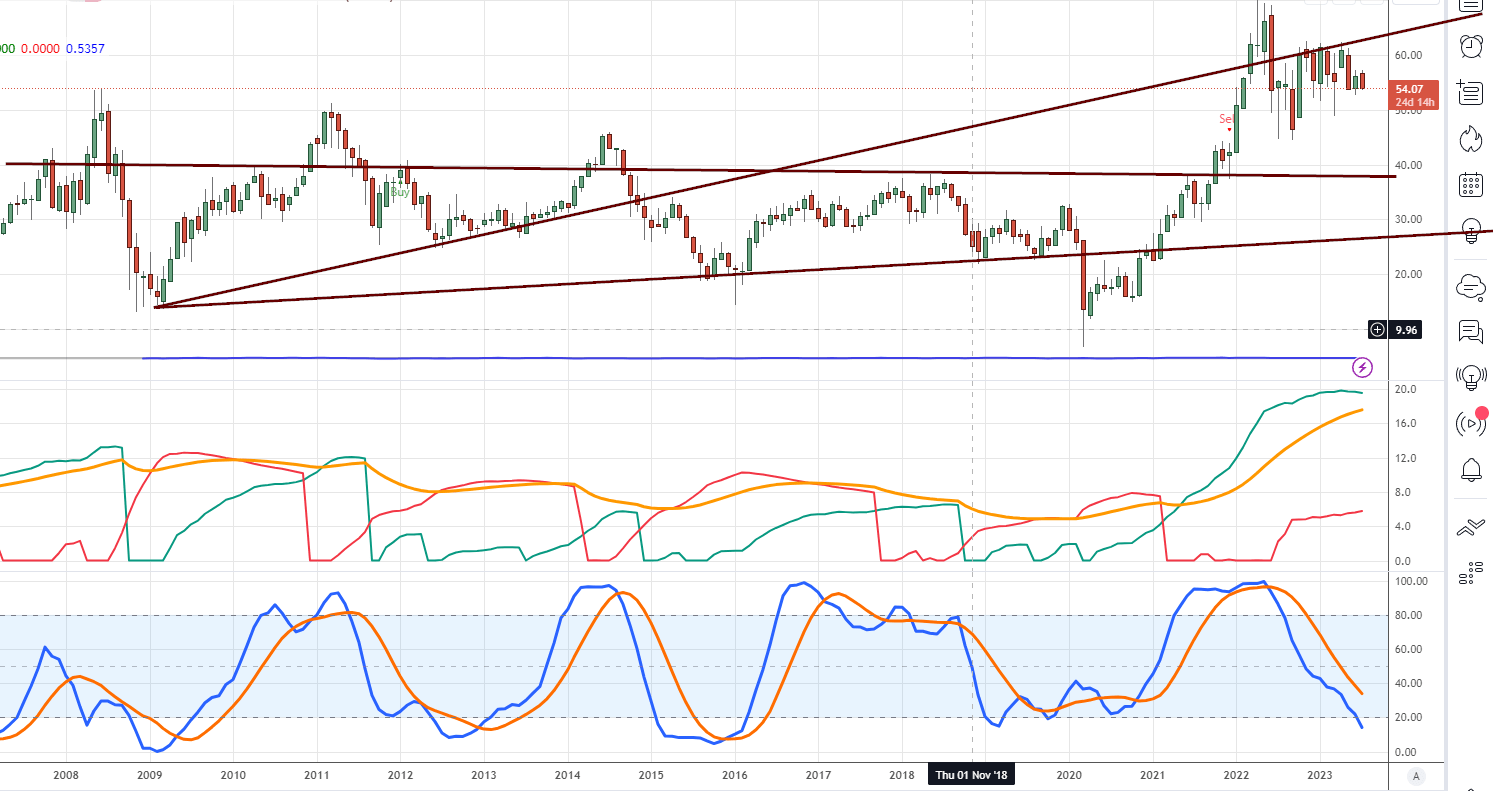

Analyzing the Monthly Chart of CNQ Stock

One aspect that is highly captivating about this stock is its resemblance to another stock we recently reviewed: in an article titled OVV Stock Analysis. However, a notable distinction lies in the pattern and its potential strength. Interestingly, it holds the potential to trigger a strong positive divergence signal, reminiscent of the significant surge observed in March 2020. As we all remember, the stock took off like a rocket thereafter, showcasing remarkable growth.

The Ideal Setup for CNQ Stock

The MACD indicators should drop into the oversold zone. Currently, they are not too far from this zone. Note that the MACDs are more reactive for OVV than for CNQ. The response is still good but not as pronounced as with OVV.

Regarding price, ideal entry points to start building a position would be $39 to $45. However, focus more on the market indicators. Price is a secondary factor.

There is an interesting pattern worth monitoring. When the MACDs experience a bullish crossover, there is a perfect chance the stock will double in price from that point onward. Watch for the stock price when this occurs.

FAQ – CNQ Stock: Diversified Energy Producer

1. What does CNQ specialize in?

CNQ is an independent oil and gas company engaged in exploring, developing, producing, and marketing various energy resources, including crude oil and natural gas.

2. Where are CNQ’s operations located?

CNQ operates in North America, the U.K. portion of the North Sea, and Offshore Africa, providing a diversified asset base.

3. How does CNQ generate revenue?

CNQ generates revenue by producing and selling light and medium crude oil, heavy crude oil, bitumen, synthetic crude oil, natural gas, and natural gas liquids.

4. What is CNQ’s production mix?

CNQ has a well-balanced production mix, with approximately 44% derived from light and synthetic crude oil, 29% from heavy crude oil, and 27% from natural gas.

5. What are CNQ’s sustainability efforts?

CNQ is committed to reducing its environmental footprint and has set a target to reduce its greenhouse gas emissions by 40% by 2035. The company actively participates in carbon capture and storage projects.

6. How has CNQ’s financial performance been?

CNQ has demonstrated consistent earnings growth, averaging around 11% annually over the past five years. Analyst estimates for 2023 project potential earnings growth of 4-18% compared to 2022.

7. What is CNQ’s valuation and market sentiment?

CNQ has a reasonable market valuation with a price/sales ratio of approximately 2.0. Additionally, the company enjoys low short interest, indicating a positive sentiment among investors.

8. How has CNQ performed in terms of revenue growth?

CNQ’s revenue for the twelve months ending March 31, 2023, was $30.484 billion, marking a 12.1% increase compared to the previous year. Annual revenue for 2022 also saw a substantial increase.

9. What should I look for in the CNQ stock chart?

It is worth monitoring the stock’s pattern for potential bullish signals, such as a positive divergence or a bullish MACD crossover, which could indicate future growth opportunities.

10. What are the ideal entry points for investing in CNQ?

The MACD indicators dropping into the oversold zone, along with price levels around $39 to $45, could be considered potential entry points, but market indicators should be prioritized.

Captivating Article Worthy of Exploration

The Rich Get Richer The Poor Get Poorer: Socioeconomic Inequality

Overcoming Crowd Phobia: Understanding the Fear of Large Crowds

US dollar vs Japanese Yen: No Bottom In Sight For Yen

ChatGpt vs Google bard: A Poetic Showdown

How to Make Organic Tortillas: A Step-by-Step Guide

De-Stress Meaning: Discover the Art of Relaxation

Stock Market Predictions 2023:Unveiling Market Trends

The Rich Get Richer and the Poor Get Prison

Recession: Best Time to Invest in Real Estate

The Banksters Club: Weapons of Mass Destruction Agenda

Fiat Fun: Unveiling the Source of Problems

How Often Should You Shower

The Free Market System Is Dead: The Fed Killed It

Why the US Medical System is Broken?