Evaluating OVV Stock Forecast: An In-Depth Look

July 7, 2023

Before determining if OVV Stock is a worthwhile investment, let’s examine the company’s stock profile to understand Ovintiv thoroughly.

Ovintiv Inc. (formerly Encana Corporation) is a Canadian oil and gas producer headquartered in Denver, Colorado.

The company explores for, develops, and produces oil, natural gas liquids, and natural gas in the Western Canada Sedimentary Basin and the Anadarko Basin in the United States.

OVV’s key assets include holdings in the Montney and Duvernay formations in Alberta and British Columbia, the Eagle Ford trend in Texas, and the Anadarko Basin in Oklahoma and Texas.

As of 2021, Ovintiv had estimated proven reserves of 1.4 billion barrels of oil equivalent and produced around 604 thousand barrels per day.

OVV’s stock trades on both the New York Stock Exchange and Toronto Stock Exchange under the symbol OVV.

The company has faced challenges due to volatile commodity prices and the COVID-19 pandemic, prompting efforts to reduce costs, repay debt, and improve efficiencies.

Ovintiv’s total revenue in 2021 was $7.1 billion, with a net loss of $2.2 billion. It had total debt of $6.4 billion and total assets of $24.3 billion as of December 2021.

Ovintiv pays a variable quarterly dividend of $0.138 per share in Q4 2021. The company has reduced its premium multiple times in recent years.

OVV Stock Forecast: Exploring Growth Prospects

Each stock has a tendency that you can observe if you spend time looking at charts in different timeframes. However, these tendencies only come into play under certain circumstances. Otherwise, you must wait. ‘Kick in’ means a turning point is imminent.

Ideal conditions:

The masses are not too bullish (this is the biggest factor). However, if you get in early and the stock is trading in the extremely oversold range unless the stock is a dud with no prospects, it will reverse course and trend higher.

The stock is oversold (monthly charts) and out of favour.

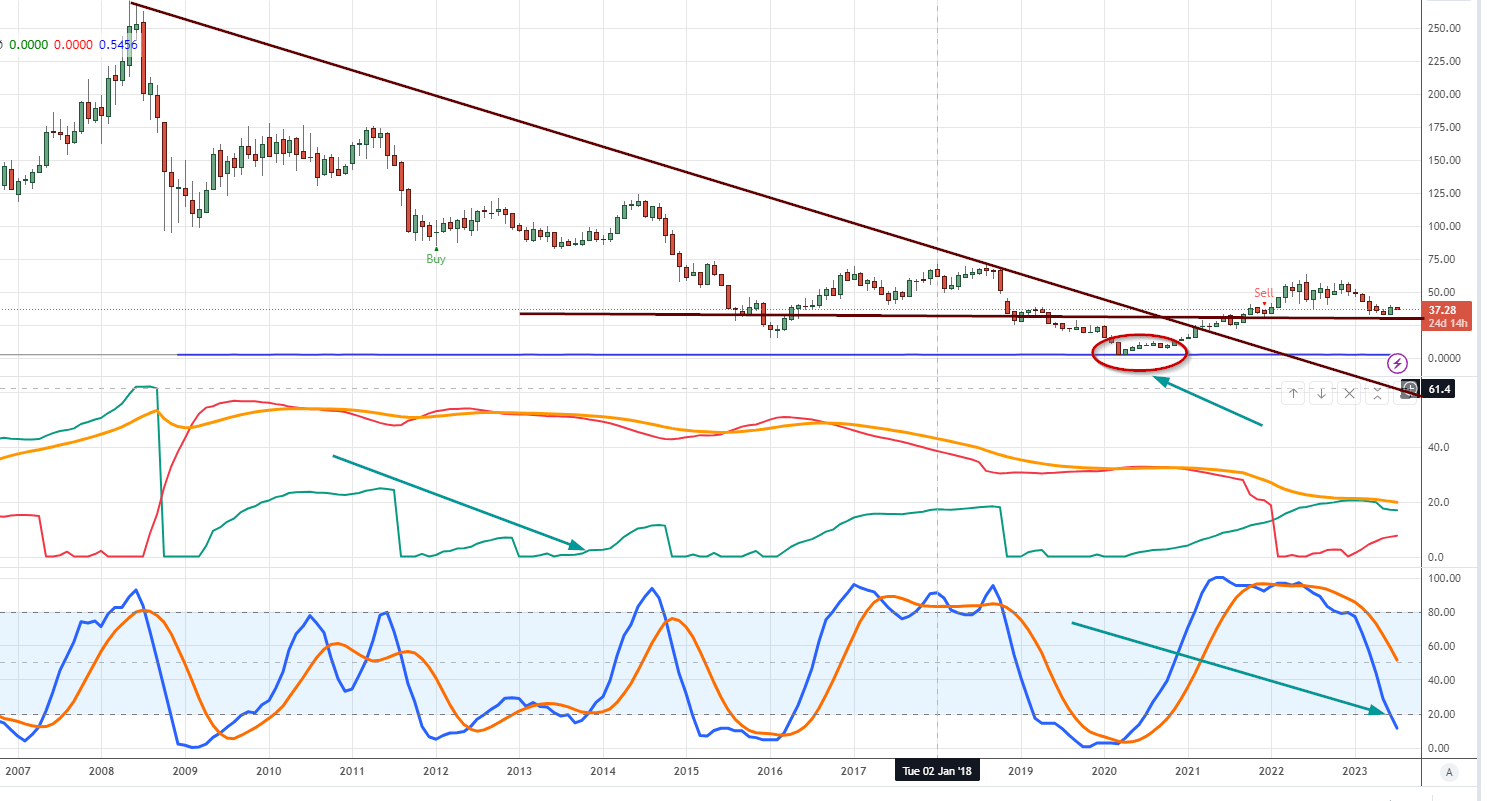

OVV has distinct patterns: when the MACDs are trading in the extremely oversold range, a bottom is very near, and the stock almost always posts large gains after Dec 2015. The golden era for this stock was from 2002 to 2008. If you pay heed, one indicator tells you when things change.

Ideally, the MACDs drop to the Dec 2015 or an even better move will be to the March 2020 levels; at that point, the odds of a 100% move will be very high. This stock was on one of my older lists that I forgot to update. This stock could take off like a rocket when the pattern aligns up.

Conclusion

OVV stock has demonstrated a clear pattern of large gains following extremely oversold MACD readings. While no investment is guaranteed, OVV may have the potential for a significant rally when the appropriate technical and sentiment conditions emerge. However, patience and discipline will likely be required as ideal setups do not happen frequently.

In summary, there is a substantial potential for OVV stock to experience significant gains under certain conditions. Notably, when the MACD indicators become extremely oversold, as seen in December 2015 and March 2020, the probabilities of a 60% to 100% increase become noteworthy. Currently, the stock is approaching a similar pattern. Consequently, those open to taking risks may consider allocating funds to this opportunity in increments. It’s advisable not to invest all funds in a single instance. Lastly, it’s essential to bear in mind the importance of avoiding overinvestment in any particular position.

Engrossing Articles That Shed Light on Complex Topics

Investor Sentiment and the Cross Section of Stock Returns: Exploring the Hot Connections

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters