Learn Technical Chart Analysis: Merging Technicals with Mass Psychology for Better Trades

September 19, 2024

One must understand more than just technical patterns to achieve true mastery in chart analysis. The collective emotions of market participants—fear, greed, optimism, and panic—shape the ebb and flow of financial markets. This blend of human behaviour and market data, known as mass psychology, can provide profound insights for traders to identify opportunities and mitigate risks. By harnessing mass psychology, one can gain an edge that sets apart a seasoned trader from the ordinary.

The Critical Role of Market Sentiment

Market sentiment, which represents the collective emotional state of investors, drives prices up and down in ways that often defy pure logic. Behavioral psychologists from centuries past, such as Niccolò Machiavelli and René Descartes, offer valuable insights into understanding this phenomenon. Machiavelli, who wrote extensively on power and human nature, emphasized that people are driven by fear and desire—forces that mirror today’s market movements. Descartes, a master of rational thought, stressed the importance of logical reasoning when confronted with emotional decision-making.

Market sentiment, often measured by tools like the Fear and Greed Index, plays a key role in mass psychology. A wave of collective panic can spark irrational selling, creating prime opportunities for disciplined traders to buy when fear is at its peak. Conversely, a rush of euphoric buying, often seen in bullish markets, can lead to overvalued stocks and potential corrections.

Example:

The 2008 financial crisis perfectly illustrated this concept. As fear spread, investors abandoned the markets in droves, selling off assets at any price. However, savvy investors who grasped the underlying psychology and recognized the overblown panic seized the opportunity to buy undervalued stocks, setting themselves up for substantial long-term gains as markets rebounded.

The Symbiotic Relationship Between Mass Psychology and Technical Analysis

Mass psychology and technical analysis are like two sides of the same coin. While technical analysis provides a structured way to predict market movements through chart patterns and indicators, mass psychology helps traders interpret the “why” behind these movements. For example, when a technical indicator like the Relative Strength Index (RSI) signals an overbought market, mass psychology can offer deeper insights into investor emotions driving that overbought condition.

Historical figures like David Hume, a philosopher of human behaviour, would argue that humans are often irrational actors, swayed by emotions rather than logic. In trading, these irrational swings—the euphoria of a rising market or the despair of a crash—can be predicted and leveraged for profitable decisions.

Example:

During the Dot-Com Bubble of the late 1990s, greed-fueled an unsustainable rise in tech stock valuations. Those who understood the psychological underpinnings of the mania, combined with technical signals of an overbought market, positioned themselves to exit at the right time before the crash, avoiding devastating losses.

Sentiment Indicators: A Guide Through Market Turbulence

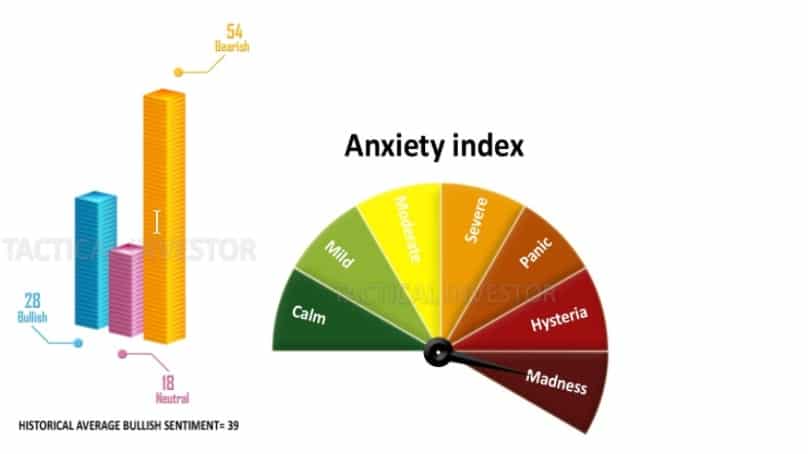

Sentiment indicators such as bullish-bearish ratios and neutral readings provide a quantitative way to measure market psychology. These metrics show when the crowd is overwhelmingly optimistic (a warning of potential market tops) or excessively pessimistic (often signaling market bottoms). Behavioural patterns described by Adam Smith, the father of economics, support this, as he pointed out that crowd behaviour often diverges from rational self-interest, a phenomenon highly relevant in today’s trading.

When neutral readings rise into the 50-55 range, it suggests that investors are paralyzed by uncertainty—neither overly bullish nor bearish. This often results in a holding pattern, with few taking risks. This uncertainty creates a prime backdrop for the astute trader to prepare for the next major move, as a shift in sentiment is often followed by significant market activity.

Example:

During the recovery phase after the COVID-19 market crash in 2020, neutral sentiment rose dramatically as both bulls and bears were unsure of the next steps. Many stayed out of the market, creating the perfect opportunity for those who understood this mass hesitation to accumulate stocks at discounted prices. Those who did so benefitted immensely from the subsequent rally, as uncertainty eventually gave way to optimism.

Applying Machiavellian Tactics to Investing

Machiavelli’s teachings can be applied directly to investing, especially in how traders navigate markets during periods of extreme sentiment. His assertion that it is better to be “feared than loved” speaks to the mindset needed to succeed in volatile markets. Investors should not aim to follow the crowd but rather to manipulate its emotions. For instance, a skilled investor might appear to be cautious while secretly preparing to make aggressive moves when fear grips the market.

Example:

Following the Great Depression, iconic investors like John Templeton and Benjamin Graham deployed what could be described as Machiavellian tactics. When others were gripped by fear, they amassed undervalued assets, profiting massively as markets recovered. Their ability to understand mass psychology and act against the grain set them apart.

The Long-Term Impact of Mass Psychology on Building Wealth

Aggressive investing after market crashes is one of the most effective strategies for long-term wealth creation. Historically, market downturns have always rebounded, making periods of fear some of the best opportunities for wealth accumulation. Figures like Isaac Newton, whose study of natural laws emphasized predictable cycles, would likely agree that economic cycles, driven by human emotion, follow predictable boom and bust patterns.

By understanding and leveraging mass psychology, investors can make confident moves during moments of panic, buying undervalued assets that can generate substantial returns once the market stabilizes. Combining this psychological insight with technical analysis amplifies the ability to see when market sentiment has reached an extreme, offering prime buying opportunities.

Example:

Warren Buffett’s famous quote, “Be fearful when others are greedy, and greedy when others are fearful,” encapsulates this approach. During the 1973-1974 market crash, Buffett took advantage of widespread panic to buy heavily discounted stocks, positioning Berkshire Hathaway for decades of prosperity.

Neutral Readings Surge: Learned Helplessness and the Power of Mass Psychology

Noteworthy events unfold when neutral readings surge into the 50-55 range, with higher readings assuming greater importance. This surge reveals profound uncertainty as bears and bulls grapple with indecision, leading them to shy away from the markets. It reflects a form of learned helplessness that persisted from 2009 until nearly 2018, as the trauma and aftershocks of the housing collapse immobilized many investors with fear, prompting them to steer clear of the markets for extended durations.

Integrating mass psychology with these indicators elevates their effectiveness. Mass psychology facilitates a comprehensive understanding of collective investor behaviour and its impact on market dynamics. Investors gain profound insights and make more astute decisions by considering psychological factors like fear, greed, and sentiment alongside these indicators. Mass psychology bestows a valuable layer of comprehension upon the market analysis process, enhancing the efficacy of these indicators in predicting market movements.

Conclusion

Harnessing mass psychology is a powerful tool in the investor’s arsenal, providing the ability to interpret market trends not just as random patterns but as manifestations of collective human behaviour. By coupling this understanding with technical analysis, traders can navigate markets more confidently, anticipating sentiment shifts and identifying risks and opportunities.

From Machiavelli’s observations on human nature to Newton’s insight into cyclical behaviour, historical wisdom teaches us that successful investors master the emotions driving market movements. Recognizing these patterns, whether facing panic or exuberance, allows traders to position themselves for long-term success, transforming uncertainty into opportunity.