Harnessing Mass Psychology for Chart Analysis Mastery

April 19, 2023

The study of mass psychology plays a critical role in understanding market movements and, when combined with technical analysis, can significantly boost a trader’s results. Mass psychology is market participants’ collective behaviour and sentiment, which can drive prices higher or lower based on their prevailing emotions, such as fear or greed. By comprehending the concepts of mass psychology, traders can gain valuable insights into the market’s overall sentiment and use this information to make more informed decisions.

The Importance of Market Sentiment

The market sentiment reflects the psychological state of market participants, often characterized by optimism, pessimism, or neutrality. These emotions can create patterns and trends in the market that traders can analyse to predict future price movements. Technical analysis studies historical price data and various indicators to forecast market trends. By incorporating mass psychology into their technical analysis, traders can better understand the reasons behind price fluctuations and make more accurate predictions.

A great read: Unlocking the Power of the Best Stock Market Indicators

The Symbiotic Relationship Between Mass Psychology and Technical Analysis

Integrating mob psychology with technical analysis can significantly improve a trader’s ability to identify market opportunities and mitigate risks. Understanding the emotional state of the market allows traders to anticipate potential reversals, breakouts, or continuations in existing trends. For example, an overwhelming fear may cause a sell-off, leading to a potential buying opportunity for a trader recognising the shift in sentiment. Similarly, excessive greed may indicate an overbought market, signalling a possible shorting opportunity.

In summary, combining the concepts of mass psychology with technical analysis can provide traders with a more comprehensive view of the market, leading to enhanced decision-making and improved trading results. By considering the emotional state of market participants, traders can better anticipate potential price movements and capitalize on market opportunities. Ultimately, understanding mass psychology and its influence on market trends can significantly boost a trader’s success in the dynamic world of trading.

Fascinating read: Stock Market Indicators: Tactical Investor’s Proprietary Tools

Sentiment Indicators and the Power of Mass Psychology: Unveiling Market Insights

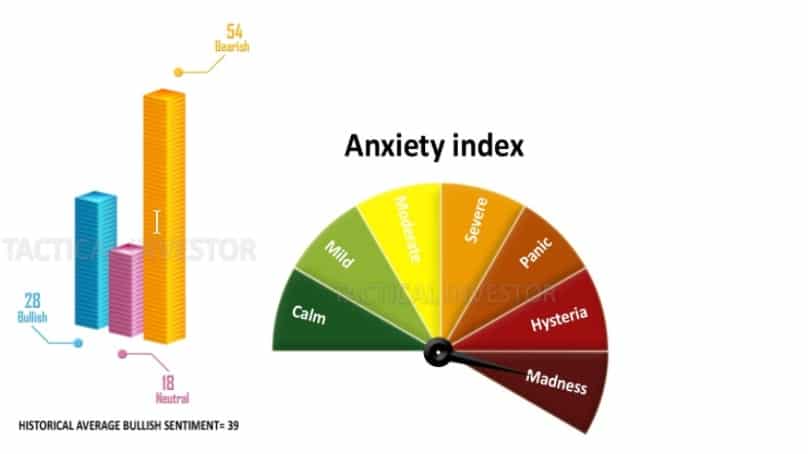

The needle on the anxiety sensitivity index elegantly provides a highly effective method for discerning extreme euphoria or mass stress/fear within the market. We can accurately pinpoint significant market turning points by amalgamating this data with our sentiment indicators, encompassing the bears, the bulls, and the neutral individuals.

Remarkable shifts frequently occur when bullish sentiment hovers within the 50-55 range, with higher readings amplifying their significance. Market tops are often associated with high bullish readings, while bearish extremes foreshadow potential market-bottoming activity. A reading of 50-55 signifies a state of complete panic among the crowd, indicating a possible long-term buying opportunity.

Unveiling Market Insights: The Power of Mass Psychology in Chart Analysis

Significant developments occur when neutral readings surge into the 50-55 range, with higher readings carrying greater significance. This surge signifies deep uncertainty as both bears and bulls struggle with decision-making, causing them to avoid the markets. It represents a form of learned helplessness that persisted from 2009 until almost 2018, as the housing collapse’s impact immobilized many fearful investors, keeping them away from the markets for extended periods.

Incorporating mass psychology enhances the effectiveness of these indicators. Mass psychology enables a comprehensive understanding of collective investor behaviour and its influence on market dynamics. Investors gain profound insights and make more informed decisions by considering psychological factors such as fear, greed, and sentiment alongside these indicators. Mass psychology adds a valuable layer of understanding to the market analysis process, improving the indicators’ efficacy in predicting market movements.

Sentiment Indicators and the Power of Mass Psychology: Unveiling Market Insights

The needle on the anxiety sensitivity index elegantly provides a highly effective method for discerning extreme euphoria or mass stress/fear within the market. Optimal readings fall in the outer zones (bullish or bearish). We can accurately pinpoint significant market turning points by amalgamating this data with our sentiment indicators, encompassing the bears, the bulls, and the neutral individuals.

Remarkable shifts frequently occur when bullish sentiment hovers within the 50-55 range, with higher readings amplifying their significance. Market tops are often associated with high bullish readings, while bearish extremes foreshadow potential market-bottoming activity. A reading of 50-55 signifies a state of complete panic among the crowd, indicating a possible long-term buying opportunity.

Neutral Readings Surge: Learned Helplessness and the Power of Mass Psychology

Noteworthy events unfold when neutral readings surge into the 50-55 range, with higher readings assuming greater importance. This surge reveals profound uncertainty as both bears and bulls grapple with indecision, leading them to shy away from the markets. It reflects a form of learned helplessness that persisted from 2009 until nearly 2018, as the trauma and aftershocks of the housing collapse immobilized many investors with fear, prompting them to steer clear of the markets for extended durations.

Integrating mass psychology with these indicators elevates their effectiveness. Mass psychology facilitates a comprehensive understanding of collective investor behaviour and its impact on market dynamics. By considering psychological factors such as fear, greed, and sentiment alongside these indicators, investors gain profound insights and make more astute decisions. Mass psychology bestows a valuable layer of comprehension upon the market analysis process, enhancing the efficacy of these indicators in predicting market movements.

Enrich Your Knowledge: Articles Worth Checking Out

I’m Never Going to Be Financially Secure, So Why Try?

Boost Your Financial Freedom and Secure a Home Equity Loan with a 500 Credit Score

Stock Market Investing for College Students: Navigating the Path to Financial Grace and Poise

Which Situation Would a Savings Bond Be the Best Investment?

How to Start Saving: Effective Strategies to Achieve Your Savings Goals

Saving and Investing for Children Market Report: Early Start, Big Wins

Investing for Income in Retirement: Refined Strategies for Financial Grace

What Is a Contrarian Investor? Embrace Unconventional Thinking

Unlocking Real Estate Investing for Beginners with No Money

Potential of Silver ETF-s: A Wise Investment Choice

USD Dollar Index Investing: A Posh Way to Hedge Against Currency Fluctuations

Are ESOPs Good for Employees? Weighing the Benefits and Risks

Copper ETF: The Great Investment Debate – Buy-In or Miss Out?

Stock Market Psychology Pdf: Mastering the Facts, Not the PDF