Unyielding Bullish Stocks: Decoding the Trend

Updated July 2023

Utilizing a historical context, we will exemplify the merits of adopting a long-term perspective when investing in the market. The earlier one begins, the more assertive their approach can be. Employing a historical backdrop serves a dual purpose: it underscores our actual actions. It serves as a vivid reminder that neglecting to glean lessons from history can lead to its repetition.

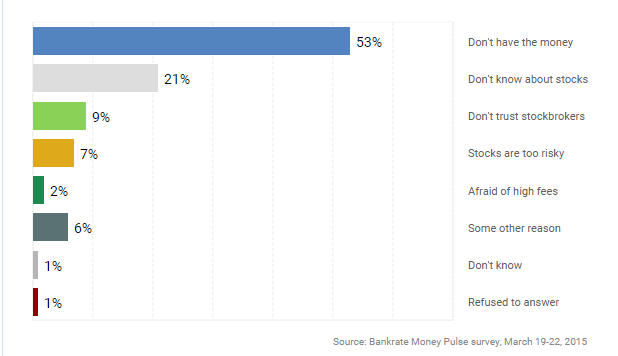

More than 50% of Americans lack sufficient funds to invest in stocks, a distressing statistic for a nation that asserts its position as the sole remaining superpower globally. This prompts contemplation about the price we pay to uphold this superpower status when, economically speaking, we seem to be drawing nearer to a third-world classification. Many Americans appear to be barely making ends meet, complicating the ability of the average individual to prioritize their financial stability. Even in the midst of this purported economic resurgence, one in seven Americans still relies on food stamps for support.

Maintaining a financial safety net for unforeseen circumstances is vital to financial well-being. Yet, the endeavour to save money is a challenge, with adhering to a budget being the most significant financial hurdle for Americans. Additionally, Americans frequently expend resources on unnecessary items. A clear illustration of this is the fact that Americans spend $1200 or more annually on coffee. Wouldn’t it be more sensible to allocate this money towards market investments rather than expending it on a cup of coffee? In an environment where people are more inclined to spend on coffee than investing in the markets, savvy investors should concentrate on bullish stocks. Bullish stocks are those that demonstrate resilience during pronounced market declines.

Unveiling Financial Potential: Making Informed Choices for a Stronger Future

It’s alarming that over 62% of Americans lack savings exceeding $1000, while paradoxically, the average American can casually spend $1200 on coffee annually. The simple act of eliminating such discretionary expenses, like excessive coffee purchases, could significantly bolster one’s savings—a seemingly straightforward approach that often eludes the majority of Americans.

As previously highlighted, channelling this discretionary spending into the market could be the optimal solution. Given that these funds were initially squandered, assuming a higher level of risk in investments becomes a viable consideration. Now, envision a scenario where the average individual adopts similar prudent measures, like resisting impulsive purchases, deferring a new car acquisition, or reducing unnecessary cable TV expenses. Implementing these changes could substantially augment the funds available for a 401K or IRA allocation.

Illustrated below, a chart sourced from Bankrate.com underscores the disturbing reality that 74% of individuals either lack the financial means to invest in the stock market or remain uninformed about stock investments. This striking contrast becomes evident when juxtaposed against the tendency of many individuals to acquire non-essential items, such as an excessively priced cup of coffee.

Demystifying the markets is much simpler than its perceived complexity suggests. Abundant resources are available, and with a modicum of effort, the everyday individual can transition from a state of unfamiliarity to surpassing the knowledge of many Wall Street experts. Peculiar experiments have even demonstrated that monkeys randomly selecting stocks with darts can outperform a significant portion of these supposed specialists.

Amidst widespread panic, focus on compiling a roster of bullish stocks.

Even as Americans grapple with unnecessary expenditures and harbour scepticism toward the markets, the intriguing aspect from a collective psychology standpoint is that this market is poised to maintain its upward trajectory. Analyzing sentiment data reveals a consistent trend: the combined percentage of individuals in the bearish and neutral categories has consistently exceeded 60% for an extended period. This underscores that this market remains one of history’s most despised bull markets.

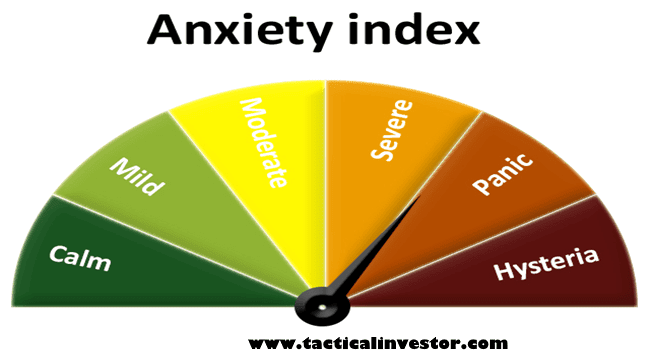

Our proprietary “Anxiety Index” has persistently oscillated within the extreme zones—ranging from severe to hysteria—for months, as depicted in the image below.

.

This index provides a glimpse into the collective mindset, affording us insight into whether the public is experiencing unease or composure regarding market investments. The readings spanning the past several months consistently portray a sense of apprehension within the crowd. As anticipated, the bullish trend has persisted, rendering a significant portion of bearish sentiment obsolete.

Until the masses wholeheartedly embrace this market, its trajectory is poised to remain upward. Historical precedent emphasizes that bull markets seldom conclude amid prevailing apprehension. Instead, history demonstrates that bull markets typically culminate during phases of euphoria.

The Potency of Integrating Psychological Insights and Technical Analysis within the Stock Market

Another aspect to consider is acquiring a solid comprehension of technical analysis, which holds immense importance. It equips individuals with the capability to identify pivotal market shifts and adeptly navigate the intricacies of crowd behaviour, herd mentality, and the bandwagon effect. These psychological phenomena can significantly influence investment outcomes, often leading to unfavourable results. Nevertheless, by incorporating the tenets of Mass Psychology into your investment strategy and embracing contrarian investing, you can mitigate the perils of blindly conforming to the masses. This comprehensive approach aids in evading succumbing to emotional biases that might cloud decision-making, allowing for well-informed choices grounded in objective analysis instead.

Originally published on July 22, 2016, this piece has undergone subsequent updates over the years, with the latest revision completed in July 2023.

Articles That Offer In-Depth Analysis

The China USA war: The Trade War of the Century.

Cool Superpower Ideas: Exploring Excellence in Various Fields

Unleashing the Bear: Russia Strikes Syria with Impact

Igniting Passion: The Thrilling Digital Sex Revolution

Navigating Fear & Opportunity in the October Stock Market Crash

Freedom and Independence: Inalienable Imperatives

Lagging Economic Indicators: Time to Thrive or Perish

Unipolar World Shakeup: US Superpower Status Fading Away

The House of Saud: Divine Rule and Deeds

People Also Ask: Decoding Google’s SERP Ranking Factors

The Greatest Wealth Is Health: US From First to Last

Ponzi Scheme Examples: The U.S. Treasury as a Prime Instance

AI-powered companies for 2023 & Beyond

How to Eat Healthy in College: Balancing Nutrition and Student Life

Hidden Toxins in Organic Food: What You Need to Know

Americans Favour Coffee over Financial Freedom (July 13)