Coffee Trends: More Americans Choose Coffee Over Stocks—A Tale of Comfort, Caffeine, and Complacency

Updated Oct 29 2024

Introduction

A little and a little, collected together, becomes a great deal; the heap in the barn consists of single grains, and drop and drop make the inundation. Saadi

Let’s face it: In America, coffee isn’t just a drink. It’s a religion. A ritual. A lifeline. Meanwhile, stocks remain an enigma—a complex, intimidating chessboard where fortunes are made or lost by the flick of a well-timed move. Recent numbers don’t lie: 61% of Americans drink coffee daily, a love affair deeply embedded in culture and convenience. Compare that to the mere 48% who actively invest in the stock market, and you see a curious, almost absurd reality. Coffee reigns supreme. Why? Because caffeine is quick, cheap, and painless. Stocks? Those are for the brave, the cunning, and the well-informed—or the fools who think they can outwit the market.

The Caffeine Conundrum—Instant Gratification, Endless Loyalty

Coffee is a classic mistress of immediacy. You want energy, clarity, and a burst of purpose? A cup delivers that in minutes. No complex decision-making, no strategic forecasts—just a comforting sip and a jolt of reality. It’s a transaction that requires no strategy, no discipline, and certainly no Machiavellian cunning. Everyone—from CEOs to baristas—can get on board. Coffee is democracy in liquid form: accessible, relatable, and infinitely accommodating.

But stocks? Ah, stocks are a different beast altogether. Investing demands financial literacy, strategic patience, risk appetite, and that elusive thing called disposable income—attributes that many Americans have but few truly cultivate. The stock market is a high-stakes arena where mistakes are amplified, losses sting like betrayal, and wins take time. It offers delayed gratification, a financial commitment with no guaranteed payoff, and a psychological gauntlet that separates amateurs from professionals and dreamers from doers.

The Temptation of Instant Reward

Coffee offers instant gratification—an immediate ROI (Return on Investment) that comforts the soul. Stocks, on the other hand, offer a more ambiguous promise. A long-term financial trajectory where outcomes are uncertain, and victory is earned through calculated patience and cold-blooded decision-making. In a society fueled by immediacy, few have the fortitude to wait. Most prefer the cup’s simplicity over the ticker tape’s uncertainty.

Let’s not underestimate the role of consumer culture. Coffee is a social glue, a symbol of productivity, hustle culture, and endless ambition. It fuels office meetings, powers stock traders, and serves as the cornerstone of networking interactions. Investing? That’s still perceived as the territory of the elite, the educated, and the strategically inclined—the kind of endeavor where only those with sharp minds and colder hearts succeed.

The Path Forward: A Revolution in Financial Literacy

If we truly want to see investing as accessible as morning caffeine rituals, it requires a revolution—an education system that cultivates financial intelligence from a young age, mentorships that teach risk management like a science, and policies that make investing as second-nature as reaching for a coffee machine.

Let’s stop fooling ourselves into thinking that markets are playgrounds for the wealthy or privileged. Investing should be a battlefield where the astute prevail, where risk is managed with precision, and where wealth is a game of strategy rather than luck.

So, while coffee remains the king of quick fixes and momentary satisfaction, it’s time we raise the stakes. Let’s start transforming investing into something that feels as accessible, empowering, and second-nature as brewing your morning brew. Because, in the end, strategy beats caffeine, precision beats impulse, and wisdom beats hope—a truth that only those bold enough to learn and risk will truly conquer.

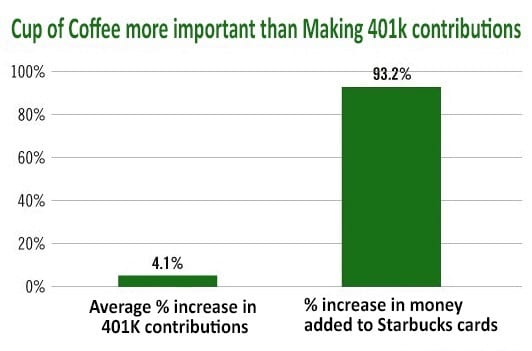

Coffee Trends and Starbucks Prepaid cards

The prepaid Starbucks card usage surge is a testament to the growing coffee culture worldwide. Coffee has become more than just a morning pick-me-up; it’s a lifestyle choice, a status symbol, and a social activity. The speciality coffee market has grown significantly, with consumers seeking unique, high-quality coffee experiences. This trend is not just limited to Starbucks; independent coffee shops and other chains also benefit from this shift in consumer behaviour.

The Power of Branding and Consumer Behavior

Starbucks’ success with its prepaid cards is also a testament to the power of branding and understanding consumer behaviour. The company has successfully positioned itself as a premium brand, and its prepaid cards are seen as a convenient and desirable product. This has led consumers to load money onto these cards, even at the expense of other financial priorities.

While the rise in Starbucks card usage is an interesting trend, it raises concerns about personal finance habits. The fact that people are choosing to spend more on coffee than investing in their future is a worrying sign. It highlights the need for better financial education and awareness regarding long-term savings and investments.

The Investment Landscape

Despite many people’s reluctance to invest in the stock market, there are still opportunities for those who are willing to take the plunge. The rise of robo-advisors and other fintech innovations has made investing more accessible and less intimidating. These platforms can provide a stepping stone for those who don’t have enough money or knowledge to invest.

Coffee consumption trends and personal finance will likely continue to evolve. As consumers become more discerning about their coffee choices, businesses must adapt to meet these changing demands. At the same time, the need for better financial education and tools will become increasingly important. The intersection of these two trends presents exciting opportunities for businesses, investors, and consumers alike.

The rise in Starbucks prepaid card usage reflects broader trends in consumer behaviour, personal finance, and the coffee industry. It’s a fascinating case study of how our daily habits can have far-reaching implications.

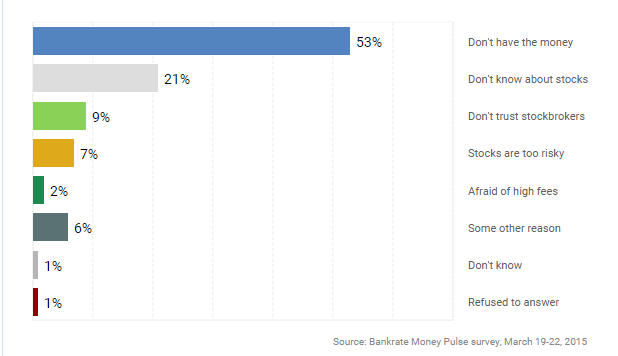

Coffee Choices vs. Investment Hesitations: Exploring Financial Attitudes

From a psychological perspective, it becomes apparent that a significant majority has yet to fully embrace the world of markets. Insights from bankrate.com highlight that a substantial portion of the population cannot invest in stocks due to financial constraints. Examining the chart below, 53% lack the financial means to acquire supplies, and 21% admit insufficient knowledge about them – a concerning stance for the current generation’s economic prospects. Interestingly, this demographic seems undeterred when indulging in pricy coffee purchases, even though these could easily be recreated at home.

Source: www.bankrate.com

Negative Interest Rates

We have extensively discussed this subject. As previously mentioned, the slight and unfortunate rate increase that the Fed initiated does not mark the onset of a new trend; rather, it reflects the Fed’s desperate attempt to convince the public that this economic recovery holds. Anyone with even a modicum of common sense comprehends that the sole driving force behind this economic resurgence is the influx of hot money; should the supply dwindle, the recovery will promptly cease.

This is precisely why one nation after another is adopting the concept of negative interest rates, and it’s merely a matter of time before the Fed is compelled to follow suit. When negative rates eventually reach the US, corporations will be forced to assume even more significant risks. We anticipate that share buybacks will soar to levels that could render current purchases appear rational in comparison.

Concluding Insights: Coffee Trends & Investing

Coffee trends and investing have intriguing connections that shed light on broader consumer behaviours and financial attitudes. Recent data reveals that 61% of Americans consume coffee daily, showcasing a deep-rooted love for caffeine. This inclination towards coffee consumption surpasses the 48% of Americans actively investing in stocks, illustrating a notable societal trend.

In a culture where coffee isn’t just a drink—it’s a ritual, a comfort, a lifeline—while stock investing remains a distant, often intimidating endeavour, we see a clear reflection of our national psyche. Coffee represents instant gratification, accessibility, and familiarity, a quick source of energy and pleasure that requires no strategy or sophistication. Meanwhile, the stock market is a domain of discipline, patience, and cunning calculation, a realm where profits aren’t given but earned through relentless strategy and cold, hard decisions.

This comparison lays bare the core issue: the divide between short-term satisfaction and long-term wealth, between consumer convenience and financial discipline. Americans flock to coffee for its immediacy and ease, while the stock market—demanding time, knowledge, and risk—remains a challenging arena that few dare to navigate. Yet, avoiding this arena out of fear only fuels a cycle where opportunity slips through our fingers, replaced by complacency and fleeting comfort.

Investing should not be an esoteric pursuit reserved for the elite or the financially enlightened. We need a culture where investment is as routine and accessible as grabbing that daily cup of coffee, a habit anyone can adopt, refine, and benefit from. A society where risk is managed with intelligence, losses are seen as lessons, and gains are not just a possibility but a strategic expectation.

As we sip our coffee and ponder the highs and lows of markets, let’s commit to a mindset of strategic rigor over blind optimism, education over impulse, and discipline over desire. Let’s stop seeing investing as a gamble and start treating it as a game of calculated insight, strategic mastery, and relentless discipline. In a world where coffee sharpens our senses and fuels our days, let’s ensure that our financial strategies sharpen our minds, fortify our resilience, and lay the groundwork for a robust, unyielding future.

Let’s drink deeply from the cup of opportunity—not because it feels good in the moment, but because we made choices that secured wealth, strategy, and mastery. We’re not just playing the game—we’re redefining it, outwitting it, and ultimately, owning it.

Play not with paradoxes. That caustic which you handle to scorch others may happen to sear your fingers and make them dead to the quality of things. George Eliot

Other Articles of Interest

Serenade for Your Heart: The Symphony of a Nourishing Breakfast