Stock Market Outlook 2025: Trust the Charts, Not the Chatter

April 17, 2025

Short-term forecasts are financial clickbait. Crystal-ball calls about where the market’s headed in the next three months? That’s voodoo dressed up in chart overlays. It’s rolling skull bones and pretending it’s a strategy. The truth? The market doesn’t care what you think will happen—it rewards positioning, discipline, and patience.

Forecasts distract. Trends pay.

From a technical standpoint, the market is stretched. The S&P 500 and Nasdaq are extended on the weekly and monthly charts. Breadth is weakening—the Advance/Decline line isn’t confirming the highs, and fewer stocks are trading above their 200-day moving averages than in late 2023. The McClellan Summation Index peaked back in January, possibly flagging exhaustion.

But without panic or euphoria from the crowd, these signals are just smoke, not fire. The market doesn’t fall because an oscillator says so. It falls when psychology breaks.

Technical signals without emotional confirmation are hollow.

That’s the edge most miss.

The Real Game: Mass Psychology and Behavioral Blindness

The market isn’t moved by logic. It’s driven by emotional overreaction, manipulated narratives, and herding behavior on steroids. Understanding price is meaningless unless you understand people.

Cognitive Traps That Kill Traders:

- Herding: Buying at the top because everyone else is. Selling at the bottom for the same reason.

- Loss Aversion: Holding losers out of hope. Selling winners too early out of fear.

- Confirmation Bias: Only seeking data that supports your view.

- Anchoring: Getting emotionally glued to arbitrary price points or past highs.

You want to win? You need to think in reverse.

When everyone’s confident, get cautious. When they’re terrified, get curious.

The Burro Theory: Who’s Riding Who?

The Tactical Investor’s Burro Theory hits the mark—when everyone thinks they’re the cowboy, the market flips the script. Retail traders think they’re in control, riding the market like some trained beast. But most of the time, they’re the burros getting bucked off when volatility kicks in.

The crowd doesn’t lead the market—they react to it. Late. Always.

Forecasts Are for Fools. Crashes Are for Kings.

The real wealth moves come not from predicting the future but from recognising opportunity when fear fogs up the windshield.

Strong pullbacks and outright crashes? That’s where the gold is buried. And you won’t find it by reading 3-month forecasts from analysts who missed the last five reversals.

Here’s how the pros play it:

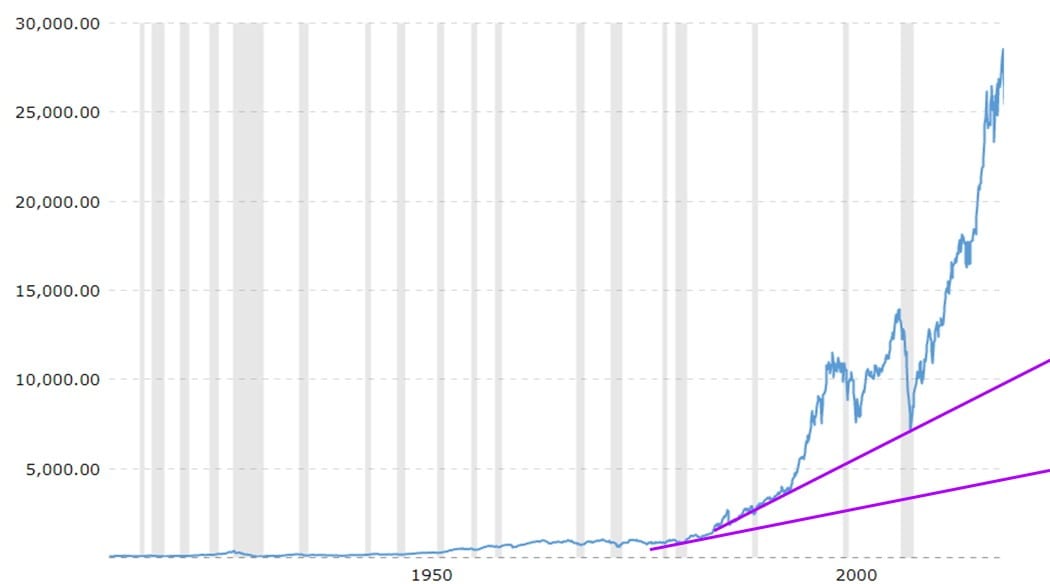

- Study long-term charts. Draw the damn trendlines.

- Look for sentiment extremes. When bearish readings go over 55%? Pay attention.

- If price dips below a long-term trendline and fear spikes? Load the truck.

Miss that train, and you’ll be the same guy FOMOing at the top and panic-selling at the low. Again.

The Bipolar Market and Where the Smart Money Hides

Right now, the AI-mania stocks—the so-called “Magnificent Seven”—are the only ones dancing. Everything else is either treading water or being dragged under. Utilities are catching bids. Bitcoin’s blowing up. That’s not balance—that’s fragmentation.

Bond markets are jittery. Commodities like lithium, palladium, and oil are volatile, underloved, and undervalued. Translation? That’s where the stealth money is rotating.

Ignore the headlines. Watch the undercurrents. That’s where opportunity begins.

Tactical Rules of Engagement

- Stop Forecasting. Start Observing.

The best traders don’t predict—they prepare. They read the tape, the sentiment, and the trend. The rest is noise. - Use Technical Analysis as a Weapon, Not a Crutch.

MACD, RSI, trendlines—they’re tools, not prophecies. They tilt probabilities. That’s all you need. - Understand Crowd Psychology. Exploit It.

The market is a giant mood swing. Use its instability to anchor your advantage. - Train for Crashes. Don’t Fear Them.

Most investors beg for a bull and panic in a bear. Flip that mindset. Crash = clearance sale. - Be Patient When Others Chase. Be Ruthless When Others Sleep.

The best setups come when no one’s looking. Be there.

The Harsh Truth: Most Traders Should Get Wrecked

Let’s be blunt. The market is a warzone. And most of the crowd walks in armed with TikToks and dopamine, not discipline.

They flip strategies like they flip tabs. They chase heat maps, not conviction. They expect instant gratification in a game that rewards pain tolerance.

Want to win?

Forget hope. Forget perfection. You strike when fear is loudest and everyone else is frozen.

Past Lessons, Present Edge

In 1999, we told clients to dump dot-com hype. They laughed.

In 2008, we warned about housing. The media rolled their eyes.

In 2020, we called COVID a generational buying moment. They raged.

They always rage before the regret. The crowd will always hate your moves when you’re early. But late is death.

History doesn’t rhyme—it echoes. Loudly.

And still, the herd hits snooze until it’s too late.

This Isn’t About Prediction. It’s About Preparation.

If you’re still looking for a 3-month stock forecast, fold this up and stuff it in a fortune cookie. You’ll get the same value—and a laugh.

This market isn’t a puzzle to solve. It’s a battlefield to survive. If you wait for confirmation, you’re already late. If you trust forecasts, you’re already lost.

The ones who thrive? They don’t forecast the future.

They prepare for chaos.

They exploit extremes.

They strike when others freeze.

And they understand this brutal, beautiful truth:

You don’t need to know what’s next. You just need to know where the opportunity hides when the crowd runs blind.

Conclusion: Market Warfare: Strike First, Leave Before the Slaughter

Trying to predict the top is a fool’s ambition. We’ve come dangerously close before, but let’s be real—sometimes it’s luck, sometimes it’s instinct. Anyone selling you a surefire system is selling you snake oil.

The true masters of the game don’t wait for confirmation. They move in before the stampede and get out while the crowd cheers. We dumped real estate before the 2008 carnage. We told clients to abandon dot-com stocks in mid-1999, while greed peaked. The masses mocked, but when the music stopped, they were left holding the wreckage.

Then came COVID. We called the 2020 crash a once-in-a-lifetime buying opportunity, and the backlash was feral. Over 90% of the crowd raged, insulted, spat venom, furious that we dared to see what they could not. But memories are short, and conviction even shorter.

The only truths in this game? Strike fast. Stay sharp. And never, ever trust the delusion that this time is different.

Because it never is. The cycle repeats—euphoria, panic, collapse, recovery. The names change, the assets shift, but the underlying psychology remains the same. The herd always arrives late, mistaking momentum for safety. They chase headlines, cling to sentiment, and scoff at those who see through the fog. But the market doesn’t reward feelings—it rewards precision, discipline, and the ability to act before the obvious becomes obvious.

When fear grips the masses, the bold take their positions. When greed consumes them, the wise step aside. Success in this game isn’t about being right all the time—it’s about being right at the right time.

The Blueprint for Bold Thinking