Demystifying the 1929 Crash Chart: Conquering Market Fears with Data

Updated April 30, 2024

In times of market turbulence, it’s natural to feel a sense of panic and uncertainty. But it’s important to remember that the stock market does not always reflect the underlying economy and that fear and panic can often create buying opportunities.

By understanding the principles of mass psychology and contrarian investing, we can approach market crashes with a game plan that allows us to take advantage of the present opportunities. This means keeping a level head, resisting the urge to follow the crowd, and looking for opportunities to buy when others sell.

It’s also important to remember that market crashes allow us to reevaluate our investment strategies and reallocate our portfolios. By taking a contrarian approach and focusing on undervalued assets with solid fundamentals, we can position ourselves to weather the storm and emerge stronger on the other side.

Ultimately, the key to surviving and thriving in market turbulence is maintaining a long-term perspective, staying disciplined in our investment strategies, and remaining mindful of mass psychology and contrarian investing principles. We can confidently and resiliently navigate even the most challenging market conditions by doing so.

Crash Survival Tactics: Navigating the Turbulent Market Storm

Market crashes are not scary because they are always a prelude to Bull runs. Stock market crashes can be viewed as an opportunity for those willing to take a contrarian approach to invest. This requires a shift in perspective and an understanding of mass psychology. While a crash may be considered a tragic event for those who invested at the top, it can be a splendid opportunity for those who got in early and banked some of their profits.

Crisis investing dictates that disasters are nothing but opportunities, and changing the lens through which we view a crash can change the picture entirely. So, instead of fearing a crash, one can prepare a game plan to take advantage of the opportunity presented by the market’s pullback, potentially leading to a massive bull run.

Bullish on Market Crashes: The 1929 Perspective and Beyond

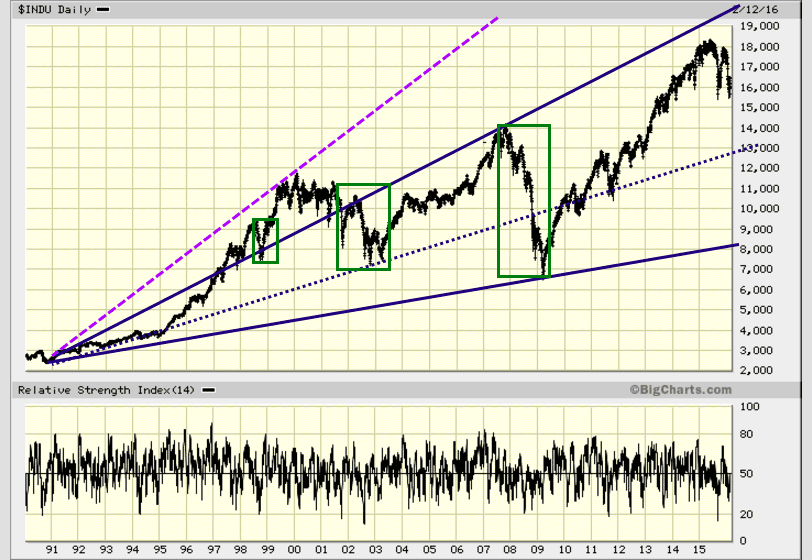

The solid blue line indicates the uptrend line, but we put in a dotted navy blue line for those who would insist that the uptrend line could be drawn through a secondary point. Whichever uptrend line you choose, you can see that this point holds, the greater the deviation, the better the buying opportunity.

Look at the chart above; who won from 1990-2016, the bears or the bulls? This chart clearly illustrates that the Doctors of Doom only make money by selling the masses crap they would never dream of using. They’re always trying to scare you with their doom and gloom predictions, but the truth is, crises represent opportunities for those who are willing to take the contrarian approach. The purple dotted line provides a guideline as to future market price action.

However, to be conservative, we drew in two lines. The navy blue one indicates that the Dow should easily trade to the 19,500 plus range in the not-too-distant future as long as the trend is up.

Challenging the “Doctors of Doom”: Debunking Predictions with Facts

The purple dotted line suggests that the Dow could trade past 25,000 before this bull market is over. Note that we base everything we do on in-house trend indicators: all other indicators, even if some message appeared in the sky stating that the Dow would crash tomorrow, take on a secondary role.

One should remember markets spend more time trending upwards. Even the terrible and devastating crash of 1987 was a buying opportunity, not a disaster. The naysayers and Doctors of Doom were wrong once again. Hence, you have proof that the contrarian approach is the way. While others panic and sell, contrarian investors see the opportunity to buy low and sell high, taking advantage of the market’s natural tendency to recover and climb higher.

Unlocking the 1929 Crash: Seizing a Historic Stocks Buying Opportunity

Market crashes are historic buying opportunities, provided you’re prepared. Avoid deploying all your funds into a mature bull market; wait for a pullback before getting in. Be wary when the masses are happy and have stops in place, just in case. As profits roll in, bank some gains and set money aside for future opportunities, such as buying after a correction. You can take advantage of market trends and come out ahead by staying smart and contrarian.

When blood is flowing in the streets as is the case right now during this coronavirus pandemic, one should consider nibbling at stocks if one has a long-term perspective. Do not deploy all your funds in one short but deploy them in lots this way if the stock dips lower your average entry price drops. Tactical Investor March 2020

In times of market turmoil, one must take a long-term perspective and approach stocks with cautious optimism. Deploying funds in increments can help to lower the average entry price and increase potential profits. At the Tactical Investor, our minimum holding time is typically several months. However, under current conditions, we extend our time frames for the potential of larger gains. While it may be a bloodbath in the short term, exceptional opportunities arise in such turmoil, leading the way to the next bull market. One must be willing to seek out the hidden gems rather than chase overvalued stocks during market booms.

Every crisis offers you extra desired power.

William Moulton Marston

Cracking the Code: Unveiling the COVID Crash and 1929 Crash Chart Patterns

The COVID-19 crash, in hindsight, was a blessing in disguise. As early as July 2019, we suggested that the markets needed a sharp pullback to release the excess steam. The crowd was already overly exuberant. Our foresight was proven correct, and the crash provided the much-needed correction to balance the market.

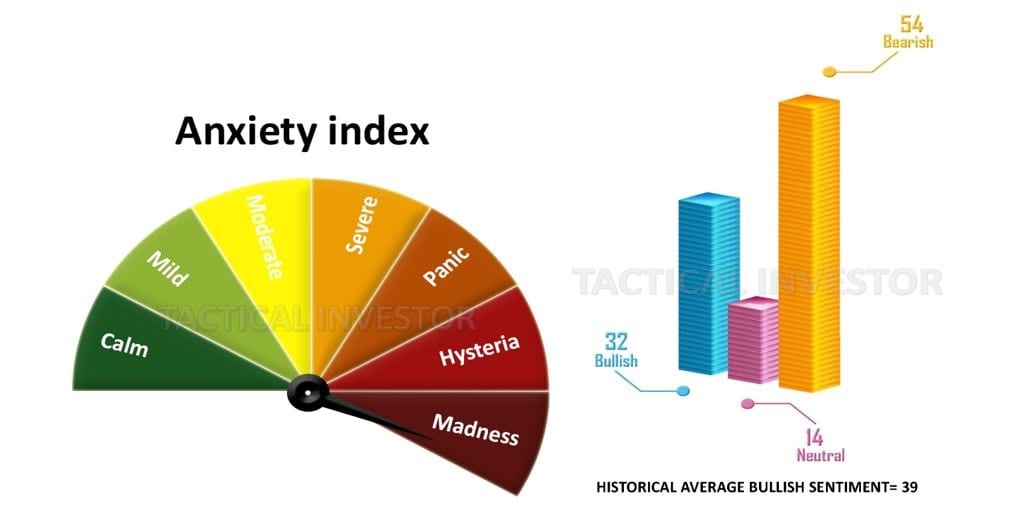

This group could be getting ahead of themselves; the investors that are already invested could be over-allocating funds because they have moved from the bullish phase to almost the euphoric stage. We already know that a large percentage are just sitting on the sidelines or betting against the market.

It is not a long term negative development, but if our hypothesis is valid, it could result in a sharp pullback over a short period, as over-exuberant individuals are the first ones to get nervous the moment it looks like the situation is changing. However, this pullback will be a blessing in disguise as there is not enough firepower to crash the markets, and the sentiment is far from bullish. Net-Net this is a long term positive development. Market Update July 2, 2019

The current market pullback offers a rare opportunity for 87-level stock prices. This pullback is unique because it occurred in uncertainty without the support of bullish sentiment. Such circumstances have never existed before, and these uncertain moments often lead to great opportunities. The melt-up following this event will be equally spectacular, offering the potential for huge profits.

It’s unprecedented as that has never occurred before, which means that the melt-up is going to be equally spectacular. Sol Palha

Covid Crash Chart Vs 1929 Crash Chart

During the COVID market crash, fear reeked so strongly that the masses sold top-notch companies for next to nothing. We witnessed the baby being thrown out with the bathwater. Our observations around March 2020 showed that the market was oversold, and we saw an opportunity.

Fear is in the air, and many strong companies are trading at attractive levels. The ball is in your court, compile a list of strong companies you always wanted to get into and slowly commit some funds to them. Or you could sit down and do what you have been doing all along and hope for a different outcome. Doing the same thing over and over again and hoping for a new outcome could be construed as being insane. Hence any crash that bears resemblance to the 1929 Crash should be embraced with gusto. Tactical Investor March 2020

Throughout history, market crashes have provided buying opportunities. Don’t put all your funds into a mature bull market. Wait for a pullback. Crowd psychology suggests being wary of the masses’ euphoria. Have stop-loss orders in place. Bank some profits and set some aside for future opportunities.

Take a long-term view, ignore short-term market noise, and prepare for volatility. Market crashes have followed robust growth. Be prepared to take advantage of the opportunities ahead.

Understanding the Gambler’s Mindset in Investing

It is crucial to comprehend the gambler’s mindset regarding investing. Speculating in the market without wisdom and a proper plan can result in significant losses.