The American Life Style Is Now An Export Product

Updated June 2023

The only thing that ever consoles man for the stupid things he does is the praise he always gives himself for doing them., Oscar Wilde 1856-1900, British Author, Wit

In India, a conservative society, the economic boom of the last several years has transformed this nation. This year the number of individuals earning over 250,000 dollars more than doubled to over 50,000. While this figure may seem small, ten years ago, less than 10K individuals would have fallen into this category. As a result, a new middle class has emerged, and they are now trying to duplicate the so-called American lifestyle.

Coffee bars have mushroomed everywhere, high-end nightclubs and fast-food restaurants (Domino’s Pizza, Subway, McDonald’s, etc.) are springing up everywhere, and everyone is going to the top-of-the-line cell phones, cars, washing machines, etc. You can get a 25k loan instantaneously from Citibank, and credit cards are being pumped everywhere. Credit cards which were unheard of, are now widely used, and Indians are slowly becoming spenders and starting to buy a lot of things on credit; this was a big no-no in the past.

American Life Style: Cocaine Usage Is Surging

The rise of cocaine usage in India has become a notable trend, with prices exceeding $100 per gram. This exorbitant cost makes it a status symbol accessible only to a select few, considering the average daily salary of around $1 in many parts of the country. It has become fashionable to frequent high-end nightclubs and indulge in these drugs.

. This growing pattern of fast food, excessive coffee consumption, drug use, and living beyond one’s means is not only limited to India. Still, it is also spreading rapidly in countries like China and other emerging nations in Asia. It further reinforces the notion that America serves as a psychological testing ground, exporting successful trends to other parts of the world.

Fast Foods are the New In Thing

This issuance of easy credit is another reason real estate prices have taken off so rapidly here; in Mumbai, the real estate market has appreciated over 100% in less than 24 months. Individuals can buy a huge amount of shares in India because they have come out with a system equivalent to margin trading in the U.S.A; the difference is that you only have to put 20% of the money down, and the rest is lent to you. Upon close examination, this sort of trading carries a much higher risk one that is normally associated with futures trading.

In a few years, one wonders if one will be able to tell the difference between the Asian mindset and the American mindset. Are the Asians about to give up what has helped them for centuries and embrace the dangerous system of credit and debt? Time will tell it’s the only teacher that kills all its students.

This tells us that competing with the Joneses’ concept is being quite successfully exported worldwide. The theme of the big boys is to entrap the majority all over the world through debt. Little do these chaps understand that nothing comes for free or what might appear to look good could be nothing but invisible chains that keep you trapped forever.

There is light at the End of The Tunnel.

There is one somewhat bright spot here. Entrepreneurial individuals can start preparing themselves for a new big business opportunity in credit counselling, and debt management will emerge. In the end, though many Jobs are being exported to these nations from the West, the smart individual with vision can leapfrog ahead and be ready to offer services that no one has dreamed of yet.

These chaps will miss managing the credit they are being given; hence, like the West, credit counsellors, debt reduction services, debt consolidation services, psychological counselling, etc., will be in huge demand. Another bonus is that individuals here always think that services offered by the West are better. So if a Westerner were to combine with an Easterner to open one of these services, the profit potential could be huge.

Emerging Markets: Growing Demand for Credit & Debt Services Presents Profit Potential

However, bear in mind this is not something that will happen tomorrow but something already underway and the trend is gathering momentum quickly. Investors willing to take risks should study these emerging markets and look for companies benefiting from this trend. As with any investment or business, one must be ready to explore the companies one will deploy capital. If you are considering opening a business, visiting the country and making connections would be prudent; the key thing always starts small.

The world values the Seer above all men and has always done so. Nay, it values all men in proportion as they partake of the character of seers. The Elgin Marbles and the decision of John Marshall are valued for the same reason. What we feel in them is a painstaking submission to facts beyond the author’s control and to ideas imposed upon him by his vision. So with Beethoven’s Symphonies, with Adam Smith’s ”Wealth of Nations” — with any conceivable output of the human mind of which you approve. You love them because you say, ”These things were not made; they were seen.”

John Jay Chapman 1862-1933, American Author

Originally written Aug 30, 2006, but repeatedly updated over the years, the last update was done on June 2023

Engaging Articles That Bridge Different Fields

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

The Dance of Investor Sentiment: Unveiling the Impact on ETF Flows and Long-Run Returns

Robot Love: Machine Affection or Mechanical Risks

Unleashing Passion: The Intriguing Realm of AI Sex Bots

6 brilliant ways to build wealth after 40: Start Now

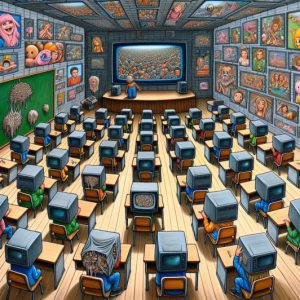

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

How can bond funds help with portfolio diversification more than individual bonds?

Russia vs USA: Timeline of US Actions Provoking Russia

Harmony Sex Doll: Redefining Intimacy and Companionship

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Black Monday 1987: Turning Crashes into Opportunities

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague

What happens to equilibrium interest when the stock market crashes?

Technical Analysis Of Stocks And Commodities Pdf

Sophisticated Strategies: How to Start Saving for Retirement at 40

BBC Global 30 Index Signals Dow industrial Index will trend higher (11 May)

Stock Market Bull not ready to buckle (4 May)

Fear mongers are parasites that profit from your fear (2 May)

Gold Bugs think & stop listening to Fear mongers (1 May)

Fear mongers are parasites that profit from your fear (27 April)

Plain evidence that financial experts know even less than Jackasses (26 April)

Negative rates fantastic for speculators but terrible for global economy (16 April)

How will Gold fare in a negative interest environment (14 April)