Apr 8, 2024

Introduction

The NASDAQ Composite, a market-capitalization-weighted index of over 3,700 stocks listed on the NASDAQ stock market, has long been a barometer of the technology sector’s health. As investors navigate the ever-changing landscape of financial markets, understanding the NASDAQ Composite’s performance and the factors influencing its trajectory becomes increasingly crucial. This article delves into the intricacies of the NASDAQ Composite, examining its current trading levels, historical context, and the philosophical and psychological underpinnings that shape its movements.

Current Trading Levels and Recent Trends

As of April 2024, the NASDAQ Composite is trading at approximately 14,500 points, a significant recovery from the lows experienced during the COVID-19 pandemic. On March 23, 2020, the index fell to 6,860.67 points, its lowest level since 2014. However, the NASDAQ Composite has since rebounded strongly, gaining nearly 111% from its pandemic low to its current level.

This impressive recovery can be attributed to the resilience of the technology sector, which has thrived amidst the accelerated digital transformation brought about by the global health crisis. Many NASDAQ-listed companies, such as Amazon, Netflix, and Zoom, have benefited from the shift towards e-commerce, streaming entertainment, and remote work.

According to recent data from the NASDAQ, the index has experienced an average annual growth rate of 12% over the past five years, outpacing the broader market. The S&P 500, a benchmark index for the U.S. stock market, has generated an average annual return of 9.2% over the same period.

The NASDAQ Composite’s strong performance can also be seen in its year-to-date gains. As of April 2024, the index has risen by 8.5% since the beginning of the year, driven by the continued strength of the technology sector and the gradual reopening of the global economy.

However, it is essential to note that the NASDAQ Composite’s rapid growth has also raised concerns about potential overvaluation in the technology sector. The index’s price-to-earnings ratio, a key valuation metric, currently stands at 35.6, well above its historical average of 24.1. This elevated valuation suggests that investors may be pricing in significant future growth for NASDAQ-listed companies, leaving the index vulnerable to a correction if these expectations are unmet.

The Wisdom of Ancient Philosophers

To fully comprehend the NASDAQ Composite’s behaviour, it is essential to draw upon the wisdom of ancient philosophers. Lao Tzu, the legendary Chinese philosopher who lived around the 6th century BC, once said, “The journey of a thousand miles begins with a single step.” This adage holds for investors in the NASDAQ Composite, as the index’s long-term success is built upon the cumulative effect of countless individual investment decisions.

Lao Tzu’s philosophy of Taoism emphasizes harmony and balance, principles that are equally applicable to the stock market. Just as the natural world seeks equilibrium, the NASDAQ Composite’s performance is influenced by the delicate interplay between supply and demand, fear and greed, and innovation and obsolescence.

The Insights of Modern Thinkers

Shifting our focus to more recent times, the renowned philosopher and mathematician Bertrand Russell, who lived from 1872 to 1970, offers valuable insights into the nature of human behavior and its impact on financial markets. In his book “The Conquest of Happiness,” Russell argues that the pursuit of material wealth often leads to a sense of emptiness and dissatisfaction. This observation is particularly relevant to the NASDAQ Composite, as the index is heavily weighted towards technology companies, many of which are driven by the relentless pursuit of growth and market dominance.

Russell’s philosophy serves as a reminder that the true value of an investment lies not only in its financial returns but also in its ability to contribute to the greater good of society. As investors assess the merits of various NASDAQ-listed companies, they must consider their short-term profitability and long-term impact on the world.

The Wisdom of Legendary Traders

To further enrich our understanding of the NASDAQ Composite, we turn to the philosophies and methodologies of two legendary traders from the past 2,000 years. First, let us consider the teachings of Jesse Livermore, the famous American trader who lived from 1877 to 1940. Livermore’s approach to trading was rooted in the belief that markets are driven by human emotions, particularly fear and greed. He famously stated, “The market is never wrong; opinions often are.”

Livermore’s emphasis on market psychology is particularly relevant to the NASDAQ Composite, as the index is often subject to the whims of investor sentiment. During periods of euphoria, such as the dot-com bubble of the late 1990s, the NASDAQ Composite can experience rapid and unsustainable growth, only to come crashing down when reality sets in. Conversely, during times of fear and uncertainty, such as the early stages of the COVID-19 pandemic, the index can plummet, presenting savvy investors with opportunities to buy undervalued stocks.

Next, we examine the philosophy of Nicolas Darvas, the Hungarian-born dancer turned investor who made a fortune trading stocks in the 1950s and 1960s. Darvas’ approach to investing was based on the concept of momentum, the idea that stocks that have been rising in price are likely to continue. At the same time, those that have been falling are likely to continue their downward trajectory.

Darvas’ momentum-based strategy particularly applies to the NASDAQ Composite, as the index is home to many high-growth technology stocks that can experience rapid price appreciation. However, as Darvas himself cautioned, momentum can be a double-edged sword, and investors must be prepared to cut their losses quickly when a stock’s upward trajectory reverses.

The Psychology of Market Movements

To fully comprehend the NASDAQ Composite’s behaviour, it is essential to consider the psychological factors that drive market movements. One such phenomenon is the bandwagon effect, which refers to individuals’ tendency to follow the crowd, even when doing so goes against their own better judgment.

In the context of the NASDAQ Composite, the bandwagon effect can manifest itself in the form of herd mentality, as investors rush to buy or sell stocks based on the actions of others, rather than on their own analysis of the underlying fundamentals. This behaviour can lead to the formation of speculative bubbles, as seen during the dot-com era, when the NASDAQ Composite reached an all-time high of 5,048.62 on March 10, 2000, only to lose nearly 80% of its value over the next two years.

Another psychological factor that can influence the NASDAQ Composite’s performance is contrarian investing, which involves taking a position that is opposite to the prevailing market sentiment. Contrarian investors seek to profit from the mispricing of stocks that can occur when the market becomes overly pessimistic or optimistic.

For example, during the early stages of the COVID-19 pandemic, when the NASDAQ Composite experienced a sharp sell-off, contrarian investors may have seen an opportunity to buy undervalued technology stocks, betting that the sector would rebound as the world adapted to the new reality of remote work and digital communication.

Technical Analysis and the NASDAQ Composite

Finally, no discussion of the NASDAQ Composite would be complete without considering the role of technical analysis in predicting the index’s movements. Technical analysis involves the study of past price and volume data to identify patterns and trends that can provide insight into future market behavior.

One commonly used technical indicator is the moving average, which smooths out short-term price fluctuations to reveal underlying trends. For the NASDAQ Composite, the 50-day and 200-day moving averages are often used as key support and resistance levels, with a break above or below these levels signalling a potential change in market direction.

Another crucial technical concept is the relative strength index (RSI), which measures the magnitude of recent price changes to determine whether a stock or index is overbought or oversold. When the NASDAQ Composite’s RSI rises above 70, it may indicate that the index is overbought and due for a correction, while an RSI below 30 may suggest that the index is oversold and poised for a rebound.

Conclusion

The NASDAQ Composite is a complex and dynamic entity, shaped by a myriad of factors ranging from ancient philosophical wisdom to modern market psychology. As investors navigate the ever-changing landscape of the technology sector, they must remain mindful of the lessons of history, the insights of legendary traders, and the psychological forces that drive market movements.

By embracing a holistic approach to analyzing the NASDAQ Composite, one that combines technical analysis with a deep understanding of human behavior and the wisdom of the ages, investors can position themselves to capitalize on the opportunities presented by this fascinating and influential index.

Explore Further: Unearth Engaging Stories

What Does Serendipity Mean? It Favors the Informed

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

The Dance of Investor Sentiment: Unveiling the Impact on ETF Flows and Long-Run Returns

Robot Love: Machine Affection or Mechanical Risks

6 brilliant ways to build wealth after 40: Start Now

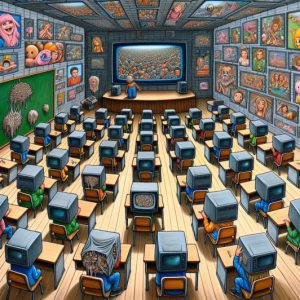

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

How can bond funds help with portfolio diversification more than individual bonds?

Russia vs USA: Timeline of US Actions Provoking Russia

Harmony Sex Doll: Redefining Intimacy and Companionship

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Black Monday 1987: Turning Crashes into Opportunities

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Golden Gains: The Key Advantages of Investing in Gold

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague