What Is Fiat Money

Updated June 2023

Every single currency out there today falls under the category of fiat money. Central bankers aim to debase the currency and provide humungous benefits to a select few. Mass psychology clearly indicates that the crowd always finishes last because, like the prisoners in the allegory of the cave, they refuse to accept a new narrative. However, let’s forget what fiat money is and instead focus on how one can benefit from fiat.

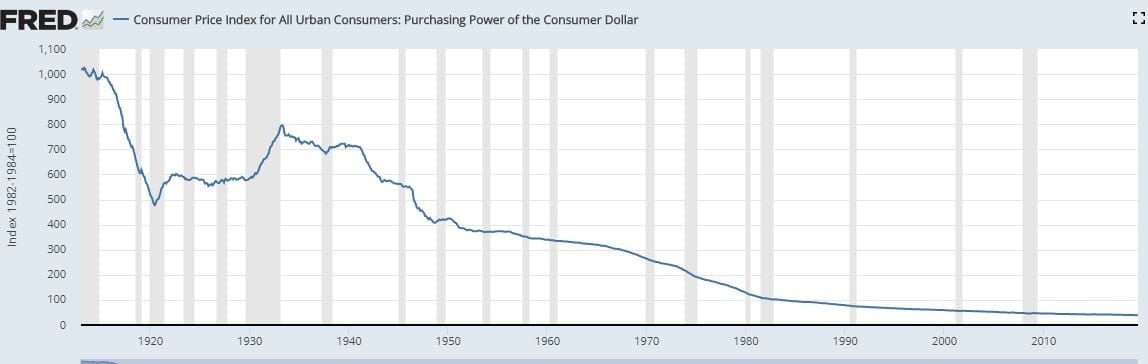

Look at the two charts closely. As the Dollar’s lost its purchasing power, the markets soared to compensate for this inflation of the money supply. This chart validates our argument that all corrections ranging from mild to wild should be embraced as long as the trend is up. This pattern will continue until fiat money ceases and who knows what that event might come to pass. Since the inception of this bull market, we have been stating that these guys would print more and more money. They would move from covertly supporting the market to overtly propping it up.

Negative Rates & The War on Savers

Now that we are moving to the era of negative rates, central bankers will become even more aggressive in attacking their respective currencies. We could go on, but the bottom line is to understand that in this era, back-breaking corrections should be viewed as manna from heaven.

To determine the trend, we examine the data from various angles and focus on the most critical data. News ranks right in the bottom in terms of value; sentiment ranks at the top. Fiat money has compounded all the problems you see in the world by a factor of at least 100. All these problems you see today, immigration, wars, poverty, etc. directly result from Central Bankers inflating the money supply.

Random Notes on the Stock Market Oct 2019

Nothing changes, and that is why the masses are destined to lose. If you examine every single bubble in history, the storyline is the same. If you are a new subscriber, this is the most important lesson you need to grasp. This is mass psychology in action; never follow the masses unless you are looking for a quick end. Market Update Aug 8, 2019

Now that the masses are almost in full-blown panic mode, the above statement applies more than ever. The crowd is always wrong. Mass Psychology can be used in nearly every aspect of one’s life. In this publication, the focus is on investing. However, one quick way to get some guidance is to understand that no matter what the arena is; if the masses fully embrace the concept, the investment, the philosophy, etc., the safest bet is to take an opposing viewpoint.

Originally published on Oct 2019, updated over the years with the latest update conducted in June 2023

Other Stories of Interest

Stock Market Crash Date: If Only The Experts Knew When