Updated Aug 2019; New Notes Posted towards the end of the article

Even Weak Economy Can’t Stop Secular Bull Market

The data below serves as further proof that the economic recovery is nothing but an illusion. It has only benefited those who don’t really need it. The rich have become even richer, the middle class has vanished and the poor are becoming even poorer.

- Real incomes have been flat to down slightly for the average household in the bottom 60% since 1980 (while they have been up for the top 40%).

- Those in the top 40% now have on average 10 times as much wealth as those in the bottom 60%. That is up from six times as much in 1980.

- Only about a third of the bottom 60% saves any of its income (in cash or financial assets).

- Only about a third of families in the bottom 60% have retirement savings accounts—e.g., pensions, 401(k)s—which average less than $20,000.

- For those in the bottom 60%, premature deaths are up by about 20% since 2000. The biggest contributors to that change are an increase in deaths by drugs/poisoning (up two times since 2000) and an increase in suicides (up over 50% since 2000).

- The top 40% spend four times more on education than the bottom 60%.

- The average household income for main income earners without a college degree is half that of the average college graduate.

- Since 1980, divorce rates have more than doubled among middle-aged whites without college degrees, from 11% to 23%.

- The number of prime-age white men without college degrees not in the labour force has increased from 7% to 15% since 1980. Full Story

How To Handle This Secular Bull Market

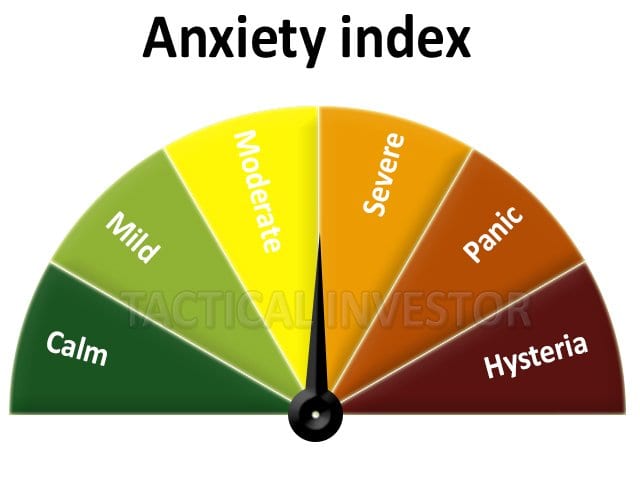

Sentiment indicates the masses are not bullish so this market is not ready to crash. Instead of panicking make a list of stocks you would like to own and when the market’s pullback, buy these quality stocks at a huge discount.

Updated Views Secular Bull Market Aug 2019

Another interesting development is that for the most part of 2019, bullish sentiment has traded well below the historical average of 39. Now let this sink in, we are in one of the longest bull markets in history, and instead of soaring to the moon, bullish sentiment is trading well below its historical average. Contrast this to the sentiment in bitcoin; currently, the sentiment is close to the euphoric stage, and this latest Bull Run is only two months in the making.

Bullish sentiment is too for this market to crash, hence the only logical conclusion is that the markets are letting out steam and preparing for the next upward leg.

When the trend is up, strong deviations are viewed through a very bullish lens; in other words, the strong the deviation, the better the opportunity factor. If the above comes to pass, it will be a good time to test your resolve for it is easy to buy when the situation appears to be calm, but when it’s not most panic and run instead of embracing the opportunity. It’s amazing how when a market is soaring everyone wants to get in and pay more and more, but the same individuals that were willing to pay more are now afraid to pay less for the same stock. Market Update July 11, 2019

Other Articles of Interest

1987 stock market crash anniversary discussions- nothing but rubbish ( Oct 24)

Dow 22K Predicted In July 2017; Next Target Dow 30k? (Oct 15)

Anxiety and Greed Index Don’t Support Stock Market Crash (Oct 14)

Fed States Inflation is not an issue? (Oct 13)

Is Bitcoin a Bubble or Good Investment? (Oct 9)

Stock market crash; best time to buy stocks (Oct 6)

Nasdaq’s Achievement Topples Stock Market Crash Argument (Oct 5)

Stock Market Crash 2018; Another Buying Opportunity (Oct 5)

Masses Trained to fear Market Crashes; why not embrace them? (Sept 27)

Buy When the Blood in the Streets is flowing Freely (Sept 13)